What should a retail investor do?

One important topic was to repeat an answer to a question posed by a potential retail investor client.

Myron (his real name) asked: "Can I get some good tips for free? What should a little guy like me invest in?" By way of background, Myron was on a job interview and had some investments he made this year in stocks. He did not remember all the tickers, did not know what the companies did, and did double his money on one trade, but not sure about the others. He bought them on a whim.

For a retail investor with limited capital, what I suggest is to take money that you can afford to put to work for five years. Money you won't need for five years for living expenses. In Myron's case, that was $25,000.

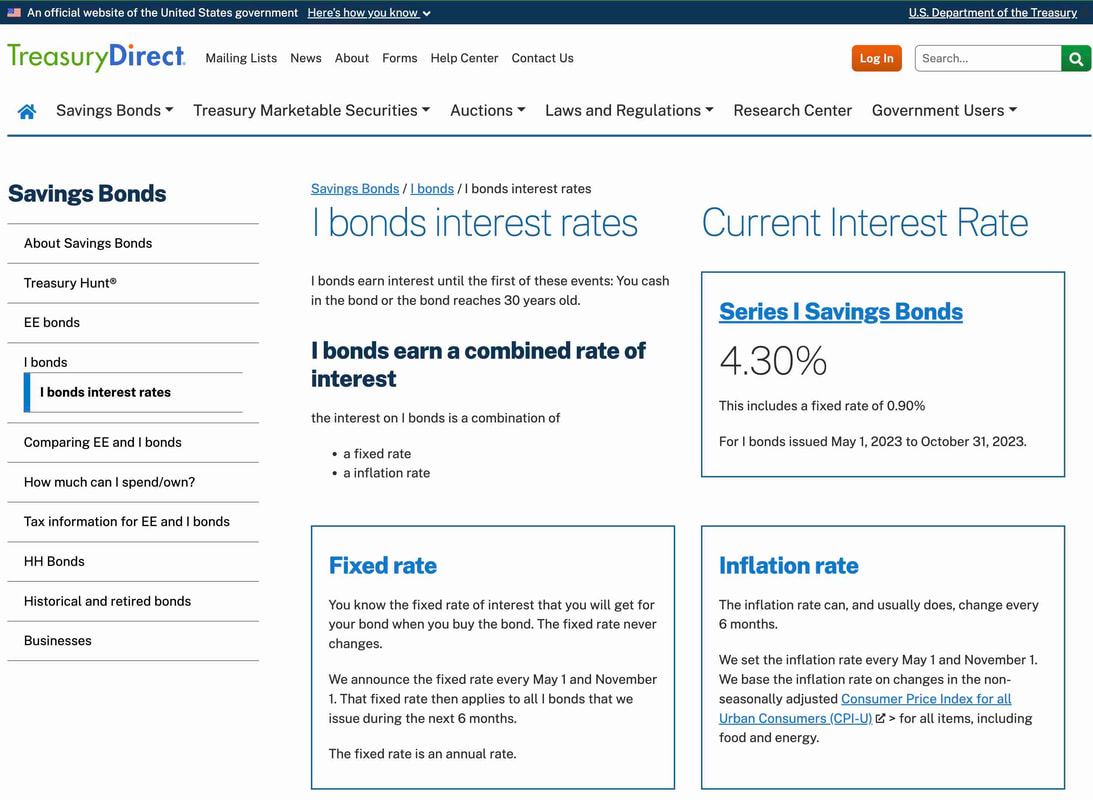

For the first $10,000 (he is a US citizen), I suggest going to Treasury.gov, or Treasury Direct, and buying I-Series US Savings Bonds directly from the US Treasury. You can lock in a 4.30% interest rate for the first six months. They promise to pay 'real' interest of 0.9% for the next 30 years, after making up for inflation. This is awesome for investors, and there are even some potential tax benefits. We recommend the first $10,000 go into I-Series US Savings Bonds. Screen-shot below from Treasurydirect.gov.

The next $15,000 goes into a low cost, passive, index equity mutual fund. We like the ones that track the S&P 500 Index although it is 100% ok if you want to put some into a passive index equity mutual fund that mirrors the Nasdaq Composite 100 (although there is significant overlap), and some into the Russell 2000 (small caps). The S&P 500 is our favorite, and provides the best risk-return tradeoff for a retail investor that cannot do the due diligence or run the quantitative models required to find an edge.

The fund manager we use personally is Vanguard and have invested in their S&P 500 Admiral Class index fund since the 1990s. Fidelity also has a low-cost fund that should be ok. Also, we are setting up a relationship with The Charles Schwab to be our custodian for client funds. It is likely they have a comparable product as well. The key is to find a very low cost mutual fund (maybe pay 6 or 9 basis points per year in expenses) and to reinvest dividends.

In year two, rinse and repeat. Put another $10k into US Savings Bonds and another $15k into US equities and watch your money grow. As your retirement nest-egg grows, and your wage income grows, there are other types of investments to consider.

A 'typical' retail investor should invest using a highly diversified US Equity portfolio like the S&P 500. If you can only buy and hold one stock, or you have limited funds to invest, it is prudent to hold a passive US stock market index.

For high net worth individuals or money managers, we can help you build a better portfolio. That is what we do.

Myron (his real name) asked: "Can I get some good tips for free? What should a little guy like me invest in?" By way of background, Myron was on a job interview and had some investments he made this year in stocks. He did not remember all the tickers, did not know what the companies did, and did double his money on one trade, but not sure about the others. He bought them on a whim.

For a retail investor with limited capital, what I suggest is to take money that you can afford to put to work for five years. Money you won't need for five years for living expenses. In Myron's case, that was $25,000.

For the first $10,000 (he is a US citizen), I suggest going to Treasury.gov, or Treasury Direct, and buying I-Series US Savings Bonds directly from the US Treasury. You can lock in a 4.30% interest rate for the first six months. They promise to pay 'real' interest of 0.9% for the next 30 years, after making up for inflation. This is awesome for investors, and there are even some potential tax benefits. We recommend the first $10,000 go into I-Series US Savings Bonds. Screen-shot below from Treasurydirect.gov.

The next $15,000 goes into a low cost, passive, index equity mutual fund. We like the ones that track the S&P 500 Index although it is 100% ok if you want to put some into a passive index equity mutual fund that mirrors the Nasdaq Composite 100 (although there is significant overlap), and some into the Russell 2000 (small caps). The S&P 500 is our favorite, and provides the best risk-return tradeoff for a retail investor that cannot do the due diligence or run the quantitative models required to find an edge.

The fund manager we use personally is Vanguard and have invested in their S&P 500 Admiral Class index fund since the 1990s. Fidelity also has a low-cost fund that should be ok. Also, we are setting up a relationship with The Charles Schwab to be our custodian for client funds. It is likely they have a comparable product as well. The key is to find a very low cost mutual fund (maybe pay 6 or 9 basis points per year in expenses) and to reinvest dividends.

In year two, rinse and repeat. Put another $10k into US Savings Bonds and another $15k into US equities and watch your money grow. As your retirement nest-egg grows, and your wage income grows, there are other types of investments to consider.

A 'typical' retail investor should invest using a highly diversified US Equity portfolio like the S&P 500. If you can only buy and hold one stock, or you have limited funds to invest, it is prudent to hold a passive US stock market index.

For high net worth individuals or money managers, we can help you build a better portfolio. That is what we do.