Platykurtic U.S. common stocks: June 12, 2024

- Stocks with a platykurtic distribution.

- What it means for a stock to have a platykurtic distribution.

- Show a platykurtic distribution example.

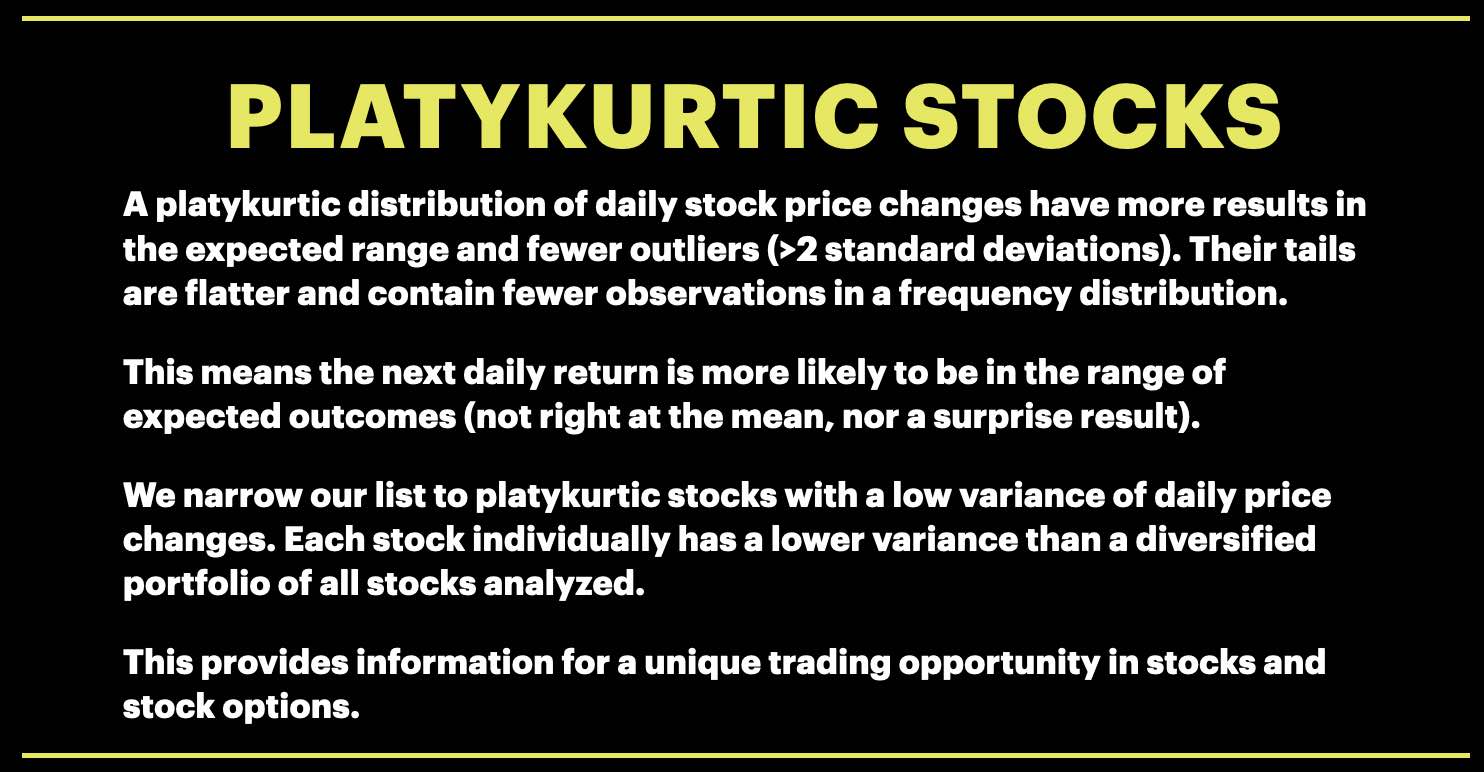

A platykurtic stock has a standardized kurtosis score that is less than a normal distribution value of three (K < 3.0). Kurtosis is the fourth central movement of a distribution. We filter the list to include stocks with K < 1.25 and stock price variance lower than the market as a proprietary choice.

Visualization:

1) a platykurtic stock distribution has fewer outliers than a normal stock price distribution, so imagine the roll of a fair, six-sided die. There are no outliers, and a die is perfectly platykurtic.

2) a platykurtic stock likely has significant liquidity so that if one side of the trade wants to drive the stock up or down, the other side is right there with plenty of buying or selling power to take the other side of the trade.

3) a platykurtic stock with low variance just did not see outlier moves last year...it was more predictable within the expected range of daily stock price changes.

The S&P 500 Equity Index ETF is a highly platykurtic stock and has been for a while.

Visualization:

1) a platykurtic stock distribution has fewer outliers than a normal stock price distribution, so imagine the roll of a fair, six-sided die. There are no outliers, and a die is perfectly platykurtic.

2) a platykurtic stock likely has significant liquidity so that if one side of the trade wants to drive the stock up or down, the other side is right there with plenty of buying or selling power to take the other side of the trade.

3) a platykurtic stock with low variance just did not see outlier moves last year...it was more predictable within the expected range of daily stock price changes.

The S&P 500 Equity Index ETF is a highly platykurtic stock and has been for a while.

Platykurtic and low variance stocks:

Here is the sorted list of the platykurtic and low variance stocks we found today, with ticker, standard kurtosis score, and normalized variance over the past year:

SPY -0.026 0.0000095

EPD -0.010 0.0000074

L 0.065 0.0000145

PNNT 0.192 0.0000198

WMB 0.280 0.0000206

PBA 0.311 0.0000174

OBDC 0.377 0.0000133

V 0.390 0.0000140

CTO 0.416 0.0000206

BCSF 0.450 0.0000191

ET 0.495 0.0000164

EQC 0.591 0.0000120

MPLX 0.651 0.0000075

KMI 0.681 0.0000196

MAIN 0.704 0.0000120

SLRC 0.739 0.0000132

MFIC 0.746 0.0000185

YUM 0.860 0.0000186

CCAP 0.881 0.0000204

ATO 0.960 0.0000196

ARCC 0.961 0.0000105

TJX 1.044 0.0000192

PM 1.047 0.0000183

BRK.B 1.117 0.0000108

OTIS 1.186 0.0000199

SPY -0.026 0.0000095

EPD -0.010 0.0000074

L 0.065 0.0000145

PNNT 0.192 0.0000198

WMB 0.280 0.0000206

PBA 0.311 0.0000174

OBDC 0.377 0.0000133

V 0.390 0.0000140

CTO 0.416 0.0000206

BCSF 0.450 0.0000191

ET 0.495 0.0000164

EQC 0.591 0.0000120

MPLX 0.651 0.0000075

KMI 0.681 0.0000196

MAIN 0.704 0.0000120

SLRC 0.739 0.0000132

MFIC 0.746 0.0000185

YUM 0.860 0.0000186

CCAP 0.881 0.0000204

ATO 0.960 0.0000196

ARCC 0.961 0.0000105

TJX 1.044 0.0000192

PM 1.047 0.0000183

BRK.B 1.117 0.0000108

OTIS 1.186 0.0000199

A short video to describe our platykurtic stock service.