US Advanced Computing Infrastructure Inc.

d.b.a. Chicago Quantum

Jeffrey Cohen, Investment Advisor Principal, President:

- Illinois registered investment advisor, Series 65 Certification

- Our firm is a non-discretionary investment advisor (we advise, you invest)

- Information technology (IT) management consulting executive

- Quantum Economic Development Consortium (QED-C) founding member firm

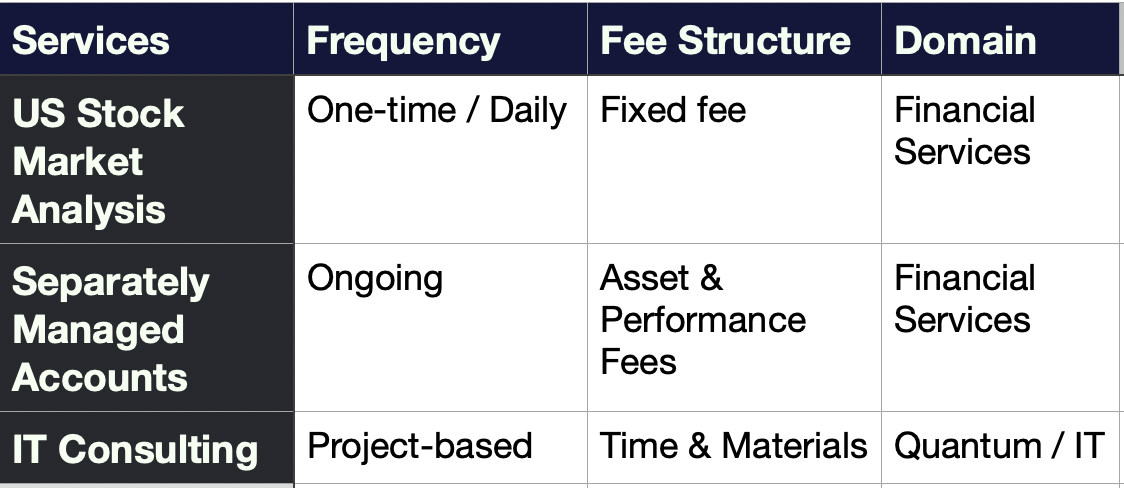

Contact us to learn more about our services and how you may become a client. Our first discussion is free.