|

By Jeffrey Cohen Investment Advisor Representative, US Advanced Computing Infrastructure, Inc. Data provided by Intrinio (and we apologize for any mistakes provided by our data provider) We discuss these stocks: $HOOD $RRGB $WBD $SAVE $RXT $RBLX $WIX $TRIP $INFA $BYND $UBER $BKR $FLR $CCL $DNUT $Z $BSGE $SABR $CHWY $WRBY $UAL $SPLK $SMG $PWP $GILT $XRX $PANW $AAL $BA $JBLU $UTZ $ZS $SPOT $ETSY $ADT $DNB $SASH $BAX $ALL $RILY $GE $AL $CAH $AES $RCI $YELL $KKR $ARES $DOCU $TTD $W $MARA This list of stocks of money losing US companies surprises us. There are large, aged, established companies that should be able to make a profit. Others are eCommerce companies and 'new economy' firms. Overall, we believe all of these firms should be able to make a profit. We discuss them all ad-hoc and on the fly. December 19: We discuss the stock market today, stock volatility, and the companies that lose money. We review a list of money loser companies that we are surprised to see on our #stockstoavoid and stockstoshort lists. These companies we highlight (3 hand written columns of stocks) are large, well known firms that should be profitable in our opinion. Probably yours too. We discuss the list of these stocks and what we think has gone wrong. Hope it helps you think about companies that lose money, and how they can do better. How we all can do better to find value and give value to others. BTW, we closed our bank stock short on Friday. Finally, we discuss Chicago Quantum's analytical services and investment advisory services and how client can work with us. We have a holiday sale, and have discounted our one-time CQNS Up and Down runs to $100 apiece. We are discounting our primary service to a nominal amount to give you, our listeners, a chance to experience the model and data and to see how it works for you. We want more people to try it out, learn, and see what having a wide-spread market scan can do for you.

0 Comments

Our focus today is on interest rates and money supply.

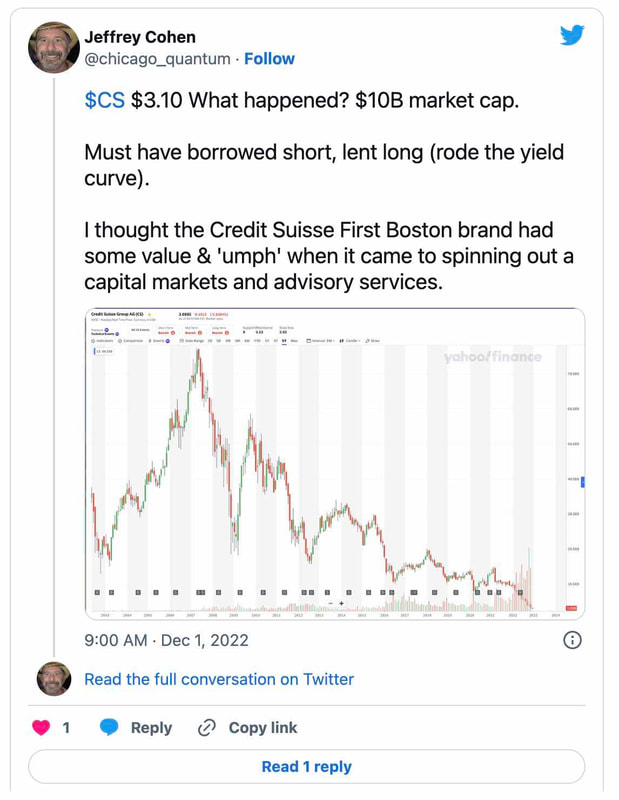

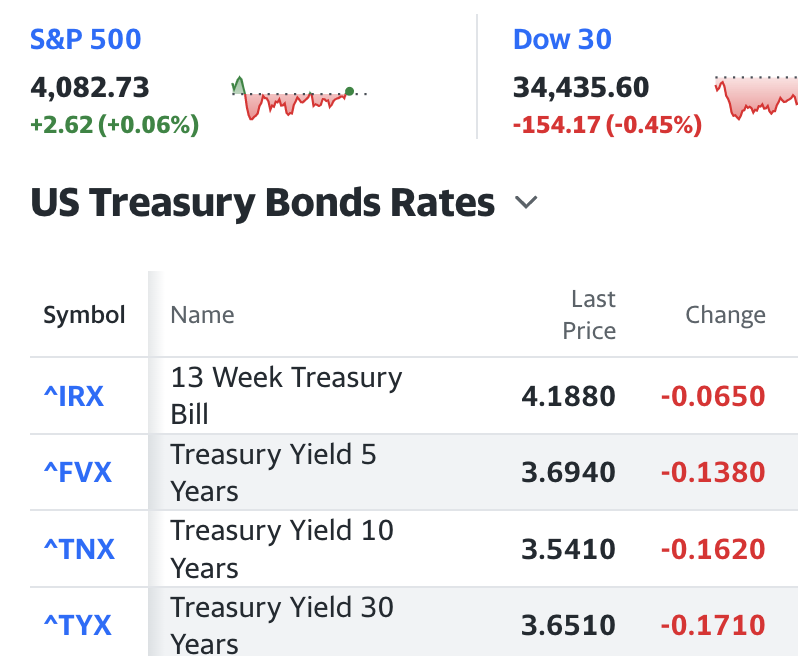

Money supply is very high, and has been coming down slightly (overall supply down $400B, excess reserves down $200B) and this impacts stocks negatively. Interest rates have risen, and continue to rise today. This is not a surprise to us, but could be to the market. Risky investments and 'bets' are less attractive when interest rates rise. We see that this morning. Stocks of US banks are down today. We are also amazed by the movement in Dollar Tree since they raised their prices from one dollar to one dollar and twenty five cents. Every item in the store, except for greeting cards, is now 25% more expensive. This has doubled the stock price due to the increase in profits. If a 25% raise doubles the share price. Why not raise it another $0.25 to 1.50? Why not two dollars? It sure seems 'too easy' for this company to be valued so much more highly from such as simple change. We also looked at other stocks in banking and they are down. We looked at stocks that have higher market capitalizations ($10 Bln and up, then $200Bln and up) and those are falling today. As a final thought, without giving any detail, we believe we see ($CS or Credit Suisse) the reason why the FED FOMC has so much trouble with Quantitative Tightening and removing excess liquidity and excess reserves from the banking system. We believe it is time for Chair Jay Powell to accelerate QT as much as possible, but also understand this could destroy our banking system and 'pop' the asset bubble even more than has been done so. Did I mention that the S&P 500 Index is trading above 4,000 again? Good luck in the markets today. We are absolutely bearish on a personal perspective, and our personal portfolio is net short. Our model portfolio from the CQNS / SV algorithms is always net zero long = short. However, we are less confident that the market has the ability to rise in the short term to make this model really profitable. We personally like a rising model better than a falling one, maybe because it seems more patriotic to have stocks go up (and profit), than to have stocks go down (and profit). Either way, the model has been doing well, but the feeling is different. Finally, the model does need orderly markets with sufficient liquidity and trading volumes to work. That is why we stopped our trading and went 100% cash about two weeks ago. Liquidity and volumes fell around Thanksgiving and we are waiting for them to come back. GLTA Jeffrey Cohen, US Advanced Computing Infrastructure, Inc Chicago Quantum (SM) What happened today? We made a video to discuss the core economic data we see today. It is all negative and recessionary for the US Consumer and US Manufacturer. Lots of bad news, and a little good news. Tiny good news. So, stocks are pretty strong today...flat...but US Treasury Bond Yields have crashed this afternoon. Good news: GDP grew in Q3/2022 by 2.9% (real) as a revision up from 2.6% (real). Forecasts call for a positive growth rate in Q4/2022. Chicago Business Barometer (TM) from ISM 37.2 (down significantly for 3 months in a row). Lots of bad news in the data for the Midwestern US. Inventory up, orders down, etc. Supplier deliveries down, new orders down, but prices paid are higher (not a joke). ADP Job Increase in November 127k jobs, except that the jobs were in the lowest rungs of the economy and job losses in manufacturing and professional / white collar jobs. Credit Suisse stock hitting an all time low (at least according to Yahoo Finance) and is down 95% from $60 to $3.00. We discuss some potential reasons why. We tweeted on this. Potential BK risk. Saudis and Qataris step in to help rescue the bank. US Treasury General Account down about $500B this year. This completely offsets quantitative easing by the Federal Reserve Bank. Ouch! The US government collects taxes and this means they likely had to spend it. So, those taxes were not disinflationary after all! BEA: Personal Income and Outlays, October 2022 showed that the US consumer fell behind. It also shows that price inflation slowed slightly. Good news on prices, but bad news on the US consumer. Also, the US savings rate fell to 2.3%, which we believe is very, very low. This couples with retail feedback from companies that are reporting earnings and forward guidance. Costco, Dollar General, Dollar Tree and weeks ago Target are all saying the same thing. More shopping value priced goods. Consumers shopping to their budget, and focusing on core essentials. Also, profits from retail are falling as costs rise. So, it costs more to sell cheaper stuff to consumers who are borrowing money to buy it. Ugh, this is bad news. $COST $DG $DLTR $TGT looks at the news for the details (all from today except TGT). Dollar Tree mentioned they might need to lower prices (what, to back to $1.00?). We slowed down our shopping at Dollar Tree since they raised prices 25% earlier this year. Anecdotally, they tried to sell $3, $4 and $5 frozen food and that seems to have failed at least in our local store (freezers are now empty in those sections). Yesterday, Chair Powell of the Federal Reserve Bank gave a speech. Here is the transcript. We leave it to the actual words spoken, because we struggle to understand the intent behind the talk. It provides transparency, but may have been meant to guide the market and rates. Forward Guidance. Does not seem right that a speech should move markets. Maybe they should stop speaking to the press and public except during FOMC press releases? So much news... Earlier in November the Federal Reserve FOMC released its meeting minutes. We have been reading them and the data on the economy seems to show slowing and weakness. We found it to be very down and negative on economic growth in the USA, and led us to think a recession might be in store for us. This is the data the Fed FOMC had when they raised rates 0.75% last month. So, what are we doing? We have our managed accounts model portfolio in 100% cash right now as the market looks for direction. We are looking into Credit Suisse $CS to see if this could be a bargain purchase (or a short to zero and BK). This could be a waste of time on due diligence, but probably good learning either way. What about interest rates? We see significant interest rate / yield drops today across the yield curve. 10-year UST down 16.2 basis points. This is a significant move lower.

|

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed