|

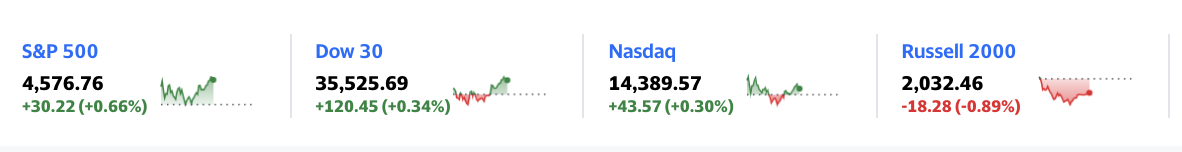

The expected market return for next year is 5.4% based on $SPY $QQQ and $IWM US equity indices.

1. Holding the $SPY provides lower price volatility than holding all CQNS UP or CQNS DOWN run stocks equally. This could be due to the advantages of capitalization-weighting. Top CQNS UP stocks are those you should own to outperform the market with lower risk: a. Best industries in the CQNS UP run are semiconductor and bitcoin related. b. Best 'large cap' individual stocks in the top 50 CQNS UP run are $NVDA $AMAT $QCOM $TROW $AAPL $BLK and $TXN. $TXN scored slightly worse than holding all 2,366 stocks equally. Top CQNS DOWN stocks are those you should avoid, or short, as they will underperform the market with higher risk. Some of these will trade like roller-coasters, if you like that kind of stock. a. Biotech and MEME stocks top the list. These stocks have moved aggressively over the past year, and many are in a steep decline since the FOMC meeting in December. b. Select stocks from the top 50: $SLNH $LWLG $AADI $ALLK $PHUN $CRTX $BSQR $FREQ $ACY $PROG $EAR $GATO $AMC $GME $EXPR $AEHR $REPX. These are all far worse than holding all 1,140 negative net income stocks (as individual longs). Overall insight: the CQNS model has been relatively consistent with its picks over the past 45 days. Keep shorting stocks that are declining and keep owning bitcoin and semiconductor related stocks. The other insight is that our model can only find ~50 stocks individually in the CQNS UP run that score better than all 2,366 stocks. This makes sense, as picking stocks that go up is difficult. Our model suggests there are 2% of the stocks that are favored. These stocks do change. The model, however, suggests that picking and holding any one stock from the CQNS down run is 'worse' than holding the full set of 1,140 CQNS down run stocks. Diversification helps you to avoid losing money, but it does limit your upside to make money. Eight CQNS DOWN Run 'dog-star' stocks that fell dramatically vs. last year's average price: ALLK -93% CRTX -90% RFL -90% KOD -90% BBIO -84% SLQT -84% NRXP -82% EAR -81% For those with stinky fingers (bottom pickers): CQNS UP stocks & decline vs. average last year's price: $SQ Block Inc. -59% $MARA Marathon Digital Holdings Inc. -41% $ICHR Ichor Holdings Ltd -29% $TROW T. Rowe Price Group Inc. -26% Respectfuly, Jeffrey Cohen President & Investment Advisor Representative US Advanced Computing Infrastructure, Inc.

0 Comments

Speaking about the CPI and Real Earnings releases from the Bureau of Labor Statistics (WWW.BLS.GOV). Impact on markets (lasted about 10 minutes). Our paper trades based on our CQNS down run day before yesterday. Due Diligence news on American Shared Hospital Services $AMS which we own. We also looked at the market this morning and saw a move. Inverse relationship between price gains and size (larger cap fell while smaller cap rose). I see this in the lens of liquidity and dividends...and retail vs. wholesale trading. Here is the CPI and Real Earnings page: https://www.bls.gov/bls/newsrels.htm

James Carter was President the last time prices starting rising this fast.

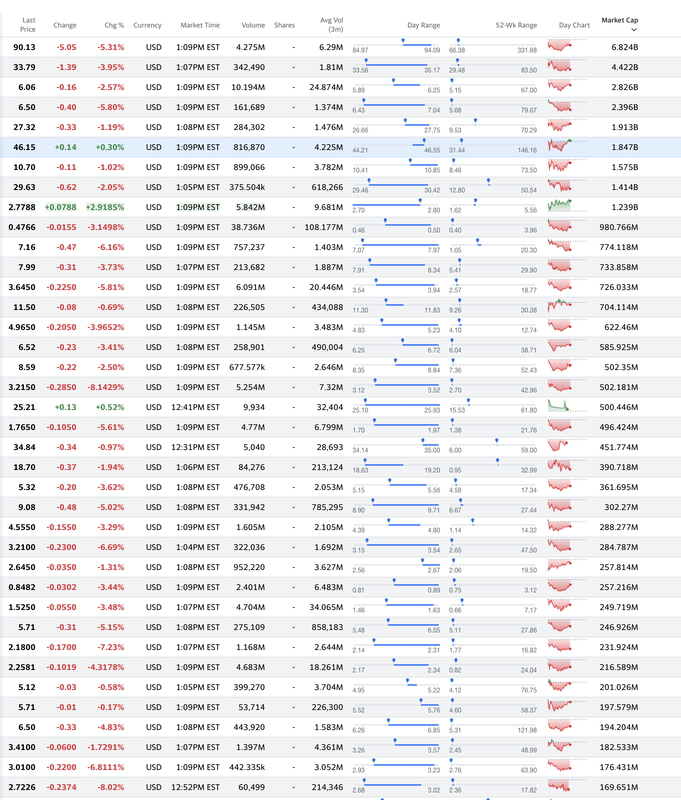

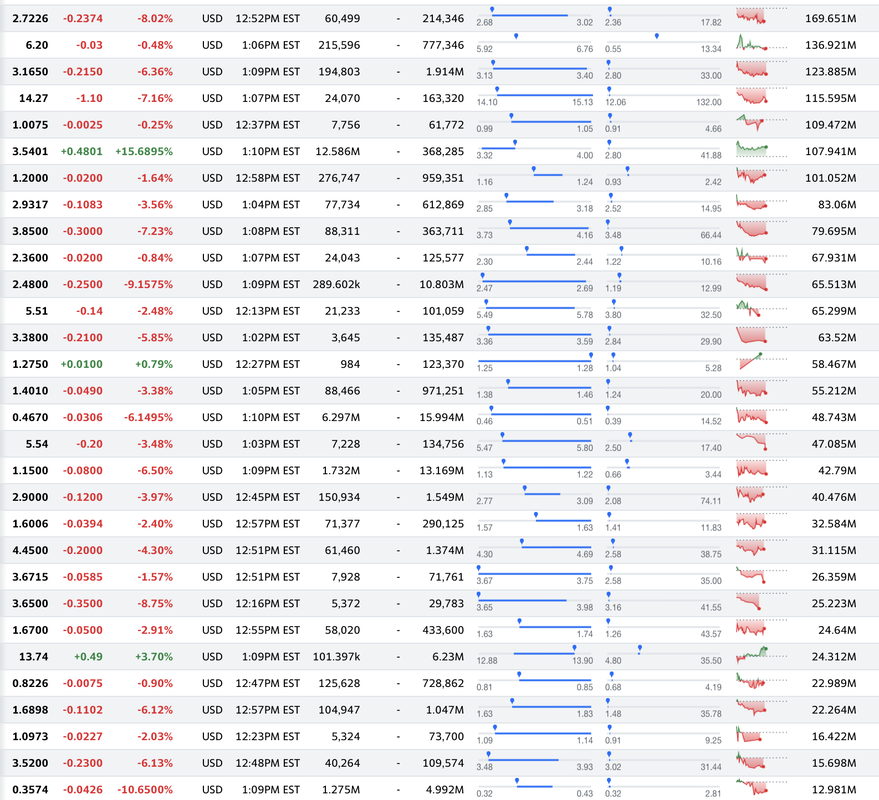

We have been running our CQNS Down run more often starting on January 5, 2022. Markets were trending lower, the FOMC announced tightening, and it became our belief that shorting "DOWN" stocks would be better than being long "UP" stocks during this market transition period. In addition, we have been studying the impact of changes in liquidity on the markets. We hypothesize that current conditions limit market participant liquidity (across participant types). Today, the market was very bearish on high volatility, low expected return stocks. Here is a pair of Yahoo Finance pictures of all the stocks we track as DOWN stocks since Jan 5, 2022, sorted by Market Capitalization (largest on top). The results as of Feb 2, 2021 at 1:09:30 pm ET: Today we see 6 stocks up and around 61 down. By the end of the day (02/02/2022), there were 8 stocks up, and 59 down. This is a very RED market and our CQNS Down picks would profit the short seller greatly. This is on a day when the indices are generally up. (time: 1:15pm ET) If you would like your own set of CQNS "DOWN" stocks before market open, please purchase the service via the button below.

|

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed