Iranian Energy Export Capabilities

This page is focused on the critical infrastructure that is used by Iran to export oil, natural gas, and other energy products as of open-source information gathered in mid-April 2024. This analysis is relevant to the question of the importance, structure and evolution of Iranian Energy Export Capabilities. These are required to maintain the cash flow of Iran, and the world's ability to consumer Iranian energy products.

We will primarily focus on the capabilities for export and which country currently imports those exports from Iran.

Finally, we might discuss what strengths, weaknesses, opportunities and threats (SWOT Analysis) around these capabilities, again with all analysis based on our expertise, on open source intelligence and on public web searches.

We will primarily focus on the capabilities for export and which country currently imports those exports from Iran.

Finally, we might discuss what strengths, weaknesses, opportunities and threats (SWOT Analysis) around these capabilities, again with all analysis based on our expertise, on open source intelligence and on public web searches.

According to the U.S. Congressional Research Service report: Iran's Petroleum Exports to China and U.S. Sanctions, updated February 28, 2024, Iran has recently slowed down exports from almost 2 million barrels per day to about 1.3 million b/d to gain a higher price from mostly Chinese importers known as teapots, and Syria and U.A.E. Those are smaller refiners who can take in Iranian crude oil and condensate, no questions asked and no US Dollars banking system required, and process crude oil by the batch. This was a short report, and the source is United Against Nuclear Iran based in New York City, here.

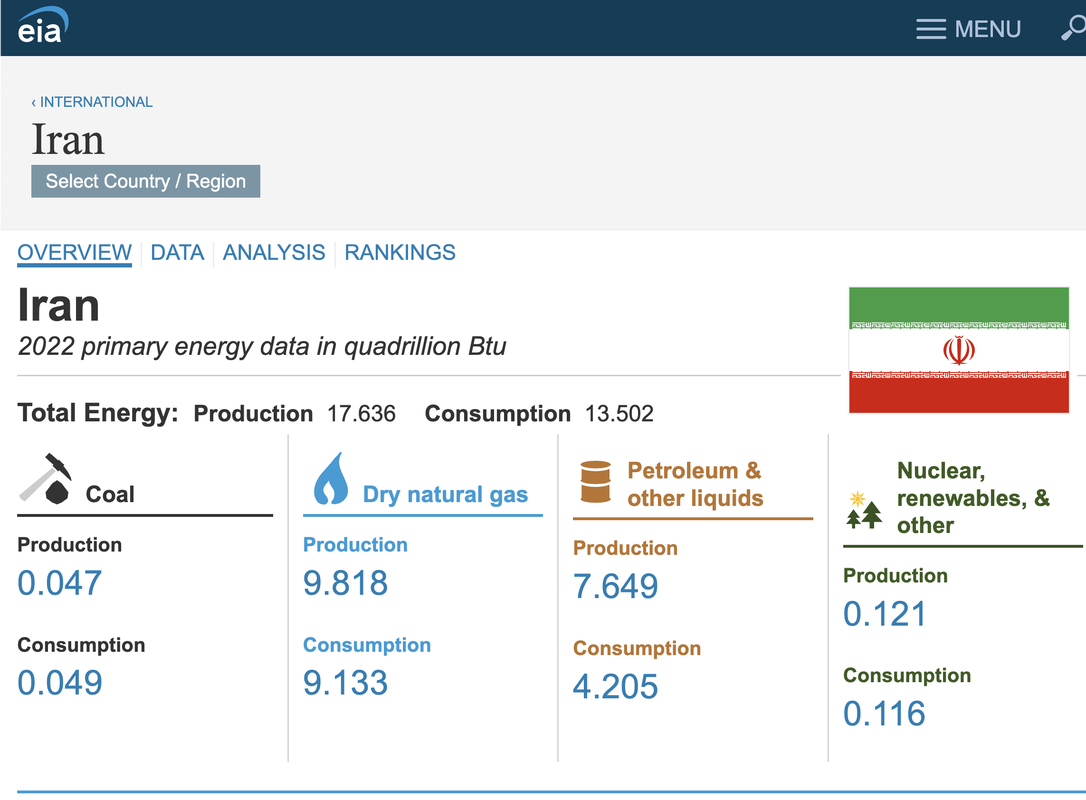

Iran's energy surplus is in Petroleum and other liquids

As you can see in the 2022 EIA country overview, Iran almost perfectly matches production and consumption in coal, natural gas, and in nuclear and renewables. the gap is in Petroleum and other liquids, where consumption of 4.2 quadrillion BTUs is 3.4 quadrillion BTUs less than production. We also believe that Iran could significantly ramp up production and export of crude oil if global sanctions were lifted and Iran could import both financing, and technology.

Iranian energy exports are not material in the area of natural gas, and Iran has significant excess capacity in its crude oil export terminals, as you will see below. When converting BTUs to barrels, at a rate of 172,413,790 barrels of crude oil per quadrillion BTUs, and assuming even production and export over 365 days / year (no Ramadan break), then this is a 1.63 million b/d export capacity assuming 2022 data.

Khark Island alone can export up to 10 million b/d out of the Persian Gulf, and add the other export terminals and the 6x redundancy is even greater.

Khark Island alone can export up to 10 million b/d out of the Persian Gulf, and add the other export terminals and the 6x redundancy is even greater.

Crude Oil Export Terminals

Iran has multiple oil and gas export terminals, and most of them are tied, or even co-located, to serve specific production fields. All but one of these terminals are west (or inside) of the Strait of Hormuz, off the southeastern coast of Iran. That means tankers have to pass through the 21-mile wide, busy choke-point between Iran and Oman where most of UAE, Qatar, Saudi Arabia, Iraq and Kuwait energy exports also travel. We have read that as much as 20% of global trade in crude oil passes through the Strait. It can take each tanker 4-5 days to transit and load from Khark Island as opposed to remaining in the Gulf of Oman.

Khark Island (or Kharg Island) is the primary export terminal in Iran. It is by far the largest and most important, with a maximum operating capacity estimated between 9 and 10 million b/d. It is in the NE Persian Gulf. It includes a main terminal, a four-berth sea island, a ten-berty jetty, conventional buoy mooring systems, and more recently added single-point moorings (SPM) about half way between shore and Khark (25km offshore) with 2 million b/d assuming the pipelines and storage capacity can flow the product. This terminal processes all onshore production (Iran Heavy and Iran Light blends), and offshore production from the Foroozan field (Foroozan Blend). NIOC reports it can load a maximum of 7 million b/d. In the past, this handled 90% of Iran's exported crude oil. The two (or three) pipelines, with a combined capacity of 6.3 million b/d, feed Khark have a last control point manifold at Ganaveh. From this terminal, crude loads in 24 - 48 hours, the pipelines are gravity operated, and Khark is fed by six submarine pipelines from the Ganaveh manifold. There are two additional terminals on Khark Island, Daryush Terminal which receives oil from nearby offshore fields, and Khemco Terminal, with a single jetty for crushed sulphur, and LPG (butane and propane) which are stored underground.

Lavan Island to export premium, Lavan Blend, from offshore fields. This has a high storage capacity of 5.5 million barrels and a loading capacity of 0.2 million b/d.

Sirri Island processes medium-gravity, high-sulfur Sirri Blend produced offshore. Its storage capacity is 4.5 million barrels.

Neka (Caspian Sea port) is relatively small and is designed to handle swap agreement trade with Azerbaijan, Kazakhstan and Turkmenistan when contract negotiations are successful, and they often are not.

Assaluyeh processes South Pars condensate for export, mainly to China, India, Japan, South Korea and UAE. It also loads Liquified Petroleum Gas (LPG), sulfur, and petrochemical products.

Qeshm oil terminal, on Qeshm island near the Strait of Hormuz, started with 3.2 million barrels of storage capacity for crude oil, condensates, or oil products, with a second phase adding another 3.2 million barrels of storage capacity in late 2021.

Bandar Mahshahr and Abadan (a.k.a. Bandar Imam Khomeini) process refined products from the Abadan refinery.

Bandar Abbas, near the northern end of the Strait of Hormuz, is Iran's main fuel oil export terminal.

Chah Bahar is a port closest to Pakistan in the Gulf of Oman (outside the Strait of Hormuz). There was a natural gas trade and pipeline deal with Pakistan, but not sure it was ever completed and taken into operation.

Khark Island (or Kharg Island) is the primary export terminal in Iran. It is by far the largest and most important, with a maximum operating capacity estimated between 9 and 10 million b/d. It is in the NE Persian Gulf. It includes a main terminal, a four-berth sea island, a ten-berty jetty, conventional buoy mooring systems, and more recently added single-point moorings (SPM) about half way between shore and Khark (25km offshore) with 2 million b/d assuming the pipelines and storage capacity can flow the product. This terminal processes all onshore production (Iran Heavy and Iran Light blends), and offshore production from the Foroozan field (Foroozan Blend). NIOC reports it can load a maximum of 7 million b/d. In the past, this handled 90% of Iran's exported crude oil. The two (or three) pipelines, with a combined capacity of 6.3 million b/d, feed Khark have a last control point manifold at Ganaveh. From this terminal, crude loads in 24 - 48 hours, the pipelines are gravity operated, and Khark is fed by six submarine pipelines from the Ganaveh manifold. There are two additional terminals on Khark Island, Daryush Terminal which receives oil from nearby offshore fields, and Khemco Terminal, with a single jetty for crushed sulphur, and LPG (butane and propane) which are stored underground.

Lavan Island to export premium, Lavan Blend, from offshore fields. This has a high storage capacity of 5.5 million barrels and a loading capacity of 0.2 million b/d.

Sirri Island processes medium-gravity, high-sulfur Sirri Blend produced offshore. Its storage capacity is 4.5 million barrels.

Neka (Caspian Sea port) is relatively small and is designed to handle swap agreement trade with Azerbaijan, Kazakhstan and Turkmenistan when contract negotiations are successful, and they often are not.

Assaluyeh processes South Pars condensate for export, mainly to China, India, Japan, South Korea and UAE. It also loads Liquified Petroleum Gas (LPG), sulfur, and petrochemical products.

Qeshm oil terminal, on Qeshm island near the Strait of Hormuz, started with 3.2 million barrels of storage capacity for crude oil, condensates, or oil products, with a second phase adding another 3.2 million barrels of storage capacity in late 2021.

Bandar Mahshahr and Abadan (a.k.a. Bandar Imam Khomeini) process refined products from the Abadan refinery.

Bandar Abbas, near the northern end of the Strait of Hormuz, is Iran's main fuel oil export terminal.

Chah Bahar is a port closest to Pakistan in the Gulf of Oman (outside the Strait of Hormuz). There was a natural gas trade and pipeline deal with Pakistan, but not sure it was ever completed and taken into operation.

Jask Island, also called Jazireh-ye-Khark, is east of the Strait of Hormuz in the Gulf of Oman. It went into test mode in 2021 and went operational in 2023. It is also called Bandar-e-Jask Port and is located in the Hormozgan Province, Kooh Mobarak, about 70 km west of the port town of Jask. This is a strategic location for an export terminal because it bypasses the Persian Gulf and the strait of Hormuz, and it cuts 4 or 5 days in transit time vs. traveling deep into the Persian Gulf. This has been in the planning stage since the 1980s, and once fully operational is expected to be a large terminal. Its planned initial loading capacity of 2 million b/d and storage capacity of 20 million barrels will be increased over time, and we read one estimate that Jask Island would have a total crude oil reservoir capacity of 100 million barrels. This would rival Khark Island and could become a co-primary export terminal.

It will have a harbor, power generation and distribution systems, jetties and single point moorings (SPM). It will handle various grades of crude oil and gas condensate. It will be fed by the 1000 km Goreh-Jask oil pipeline starting in 2022, which itself is new and a major investment for Iran as it also introduces redundancy into the domestic pipeline lattice.

We read on May 19, 2023, in Quantum Commodity Intelligence, that Iran says its east coast Jask export terminal is now ready after a 2-year delay.

It will have a harbor, power generation and distribution systems, jetties and single point moorings (SPM). It will handle various grades of crude oil and gas condensate. It will be fed by the 1000 km Goreh-Jask oil pipeline starting in 2022, which itself is new and a major investment for Iran as it also introduces redundancy into the domestic pipeline lattice.

We read on May 19, 2023, in Quantum Commodity Intelligence, that Iran says its east coast Jask export terminal is now ready after a 2-year delay.

Main 'Competitive' Export Terminals & Routes

Here are the primary export terminals for Iran's neighbors in the Persian Gulf, which also transit the Strait of Hormuz.

- Qatar: Hulul Island

- Iraq: Al Basrah

- UAE/Abu Dhabi: Ruwais

- Saudi Arabia: Ras Tanura (the world's largest oil terminal)

- Kuwait: Mina al-Ahmadi (with others, and a new terminal on Bubiyan Island).

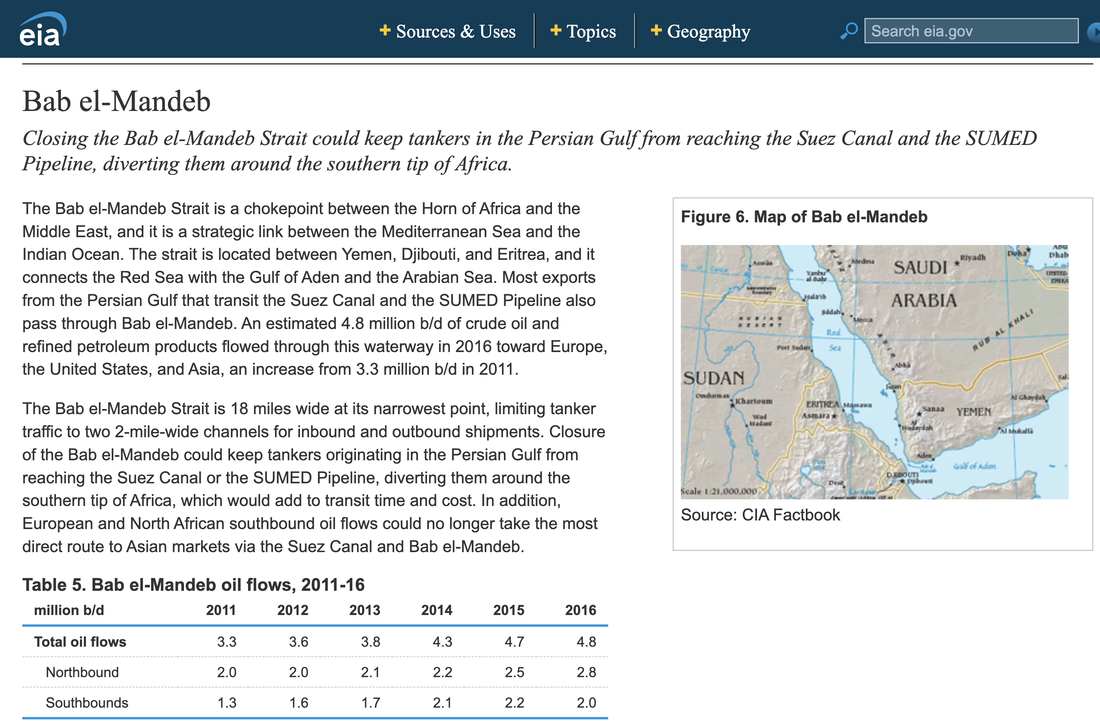

Iran has halted trade through the Suez Canal for those countries that act against its national interests through its proxy Houthi military forces in Yemen. They did this by closing the Bab el_Mandeb Strait which is a think shipping channel, 18 miles wide, that runs between Yemen and Djibouti and Eritrea. Iran has never claimed this as their work, but the U.S. and its allies have developed an anti-piracy naval consortium that has been interdicting Iranian weapons before they land in Yemen, and by destroying Houthi weapons, including missiles, while on the launchpad.

Iran, through its Houthi proxy army in Yemen, has effectively shut the Bab el-Mandeb chokepoint to energy and trade flows that belong to unfriendly nations. These are nations that are allied with the United States, Israel, and likely most of Europe, especially after the United Kingdom and France shot down their weapons fired at Israel in Mid-April 2024. This impacts trade between the Persian Gulf and Europe / North America, and concerns both northbound energy trade and southbound non-energy trade.

For a more thorough understanding of the Bab el-Mandeb chokepoint, please view the 2017 EIA analysis here.

Iran, through its Houthi proxy army in Yemen, has effectively shut the Bab el-Mandeb chokepoint to energy and trade flows that belong to unfriendly nations. These are nations that are allied with the United States, Israel, and likely most of Europe, especially after the United Kingdom and France shot down their weapons fired at Israel in Mid-April 2024. This impacts trade between the Persian Gulf and Europe / North America, and concerns both northbound energy trade and southbound non-energy trade.

For a more thorough understanding of the Bab el-Mandeb chokepoint, please view the 2017 EIA analysis here.

Pipelines

Iran exports a relatively insignificant amount of natural gas via pipeline, and mostly that goes to Iraqi power plants and Turkey. Trade north into the former Soviet states is relatively insignificant. We have no information on trade with Pakistan and India except that the gas export deal never became operational with Pakistan.

Iran has an extensive domestic oil pipeline network which seems to be oriented to moving oil and product from production to refineries, and domestic distribution to consume those products. We read that there are 20 domestic pipelines, with more in the planning stages.

It is too early to tell, but it looks like Iran has significant and diverse, domestic pipeline capability within the country to enable public, domestic, internal natural gas consumption, and to transport raw energy to refineries.

There are two natural gas pipelines that connect into Turkmenistan, two into terminals into the Caspian Sea, two into Azerbaijan, one into Armenia and the Iran-Turkey Pipeline into Turkey. There are also natural gas pipelines and trade agreements with Iraq to supply their power plants while they rebuild their natural gas production. There may also be pipelines under the Persian Gulf leading into the United Arab Emirates (U.A.E.). We do not believe these are high volume, high-value export channels.

There is also a natural gas pipeline that terminates in a few places into the Caspian Sea, which may not be seeing heavy use currently.

Looking at a large-scale, Middle Eastern map, we see additional pipelines:

IGAT VII, the Iran - India Pipeline, which runs from Iran through Pakistan

There may also be natural gas pipelines leading from Southern Iran to the Caspian Sea. More research required.

It is too early to tell, but it looks like Iran has significant and diverse, domestic pipeline capability within the country to enable public, domestic, internal natural gas consumption, and to transport raw energy to refineries.

There are two natural gas pipelines that connect into Turkmenistan, two into terminals into the Caspian Sea, two into Azerbaijan, one into Armenia and the Iran-Turkey Pipeline into Turkey. There are also natural gas pipelines and trade agreements with Iraq to supply their power plants while they rebuild their natural gas production. There may also be pipelines under the Persian Gulf leading into the United Arab Emirates (U.A.E.). We do not believe these are high volume, high-value export channels.

There is also a natural gas pipeline that terminates in a few places into the Caspian Sea, which may not be seeing heavy use currently.

Looking at a large-scale, Middle Eastern map, we see additional pipelines:

IGAT VII, the Iran - India Pipeline, which runs from Iran through Pakistan

There may also be natural gas pipelines leading from Southern Iran to the Caspian Sea. More research required.

Trucking

No information on crude oil exports via truck.

Railroads

No information on crude oil exports via railway.

Primary customers of Iranian energy

According to the EIA, in 2017 before sanctions were imposed, primary buyers were China (25%), India (17%), Turkey (9%), South Korea (13%) and the European Union (20%). South Korean imports were weighted towards condensate.

Other petroleum product exports (e.g., fuel oil, gasoline and diesel) went to Asia, neighboring countries and Syria.

Other petroleum product exports (e.g., fuel oil, gasoline and diesel) went to Asia, neighboring countries and Syria.

Iraq attacked Khark & Ganaveh in the 1980s

It is true. During the Iran vs. Iraq war, Iraq attacked Khark and then attacked Ganaveh. This were relatively minor attacks, conducted from safe altitudes and distances from Iranian air defense systems, and seemed to lack the 'oomph' to take out the facility entirely. They were rather minor (e.g., damaging 4 of 32 storage tanks). Iraq also attacked pumping stations in both 1985 and 1986 which were upstream of Ganaveh and would act to reduce pipeline capacity, but in our estimation by only about 50% due to their gravity system.

Iraq air force attacks on Khark:

Iraq air force attacks on Ganaveh:

These attacks did not achieve their strategic objectives. Peace was achieved in 1988 without a clear winner. Jask is just at the combat range limit of the Iraqi air force MIG-25, which was the aircraft they used during the war against Iran.

Iraq air force attacks on Khark:

- August 15, 1985

- September 19, 1985

- November 14, 1985

- November 15, 1985

Iraq air force attacks on Ganaveh:

- January 23, 1986

These attacks did not achieve their strategic objectives. Peace was achieved in 1988 without a clear winner. Jask is just at the combat range limit of the Iraqi air force MIG-25, which was the aircraft they used during the war against Iran.

What about now?

Our conclusion is that Iran is relatively safe against service disruptions of any one of its crude oil and natural gas terminals, unless it was a repeated and focused intentional destruction and interference with repair activities.

In fact, Iran has taken a big step in protecting its export capabilities by closing the chokepoint at Bab el-Mandeb, which already has constrained global energy trade and increased the price of oil to over $80/barrel in global markets. In hindsight, this was a clever move before attacking Israel.

The big question is what would happen to Iran if their exports of crude oil were halted? In the 1980s, when oil was less expensive and Iran was exporting well below nameplate capacities, it was thought that Iran could survive for 3-6 months on existing foreign reserves before causing any crisis militarily or with their civilian population.

In 2024 there are four questions:

1. Could Iran live off their foreign current reserves while repairing the damage?

2. Would Iran close the Strait of Hormuz?

3. Would Iran leverage improving diplomatic and trade relationships to reroute exports?

4. Would Iran go strategic in a dramatic response (e.g., WMD or expand Arabian Peninsula influence further?

What about the response from Iran's oil customers? We believe that despite the sanctions, the world is consuming excess Iranian crude oil. A disruption of Iranian oil exports would be met with concern from significant Asian economies as global export energy supply shrinks and prices rise.

In fact, Iran has taken a big step in protecting its export capabilities by closing the chokepoint at Bab el-Mandeb, which already has constrained global energy trade and increased the price of oil to over $80/barrel in global markets. In hindsight, this was a clever move before attacking Israel.

The big question is what would happen to Iran if their exports of crude oil were halted? In the 1980s, when oil was less expensive and Iran was exporting well below nameplate capacities, it was thought that Iran could survive for 3-6 months on existing foreign reserves before causing any crisis militarily or with their civilian population.

In 2024 there are four questions:

1. Could Iran live off their foreign current reserves while repairing the damage?

2. Would Iran close the Strait of Hormuz?

3. Would Iran leverage improving diplomatic and trade relationships to reroute exports?

4. Would Iran go strategic in a dramatic response (e.g., WMD or expand Arabian Peninsula influence further?

What about the response from Iran's oil customers? We believe that despite the sanctions, the world is consuming excess Iranian crude oil. A disruption of Iranian oil exports would be met with concern from significant Asian economies as global export energy supply shrinks and prices rise.

Primary Source: U.S. Energy Information Administration Country Analysis Brief for Iran. Data presented are the most recently available as of April 30, 2021.

Iran set to begin oil exports from the new Gulf of Oman terminal, Marine Traffic Blog, June 22, 2021, article by Penny Thomas, Navigate PR.

Iran set to begin oil exports from the new Gulf of Oman terminal, Marine Traffic Blog, June 22, 2021, article by Penny Thomas, Navigate PR.