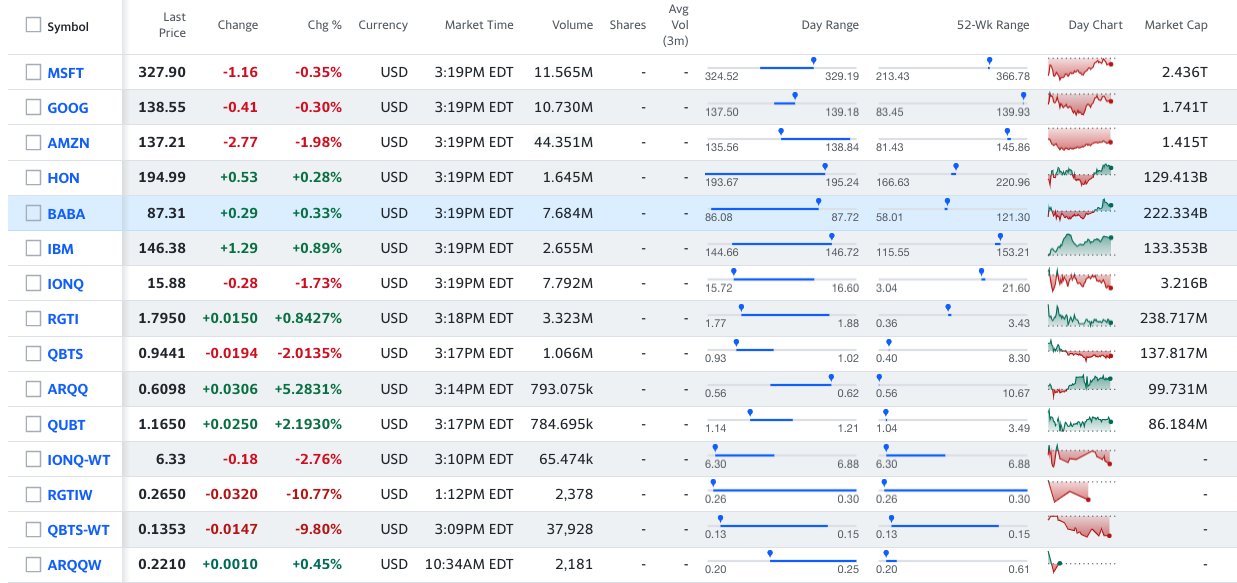

Investing in Quantum Computing Stocks

Here is a list of stocks of U.S. companies that are quantum computing pure play investments. These companies are focused on creating quantum computing hardware, software, and quantum-simulating applications.

We are adding information on Zapata Computing Holdings Inc. ZPTA

This is a software and services firm.

United States - pure play quantum computer supplier:

IonQ, Inc., IONQ

Rigetti Computing, Inc., RGTI

Canada - pure play quantum computer supplier:

D-Wave Quantum Inc., QBTS

United Kingdom - pure play:

Arqit Quantum Inc., ARQQ (secure communications)

Quantum simulation software

Quantum Computing Inc., QUBT (software

List of companies with small* quantum computing programs:

US quantum computing program - quantum computer supplier

International Business Machines Corporation, IBM

Honeywell International Inc., HON

Alphabet Inc. (dba: Google), GOOG

US quantum computing program - quantum computer access

Amazon.com, Inc., AMZN

Microsoft Corporation, MSFT

Chinese quantum computing program

Alibaba Group Holding Limited, BABA - Cancelled their quantum computing program

Tencent Holdings Limited, TCEHY - Quantum related analytics

There are long-term traded stock warrants on Arqit, Rigetti, D-Wave and IonQ:

ARQQW

RGTIW

QBTS-WT

IONQ-WT

Other Considerations:

One thing is certain, the companies that we know with a material focus on quantum computing have very high market valuations. In our opinion, this is because companies, or governments, need to be very well funded to spend on a longer-term investment like quantum computing.

We are adding information on Zapata Computing Holdings Inc. ZPTA

This is a software and services firm.

United States - pure play quantum computer supplier:

IonQ, Inc., IONQ

Rigetti Computing, Inc., RGTI

Canada - pure play quantum computer supplier:

D-Wave Quantum Inc., QBTS

United Kingdom - pure play:

Arqit Quantum Inc., ARQQ (secure communications)

Quantum simulation software

Quantum Computing Inc., QUBT (software

List of companies with small* quantum computing programs:

US quantum computing program - quantum computer supplier

International Business Machines Corporation, IBM

Honeywell International Inc., HON

Alphabet Inc. (dba: Google), GOOG

US quantum computing program - quantum computer access

Amazon.com, Inc., AMZN

Microsoft Corporation, MSFT

Chinese quantum computing program

Alibaba Group Holding Limited, BABA - Cancelled their quantum computing program

Tencent Holdings Limited, TCEHY - Quantum related analytics

There are long-term traded stock warrants on Arqit, Rigetti, D-Wave and IonQ:

ARQQW

RGTIW

QBTS-WT

IONQ-WT

Other Considerations:

- There are many other companies that are building their business that are not yet listed on US stock exchanges.

- There are large companies with early-stage quantum computing programs (e.g., creating quantum applications) that will take advantage of quantum computing in their business, either by creating new capabilities or improved optimization.

- One company, Honeywell, spun out their quantum computing business with a quantum consultancy.

- How to buy quantum computing stocks: very carefully. These pure-play companies are in the experimental phase and have not scaled into commercial production. These companies will need to raise and spend capital on developing quantum computers on scale, and there is a risk that they will either not succeed, or that their products will not be commercially acceptable. Buyer beware.

One thing is certain, the companies that we know with a material focus on quantum computing have very high market valuations. In our opinion, this is because companies, or governments, need to be very well funded to spend on a longer-term investment like quantum computing.

Alibaba canceled its quantum computing program (specifically its quantum computing research lab), as announced by Bloomberg and Jane Zhang on November 27, 2023 in a cost-cutting move.

This suggests that quantum computing research is for companies with both access to R&D capital and long-term development time horizons. It is an aspirational investment in a potentially high-return technology that requires capital, expertise and close oversight to protect IP, cultivate innovation, build an expert team, partner across the hardware, software, storage, networking and political ecosystem, all while maintaining a focus on potential market requirements that customers will pay for.

Companies require a long-term investment horizon to invest in quantum today, not just size.

This suggests that quantum computing research is for companies with both access to R&D capital and long-term development time horizons. It is an aspirational investment in a potentially high-return technology that requires capital, expertise and close oversight to protect IP, cultivate innovation, build an expert team, partner across the hardware, software, storage, networking and political ecosystem, all while maintaining a focus on potential market requirements that customers will pay for.

Companies require a long-term investment horizon to invest in quantum today, not just size.

We maintain a Yahoo Finance portfolio of these stocks, and are constantly adding to the list. We will send you a screenshot upon reasonable request to [email protected].

We are available to provide you with a 'publicly available information' analysis of these companies that leverages our skills, expertise, experience and publicly available information. We can help companies with how to take advantage of quantum computing in their core busineses. We can serve as an expert witness.

We can help you to better understand the quantum computing industry landscape and companies.

We cannot predict the future, but we can give you our opinion on where quantum computing is heading.

Note: * small quantum computing programs does not reflect on the importance of the program, but on the size of the program's investment and revenue relative to overall company size.

We can help you to better understand the quantum computing industry landscape and companies.

We cannot predict the future, but we can give you our opinion on where quantum computing is heading.

Note: * small quantum computing programs does not reflect on the importance of the program, but on the size of the program's investment and revenue relative to overall company size.