Energy and the South China Sea

This page will be frequently updated with new information

Energy Transportation

According to the U.S. Energy Information Administration, or EIA, The south china sea is relevant to global energy production and consumption.

On the consumption side, this is a major transit point for both crude oil and liquefied natural gas (LNG). Energy products coming from the Persian Gulf, Gulf of Oman, and points along the Atlantic Ocean will pass through this area to reach the economies of China, Japan, South Korea and others. In 2023, 18 million b/d Traversed the South China Sea, with the majority coming from the Middle East to these trading partners. Imports to China are 9 million b/d, followed by South Korea at 2.5 million b/d, Japan at 2.2 million b/d, and Taiwan at 0.7 million b/d.

According to the EIA, in 2023 76 million b/d of petroleum and petroleum project was shipped globally via ship. Approximately 28 million b/d, or 37%, traversed the South China Sea. Also, 21% of global trade, or $3.4 trillion dollars in 2016 traversed the South China Sea. These countries have a significant portion of their trade traverse the South China Sea in 2016:

China 40%

India 31%

Brazil 23%

Japan 19%

United Kingdom 12%

Germany 9%

Italy and France 8% each.

Liquid Natural Gas (LNG) entering the South China sea comes primarily from Qatar, Oman and the UAE in the Middle East, and Malaysia, Indonesia and Brunei in the South China Sea, and Australia and the United States.

On the consumption side, this is a major transit point for both crude oil and liquefied natural gas (LNG). Energy products coming from the Persian Gulf, Gulf of Oman, and points along the Atlantic Ocean will pass through this area to reach the economies of China, Japan, South Korea and others. In 2023, 18 million b/d Traversed the South China Sea, with the majority coming from the Middle East to these trading partners. Imports to China are 9 million b/d, followed by South Korea at 2.5 million b/d, Japan at 2.2 million b/d, and Taiwan at 0.7 million b/d.

According to the EIA, in 2023 76 million b/d of petroleum and petroleum project was shipped globally via ship. Approximately 28 million b/d, or 37%, traversed the South China Sea. Also, 21% of global trade, or $3.4 trillion dollars in 2016 traversed the South China Sea. These countries have a significant portion of their trade traverse the South China Sea in 2016:

China 40%

India 31%

Brazil 23%

Japan 19%

United Kingdom 12%

Germany 9%

Italy and France 8% each.

Liquid Natural Gas (LNG) entering the South China sea comes primarily from Qatar, Oman and the UAE in the Middle East, and Malaysia, Indonesia and Brunei in the South China Sea, and Australia and the United States.

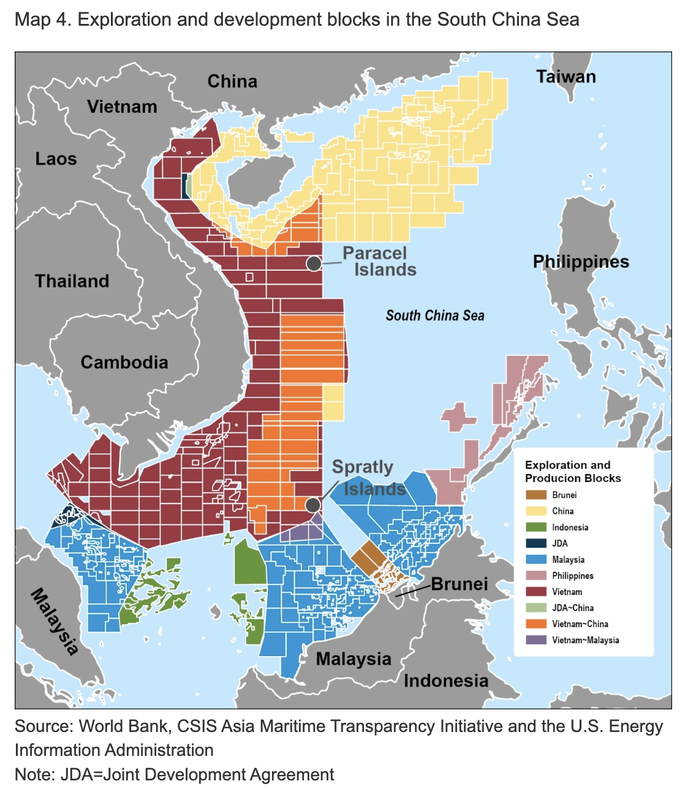

Potential Energy Resources

On the production side, we have read that there are potential sources of hydro-carbons (oil and natural gas) and other metals in the area, however we are gathering specifics at this time. The massive space of the South China Sea is contested between multiple countries, including the People's Republic of China's (PRC) new 10-dash line, and most nations claiming a 200 nautical mile exclusive economic zone (EEZ), that is adjacent from their 12 nautical mile territorial zone, starting from their mainland and permanently inhabited islands. As a result, most of the proven and probable reserves are in territorial and uncontested EEZ zones. This would indicate there are significantly more energy reserves which would become available once those disputes are settled, regardless of who 'wins' the mediation.

What we do know for a fact is the Vanguard Bank, off the coast of Vietnam, is already home to active oil and gas exploration work by Vietnam, and the Chinese Coast Guard pays this field frequent visits as the PRC contests this area's ownership.

In 2023, the U.S. Geological Survey (USGS) analyzed the potential for conventional oil and natural gas fields in portions of Southeast Asia as part of the World Petroleum Resources Assessment Project (thank you again EIA for making this known). In two of the thirteen basins studied that are within the South China Sea, the South China Sea platform (mostly the Spratly Islands area), and the Palawan Shelf (Philippine nearshore), there are estimated to be between 2.4 billion barrels and 9.2 billion barrels of petroleum and other liquids, and between 62 Tcf and 216 Tcf of natural gas, including fields that would extend outside the SCS or under land masses.

According to the EIA, the total liquids proved and probable reserves (millions of barrels) are 3,598 million bbl, split ~40% China, ~35% Malaysia and ~15% Vietnam. Natural gas proved and probable reserves (trillions of cubic feet or Tcf), are 40.3 Tcf, with ~70% in Malaysia, ~14% in China, and 6% in Vietnam.

What we do know for a fact is the Vanguard Bank, off the coast of Vietnam, is already home to active oil and gas exploration work by Vietnam, and the Chinese Coast Guard pays this field frequent visits as the PRC contests this area's ownership.

In 2023, the U.S. Geological Survey (USGS) analyzed the potential for conventional oil and natural gas fields in portions of Southeast Asia as part of the World Petroleum Resources Assessment Project (thank you again EIA for making this known). In two of the thirteen basins studied that are within the South China Sea, the South China Sea platform (mostly the Spratly Islands area), and the Palawan Shelf (Philippine nearshore), there are estimated to be between 2.4 billion barrels and 9.2 billion barrels of petroleum and other liquids, and between 62 Tcf and 216 Tcf of natural gas, including fields that would extend outside the SCS or under land masses.

According to the EIA, the total liquids proved and probable reserves (millions of barrels) are 3,598 million bbl, split ~40% China, ~35% Malaysia and ~15% Vietnam. Natural gas proved and probable reserves (trillions of cubic feet or Tcf), are 40.3 Tcf, with ~70% in Malaysia, ~14% in China, and 6% in Vietnam.

Energy Production

There are six nations with production of crude oil and other liquids in the South China Sea, including:

Malaysia 41%

China 34%

Vietnam 15%

Brunei 8%

Indonesia 1%

Philippines 1%

There are several nations with natural gas production:

China 66%

Brunei 13%

Indonesia 8%

Vietnam 7%

Malaysia 4%

Philippines 2%

Malaysia 41%

China 34%

Vietnam 15%

Brunei 8%

Indonesia 1%

Philippines 1%

There are several nations with natural gas production:

China 66%

Brunei 13%

Indonesia 8%

Vietnam 7%

Malaysia 4%

Philippines 2%

Brunei has two primary fields, Champion, which began production in 1972 and the SW Ampa natural gas field. In 2023, Brunei produced under 0.1 million b/d in petroleum liquids and 0.1 Tcf of natural gas from the SCS.

China has been ramping production since 2018 as they move into deepwater areas of the SCS. They have recent discoveries and commercial activities which should continue to ramp production. In 2023, they produced over 0.4 million b/d of petroleum liquids, and 489 Bcf of natural gas from the SCS.

Indonesia has offshore production outside of the SCS, and in 2023 produced 0 million b/d of liquids and 134 Bcf of natural gas. They have a project under development in Natuna Island, called the Tuna natural gas field.

Malaysia has several deepwater projects underway in the Sabah and Sarawak Basins. In 2023, Malaysia produced 0.5 million b/d of petroleum liquids and 2.4 Tcf of natural gas, and with recent discoveries and five development projects signed in just 2022, we would expect this production to greatly expand. Malaysia and Thailand are jointly developing a section of the Gulf of Thailand which they will share production.

The Philippines produces natural gas in the South China Sea, producing 0 million b/d in liquids and 80 Bcf of natural gas. They have a mature field, Malampaya natural gas platform, in the northern Palawan Basin, and requires additional investment to offset significant declines. The Philippines did explore and find natural gas in the Reed Bank area of the Spratly Islands. That project was one of the reasons for the submission to the Permanent Court of Arbitration (PCA) in the Hague, and the 2016 settlement that rejected China's historical claims.

Singapore is a major refiner with 1.3 million b/d of crude oil refining capacity in 2023.

Thailand is a relatively small producer out of the Gulf of Thailand with mature fields in the north Pattani Basin, and Bongkot.

Vietnam is the up and coming producer to try and meet domestic demand, and increasing manufacturing demand for energy. In 2023, Vietnam produced 0.2 million b/d of liquids and 271 Bcf of natural gas in the South China Sea. Vietnam has had its development efforts halted by Chinese protests and disputes, such as the Vanguard Bank development project. There are three development projects which have been delayed that would occur in the nearshore areas of Vietnam.

Thank you to the EIA for access to detailed information on country production and plans, in the website found here.

China has been ramping production since 2018 as they move into deepwater areas of the SCS. They have recent discoveries and commercial activities which should continue to ramp production. In 2023, they produced over 0.4 million b/d of petroleum liquids, and 489 Bcf of natural gas from the SCS.

Indonesia has offshore production outside of the SCS, and in 2023 produced 0 million b/d of liquids and 134 Bcf of natural gas. They have a project under development in Natuna Island, called the Tuna natural gas field.

Malaysia has several deepwater projects underway in the Sabah and Sarawak Basins. In 2023, Malaysia produced 0.5 million b/d of petroleum liquids and 2.4 Tcf of natural gas, and with recent discoveries and five development projects signed in just 2022, we would expect this production to greatly expand. Malaysia and Thailand are jointly developing a section of the Gulf of Thailand which they will share production.

The Philippines produces natural gas in the South China Sea, producing 0 million b/d in liquids and 80 Bcf of natural gas. They have a mature field, Malampaya natural gas platform, in the northern Palawan Basin, and requires additional investment to offset significant declines. The Philippines did explore and find natural gas in the Reed Bank area of the Spratly Islands. That project was one of the reasons for the submission to the Permanent Court of Arbitration (PCA) in the Hague, and the 2016 settlement that rejected China's historical claims.

Singapore is a major refiner with 1.3 million b/d of crude oil refining capacity in 2023.

Thailand is a relatively small producer out of the Gulf of Thailand with mature fields in the north Pattani Basin, and Bongkot.

Vietnam is the up and coming producer to try and meet domestic demand, and increasing manufacturing demand for energy. In 2023, Vietnam produced 0.2 million b/d of liquids and 271 Bcf of natural gas in the South China Sea. Vietnam has had its development efforts halted by Chinese protests and disputes, such as the Vanguard Bank development project. There are three development projects which have been delayed that would occur in the nearshore areas of Vietnam.

Thank you to the EIA for access to detailed information on country production and plans, in the website found here.