|

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. June 30, 2022 We noticed a few things this morning:

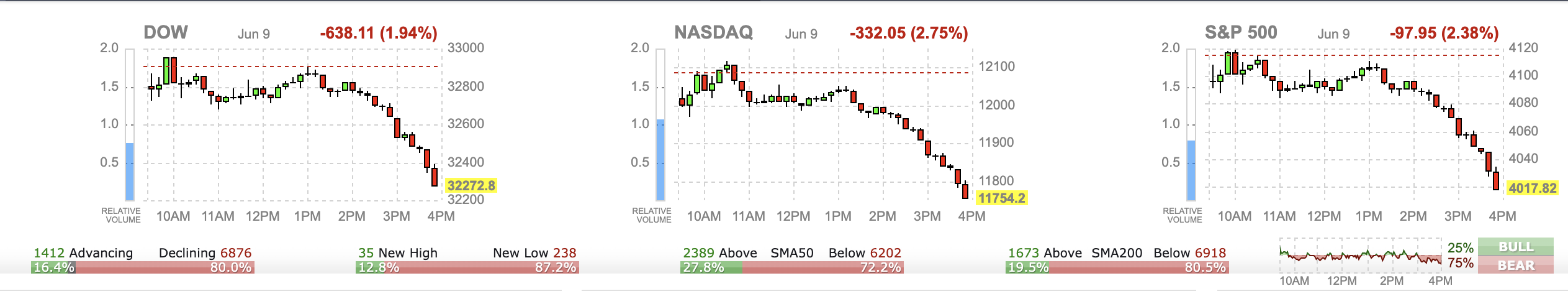

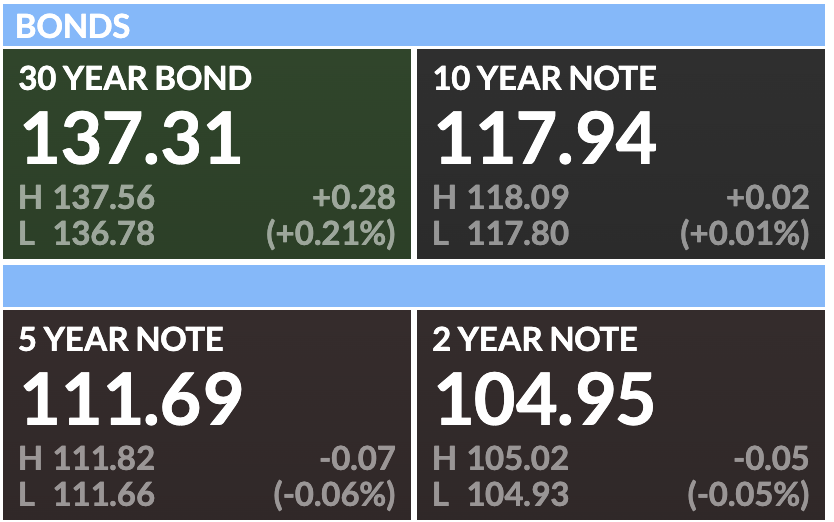

1. New lows are outweighing new highs again, both in US Equities and US Fixed Income. This is a key indicator for us on the breadth of the decline in stocks. Don't catch falling knives. 2. Interest rates are falling today, into the end of the quarter. We think this may be window dressing, and may not last. The FED is raising rates, right? 3. We discuss, again, our logic for betting against Lakeland Financial $LKFN and Bank of Hawaii $BOH. We go to the 10-Qs. What we didn't realize is how poorly they treat their depositors! These companies are not very kind to their depositors financially. You will see it in the videos. We also show how much money they lost in Q1 and likely the same thing happens in Q2, but you won't see it in the income statement or net income. However, those losses show up in the balance sheet and banks trade at a multiple of common stock equity. 4. Not surprising is that the US equity futures are red today. What is surprising is how badly the European markets did, and the Japanese Nikkei. They surpassed the US Equities market performance yesterday. The tail is wagging much harder than the dog today. Good luck to all. Jeff

0 Comments

By: Jeffrey Cohen, Investment Advisor Representative

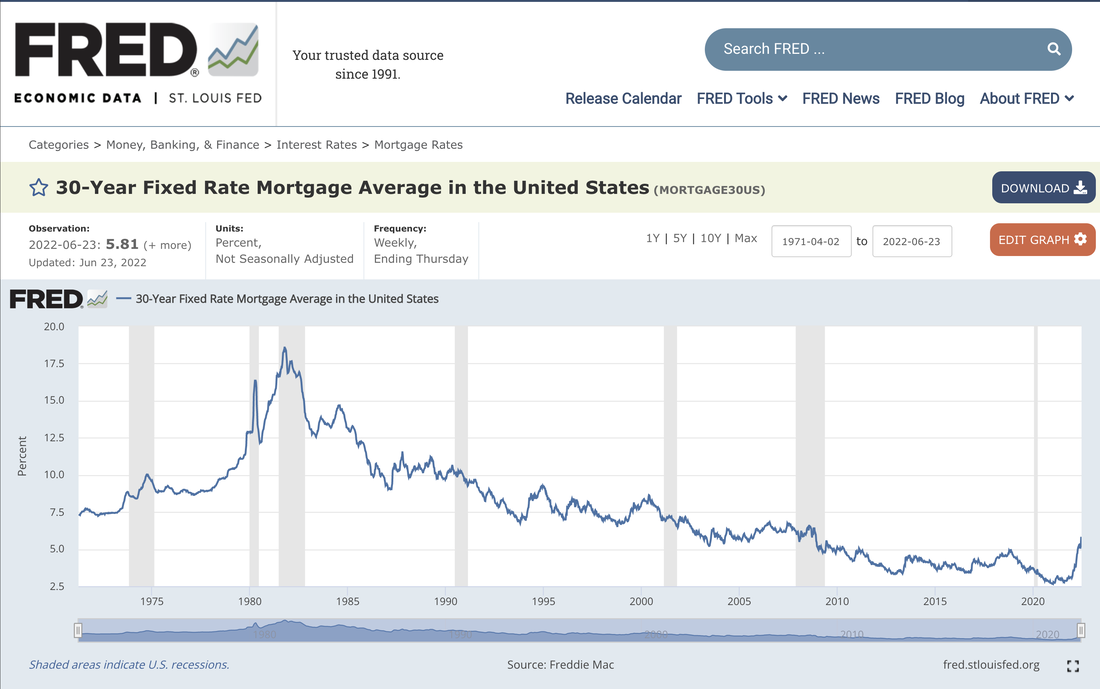

US Advanced Computing Infrastructure, Inc. We made our morning video which pointed to US equities being weaker, despite US equity futures indicating an UP or Green open. As we checked our key industry sector indices, they were pointing to a declining market. However, the indices themselves (S&P 500, Nasdaq 100 and Russell 2000) were higher. This is a disconnect. We checked $TNA and $TZA, which allow traders to bet 3x on the direction of the market in the short-term. TZA (bear) was up, while TNA (bull) was down, despite the $SPY being up. So, we move to our stocks. Just the four we have a position in, and a few others on our buy list. Broken market, broken arrow, red dawn, Wolverine, OMG, Honey who shrunk the kids, operation RED SQUARE, and Great Scott! We see fewer shares offered for purchase and sale at the top of the book (thin markets). We see larger spreads in price between best bid and ask. We see signs of liquidity weakness in downtrodden stocks. We see low volumes being traded. By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Today will be quick: 1. Expected returns in stocks and bonds are going up due to the fundamental weakness in the economy, fear of a recession (and the game theory answer which is to sell first), and increasing risk-free rates of interest. When expected returns go up (or need to), then prices fall. 2. Currency markets are boiling. US Dollar is strengthening (but not against the Canadian Dollar today, which is already down), and this will hurt the US Economy at the expense of our major trading partners. They are all (except for Europe) weakening their currency which lowers inflation in the US, and makes us prefer imports to our own domestically manufactured goods and services. 3. Long term interest rates are up (even over the 5-days) and mortgage backed securities are down (also over the past 5-days) of the bear market rally. They fell, which fed the rally, and now they rise, which will starve the rally of fuel. We shared our investments. CRBP and AMS are long term holdings where we are under-water. We are long, diamond hands, and could either gain a big pay-day or lose it all. BOH and LKFN are short or long-put positions where we are out of the money and betting on a decline based on their losses on investments. These show up as AOCI, which is reflected in their weakening balance sheets, but not in their net income. Larger depositors may flee these banks, while the FDIC bails out (and back stops) smaller retail depositors. These banks are trading at high multiples of common equity, which continues to fall with rising rates. This is a very bad situation for their stock prices. Good luck out there. If you like the video on youtube, please hit the subscribe button and leave a comment. It helps us spread the word without advertising. Also, we are not paid to write these blogs or make our videos. Update: Bank of Hawaii is a Hawaii-based bank holding company. Lakeland Financial Corp is an Indiana-based bank holding company. Since banks lend primarily on housing (both residential and commercial), let's see what the Federal Housing Finance Agency has to say on this topic (here): Hawaii housing prices are up 4.3% this quarter, 22.75% this year, and 59.15% over the past 5 years. Indiana housing prices are up 3.52% this past quarter, 15.65% this year, and 60.98% over the past 5 years. Mortgage rates also vary by state. According to Consumer Finance .gov (here), a well qualified buyer (800-820 credit score) buying a $500k house and putting 20% down for a fixed 30-year conventional loan has access to a spread of rates.

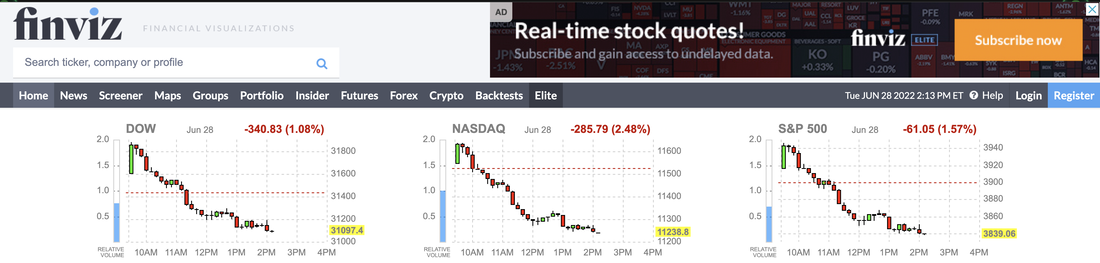

Lake City Bank offers mortgages on their website. 30-year fixed rate, with zero points, has an APR of 6.105%. We went deeper and entered information for Fishers Indiana, $500k house, $400k mortgage, without impounds or escrows. 30-year Fixed Rate: 6.033%, with no points. Excellent Credit History required for this rate. In Aiea, Hawaii (96701, 96740), there is only one mortgage available and it is from LoanDepot, with an APR of 5.22%, 1.946 points, and fees of $7,219 and the loan is only a 15 year fixed loan. BankRate does not have any lenders giving quotes on 'the big island' at 96740. Bank of Hawaii offers a 5.305% APR with 2 points, 20% down payment for a 30-year fixed loan. Maximum loan amount is $970,800 and these are not fixed rates, just a calculator used today (here). To drill down deeper, you have to create an account with SimpliFi, and that seems intrusive to us. A $400k house would then have a payment (before taxes and insurance) of $2,406/month, unless the borrower chose to pay $8,000 in up-front points and then the monthly payment would be $2,224, or $182/month cheaper, with a 44 month break-even point on the points, excluding interest you forego, which would likely take it out to 45 - 48 months. It seems that Bank of Hawaii charges more for mortgages Lake City Bank. The question is whether people buying a home can still afford the $2,400 mortgage payment, property tax of ~ $1,000 to $2,000, property insurance and the cost of operating the home. Conservatively, this makes the home cost ~$5,000 / month. If not, we will see homes declining in price, or people losing their homes in a recession. Again, we are betting against the prices of $BOH and $LKFN as we think a recession is possible, and we estimate both banks will have negative (net income - AOCI), which will reduce their shareholder equity and make their stock market valuation more 'rich' all things being equal. Everyone knows this who watches social media, but just in case, mortgage rates are above 5% for the first time since February 2011, or 11 years ago. At some point, this will slow down house purchases for 2nd and 3rd time home buyers. If the 10-year and 30-year US Treasury rates continue to rise as the FRB raises interest rates, then mortgage rates will continue to rise too. Look at the performance in the 1970 - 1983. Mortgage rates are historically sticky. Update Two: The market did rise initially (first 15 minutes) then fell and flatlined after lunch. Even if they go up into the close, it is just more volatility that isn't helpful to stock market investing. Look at NASDAQ 100 down 2.48% on an initially up day. This is a very large swing from a historical perspective.

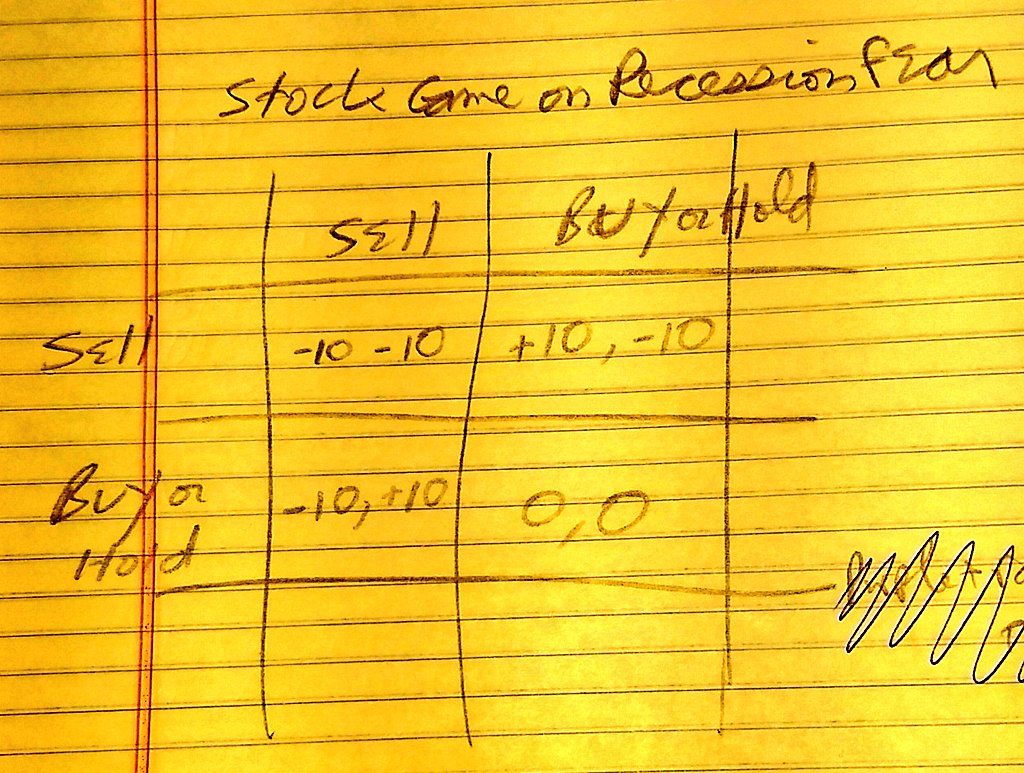

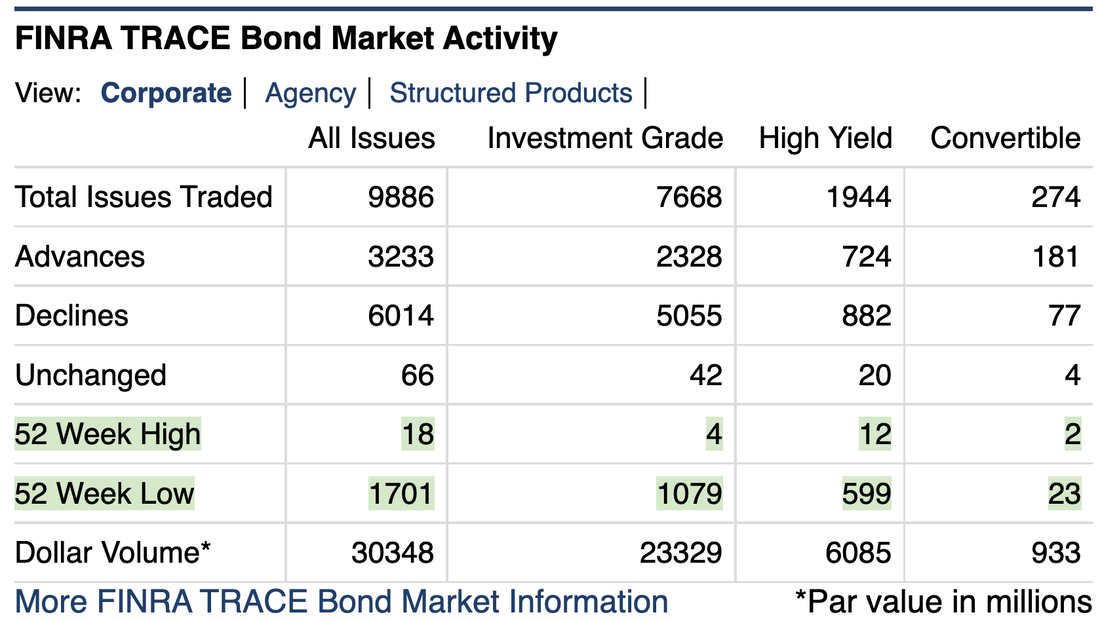

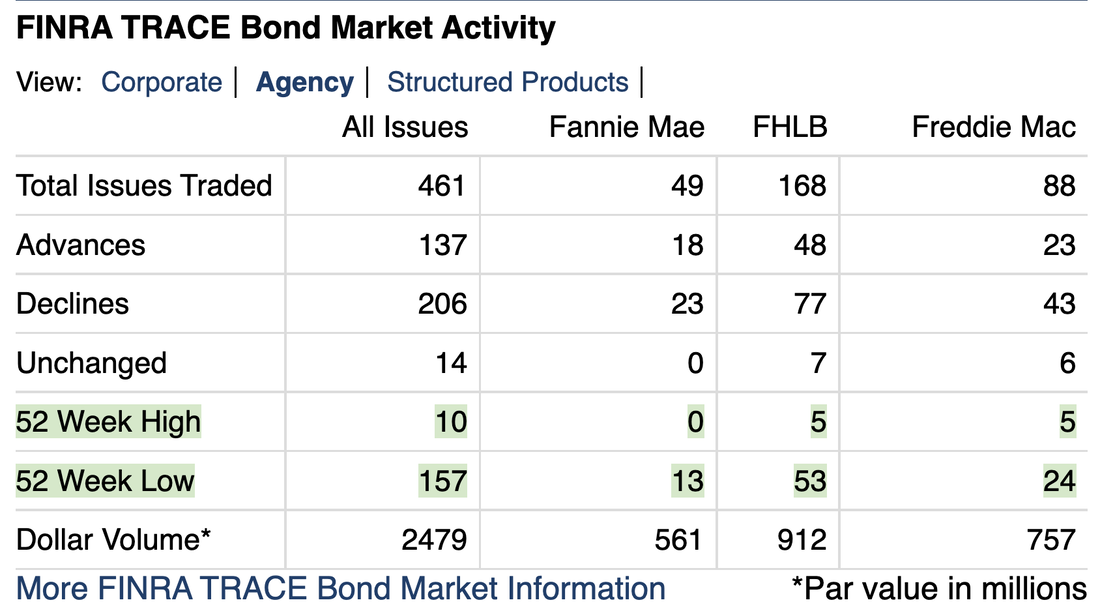

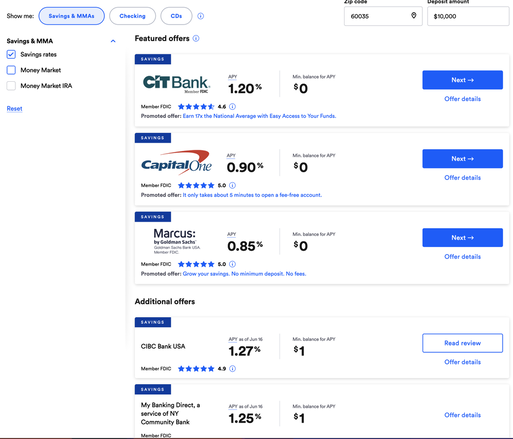

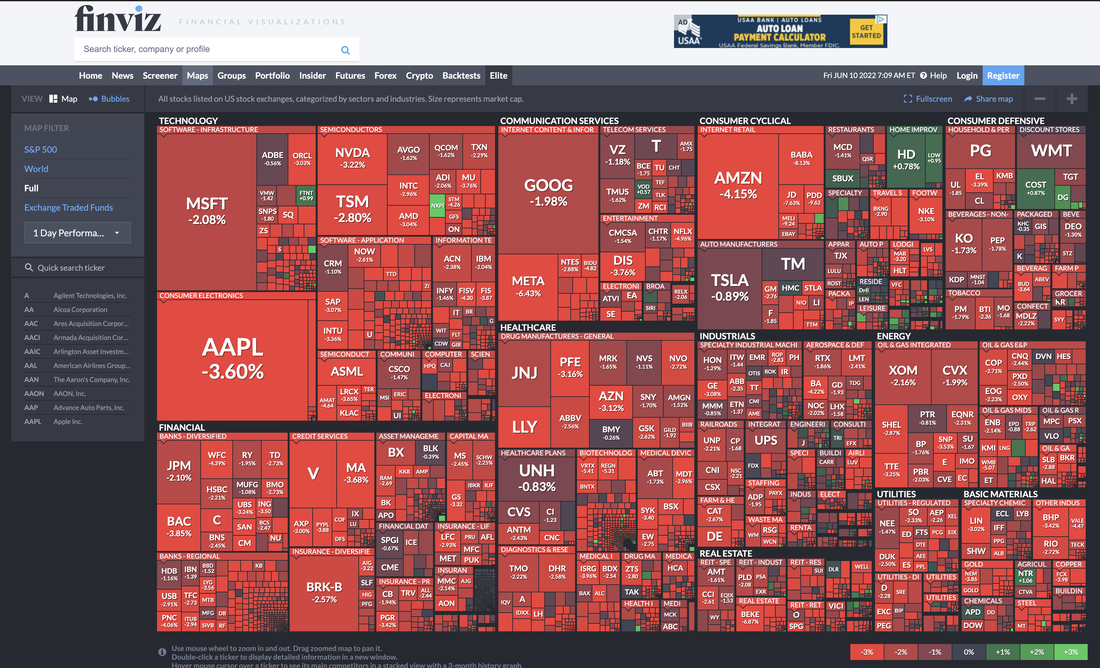

Thank you Finviz for the visualizations. By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Good morning. We see these key facts in the market today: 1. Multiple bank stocks had significantly higher volume on Friday. Banks made up most of the top 10 volume increases in our CQNS UP run. 2. Futures are up this morning on US Equities. Most of the economically sensitive sectors we track are also up pre-market, but not 100% of the stocks are up in each. This is a broad-based pre-market rally. 3. US Treasury Bond Yields are up this morning as bond futures fall. Bonds are still above their support levels having recovered over the past week, but are not making new highs either. Long-duration bond yields are higher this morning. 4. California wants to drop $1050 on every family with three or more members that own a car. This is to help pay for gasoline price increases, or other price increases that California families are facing. In our opinion, this is not a good idea. If you want to drop money on people, then leave quarters for people to pick up. This way, everybody gets some if they work at it and those that need the money can pick up more quarters. 5. Our CQNS UP run model has finally given up on individual stocks, and has selected the three US Equity Index ETFs as the three individually best performing (risk - return) tradeoff stocks. SPY, QQQ and IWM score better than any other individual stock. The market is 'rational' again and does not favor stock pickers. This is good to see, but also terrifying to see as it eliminates the edge that some traders have from running quantitative models like ours. Net-Net: if you have $100 to put into the market, the model suggests to invest it into one of the three ETFs above and not to pick an individual stock. Bitcoin, currencies, commodities all look ok. No big changes. GLTA! By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Today we are wondering why there is so much movement in the market around the committed downturn in stock prices. We see economics-driven stocks (business cycle stocks) like Citibank, Freeport McMoran, Cleveland Cliffs crashing, but then we looked today and they always go up and down 2-4x, or 1/2 to 1/4. This is what they do as the economy goes from boom to bust. We see whole industry subsectors of stocks go up in after hours trading, just to fall in pre-market trading. In certain industry sectors, the stocks that go up in after hours go down pre-market, and vice versa. This is movement to scalp pennies, or dimes, on share prices, or to fine tune positions. The overall trend is negative and down. Two stocks are dropping that give us pause, and we will do some due diligence. DB and CS are down, and I am concerned there may be a banking problem in Europe. There is no real economic news today in the headlines. Just commentary. Interest rates look to fall today based on the futures, which brings US Treasury Bond and Note prices lower. Could be a small flight from US investments in fixed income. New lows to new highs maintained a 29:1 ratio today in both corporate equities and corporate fixed income. For every one company stock or bond that hit a new high, twenty nine hit a new low. Be careful out there. Don't lose sight that we are in a downturn and whatever stock you hold that is exposed to the economy will most likely be lower in a few weeks. Hold if you can / must, and sell if you are unsure. The first person who sells into a recession wins. The first one who buys at the bottom also wins. Best regards and good luck today. GLTA Jeff By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. #recession #stocks #market #analysis #news #stockmarket #portfolio #stockstobuy #stockstosell #contagion We discussed four points today in great detail. 1. Most stocks we follow are trading near their 52 week lows. Many new lows were hit, both in US equities and fixed income. This 'contagion' is also hitting in US Agency debt, which is largely invested in mortgagers. 2. The major indices are in a down trend. They are following very clear and straight trendlines. The way up was marked by a similar straight line, but the candles were smaller. The way down is equally straight, but the candles are larger (more movement on the way down each day). Please be careful out there, the market is in a decline pattern. 3. There are signs of bets being made based on recession fears. Commodities are down. Long-term interest rates are falling (from last week's highs). Stocks in companies that make things (e.g., FCX, CLF, MT) are down. 4. We shared our game theory model. Hope you enjoy the video. By Jeffrey Cohen, Investment Advisor Representative So, where does that leave us in pre-market today? The US equity futures are up this morning. Bets were made while we were sleeping and before the market is open. Makes it hard to invest in this market because the 'action' is all decided by others before the market opened. Not investment advice. Hope you enjoy this morning's video. We enjoyed making it. We reflect on recessionary fear bets, the overall market direction, and our take on what is happening out there. Net-Net: almost all the 'bell-weather' stock industries we track are trading near 52-week lows. We are taken by surprise by this, and think most investors are unaware of this fact too. By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. We noticed a few important things yesterday. 1. The market move happened before the market opened. The market opened gap up. Retail investors could not participate. Once the market opened, the moves up and down were slight ripples. This means, to be precise, that stocks you might want to buy were already up in pre-market so you would be buying them at the open, or in the first hour, at their already 'runner' prices. We see this today with the lower open expected. Pre-market stocks like $COIN Coinbase are already down more than 8% pre-market. If you wanted to ride Coinbase lower, you already missed that move. It is the same across our 'indicator' or 'canary in a coalmine' industry sectors. They have already moved in pre-market. 2. We also see a significant number of new lows in yesterday's 'UP' market. This is very surprising to us. We also see the average stock is lower than it was over the past 2.5 months, and over the past 10 months. There is still a weakness in individual stocks and bonds. Corporate bonds (91:1) new lows to new highs (not a typo, ninety-one to one) Agency bonds (16:1) new lows to new highs (largely residential mortgage holdings) US Equities (10:1) new lows to new highs. What this says to us is that the market is not 'throwing good money after bad' and is leaving many companies behind. This does present a buying opportunity in certain companies with strong valuations that are down-trodden. However, those stocks likely will be less expensive in a week or two. Probably better to wait. 3. We see commodities like Copper showing weakness, approaching $3.90 from ~$4.50 when we first starting tracking it. However, big picture, copper has traded for a long time around $2.00, and rose (similar chart as the Russell 2000) from the Covid-19 pandemic lows to more than double. This is a return to a normal, historical level of pricing. We would also expect copper miners like Freeport McMoran $FCX) to fall with it. 4. We see weakness in the mortgage backed securities MBS market, both in Freddie Mac, Fannie Mae, Ginnie Mae and FHLB. This is likely due to the rise in long term interest rates. Yes, short-term and long-term interest rates are rising. This makes everything in our economy more expensive. Companies that borrow short and lend long, or that take in deposits and make investments in long-term fixed income, will not have a good Q2/2022 according to the data we are tracking. When we looked, the banks have dropped from 20% to 30% over the past quarter with the adjustment in market rates. Good luck in the markets today. It looks like a RED or down open for US equities, and the move is already well underway in pre-market. I hope that if you have a trading idea, it is still there when the markets are open and not 'already played.' Thank you to the websites we are using for our data and analysis.

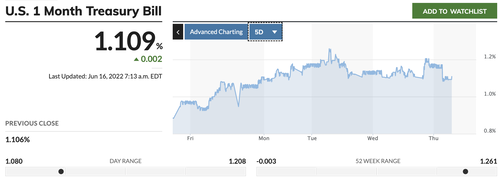

https://finra-markets.morningstar.com https://app.koyfin.com https://finviz.com https://www.marketwatch.com https://www.mortgagenewsdaily.com https://finance.yahoo.com https://www.chicagoquantum.com https://www.cmegroup.com Stocks quickly rose this morning (they gained most of their advance pre-market). I noticed that 1-month US Treasury Bills yields fell dramatically to 1.02% today. Not sure why, but this would explain why financial stocks are doing very well today, and overall the market is higher. This is a riskfree rate, and a rate that you peg to for interest-bearing savings accounts. When the riskfree rate drops, stocks are actually worth more, and banks are expected to earn more.

The longer term UST did not rise (yields did not fall). This is only on the short-end of the stick (or yield curve). VIX fell 5% today. I guess people are no longer worried about stock market volatility, or at least are not willing to pay to protect against it. Russell up 2.0%, S&P up 2.6%, and NASDAQ Composite 100 up 3.0% today as we write this at 1442 ET.

There are a few ways to gamble on a market recovery or a market decline that are efficient, lower cost and relatively easy. There are some ETFs that deliver multiples of the underlying index on a daily basis. You can buy and sell them like stocks (they are exchange traded funds), and they tend to behave well on a one-day basis.

$TNA - for up days $TZA - for down days Are we in a recession? We don't know. There is no confirmation. However, credit quality will give clues:

Game theory suggests you should sell stocks before a recession is confirmed (tweet below).

US Equity Futures: still greenBy Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. June 20 2022: 2120 ET (updated) Key take-away: we should not buy financial assets (stocks, bonds or bets on commodities) if we are in a recession. However, we can only know that after the fact, once the media/government tell us. By then, it is too late. Game theory suggests that the markets are falling precisely because we are in a recession, and you just don't know it yet. Or, it does not matter, because the losses are so bad, it is profitable to act like we are in a recession, especially before you do, and sell everything that is not nailed down, before prices fall. The marklets are down significantly over the past year, although the comparables are tough. A year ago we were enjoying the post COVID-19 pandemic rise in stock prices. These falls are off that recovery. Also, the riskfree rate is higher in our model than it was a week ago. Notice the forward looking market return is 3.5% on a fully diversified basis. The trend is not our friend in the markets right now. Riskfree rate = 1.50% Actual SPY return = -12.16% Use floor S&P500 rate = 5.00% Actual IWM return = -26.55% Use floor Russell 2000 rate = 5.00% Actual QQQ return = -20.08% Use floor NASDAQ 100 rate = 5.00% =========================================== Market return = 3.50% We ran our models on Friday night and spent the long weekend celebrating our family. We went out, visited a museum, and walked along Lake Michigan. We were together. My daughters gave me cards and sent me texts while my sons bought me a Home Depot gift card. We saw grandma. All is good in the world. However, we do feel a little tight financially. Not only are gas and food more expensive, but so are insurance, property taxes and almost everything we spend money on. We are stretched across the extended family, and it is likely that you are too. So, is this the week that the market goes up? Our model says to invest in a leveraged ETF that should outperform the S&P 500 significantly, and to pair it with one or a few high BETA stocks. The model also suggests that the largest S&P 500 tech stocks and large money managers are some of those consolidating the most, and may be ready for a run higher. That seems ridiculous to us on a holiday when people seem worried, but it is not 'people' or retail that determines stock prices in the short-term. It is the large-scale money managers, pension funds, wealth funds, and asset managers. As investment managers, we are not sure that you should buy anything on Tuesday. This is the purpose of today's post and tomorrow morning's video. Should we wait to turn bullish, even if it is just for a week to catch a bear rally? How to answer the question: The question is to decide whether we are in a recession, which is a period of negative 'real' economic growth over a 6-month contiguous period. Real means after inflation, which has been running 8-12% over the past 6-months. So, has our economy been growing, in constant prices, at 8%-12% over the past six months? We are not sure. Growth seems weaker than that based on anecdotes, direct observation in our small corner of the world, social media, news, and our 'feelings.' We heard retailers bulked up on inventory that nobody wants, that cannot be helpful. However, we can look at specific factors. Supply

Demand

Stock Market signals:

Credit Quality: This is our 'truth stone' in this market. If the US consumer cannot pay their bills, the economy slows down. Banks and credit-providing businesses will take losses, and restrict credit at a time of higher interest rates. Crypto and Bitcoin: These 'assets' or retail bets are down considerably over the past 2 weeks, when they broke below support levels around $30,000 and fell $10,000 or more. We saw prices as low as $18,300 this weekend. Currencies: The USD / Japanese Yen price is again climbing (Yen is weakening vs. US Dollar), now over 135.14. However, the EuroDollar is almost $1.06 which shows the Euro strengthening vs. US Dollar, likely because the European Central Bank will start raising interest rates as well. War:

OK, so what are you going to do on Tuesday?We truly don't know. We have restricted our cash in our trading account so any moves would be very small. We will likely just double down a bit more if prices move against us significantly. We will reevaluate this at 0700 ET tomorrow and discuss it in our livestream video at 0730 on youtube. GLTA It's Tuesday morning and things are still not clear.We know that US Equity Futures are green and up significantly (1.78% to 2.00% across the three indices we track). This is a big morning move, and should send equities rocketing higher. We just don't buy it this morning, unless there are some internal moves happening.

What would we be looking for:

There is no real news. Asian markets ex.China are up, China markets are down. Not sure if Asian equities strength is due to views of US economic demand for imports, money flows, or just a sunny, positive day with Japan leading the way with quantitative easing and 'cheap money.' CNN was absolutely boring. ZeroHedge largely irrelevant except for Lithuania enforcing the sanctions on Kaliningrad. I think this is great, BTW. European integrity and consistency in action. Russia is so angry they are turning more red than they already are. Link here. By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Today is options expiration day. The markets should be volatile today as positions are closed out and options (and the underlying asset) prices are moved around to maximize trading profits. We also expect the market to digest many changes from yesterday's action: - Bank of Japan gave up the JGB yield cap of 0.25%, which boosted the YEN, which has now come back to its previous highs of 134.50 - US equities opened lower yesterday (gap down) and traded in a range, ending down ~4%. This is a significant drop. - US Federal Reserve raised interest rates by 0.75%, and short-term yields rose - High number of new lows in both Agency and Corporate fixed income, and US equities. New lows dominate the decliners (about 40% of all stocks or bonds that declined broke through new lows). On the opposite side, ~4% of advancers broke through new high levels. However, this morning US equity futures are up around 1%, and all looks calm. Foreign exchange markets look normal, crypto seems to be setting into its new, lower range. BTC/USD ~$21,000. This confuses us, we expected more action this morning. We spoke in support of rational stock market pricing today. We went back to the $CLF or Cleveland Cliffs discussion from twitter yesterday. The price of the stock is down ~50% recently, and we support the company's mission of domestic iron ore and steel production. The stock is down because the futures on their primary inputs are up, and the futures on their 'best, highest price' output is down. Also, we should expect higher energy and labor costs to tighten their margins further. This stock is dropping because public information suggests their profit margins may evaporate. We saw one key indicator this morning flash RED. Short-term interest rates are rising. This has an immediate impact on our quantitative model, the Chicago Quantum Net Score. It lowers the expected return to risk assets, which lowers the benefit of risk, which then increases the benefit of reducing variance. If you hold risk for expected return and that return falls, then you should hold less risk. There is a lower risk-return trade-off. (there, we finally said it). So, our model picked more stocks to hold (spreading out investments) to get a smaller edge on the S&P 500 Index ($SPY is the ETF we use). As a reminder, the overall indices are much lower than they were a year ago. Year through: 2022-06-16

QQQ: 271.39 339.38 IWM: 163.90 227.43 SPY: 366.65 416.62 Riskfree rate = 1.50% Actual SPY return = -12.00% Use floor S&P500 rate = 5.00% Actual IWM return = -27.94% Use floor Russell 2000 rate = 5.00% Actual QQQ return = -20.03% Use floor NASDAQ 100 rate = 5.00% =========================================== Market return = 3.50% CQNS negative net income stocks variance: 0.0004616010737782597 Expected Return = 5.64% CQNS positive net income & positive cash flow from operations stocks variance: 0.0001598 Expected Return = 4.31% $SPY S&P 500 Index ETF variance: 0.00014970911 Expected Return = 4.5464% In other words, by picking money losing companies to invest in, your expected return for risk increases by 1.33% and you take on ~3x the price variance. That risk/return trade-off is getting less attractive in a negative return, increasing risk-free rate environment. The risk/reward trade-off by holding the $SPY is better than for any individual stock in our run. You still can find an edge by holding (10,16) stock portfolios, evenly weighted. That edge is 2.3x10-4, which is less than half the edge we were finding a week ago. This market is getting unpredictable. By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Updated intra-day 1421 ET We ran our models last night and made a few tweaks based on the Federal Reserve Bank raising interest rates. We thought it would not make a significant difference. We watched the futures last night and everything looked Green/UP. This morning, our analysis suggests something different and the US equity futures and UST bond and note futures are RED/down. What do we see? 1. We raised the 'risk-free' interest rate in our model last night to 1.5% from 1.0% and it made a big difference. You may remember in school when people said 'rising interest rates make people sell stocks and put their money in the bank.' We do. I also remember people saying that inflation is the enemy of stocks, and interest rates are bad for stocks, and there is competition. We see it today. 2. Many new lows were hit in US Corporate bonds (fixed income) and US equities even though the indices were up yesterday. This makes sense if you remember the adage "do not catch a falling knife" or "bottom pickers get stinky fingers" or "hey you, get out of the way." Stocks that have been weak in this market continue to weaken further. It isn't the hedgies or big money guys or 'The Man' betting against your favorite stock. These companies are worth less every day due to something that is likely very real. Retail sales were negative on a REAL basis in May, and were flat for the entire year (May 2021 - May 2022). 35% of stocks and 80% of bonds that declined (the quantity of declines) were new lows. 3. There are many analysts that speak about trading strategies and big events. There are two that I remember from reading last night (after market close). Friday is OPEX or options expiration where I believe ~$3T in options (at nominal values) expire. Also, supposedly there are investment funds that will be buying stocks at month-end. 4. Our model gave very different results today. Watch the video to see if we share more of this new, cutting edge insight (or if it just goes to clients who pay for our runs). GLTA. Enjoy the video. Intra-day update (1421 ET)

A few key industry sectors:

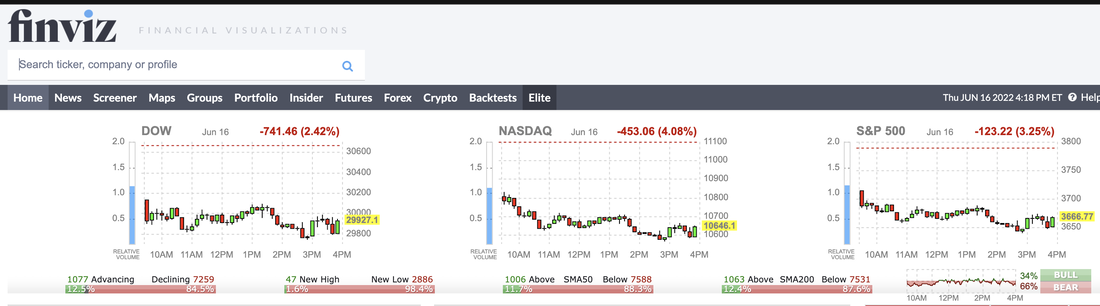

Update at market closeThe markets continued to fall throughout the afternoon. Notice the slight uptick, decline, and uptick into the close during the last hour of trading.

We will likely discuss how 2,886 stocks hit new lows out of the 7,259 that traded lower today, and how 66% of participants were bearish. The market opened lower, likely due to large bets already set in motion at the open. This was not retail driven and the day saw little strength. Tomorrow about $3T in nominal value options expire, then the cycle starts up again into July. By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. June 15, 2022 We noticed something. There were many new lows in a relatively flat day in the market. Fixed Income (Agency and Corporate) US Equities. We also speak about the Federal Reserve FOMC meeting ending today, and the upcoming press release. Hear us talk about it this morning. Lots of data shared. By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Good morning. Yesterday was a really RED day in the US equities markets and US Corporate and US Treasury fixed income too. The markets are down hard over the past year. We could show charts and graphs to prove it, but you already know.

Year through: 2022-06-13 QQQ: 275.41 339.61 IWM: 170.20 229.25 SPY: 375.00 418.80 SPY Variance: 0.00014462534 Riskfree rate = 1.00% Actual SPY return = -10.46% Use floor S&P500 rate = 5.00% Actual IWM return = -25.76% Use floor Russell 2000 rate = 5.00% Actual QQQ return = -18.90% Use floor NASDAQ 100 rate = 5.00% =========================================== Market return = 4.00% Net-Net: Invest regardless of market levels. When stocks go down, it is a chance to add to positions. Trade based on the market. Don't fight the trend. Bulls make money, Bears make money, but Pigs get slaughtered. Trade carefully. Video coming up! Jeff

By Jeffrey Cohen, Investment Advisor Representative

US Advanced Computing Infrastructure Inc.

We did our cursory look at the financial markets on Sunday night. We do the typical 'blah blah' look at global markets and figure that Monday is a mystery. The vision is not clear, and usually never is.

Today, it looks very clear. The markets are set for a dramatic fall on Monday, if things stay the way they are. We condensed it down to a tweet just now. Here are the pictures we saw that give us the most pause.

Bitcoin has fallen through its $30k support level. The US Dollar is starting to approach support levels for the EuroDollar. Stronger dollar and weaker bitcoin starts to impact global citizens. It makes people feel less safe, less 'on top of their game' and less sure of their 'new world' narrative.

If bitcoin continues to fall, and the dollar continues to strengthen, this takes us back towards the old world order where the US and capitalism are the safe place, the place to invest, thrive and survive turbulent times.

The Eurodollar is approaching support levels (around 103.5) and the Japanese Yen continues to weaken against the US Dollar. It will soon take 135 Yen to buy one dollar. Why any US company would work hard to generate profits in Japan and repatriate their earnings into US Dollars is beyond me. Japan is self-isolating and will survive due to exporting their way out of economic trouble.

This is also a return to traditional ways of being.

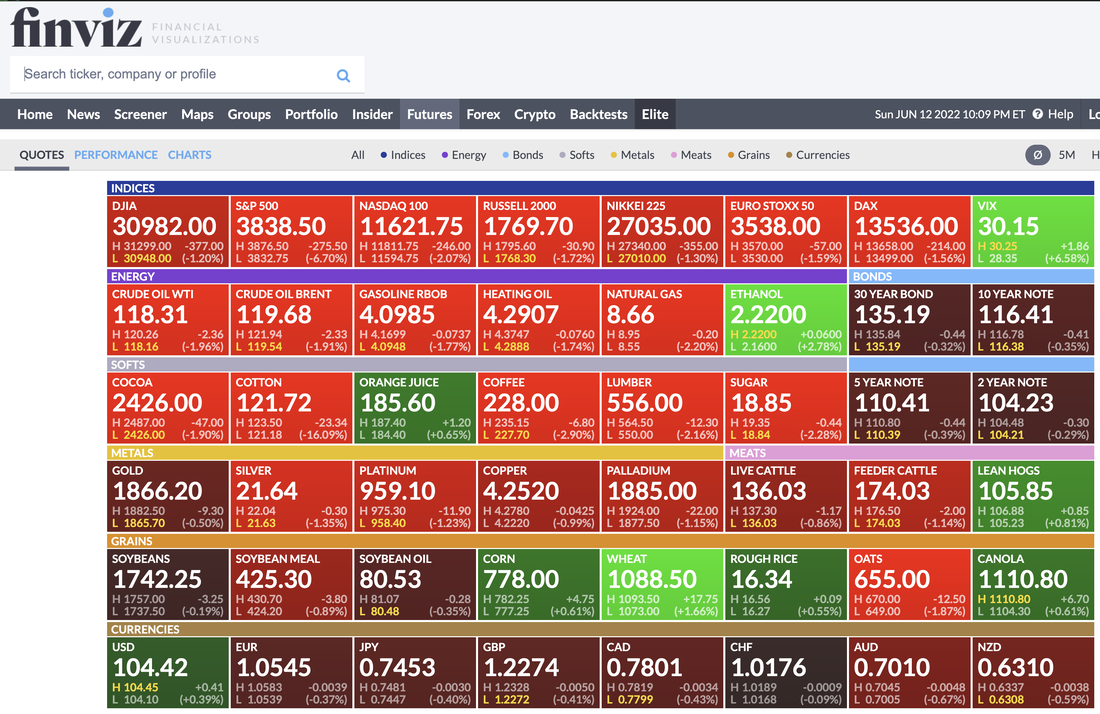

Thank you Finviz (found at finviz.com) for this excellent visualization. You can see the VIX has now broken above 30. This reflects the same analysis we did this weekend and found that volatility (actual, historical) volatility is higher today than it was yesterday, or last week, or largely for the past year. I would expect that if the US Equity markets continue to 'rock the boat' like they have been, VIX will continue to rise. In this case, it is only math and not emotion.

Gasoline fell to below $4.10. This is good but not enough. UST 30 year bonds are approaching key support levels of 135.0. Other UST notes are also lower. This indicates higher market-set long-term bond yields. This turns into less business and real estate demand and activity. This is a 'wet blanket' on the real economy. I don't know if I believe the S&P 500 hitting 3838.50 on Monday, but that is where it is trading right now (or at least about 20 minutes ago when we took the picture). That is a 6.7% decline, and something like a 4 standard deviation move in one day. Seeing markets like this makes me glad I am taking the next four mornings off from trading and taking my daughter to her Summer camp. It is a day-camp, far away, and I will drive her back/forth each day. I may have my trading account open...and may make a few trades, but I will not be in front of my office screens until the earliest 2pm ET. Good luck to everyone. I will sleep with a heavy heart for all of those fully or heavily invested in the US equities or US fixed income markets. I pray for your net worth, your sanity, your courage and your ability to recover from shocks like a 6.7% decline in the S&P 500 on a Sunday. GLTA Jeff By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. This weekend, we were asked the question "what is quantum about investment advisory?" or put another way, why do we only see mentions of quantum computing in relation to information security?

The answer is that quantum mechanics (physics at a really small scale) is truly random. All the 'stuff' that happens in our computers, or in the old testament (we checked), or in physics in objects that are relatively large (so you can see them without an electron microscope or a carefully crafted experiment), like a grain of sand, are classical and not random. For example, ask your computer for a random number and it will come up with an odd calculation that is hard to guess, and a gem or starting point like the time in the system clock. With enough smarts and computing power, you can figure out the gem, and crack the code...so the action is not random. Quantum is random. Security requires true randomness because today's security requires a hard calculation that can be reverse engineered. Randomness is more secure, and more interesting for picking stocks. In this week's "Investment Information" tab you will find data that is split between stocks of companies that lose money, and stocks that make money (and generate cash in their operations). Things like skewness, or price declines, or daily price change variance do depend on the profitability of the companies (as a true/false flag). Most everything in the markets is not random, and can be figured out, and role-played or game theory-ed against, or even programmed against with a bot or trading algorithm. I believe our model has been deciphered and there is someone in a dark room figuring out how to bet against the CQNS UP and Down runs. That is ok, because when we run it on a quantum computer, it has a little more randomness, a little less precision, and can pick slightly different stocks. For those that want a core, quantitative edge, we use our classical runs. We can run our server for 6 or 8 hours overnight, and sometimes do, to find the best answer (or the best we can find, in a computational equilibrium). When we run it on quantum, the answers are a little weaker, a little different, and anecdotally, behave differently. Being random in your computational power could be edge you need to beat the algorithms and large trading desks. And now for the week's picks:

We noticed a frew things this week.

In our opinion, holding equities this week is more risky than last week. Buyer beware. Good luck in the markets this week. GLTA! Jeff

By Jeffrey P. Cohen, Investment Advisor Representative

US Advanced Computing Infrastructure, Inc.

Inflation numbers came in. Consumer prices accelerated higher in May 2022. Link here.

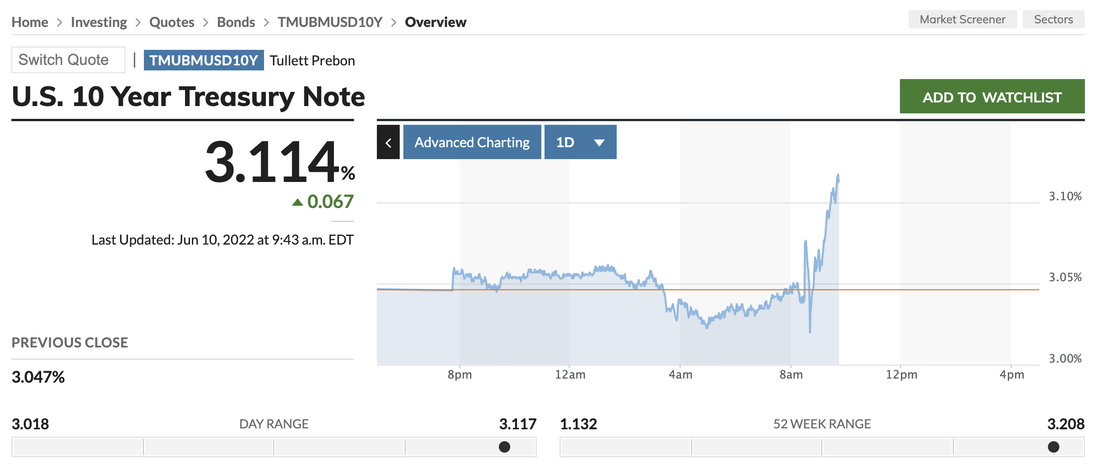

10-year US Treasury Note Yields are screaming higher this morning. Up to 3.114%

Gasoline prices are down ~1% today. They are seemingly immune to the market action and concern over their prices. Gasoline is still trading over $4.23 / gallon wholesale, untreated, awaiting transportation.

We finished running our models last night, as we now do every night.

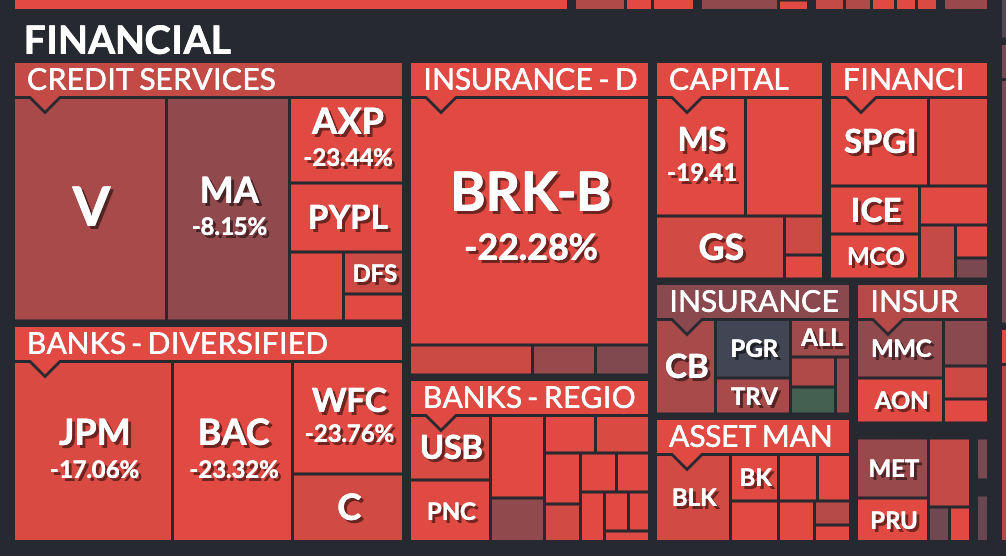

The CQNS Down runs are faster. We usually have these after a few hours. This is because if you are going to short a portfolio in a least risky way...it should be a smaller portfolio. Our models can focus on smaller solutions and this takes last time. Lately, the model has been identifying anomalous stocks in a tricky trading environment. We find stocks that are seeing significant price and volume movements, followed by calmness and generally, weakness. Yesterday we really wanted to short a small-cap stock that is dramatically over-valued. However, we ran into a pattern on two of these ($RGC and $VIEW) in that there was zero borrow. So, we could only watch. BTW, both continued their relentless climb higher into the stock 'stratosphere' and we will watch those for an eventual fall. Others like $INDO started their descent earlier this week and are down significantly. We personally have only so much capital to risk in this market (we are in a downtrend, and most of our capital is side-lined), so we are missing most of these. This is why we offer our services to clients, so others can take advantage of the literally 3,000 stocks we analyze and profit on the anomalous down-run picks. The market fell into the close. Why did the market fall yesterday? Yesterday, we saw a down market where the indices started out green, then moved to the RED by the end of the day. I read pundits that said it was because investors are worried about inflation. The problem is that we have had inflation for over a year now, and so it does not explain yesterday. The losses were wide-spread as you can see in the charts below. Funny thing is, we were trading one stock yesterday and did not really notice the market falling. I guess nobody knows why markets rise and fall except for the market makers (who see supply and demand) and the regulators (who have the data after the fact). If I had to make a guess, I would say more shares and equity index futures were sold than bought yesterday. This also could be a corporate fixed income driven drop as companies may not have the earnings and cash flow to meet their obligations. Inflation fears create recession fears, and reduce overall economic demand in the short-term. Rising interest rates, if they indeed rise as indicated, are also demand destruction devices. So, maybe the bet against stocks yesterday was due to recessionary fears driven by inflation and inflationary counter-measures. Images from Finviz www.finviz.com. Thank you. Data from our runs comes from Intrinio. Chicago Quantum is powered by Intrinio. www.intrinio.com

We also noticed a few other things in the market. US Treasury Bonds are holding on nicely, despite the upcoming rate hikes and quantitative tightening to start in June 2022. These are the same numbers we have been seeing all week, and indicate a stability for fixed income that we welcome.

30-year US Treasury Bonds yielding 3.148% 10-year US Treasury Notes yielding 3.039%

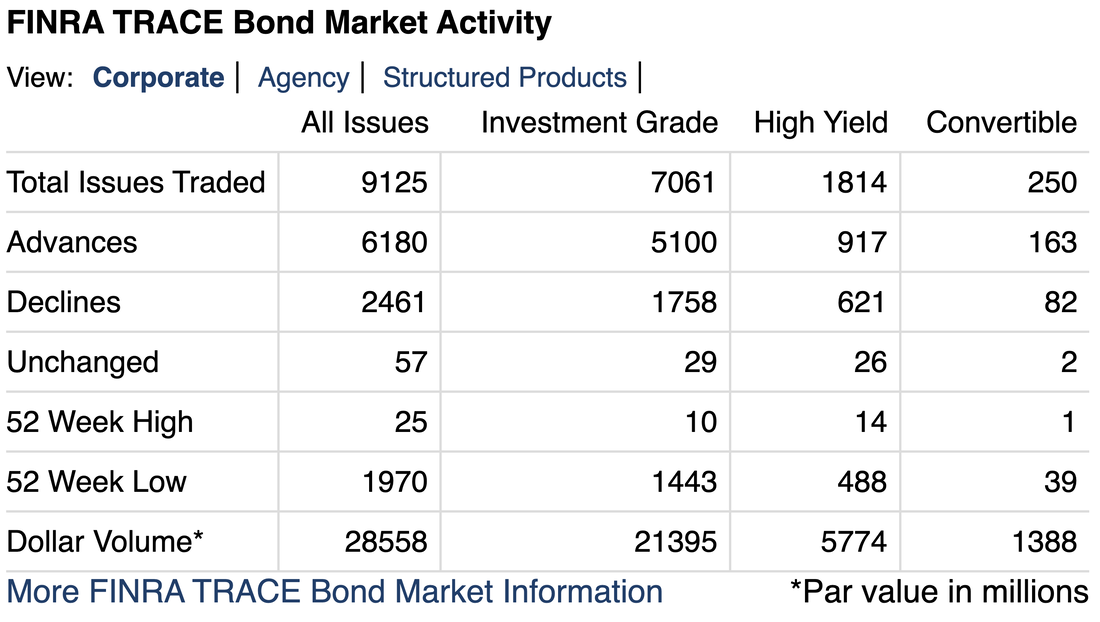

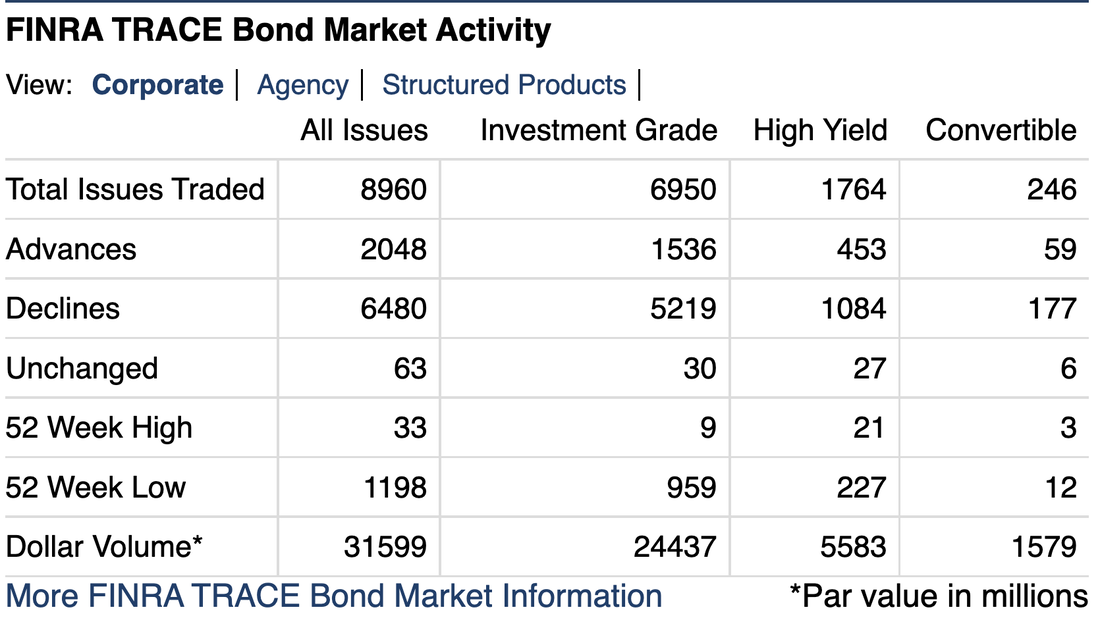

On the corporate fixed income side, things are not doing as well. Yesterday was a very weak day.

Decliners and new lows outpaced advancers and new highs, according to Finra & Morningstar. Look at the investment grade corporate bonds: 9 new highs vs. 959 new lows. These are stunning metrics.

So, where does that leave us in pre-market today?

The US equity futures are flat to down, about 2 hours before market open. Bitcoin is trading right at $30,000 (it is actually $30000.13). Take $0.10 off and you have a palindrome. Ok, that was just a moment in time, it is now $30,004.38. This is a support and resistance level for Bitcoin. Range-bound. Currencies are interesting this morning. They changed from last night. EuroDollar at 1.0573 means a stronger dollar DollarYen at 133.95 is about the same as we've seen it, and is a historically strong level for the USD. DollarYuan is 6.6958 which is a very strong USD, and support continued imports from China. DollarMXNPeso is 19.725 which is recently strengthening in USD, but down from last year when the Peso was much weaker (reached almost 22 Peso/Dollar). USD/CAD is 0.7836. This is largely range bound between $0.80 and $0.77. Both DollarYen and DollarYuan imply a 'free shipping' offer from our large, overseas trading partners.

We follow global, physical mining stocks and companies that produce steel in the United States. These stocks fell out of bed yesterday. The valuations are not at the lows we saw recently, but they are showing weakness. This is an economic bell-weather sub-sector.

However, trucking and transportation was mixed yesterday, and is set to open mixed today. There is some strength in trucking stocks. Other industry indices (proprietary) that we follow: Quantum Computing Companies: UP PCs and Chips: mixed Chips and Semiconductors: UP Cannabis and Tobacco: Mixed / UP Physical miners: down, Crypto industry: UP Retail / Specialty Retail: mixed, flat, no big moves PM Money Managers: mixed / DOWN High BETA stocks: mixed and our two long positions are flat: ($CRBP & $AMS)

The VIX, or the CBOE Volatility Index, is trading at 26.59. This is up versus the past few days, but is down from recent highs when it scored above 30.00. It is up this week, but as you can see in the weekly chart, it is not significantly elevated.

By: Jeffrey Cohen Investment Advisor Representative The media fed us negative news all morning. The futures look to be down slightly. A few stocks look much lower in pre-market due to specific earnings concerns. Nothing is running higher today on our radar, and our key industry segments are all down. However, my sense is we are in a trading range on the S&P 500 Index and everything will be fine today. Market will trade flat. Bonds strengthening on the corporates, flat on the mortgage backed agency debt, and the long US Treasury duration debt is falling, so yields are rising. Looks like yields want to rise more, working to go higher. Bitcoin is in a trading range around $30k. Been there for a month. During the day it is at $30,543. Range-bound. Euro/Dollar at 10742, which is right where it has been for a while. USD/JPY at 133.85 means the YEN is falling against the US Dollar. Twitter is surprisingly negative these days. Again, I think the markets may end green today Enjoy the video. P.S. I think I am catching another cold, and hope it isn't Covid again. Throat is sore, head hurts, congestion, and tired. GLTA Update as the market is open.

Slow and low market. Not much movement. Cannabis wholesale prices are down, again. $SMG Scotts MiracleGro is down, along with most of the cannabis sector. As long as the wholesale price continues to fall, this sector will fall. Cannabis Business Times maintains an index: here. Mortgage applications down 6.5% this week. New mortgages down 7.1%, and refi down 5.6%. Trading Economics published the data here. By: Jeffrey Cohen, Investment Advisor Representative Some good news and bad news in the markets today. Retail had the bad news. Target warned lower on graphic images of weakness in their business. Kohls is selling themselves for $8B. The balance of trade was good news, the Census Bureau here reported that the trade deficit narrowed by $90B on 3% more exports and 3% fewer imports. It's amazing how small adjustments like that can bring us back towards balance. All major indices we follow were set to open lower in pre-market trading, including our new high BETA index we just rolled out this morning. All 'canary in a coalmine' or leading indicator industry segments were negative this morning. As an example, 100% of the trucking and transportation companies that were not unchanged were lower. Covid: still here. Numbers of new cases are elevated, but stable. However, new hospitalizations are up to 3,808 yesterday, and this is an elevated level. Bonds were lower, across all categories of US Treasury, US Agency debt, and Corporate Debt. However, price declines seemed to be moderating into the open. The ratio of new lows to new highs is climbing again, and reached 20:1. For every one new high, 20 issues reached new lows, and most were in the investment grade category. None of the runners or potential short squeeze candidates seemed to be very active except for $HLBZ (up) and $MULN (down). The rest of the crew was trading very low volumes pre-market. A few notes. This is not investment advice. We are not paid for blogging or video live streaming. We do this to share our messages and help others trying to make money in the financial markets.

If you like our work, please tell others. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed