|

Hello on this calm Sunday evening. As we write this, US Equities will likely open lower, Energy prices are higher (significantly), US Government Yields are rising, Political Uncertainty seems higher, and there is fear of further market declines.

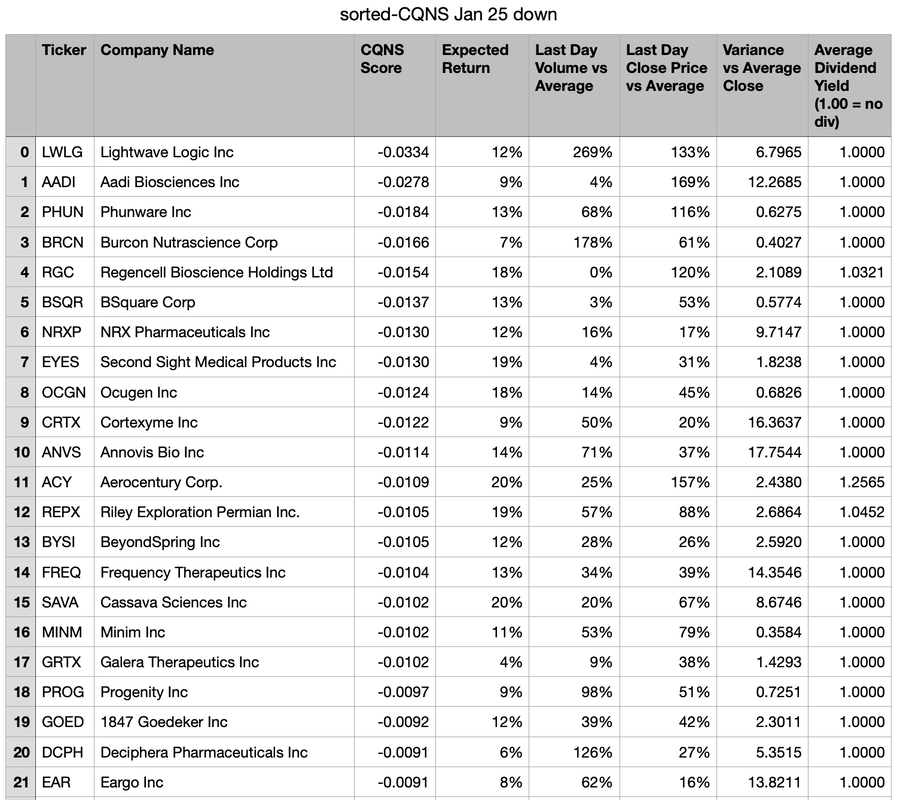

People are discussing things that make equity prices drop. Here is a sobering thought: Market returns continue to fall (based on prior 12 months or 252 trading days): Riskfree rate = 1.00% Actual SPY return = 21.02% Use ceiling S&P500 rate = 20.00% Actual IWM return = -4.11% Use floor Russell 2000 rate = 5.00% Actual QQQ return = 12.23% Use actual NASDAQ 100 rate = 12.23% =========================================== Market return = 11.41% Much of the euphoria of the past 2 years is behind us. It is already behind us, and now we decide, as a market, how we continue. Anyone with money in the market has resigned themselves, all things being equal, to lower expected returns (or lower prices and higher risk for higher expected returns). On the UP run, we see a new mix of stocks (some of which have risen closer to the top of the run), and a few new performers. We see the same type of stocks even after the latest market weakness. This means that these stocks are lower in price than they were a year ago, and they still have lower risk/return than other stocks. Total US listed equities (or tickers of things that are listed in equities markets that are not equities) that traded on Friday: 11,267 tickers. Profitable stocks that traded (and passed all of our data validation steps): 2,313 common stocks. If you held all of these stocks equally, you would expect to earn 13.1% (excluding dividends). Volatility of prices is 1.1 x 10-4. Top 22 UP run stocks: $SI $ICHR $UCTT $ACLS $AOSL $LSCC $EQOS $SITM $GRWG $MGNI $CALX $EXPI $TTGT $AMAT $CLFD $COHU $NVDA $TTD $APAM $FORM $LKAC $TER The stocks chosen are driven by having exceptionally large BETA values (vs. $SPY). These "UP" run stocks will scream higher (and with lower volatility) if the general S&P 500 rises. We see stocks from a number of industries. On the DOWN run, out of 11,267 stocks only 1,187 have negative net income and passed all of our data validation steps. The expected return of these stocks is higher than for the UP run, coming in at 16.8%. The volatility of prices is 3.0 x 10-4, or almost 3x higher. Lesson 1: volatility is higher for stocks with negative net income than for stocks with positive net income. Down Run: $LWLG $AADI $PHUN $RGC $BSQR $GME $CRTX $OCGN $NRXP $ANVS $ACY $BYSI $FREQ $PROG $GOED $EAR $DCPH $MMAT $ATER $RFL $AMC $SAVA On the down run, we see many of the same stocks in the list with a few notable exceptions. We see a few popular MEME stocks make the top 22. These have increased risk than before relative to their expected returns. Overall, short bets from last week would stay in place. Good luck in the markets this week. Jeffrey Cohen

0 Comments

Jan 27 (market close) update:

Most of the small cap, aspirational growth stocks that we track fell today. Larger, and more profitable stocks held strong. Our CQNS "DOWN" stocks (~40) from this week, and those that used to be on the list in November 2021, were all down with one exception. The market punished stocks with higher volatility. IMO: This is due to the connection between volatility, liquidity, and expected returns. We ran our CQNS "DOWN" model last night (Jan 25) and came up with these 20 stocks to avoid, especially if the market drops. We shared them in a video this morning. Interestingly enough, the US Equity Futures are up today, so it will be interesting to see if these rise 'with the tides of risk.' IMO: Risk is higher than expected return, relatively speaking, so these are still stocks to avoid. Could be fun if you like roller coasters. A roller coaster goes up and down (and people make and lose money), but end up at the same place. Oh, and watch $KMB today. It is snapping back into its trading range. Down almost $8 in pre-market trading today. Top 22 Down Run picks today (based on last night's market close data): $LWLG $AADI $PHUN $BRCN $RGC $BSQR $NRXP $EYES $OCGN $CRTX $ANVS $ACY $REPX $BYSI $FREQ $SAVA $MINM $GRTX $PROG $GOED $DCPH $EAR $CRTX fell 32% this morning. Would have paid for the run :-) The FOMC call destroyed the 'short bump up' the market was enjoying today, sending the risky indices down 4%+ during the call. The market was flat from press release to call start (so it really was the call). We re-recorded our Week 4 video tonight after markets closed (with sound this time). Sorry for this morning's video. You can still read the stocks and see the screens we shared. Here is the tweet we sent this morning with our video. CQNS "DOWN" run. Top 21 stocks to avoid or short today (20 trading days). GO! Video: https://youtu.be/xzv7sbT4RQ4 $LWLG $AADI $PHUN $BRCN $RGC $BSQR $NRXP $EYES $CRTX $OCGN $ANVS $ACY $BYSI $FREQ $REPX $MINM $GRTX $SAVA $PROG $GOED $EAR WE HAVE NO POSITION. We gave out these results before the market opened on Jan 21, 2022.

Good morning. We ran the model late into the night (had to start it at ~7:30pm CT once market data provider was ready). 2,390 US listed equities with market capitalization > $50M and net income > $1 that traded every day for the past year. Top Stock Portfolios were all anchored around $MARA. Here they are...all the scores (first number, negative) are to be compared against holding all profitable (net income > 1) stocks in equal capitalization. That portfolio has a CQNS score of zero. These are the top "UP" portfolios. The more negative the first number, the better. This is an absolute risk-reward trade-off. -0.0146 ['MARA'] 1 -0.0106 ['MARA', 'SI'] 2 -0.0089 ['MARA', 'PEP'] 2 -0.0088 ['MAA', 'MARA'] 2 -0.0087 ['EQOS', 'MARA', 'SI'] 3 -0.0086 ['MARA', 'XPO'] 2 -0.0085 ['MARA', 'NOW'] 2 -0.0083 ['ACLS', 'MARA', 'SI'] 3 -0.0080 ['ADC', 'MARA', 'SI'] 3 -0.0080 ['MARA', 'NFG', 'SI'] 3 -0.0079 ['COST', 'MARA', 'SI'] 3 -0.0079 ['KEYS', 'MARA', 'SI'] 3 -0.0079 ['HI', 'MARA', 'SI'] 3 -0.0076 ['HAE', 'MARA', 'SI'] 3 -0.0069 ['GRWG', 'ICHR', 'MARA', 'SI'] 4 -0.0069 ['CMS', 'ICHR', 'MARA', 'SI'] 4 -0.0068 ['CAG', 'ICHR', 'MARA', 'SI'] 4 -0.0068 ['ICHR', 'MARA', 'NOC', 'SI'] 4 -0.0068 ['APAM', 'ICHR', 'MARA', 'SI'] 4 -0.0067 ['GLRE', 'ICHR', 'MARA', 'SI'] 4 -0.0067 ['ACLS', 'MARA', 'SI', 'SITM'] 4 -0.0063 ['MARA', 'MMM', 'WEC'] 3 -0.0063 ['COHU', 'DKL', 'MARA'] 3 -0.0062 ['FFNW', 'MARA', 'SNDR'] 3 -0.0062 ['AEP', 'MARA', 'WMS'] 3 -0.0060 ['ACLS', 'ICHR', 'MARA', 'SI', 'SITM'] 5 -0.0059 ['MARA', 'TPC', 'UVSP'] 3 -0.0059 ['ACLS', 'ICHR', 'MARA', 'MGNI', 'SI'] 5 -0.0058 ['ACLS', 'EQOS', 'ICHR', 'MARA', 'SI', 'SITM'] 6 -0.0053 ['ACLS', 'EQOS', 'EXPI', 'ICHR', 'MARA', 'SI', 'SITM'] 7 -0.0051 ['ACLS', 'AMAT', 'HWBK', 'ICHR', 'MARA', 'SI'] 6 -0.0050 ['ACLS', 'ICHR', 'MARA', 'SI', 'SYY', 'WMK'] 6 -0.0050 ['ACLS', 'CAG', 'ICHR', 'MARA', 'SI', 'USFD'] 6 -0.0050 ['DHIL', 'GRWG', 'MARA', 'WBS'] 4 -0.0050 ['ACLS', 'ICHR', 'MARA', 'RVSB', 'SI', 'TMHC'] 6 -0.0048 ['FAF', 'FORM', 'MARA', 'RGLD'] 4 -0.0047 ['ACLS', 'EQOS', 'ICHR', 'MARA', 'NYT', 'SI', 'UCTT', 'UTL'] 8 -0.0046 ['ACLS', 'EQOS', 'EXPI', 'ICHR', 'MARA', 'PPSI', 'SI', 'SITM'] 8 -0.0046 ['HFWA', 'ITRI', 'MARA', 'SNCE'] 4 -0.0046 ['BEP', 'MARA', 'QNST', 'STC'] 4 -0.0046 ['EVR', 'MARA', 'QLYS', 'SMG'] 4 -0.0045 ['ACLS', 'BBWI', 'ICHR', 'MARA', 'PNC', 'SI', 'UCTT'] 7 -0.0043 ['ACLS', 'AEE', 'AEM', 'EQOS', 'ICHR', 'MARA', 'PPG', 'SI', 'UCTT'] 9 -0.0042 ['ACLS', 'CHTR', 'ENB', 'EQOS', 'ICHR', 'MARA', 'SI', 'SPLP', 'UCTT'] 9 -0.0042 ['CATY', 'CIO', 'MARA', 'RPAY', 'SI', 'ZEUS'] 6 -0.0039 ['ACLS', 'CIFR', 'ICHR', 'MARA', 'PRFT', 'SI', 'SLAB', 'UCTT'] 8 -0.0037 ['ACLS', 'AMCR', 'HFWA', 'ICHR', 'MARA', 'NMRK', 'NUE', 'SI', 'UCTT'] 9 -0.0037 ['ACLS', 'BBSI', 'GILD', 'ICHR', 'MARA', 'SI', 'SMCI', 'TG', 'UCTT'] 9 -0.0036 ['ACLS', 'BIG', 'CATY', 'ICHR', 'MARA', 'PCGU', 'SHC', 'SI', 'UCTT'] 9 -0.0036 ['APAM', 'AUY', 'CALB', 'GRWG', 'HTH', 'MARA'] 6 -0.0034 ['ACB', 'BV', 'ICHR', 'MARA', 'PFIS', 'PLMR'] 6 -0.0034 ['CBT', 'CVCY', 'EQOS', 'MARA', 'ORA', 'SPNT', 'WSM'] 7 -0.0034 ['AMCR', 'BANF', 'FFNW', 'MARA', 'MGNI', 'SPLP'] 6 -0.0033 ['ANF', 'CMCSA', 'MARA', 'OTTR', 'PBIP', 'QLI', 'SI', 'VMC'] 8 -0.0033 ['AROC', 'CROX', 'HPE', 'HUMA', 'MARA', 'SAFM', 'SEIC', 'SI'] 8 -0.0030 ['ACLS', 'EQOS', 'EXPI', 'GSHD', 'ICHR', 'INGR', 'MARA', 'PM', 'PPSI', 'SI', 'SITM', 'SJW', 'TFX', 'WTRG'] 14 -0.0027 ['AHH', 'BSY', 'CCOI', 'CTAS', 'MARA', 'MELI', 'SP', 'UCTT'] 8 -0.0027 ['ABNB', 'ASTE', 'CHMI', 'ECPG', 'ETN', 'EXPI', 'FIVE', 'MARA'] 8 -0.0026 ['ASB', 'ATGE', 'BLK', 'EXPI', 'HIW', 'MARA', 'ONEW', 'REGI'] 8 -0.0025 ['AMT', 'APPS', 'ATVI', 'BAC', 'ESI', 'HBAN', 'HFFG', 'MARA'] 8 -0.0024 ['CFX', 'ESGR', 'ICLR', 'IPGP', 'MARA', 'NOA', 'OKE', 'XRX'] 8 -0.0016 ['ABNB', 'CSCO', 'FDBC', 'FRHC', 'GO', 'MARA', 'MS', 'PAYA', 'PCYG', 'PEAK', 'SRE', 'STRA'] 12 The market returns have fallen dramatically these past two months. Lowest I have seen since just past the pandemic crash. Year through: 2022-01-19 QQQ: 366.48 322.63 IWM: 204.45 212.38 SPY: 451.75 378.84 SPY Variance: 6.8237416e-05 Riskfree rate = 1.00% Actual SPY return = 19.25% Use actual S&P500 rate = 19.25% Actual IWM return = -3.73% Use floor Russell 2000 rate = 5.00% Actual QQQ return = 13.59% Use actual NASDAQ 100 rate = 13.59% =========================================== Market return = 11.61% Leptokurtic and low variance stocks. Here are your 'best' options plays if you just like to pick a side and make a leveraged bet. The stocks that are leptokurtic and low variance: This is the minimum Leptokurtic score and variance of all stocks: 4.5 0.0001666 ['ABBV', 'AMGN', 'APD', 'AQN', 'ARE', 'FE', 'FRTA', 'LMT', 'MNR', 'NOC', 'PNM', 'PPL', 'ROP', 'SPH', 'T', 'TRI', 'TSN', 'VZ', 'WMT'] 19 These are the top 50 stocks selected by our model as of last night. If you held only one stock, these stocks provide the best absolute risk-reward tradeoff based on how we do the math: First number is CQNS score, second number is expected return (CAPM based on BETA), third number is a volume metric for the last trading day, fourth is the price compared to last year's average, and finally variance of the adjusted close price. 0 MARA MARATHON DIGITAL HOLDINGS INC. -0.01459 0.48 0.59 0.69 3.34717494 1 SI Silvergate Capital Corp -0.00464 0.41 1.59 0.84 8.42056373 2 ICHR Ichor Holdings Ltd -0.00206 0.34 0.65 0.90 0.70294300 3 ACLS Axcelis Technologies Inc -0.00142 0.32 1.47 1.33 2.43897799 4 UCTT Ultra Clean Hldgs Inc -0.00138 0.33 1.58 1.02 0.61370958 5 EQOS Eqonex Ltd -0.00129 0.39 0.35 0.28 2.71065489 6 AOSL Alpha & Omega Semiconductor Ltd -0.00125 0.33 1.87 1.34 2.26670926 7 LSCC Lattice Semiconductor Corp. -0.00088 0.30 0.89 1.01 2.40309019 8 GRWG GrowGeneration Corp -0.00062 0.33 1.01 0.25 5.35860102 9 EXPI eXp World Holdings Inc -0.00058 0.35 0.78 0.62 2.68425762 10 AMAT Applied Materials Inc. -0.00039 0.28 1.57 1.07 1.50413063 11 COHU Cohu Inc. -0.00037 0.29 0.56 0.87 0.72677548 12 SITM SiTime Corp -0.00024 0.32 1.72 1.27 29.51835164 13 APAM Artisan Partners Asset Management Inc -0.00023 0.26 1.24 0.91 0.08543206 14 TER Teradyne Inc. -0.00014 0.26 0.97 1.14 1.75345774 15 FORM FormFactor Inc. -0.00014 0.28 0.87 1.03 0.59874225 16 KLAC KLA Corp. -0.00009 0.26 1.26 1.15 5.49810841 17 MTSI MACOM Technology Solutions Holdings Inc -0.00008 0.26 1.13 1.05 0.71692289 18 DIOD Diodes Inc. -0.00005 0.25 1.02 1.04 1.61746525 19 LRCX Lam Research Corp. -0.00004 0.26 1.27 1.06 4.28793238 20 NXPI NXP Semiconductors NV -0.00002 0.24 0.68 1.04 1.20889843 21 ON ON Semiconductor Corp. 0.00000 0.26 1.28 1.29 2.15080146 22 CALX Calix Inc 0.00002 0.29 1.35 0.98 2.64070591 23 NVDA NVIDIA Corp 0.00003 0.26 2.12 1.24 17.51288435 24 PNM PNM Resources Inc 0.00004 0.02 0.93 0.94 0.03120138 25 BCE BCE Inc 0.00005 0.06 0.86 1.11 0.25081524 26 SOLN Southern Company 0.00005 0.05 0.05 1.08 0.07056424 27 FTS Fortis Inc. 0.00005 0.05 1.77 1.06 0.12292842 28 SMTC Semtech Corp. 0.00006 0.24 1.08 1.03 1.15506935 29 AMKR AMKOR Technology Inc. 0.00006 0.27 0.54 0.97 0.28018419 30 ONTO Onto Innovation Inc. 0.00006 0.26 1.30 1.24 1.94881245 31 JELD JELD-WEN Holding Inc. 0.00007 0.25 1.12 0.88 0.09960098 32 DCUE Dominion Energy Inc 0.00007 0.05 2.42 1.05 0.09170463 33 NVMI Nova Ltd 0.00008 0.24 1.79 1.21 3.04466597 34 KO Coca-Cola Co 0.00008 0.07 1.17 1.14 0.18204282 35 EQC Equity Commonwealth 0.00008 0.03 0.57 0.96 0.04427682 36 PEP PepsiCo Inc 0.00008 0.07 1.31 1.17 1.04911695 37 JNJ Johnson & Johnson 0.00008 0.05 0.84 1.02 0.16650824 38 RY Royal Bank Of Canada 0.00008 0.09 2.34 1.20 0.65791903 39 VZ Verizon Communications Inc 0.00008 0.04 1.00 1.00 0.05186990 40 TTMI TTM Technologies Inc 0.00008 0.07 0.90 1.04 0.03010160 41 HSY Hershey Company 0.00008 0.05 1.49 1.17 1.11456029 42 MCD McDonald`s Corp 0.00009 0.08 0.78 1.09 1.17297867 43 CL Colgate-Palmolive Co. 0.00009 0.04 1.24 1.07 0.11417914 44 PG Procter & Gamble Co. 0.00009 0.05 1.78 1.17 0.74145369 45 SO Southern Company 0.00009 0.05 0.88 1.10 0.14809517 46 WCN Waste Connections Inc 0.00009 0.08 1.10 1.03 1.15235832 47 BIP Brookfield Infrastructure Partners L.P 0.00009 0.07 0.79 1.11 0.14768481 48 BRK.B Berkshire Hathaway Inc. 0.00009 0.09 1.18 1.14 1.29862062 49 MDLZ Mondelez International Inc. 0.00010 0.07 0.97 1.12 0.19462593 Negative BETA stocks: Here are the stocks with BETA values outside the data validation range. APO Apollo Global Management Inc -0.10 APT Alpha Pro Tech Ltd. -0.24 AUBN Auburn National Bancorp Inc. -0.25 AVIR Atea Pharmaceuticals Inc -0.07 CBAN Colony Bankcorp Inc. -0.09 CCRD CoreCard Corporation -0.00 CFFI C & F Financial Corp -0.01 CLX Clorox Co. -0.21 CPK Chesapeake Utilities Corp -1.09 CVLY Codorus Valley Bancorp Inc. -0.25 DJCO Daily Journal Corporation -0.04 GCBC Greene County Bancorp Inc 0.00 GEO Geo Group Inc. -0.05 GRAB Grab Holdings Limited -0.43 HRL Hormel Foods Corp. -0.04 IHS IHS Holding Ltd -1.43 KOSS Koss Corp. -3.15 LARK Landmark Bancorp Inc -0.18 LGO Largo Inc -0.03 MKFG Markforged Holding Corporation -0.14 MRLN Marlin Business Services Corp -0.11 MYFW First Western Financial Inc -0.07 NICK Nicholas Financial Inc. -0.16 NWFL Norwood Financial Corp. -0.13 PDEX Pro-Dex Inc. (co) -0.33 PNT POINT Biopharma Global Inc -0.01 QDEL Quidel Corp. -0.29 ROIV Roivant Sciences Ltd -0.08 SBFG SB Financial Group Inc -0.22 SGLY Singularity Future Technology Ltd -1.02 SIEB Siebert Financial Corp. -0.08 SMLR Semler Scientific Inc -0.76 TCFC Community Financial Corp -0.08 TR Tootsie Roll Industries Inc. -0.05 UNB Union Bankshares Inc. -0.02 VRE Veris Residential Inc -0.01 Low BETA stocks (but still >0). These are not necessary 'slow movers' but they are relatively uncorrelated to the S&P 500 ETF $SPY. 0 ISTR Investar Holding Corp 0.01 1 SJM J.M. Smucker Co. 0.02 2 CIZN Citizens Holding Co 0.03 3 PFE Pfizer Inc. 0.03 4 PROV Provident Financial Holdings Inc. 0.03 5 RMBI Richmond Mutual Bancorporation Inc 0.04 6 CMPO CompoSecure Inc 0.04 7 HWBK Hawthorn Bancshares Inc 0.05 8 LOAN Manhattan Bridge Capital Inc 0.05 9 CPB Campbell Soup Co. 0.05 10 UBCP United Bancorp Inc. (Martins Ferry OH) 0.06 11 KMB Kimberly-Clark Corp. 0.06 12 OVBC Ohio Valley Banc Corp. 0.06 13 K Kellogg Co 0.07 14 ASRV Ameriserv Financial Inc 0.07 15 TTSH Tile Shop Hldgs Inc 0.07 16 CALM Cal-Maine Foods Inc. 0.07 17 SFM Sprouts Farmers Market Inc 0.07 18 SEB Seaboard Corp. 0.08 19 AJRD Aerojet Rocketdyne Holdings Inc 0.08 20 PETS Petmed Express Inc. 0.08 21 FSFG First Savings Financial Group Inc 0.08 22 FFNW First Financial Northwest Inc 0.08 23 SLNH Soluna Holdings Inc 0.08 24 CRWS Crown Crafts Inc. 0.09 25 EPSN Epsilon Energy Ltd 0.09 26 BGS B&G Foods Inc 0.09 27 CALB California Bancorp 0.10 28 ALOT AstroNova Inc 0.10 29 TCI Transcontinental Realty Investors Inc. 0.10 30 LGL LGL Group Inc 0.11 31 FCCO First Community Corp. 0.11 32 CAG Conagra Brands Inc 0.11 33 PNM PNM Resources Inc 0.11 34 NEWP New Pacific Metals Corp 0.13 35 PLBC Plumas Bancorp. 0.13 36 KR Kroger Co. 0.13 37 THS Treehouse Foods Inc 0.14 38 UWMC UWM Holdings Corporation 0.14 39 ED Consolidated Edison Inc. 0.14 40 ARMP Armata Pharmaceuticals Inc 0.14 41 WEC WEC Energy Group Inc 0.14 Here are the stocks with one day volume spikes, and the multiple of average volume in the busiest day. AAME Atlantic American Corp. 160 ASRV Ameriserv Financial Inc 123 COHN Cohen & Company Inc 108 GMTX Gemini Therapeutics Inc 108 GSMG Glory Star New Media Group Holdings Limited 145 GTEC Greenland Technologies Holding Corp 134 IFRX InflaRx N.V. 123 IPA ImmunoPrecise Antibodies Ltd 187 LFG Archaea Energy Inc 136 MMMB MamaMancini`s Holdings Inc 147 PRQR ProQR Therapeutics N.V 113 SYPR Sypris Solutions Inc. 113 ULBI Ultralife Corp 147 VTSI VirTra Inc 192 VYGR Voyager Therapeutics Inc 114 Good luck in the markets today. If you want to learn more and maybe become a client (where we run this for you whenever you want, and can tailor the run), please check out our brochure on the homepage. You can buy services through this website in the "Stock Market Quant Analysis" or "Project Services" tabs, or by calling Jeffrey Cohen at 847.780.4401.

I am Jeffrey Cohen and I wrote this. We receive no compensation for this blog. We ran the model on yesterday's market close data...here is what we found.1) Actual Russell 2000 (ETF $IWM) return = 3.98%

2) ALL ASSET PORTFOLIO - equally weighted Expected Return = 15.75% 3) All Stock Variance = 0.0001105 There are types of stocks in the top 50 "UP" individual stock list (the top 50 CQNS scores for individual stocks): 1. High risk: $MARA $EQOS $SI 2. Technology growth in semiconductor mfg: $AOSL $ACLS $UCTT $LSCC $AMAT $NVDA $ON $LRCX $KLAC $NXPI 3. Utilities and slow movers: $SOLN $FTS $DCUE $EQC $PNM $SO $WCN $BRK.B $RY 4. Consumer-related (discretionary & CPG): $KO $PEP $PG $VZ $JNJ $HSY $CL $MCD $MDLZ 5. Then, at #10: $GRWG: GrowGeneration Corp (we have a long position in this stock). There are stocks that have super-high closing price variance. These are 'broncos' that you have to strap onto and ride as they move so aggressively. Super high variance (on a normalized basis): $SI $GRWG $SITM $NVDA $KLAC $STFC UPST $WULF $DISCB $LZ $CYT $MOXC $BTX $PTSI A few key points we found outside the model: 1. Energy prices are still high and climbing. This portion of CPI or consumer inflation is not retreating, regardless of the moves with monetary policy. This will require real actions taken in the real economy (boots on ground, rigs and pipes). 2. Small capitalization stocks are largely trading lower vs. a year ago. Small caps are either a contrarian play, a value play, or a way to lose your money if you are long these stocks (which we are). Three stocks were unchanged of the 37, and the stocks that dropped today fell further than the stocks that rose.

We have a model that picks stocks that will fall faster than the overall market. It does even better as we refine our analysis and models accordingly. This last update was pretty simple. Our "UP" run only includes stocks with net income > $1, and our "DOWN" run only includes stocks with net income < $1. Makes it easier to 'believe in' the model when you are betting against companies that lose money...not just because of technical analysis. We continue to refine our model for our clients. We are seeking new clients. Best regards, Jeffrey Cohen, President There are 2,130 stocks with positive Net Income, vs. ~3,100 stocks that passed the same data validation last week without the Net Income test.

The expected return of these stocks, all held in an equal capitalization portfolio, is 19.71% over the next 12 months, excluding dividends. The stocks chosen in the best 10 portfolios are similar to the stocks picked the week before. However, there are many fewer leptokurtic stocks with low variance. There are 15 of those stocks identified this week vs. more than 40 last week. It seems that now we have an interesting list for options trading. Excerpt from our model run last night:

Over the past two weeks we have been running the Chicago Quantum Net Score often, and using the information to make trades. Overall, the model has been right (even today), but that does not make stock trading easy. We are making decisions on buying, selling, holding and leverage and these impact our results.

Here is one example: We ran the "UP" version of the model and did some (not much) due diligence on the top 50 stocks chosen. 1) The top 25 were high expected return stocks (high BETA values) with relatively low risk. 2) The next 25 were low risk (low closing price variance) with relatively high expected returns. However, the top 25 stocks were 'story' stocks concentrated in a few industries, and so holding those meant taking a position in a market segment. It also meant investing in growth stocks that in some cases had poor fundamental business results. The next 25 stocks tended to have stronger fundamental business results. Some of them trade in somewhat regularly repeating patterns (up and down). 3) Finally, another set of stocks we evaluate have a leptokurtic distribution (fat tails) and low price volatility. These are stocks that do not move very much each day, but have moved explosively over the past year more than would be suggested by a normal distribution. In other words, they are mostly 'safe' but occasionally jump up or down. This third set of stocks also may have a trading range and somewhat regular periodicity or repeating patterns. They also tend to have lower cost options premiums, so their options can be purchased and if the stock 'leaps' during your option period in your direction, you could make a profit. In some cases, you can buy puts and calls at the money, and if the stock moves explosively in any direction, you can make a profit. However, all of these signals and 'edges' you may have in the market may not be enough for a value-based investor that does fundamental research to take a position in a stock. Just because a stock, or portfolio, is efficient, it may not be compelling enough to go long the stock(s). Just because a stock or portfolio is inefficient, it may not be compelling enough to short it/them. What are we looking to add to the model? 1) We are looking at adding a data validation filter before we do the 'solving' that incorporates a fundamental valuation 'hurdle.' For example, our UP run may only include well performing businesses and our DOWN run may only include poorly performing businesses. - There are many historical metrics we can use, and we are beginning our experimentation now. 2) Our Chicago Quantum Net Score balances out the effects of expected returns and price volatility. Would we consider shifting that balance to more greatly favor either returns or risk? We have this as a parameter today, so clients can request higher or lower risk runs. Maybe this is a factor where we can do more analysis? 3) Regardless of how we change the model, we could add additional data to the output spreadsheet where we provide clients the CQNS score for every stock that passed data validation. Here is the data we include today (with an example): There are six metrics for each stock:

Please add comments to this post if you would like to start a dialog, or email me directly at [email protected]. Good luck to all. Best regards, Jeff |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed