|

Good morning. 11:06am ET. Markets are open. Not sure what I am witnessing. Interest rates are up, including mortgage rates. Will go through the list of industries we track (equities):

US Banks are decidedly mixed, with an almost equal number up as down. Quantum companies are mixed to lower Enterprise IT is a little lower, and most companies are lower. Logistics and Transport is higher Chips and Semiconductors are lower Cannabis and Tobacco are higher (the small caps) and the large caps which pay high dividends are lower. Dividends are 'out of fashion' today in tobacco companies. Crypto and miners. A few commodity miners and assorted stocks are up slightly, but the rest are down significantly. Dogecoin is up almost 5%. Coal is mixed. Retail is mixed. The largest, discount retailers are down. Money managers are down, except for a few investment banks and money managers. Robinhood is up today $hood. Oil, Gas and Pipelines are up today (mostly). Overall, the market is mixed and no single industry or narrative is holding. The FOMC meets on Tuesday and Wednesday, with a press release on day 2 indicating the new policy stance. Most banks are expecting a 75bps rise in the policy (or overnight and prime lending rates) this week.

0 Comments

Good morning and happy Halloween.

It looks like a different market today than Friday. 1. Interest rates are higher (13 weeks through 30 years: US Treasuries) 2. Russia ended the Grain Deal, and wheat prices (which means food prices) are up. In fact, food (grains) futures are up significantly, including oats, soybean, corn, rice, canola and especially wheat (up 5.5%). 3. The US Dollar is up slightly this morning, by about 0.5%. 4. Crude oil, precious and industrial metals, and US gasoline (wholesale) are lower today. 5. US equity futures are down into the open, suggesting a ~0.5% lower open today. This would claw back a little of the gains from last week, but not much. 6. The news globally is generally local. There were deadly accidents in South Korea and India. Russia is escalating their 'war on infrastructure' in Ukraine. Brazil had a successful, peaceful election of their Left party candidate Lula da Silva as President of Brazil. As a reminder, da Silva was arrested and imprisoned on allegations of corruption and served 580 days in jail. He is now back in power for a third term, and suggests that Brazil's 215 million people come together, unify, and move forward. At the open, our CQNS Short picks are either flat or down slightly. Our UP long picks are down (12 of 14 are down). After two minutes, all three of our CQNS short picks are up, suggesting a continuation of the push into 'stonks' we saw on Friday. The CQNS longs are still decidedly RED or down three minutes into the trading day. By Jeffrey Cohen, President & Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Good morning. Notice a few things in the market this morning (pre-market at 8am ET): 1. The US Dollar has fallen significantly over the past week, and the EUR/USD went back over parity (currently 1.0081). However, this morning the US Dollar is stronger. Up by 0.35% 2. Copper is back to $3.50 / oz and other industrially sensitive commodities are also higher. Crude oil WTI at $88.12 / bbl is up there, along with silver at 19.35 / oz. This is not the sign of a global economy in trouble now. This demonstrates either market 'restraint' or 'strength' as companies acquire future supplies (which is possible pre-war with Russia), or that companies may be cutting costs, but not production in Q4 and into Q1 2023. 3. US Riskfree interest rates have risen, and bonds have fallen. Bonds are down this morning, and are generally very weak compared to where they were even just a few months ago. Interest rates across the yield curve are at or above 4%. This is great for savers, who can earn 4% interest with just a little effort. However, this is not great for companies or organizations (like regional banks) that hold bonds to boost current income through bond interest payments. They are holding bonds that have been weakening for the past few months. There was even a crisis in the United Kingdom about this when pension funds used borrowings, or leverage, to hold more bonds than they could afford as they fell in value. So, what does that mean for equities this morning? Europe is down a full percentage point, and Asia was down. The exception in Asia is the Hang Seng, which ended up almost 1%. The Hang Seng fell dramatically earlier this week, so a technical reversal or 'bounce' can be expected. It was up almost 4% at one point last night. US Equity futures are mixed. The Nasdaq Composite 100 ^IXIC is set to open lower by 0.6%. This is NOT surprising as tech stocks reported earnings yesterday and after hours and had issues. The Metaverse company $META, formerly known as Facebook $FB, traded significantly lower last night after hours (down 20% at one point as we watched) on top of a 6% drop during the trading day. Other stocks may be falling in sympathy, but it is hard to tell. The moves are too slight this morning. What are we watching today?

We have two personal holdings that hopefully will be profitable positions. There isn't much to do on those but to watch and either buy or sell. No need to discuss them. We ran our model last night, and will save that update for another BLOG post. Good luck to all. By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Chicago Quantum (SM) Maybe it does not matter that the markets look to head lower today. Our personal investments are well hedged (~75%), and our new Chicago Quantum Net Score / Smart Volatility 'hedged' fund is 100% hedged against downside risks. However, we keep seeing warning signs in the data. Here are a few that indicate that we are in a bear market and it is likely that equities will keep falling. Top 10 List: 10. Energy prices are up. WTI Oil is over $90 / barrel 9. Interest rates are up, and look to continue rising (long and short term rates) 8. Earnings season is coming and we see headwinds to profits, including the strong USD, rising inflation on inputs, rising interest rates on borrowings, and potentially slower consumer and B2B demand. 7. Variance of stock prices is elevated and continues to increase. Stocks are more risky by the week. 6. Stock prices keep falling 5. Market breadth is weak (many stocks falling and many new lows vs. stocks rising). 4. Corporate bonds are weaker (absolute prices are down and in many cases, yield spreads are increasing). 3. US Bank equity 'cushions' are declining for banks that hold long-duration bond investments 2. The Federal Reserve is likely to continue raising interest rates & tightening the US money supply 1. Potential for war in Europe between NATO and Russia over Ukraine. We learned a valuable lesson in August, September and October in this market. It is similar to a lesson learned in January, February and March of this year.

Always hedge a new long position. GLTA By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Pre-market:

Dow, S&P 500 and NASDAQ futures all lower. Source: CNN Business. Bonds are looking weaker, down between 0.1% and 0.9% pre-market. MBS Trading lower this morning. Bitcoin down slightly, trading at its support level of $20k. Energy stocks are lower UST Interest Rates are higher, so US Treasury bond prices are lower. US Banks are set to open lower Money Managers lower Retail (wide portfolio range) lower Coal, Mining, Steel, & Crypto (all lower) Cannabis and Tobacco (lower, but mixed - some higher) Chips and Semiconductors (all lower or unchanged) Trucking and Transport / Logistics (all lower or unchanged) Computers, Phones, IT Services, Software & Hardware (lower) As we look at yesterday, we see that stocks and corporate/agency bonds rose. European equities are trading lower, along with Mainland China. Japan, Hong Kong and many smaller markets traded higher yesterday / last night. Energy trading higher. Overall commodities (excluding energy) are down slightly. We do have news about mortgage rates rising, and strong job growth in September 2022. Today is a day when we test our hedging strategy. Our longs are down...can we profit by our shorts being down more? Let's find out. Good luck to everyone in the markets today. Be safe out there. Finally, keep your eyes on the US Treasury Bonds. We believe these are key today. By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. So Jeffrey, I hear, what is the bottom line in the markets today? Bottom line is the stock market and overall financial markets are moving a little more than normal. That movement can accentuate trends. Highs go higher. Lows go lower. Things move more quickly and more deeply than before. Also, prices trending towards weakness, with lower stock prices, lower bond prices, and even lower housing prices. We see commodities weaker (except for oil, which is staying strong in the $80s). So, what should we do? We are debating that same question, and today, Monday, requires some deep analysis. When financial assets fall, expected returns rise, especially for companies that make an economic profit. An economic profit is when a company earns enough money to supply sufficient capital to grow, and to pay dividends (or pay down debt, or buy back shares). As those stock prices and bond prices fall, the expected return of those financial assets rise. The question is whether expected returns are rising as asset prices fall, right now, today, and for the next 253 trading days (1 year). Our models assume an 8.5% return on new money in risk assets (including dividends). It also assumes a 3.5% return to risk-free assets (e.g., 3-month US Treasuries, short-term CDs, Money Markets, US Savings Bonds, etc. Should we go up to 10% expected returns as the market falls further? When do we make that shift? When do most people become optimistic? Is it when stocks are falling the fastest, when stocks bottom, or when they begin a recovery? Do you buy the recovery or buy on the way down? When does the mindset change for the market in regards to expected returns? What our new Chicago Quantum Net Score / Smart Volatility fund is doing is to keep a relatively small number of stocks (currently ~12 longs) and three shorts. The model sees opportunity in risk today, and is RISK ON. If we increase our expected returns then the model will pick fewer longs, and will choose different stocks to hedge with. BTW, we are paper trading our model while we work through the investment processes, outsource our custodial services to Charles Schwab, and look at different hedging strategies. We will be our own first customer once the processes are complete and plan to open the fund to investors. What we notice in the markets is a falling knife.

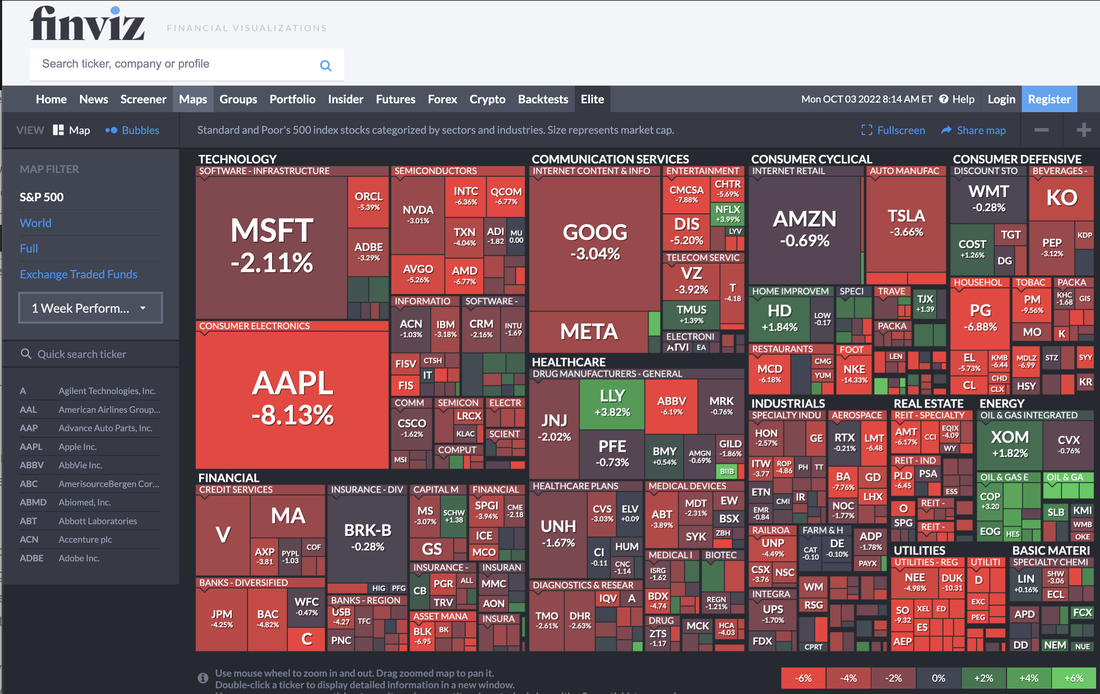

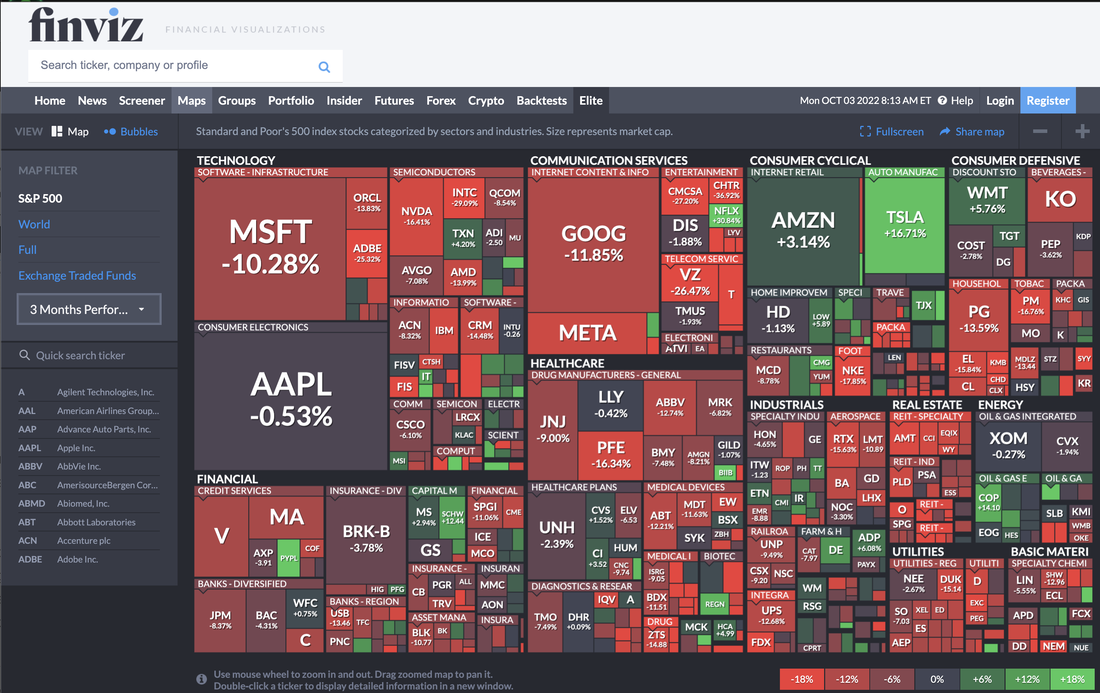

US Equities are down and trending lower. We are in a bear market. (TY Finviz) 32 new highs vs. 1,282 new lows (40:1) US Corporate Fixed Income is down too. We are in a bear market for bonds. (TY Finra Morningstar) 22 new highs vs. 1,633 new lows (74:1) Strategy #1: Do not catch a falling knife. Fear of missing out is a cost effective strategy. Wait for your favorite stocks that is reaching new lows to bottom before buying. Do not buy just because a stock is falling. Strategy #2: Fundamental valuations are more important than ever. As companies face higher interest expenses, and more difficulty in raising money (tougher terms & conditions), companies that are generating cash flow and paying down debt at a discount are building wealth. Look at stocks that are down that are worth more than their stock price and hold those dearly. As an example, we hold two stocks that we value more highly than their stock price, and will keep adding to those positions over time. We may be early, and we may be wrong, but we will feel ok holding those stocks for a long time while the market valuation catches up to fundamental valuation. Strategy #3: Stay hedged. Have a mix of investments that move up and down. We made the mistake in January 2022 of only holding bullish bets and it cost us dearly. Now, we are about 65% bullish, 35% bearish, and we are thankful for the gains of our hedges. We can always sell off our profitable hedges and replace them with new hedges at lower prices. See evidence below of the performance of the S&P 500 (TY Finviz) over 1 week, 1 quarter and 1 year. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed