|

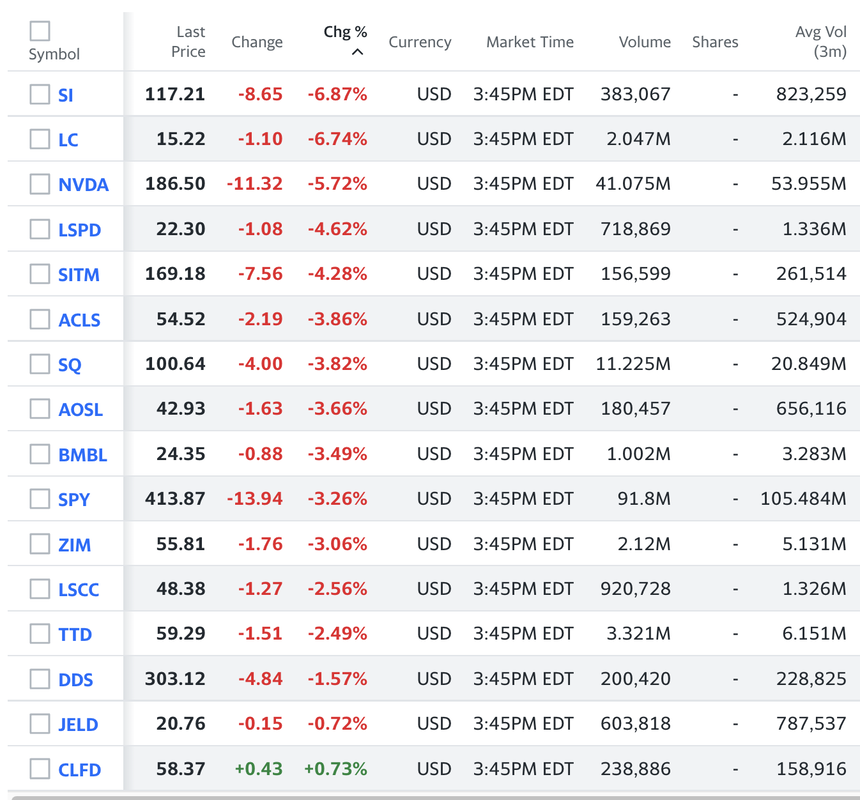

We made two videos to discuss the details. One pre-market where we share technical and quantitative things about the market. One tracked the last 30 minutes into the close and we thought was happening at the higher level. Enjoy. I think we found and shared some insights. How did our CQNS UP run do today? Pretty well. One up, the rest down and the median return was 3.55%, slightly higher than the $SPY (our benchmark) at -3.26%. Yesterday it outperformed the $SPY significantly during the trading day (it was an up day).

0 Comments

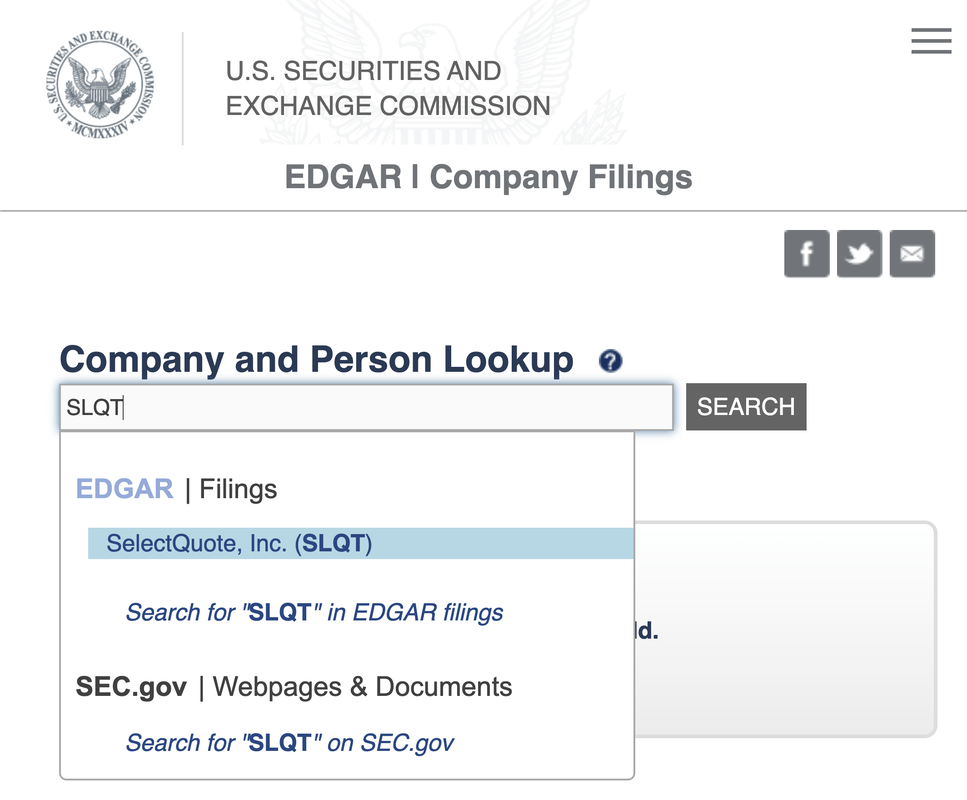

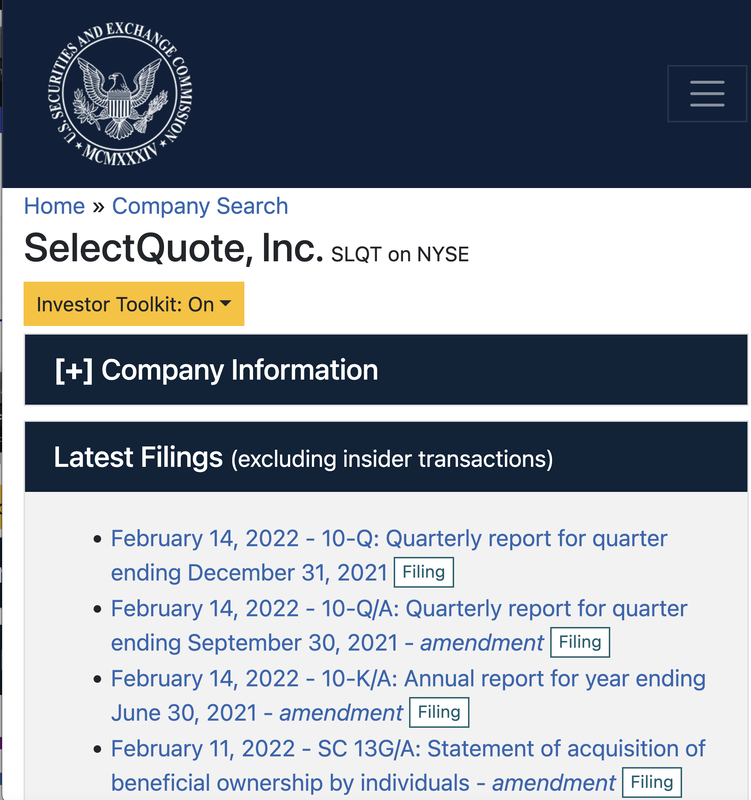

By Jeffrey Cohen, Investment Advisor Representative April 28, 2022 Stocks reflect company valuations & significant information. Companies report important info to the US Securities and Exchange Commission (SEC). Start here when looking to buy a stock. 4 easy steps: 1. Type "sec edgar search" in browser 2. Type ticker symbol into search bar 3. Select a filing (usually about 1 x month) 4. Read & think about it. Could create a spreadsheet to come back to. Years ago I read a quote by a younger Jim Cramer who said that picking and holding stocks is a full time job for professional investment analysts. He recommended spending 1 hour / week per stock you hold. This is one great way to spend that hour, along with browser web searches on their key products, jobs posted, and company information. We also suggest listening to earnings calls and reading earnings call transcripts.

For those, like us in the past, who don't have time for this, the best thing to do is to hold a passive fund that is widely diversified, like the S&P 500 Index ETF ($SPY). Recent Tweet:

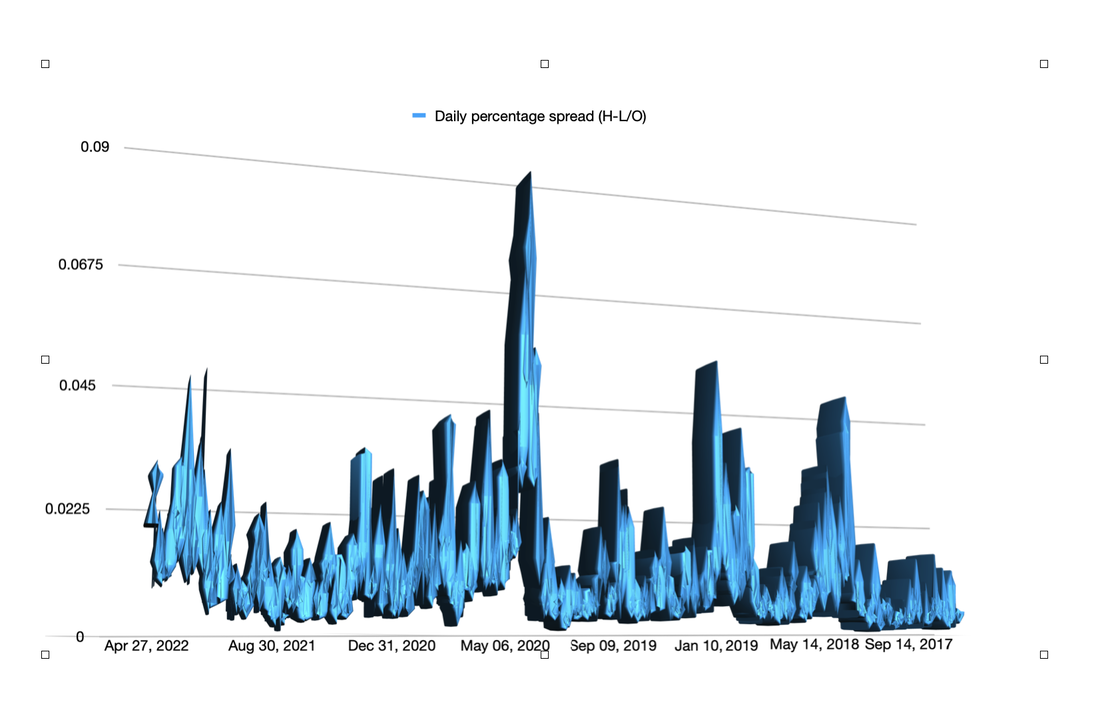

S&P 500 Daily Trading Range is up to levels that reflect market turbulence Definition: (High minus Low)/Open Causes: Liquidity is drying up Markets like turbulence News really is that interesting & unique every day Big bets in dark pools War & Politics This is not a good sign for the overall health of the market. Fear of missing out (FOMO) is not that expensive. It is ok to wait if/while the market falls further. As we have posted before, there are many stocks on sale today. These are stocks that are down 10% or 70% over the past year and you may be thinking that these are bargain basement purchases. They may be (we think we might like SLQT, doing DD), but likely these stocks will be cheaper in a week or two. By: Jeffrey Cohen, Investment Advisor Representative April 28, 2022 Yesterday we enhanced our code-base and added a few things to our model. It helped, and we found more insights. We also made a video pre-market. Rambled on about the markets including stocks, fixed income, and how we see the indices performing. Then, 20 minutes in we started sharing real content. We shared tickers, new ways to view stocks, and some very interesting things for traders and data analysts alike. Technical things... Hope you like the video, and will send out the white paper to our mailing list, and a few friends via US mail. If you are interested in becoming a client, our brochure is available for free and without logging in on our homepage. Good luck today to all, Jeff I may transcribe this. Good insights today from the model.

by Jeffrey Cohen, Investment Advisor Representative Ran our CQNS UP and DOWN runs KTA: Down run similar with a few new names. MEME stocks (high volatility) are out there. We see the same stocks maintaining their higher volatility status, with a few new names appearing. Swing trader's paradise for daily trading, with common or calls/puts. More diversification needed for long portfolios, and add QQQ names. More large technology companies making the list (showing tops or consolidation which reduces volatility). UP run maxed on the same 8-stock portfolio. It also found larger portfolios (3 to 42 stocks equally held). These portfolios have 6x the benefit of a fully diversified portfolio ($SPY, $QQQ or $IWM) in terms of risk-return. We ran the model for 8 hours and 15 minutes last night, and the results are clear ... find more stocks to smooth out daily price volatility. There are only 2 stocks that are individually better than the diversified market (this used to be ~25 when returns were higher). Indices score very well for long portfolios, unless you want to build your own 8 stock, or (3,42) stock portfolio. For those sizes, what we mean is that the model found 3, 4, 8, 8, 9, 10, 11, 12.....all the way to 42 stocks with roughly the same CQNS score). That score was 6x better than a fully diversified portfolio. ########### Yesterday was a crazy day in the markets. We had a reversal at about noon ET and markets turned higher. What that meant for Chicago Quantum readers and clients is that if you would have bought our 8-stock portfolio (or the larger 10-stock model) in the morning as the market fell, you would have done exceptionally well if you sold it at day's end. Return, less trading costs, would have been 6x higher than the SPY. This is the logic of the model, when the stock market goes up, these do even better. However, they do fall when the market falls. We have not looked at futures this morning. Good luck out there. The end of the day. US Equity markets were down with a small late-morning head-fake to make us think it was a repeat of Monday, but it never happened.

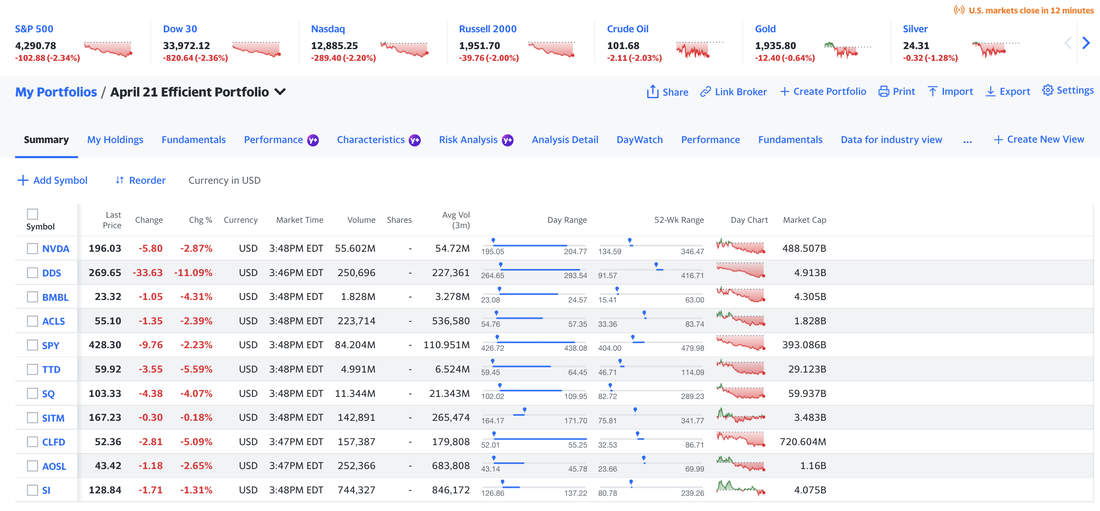

Our CQNS UP Run stocks were down (all but one) on low to moderate volume. We will run the model very deeply again tonight (we tuned the solvers again). We do not have any liquid investable capital today, so we cannot test these stocks. However, we keep watching the markets. They work when the markets go up. In defense of the picks, almost every sector we follow (with a buy list), was down today. Leptokurtic and low variance Current Efficient Portfolio (this one below) Chips and Semiconductors Specialty Retail & Furniture (Flexsteel was up, and we like that stock alot) Money Managers Trucking Crypto & Metals / Mining Cannabis We also have a long list of stonks (we call them shitcos - sorry), that are weak but potentially fast flyers when they turn around. in general, most stocks today were down. Our own personal portfolio is down 16% since we started looking at it again (about a month ago). It is down 3.45% today. This is not personally satisfying...but at least these stocks are a better value than they were a month ago. By Jeffrey Cohen, Investment Advisor Representative, April 25, 2022

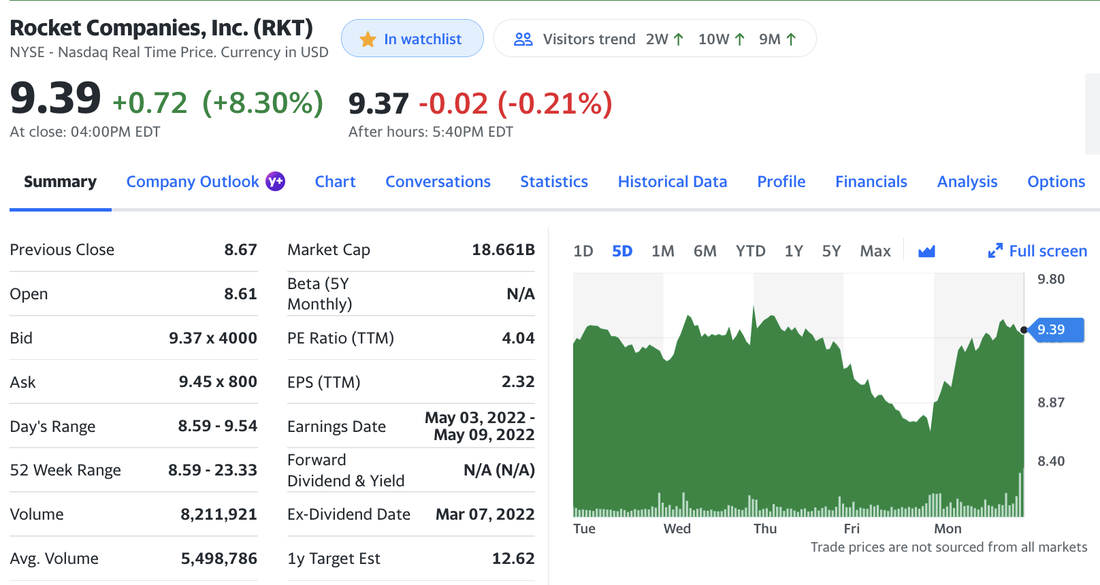

This morning the entire global financial market seemed to be flashing RED (meaning down). I tweeted this morning about a host of financial assets being down, including commodities, global equities and fixed income. The VIX, US Dollar and US Treasury yields were all up (bearish signs for equities). Almost every stock we track across sectors was lower this morning, including money managers, specialty retail, minerals and mining (including crypto), semiconductors, high-BETA and low variance stocks, the diversified indices, the stocks we think of as shitcos (high risk and speculative names), and others were all down, hard. Broad declines, and steep declines. The CQNS model forward looking returns hit the floor limit of 4%. This is because the S&P 500 Index ETF $SPY earned only 5% last year, while both the NASDAQ Composite $QQQ and Russell 2000 $IWM were down. Decided to work on our model today and take a long bike ride. First day exercising after COVID 19, and felt good to ride 12 miles, although it took ~90 minutes, and came back around 3:30pm ET to watch the close. To my surprise the markets were up, and key 'institutional investor' sectors were up strongly. Money Managers - up IT Services - up Shitcos - mixed Cannabis - mixed Minerals and Mining - down (but recovered ~ half) Crypto - up Personal Computers - mostly up Leptokurtic and low variance (down - people avoided these fairly riskless havens of income) Efficient portfolio (CQNS UP Run & individual efficient names) - UP strongly Chips and Semiconductors - UP significantly Specialty retail & high-end Furniture- up Discount retail - down Trucking - up This is a reversal of the recession fears of this morning. It happened at Noon ET today across the DOW, NASDAQ and S&P 500. Why the change? I think that the market had fallen enough to make the risk-reward trade-off attractive for institutional money. The high BETA stocks that will rise with the market (much faster and straighter), were bid up because at some point the S&P 500 will reverse. The specialty retailers pay healthy dividends and have strong earnings. Maybe next year will be down, but the return implied at current prices makes the trade more worthwhile. There also could have been short-covering and options bets being made as we have a full month until May expiration. As an example, I saw one of my personal holdings (a stock under $1.00), have 100,000 shares worth of calls purchased for $5,000, or $0.05/share, near market open. A nominal bet that could pay off well if this stock turns around. At the same time, the MEMErs called out to short this stock today, so we saw relentless pressure (at first with low volume), then a partial recovery at day's end. Even I thought of burning the shorts by buying their short shares this morning, but I already have enough exposure to this stock. I also thought of putting some money to work in those cheap, OTM options, since they were suddenly liquid. Institutional investors might have taken the other side of the short/RED stock sales this morning, which could explain the mid-day reversal. Our CQNS UP run stocks look to have returned about 5x the $SPY return today, so the 'smart money' in the market that wants exposure on the long / upside knew where to place their bets. This tells us that it was institutional investors or well informed accredited investors. Let's see what tomorrow brings. Thank you for reading our BLOG. For more information and to read our brochure* please visit our website at www.chicagoquantum.com. *(available at no charge and without logging in, from our homepage) PART 2 (UPDATED 17:44pm ET): Bitcoin (currently trading at 40,112 to 40,165) had a green day. This was another asset that was down sharply this morning and recovered. Speculative shape of the week. We see this, to varying degrees, across many speculative names at market close today. 5-day chart. $RKT is an example. Recession & rising interest rates destroy the fundamentals of their business (mortgage initiation). Friday and into Monday the story was pessimistic, including China's Beijing COVID 19 lockdown, but Monday afternoon this name fully recovered. It still makes us think about what macro force brought all these names back this afternoon (e.g., short-covering, long exposure into May). VALE and FCX and CLF are all solid. Business performance is strong. Financials are conservative and firm. CLF is up 50% on Q1 performance. VALE and FCX are down during the same time period.

However, the prices are falling despite strong underlying metals pricing. This is either a bet against a strengthening economy, or just profit taking. Not sure. Is this why valuations are down and dividend yields are up?We just did a quick analysis of 10+ specialty retailers in the apparel and general merchandise space, including sporting good and footware. Dividends are up, prices are down, and valuations are improving across the board. The only thing that makes sense to us is that the market expects revenues, profits and future cash flows to fall.

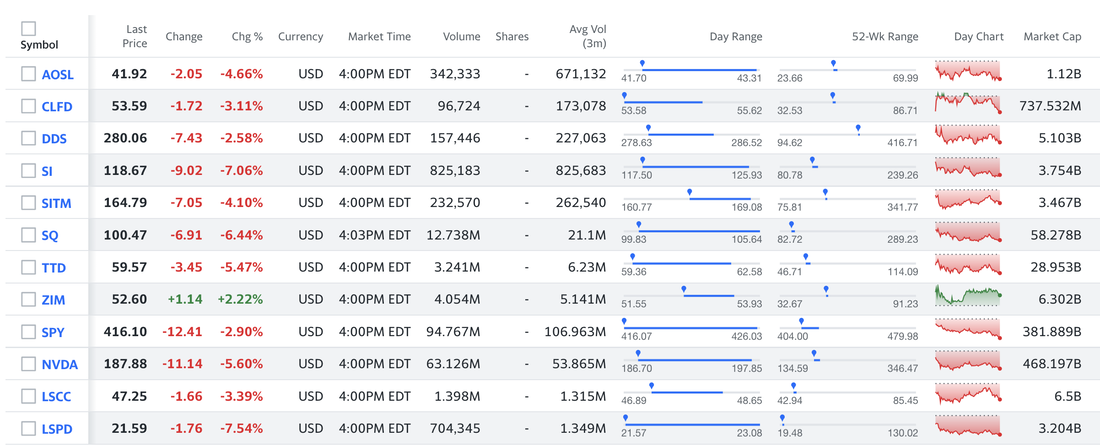

This is not limited to specific sectors in specialty retail, but across the board. This, combined with increasing valuations for the discount retail sector (think Walmart), shows the expected shift away from fashion and accessories to basic necessities. The top 6 and 10 stock portfolio fell along with the indices. Over time, these stocks should outperform the $SPY. The six stocks below the SPY entry make up the optimal portfolio. All 10 stocks, excluding SPY, make up the 6th best portfolio (out of over a quintillion possibilities). This snapshot was taken 12 minutes before market close, and assumes you would have bought all stocks at the market open price. These are the stocks to hold when the market rises, but are not as helpful when the overall market falls. If you like them, please leave a comment and subscribe to our youtube channel By: Jeffrey Cohen, Investment Advisor Representative Well, it's late and the run did not finish. We added back some extra solvers including the particle swarm optimizer, the simulated bifurcator, the 'fast' genetic algorithm, the gradient descent model, the D-Wave simulated annealer (not quantum), the TABU multi-start solver, and even our own custom coded simulated annealer. This model takes so many hours to run, and crunches the data so many ways, that we sure hope we find the best portfolio.

That portfolio will have just the right amount of zig and zag in the prices, so that the price variance of the overall portfolio is the lowest given the highest expected return of that evenly weighted portfolio. Put another way, it finds the portfolio with the lowest risk and the highest return that it can. We could run it faster, but when the market returns are so low (like they are now), risk matter more than return and it is very hard to find lower risk portfolios. That said...we will just keep on waiting and wake up early and share our results with you, our faithful readers. One more thing...there is a stock we like tonight. It is a retailer with management changes, a declining business forecast (due to recession fears no less), and assortment balancing problems. However, it is conservatively run, a great household name brand, a solid balance sheet, and a history of paying dividends and taking care of shareholders. It is an icon of the retail industry with deep roots and solid foundations. It will be a great addition to our 'long portfolio' when we buy some in the morning. Call me for the stock. I promise to tell you. Just did DD on it. If the price hits the right entry point, we will be in. Whether you buy a run or a service from us is up to you. However, you need to read our brochure first (or at least download it) before you buy. FINRA/SEC wanted me to tell you that. Just checked one more time...needs a little more time to run and crunch those portfolios. With 2,384 stocks with $100M equity market capitalization, positive net income, and liquid stocks that pass our stringent data validation process, there are many permutations to search. If I get my math right, it is on the order of 10 ^ 750 possible solutions (give or take a few trillion combinations). The next morning... The number crunching is done. A few insights appear. There are five leptokurtic stocks with low variance. These are familiar names to us, but are not necessarily stocks we can act on. ['AQN', 'HCIC', 'PNM', 'SLF', 'WMPN'] 5 The early solvers in our process found small portfolios. I think those are easiest to find by our solvers. After the runs are complete, the best portfolios range from 6 to 10 stocks, equally held. These are a combination of high BETA stocks and stocks in the technology space. Here are the 6 to 10 stock portfolios: -0.0009 ['AOSL', 'CLFD', 'SI', 'SITM', 'SQ', 'TTD'] 6 -0.0009 ['AOSL', 'CLFD', 'DDS', 'SI', 'SITM', 'SQ', 'TTD'] 7 -0.0009 ['AOSL', 'BMBL', 'CLFD', 'DDS', 'SI', 'SITM', 'SQ', 'TTD'] 8 -0.0008 ['AOSL', 'BMBL', 'CLFD', 'DDS', 'LC', 'SI', 'SITM', 'SQ', 'TTD'] 9 -0.0008 ['ACLS', 'AOSL', 'BMBL', 'CLFD', 'DDS', 'SI', 'SITM', 'SQ', 'TTD'] 9 -0.0008 ['ACLS', 'AOSL', 'BMBL', 'CLFD', 'DDS', 'NVDA', 'SI', 'SITM', 'SQ', 'TTD'] 10 We found 50% better solutions by letting our solvers run longer. Dividend stocks Only two stocks make the cut today because the indices score better today. The SPY (S&P 500 Index ETF) was the 13th most efficient individual stock. BX (Blackstone Inc) CG (The Carlysle Group) Good luck in the markets today. Office: 1.847.780.4401 Email: [email protected] Jeffrey Cohen, Investment Advisor Representative We ran our CQNS UP and DOWN runs tonight. DOWN run goes faster (less deep optimization required) so taking a break to share some results. If you bought this run, then you would be getting a management report with all the results and insights we could muster. The three major US equity indices we use in setting expected market returns (for next year) and doing very badly (ex. div). The S&P 500 has faltered. SPY is up 6.67% (respectable, but down from expectations). The Russell 2000 IWM fell off the truck, down 10.43%. I can tell you how this feels, because I hold three small cap stocks. They are down too. According to the DOW Theory, small caps do the worst in a downturn, or liquidity event, because people are worried about getting any money for their stocks. Large caps are the safest, especially those with earnings and operating cash flows. Growth stocks with no earnings, but large market caps, come next, then the small caps.

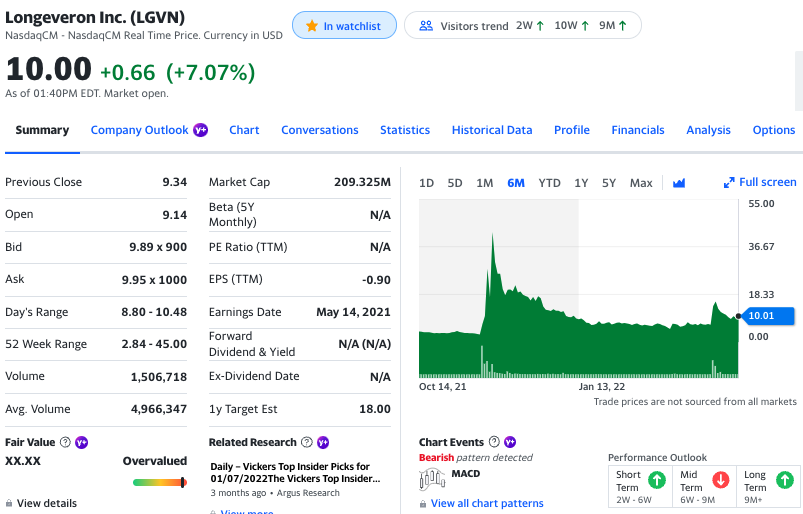

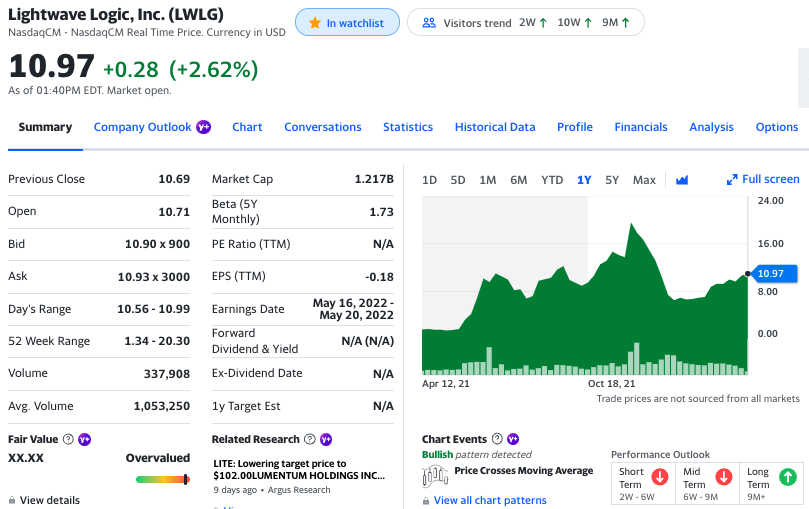

So, the NASDAQ Composite 100 is down 1.04% this past year. That is not good...as these are technology or growth stocks and this shows how little innovation is worth this past year. All in all, our market expected return is 4.56%. In a market like this, you either buy value stocks (you don't mind waiting since the price is so good), or you buy reduced volatility holdings. This way, you are more likely go get your 4.56% with less risk, and maybe an unexpected capital gain. At least you avoid the worst of the drawdowns by reducing your risk. The Variance of the SPY (or S&P 500 Equity Index ETF) is staying relatively constant at 9.14 x 10-5. It's returns are down, but still a relatively safe bet. We ran 11,176 tickers that traded in US equity markets (and were listed on those US exchanges) today. Out of those stocks, we found 1,126 dogs, stocks that are liquid, have at least $100M in equity market capitalization, pass all of our data validation, and lose money. So, these are the bottom of the pile, Money losing stocks have a higher level of price variance (more risky) by a factor of almost 3:1 to profitable companies. Their variance is 3.5 x 10-4. They do have a higher expected return. Personally, we own 2 money losing stocks that trade at absurdly low valuations (~0.6x book value and ~0.2x book value). if they turn around their business and have good news, their returns are expected to be explosive. However, if they don't make it, we likely lose all of our investment. We see the same dogs every day. This is a strange market for dogs. It is almost like stocks that trade aggressively higher and lower, without direction, stay that way for extended periods of time. One particular stock has no revenue, and likely never will. A few are down-trodden biotechs with bad news and little/no chance of a drug approval. Some seem to us like scams, where there are low floats, tight controls over shares, and the prices defy valuation. I have looked at most of these Top Dogs and would be happy to short or buy puts on most of them. Few can be borrowed, and the prices o the puts are very high. Lots of biotech, and a few MEMEs. Probably a few that should be on a compliance watch list. LWLG, AADI, ALLK, LGVN, PHUN, RGC, INDO, CRTX, PROG, CMPI are the ten CQNS DOWN picks. Leptokurtic and low variance list among CQNS DOWN stocks: ['CHNG', 'EARN', 'MIC', 'MLP', 'PPL', 'RCI'] These are the worst portfolios from a risk/return perspective found by our model: LWLG LWLG & ALLK LWLG & LGVN LWLG & RKLY Note: we may short LWLG or buy puts. However, in a feat of quantum entanglement, every time we think the stock is a little too high, it falls before we can move money and short it. I wonder if anyone else thinks LWLG is a swing stock that is made to ride, but not to hold? The puts are super expensive, so that makes it more challenging too. Six individual tickers scored better than the $SPY, $QQQ and $IWM: ACCD, MRVL, PI, MXL, MARA and FTCH. These are attractive risk-return trade-offs from the CQNS model's perspective. Net-Net: falling or flat markets are hard to play. Take your edges where you can. Good luck out there. Jeff If you want to chat during the market day, call the office at 1.847.780.4401, or email at [email protected] New clients welcome: money managers and institutional please I see swing traders are active today. I wonder at the audacity of buying stocks in worthless companies just because they are going up, selling them before they fall, then buying them back, in a continuous cycle.

Prediction #1: Inflation = energy prices Inflation will react to energy prices before monetary policy. Central banks have not tightened. Global leaders cannot increase energy production without political consequence. Prediction #2: Valuations in the 'select' industry sectors will improve due to bets on global recession (e.g., money managers, specialty retailers, chips and semiconductors) Observation #1: Inertia is a powerful force in business. This is why innovation, discipline and vision are so valuable. Belief #1: I could help turn around so many services businesses. I am ready to be helpful. Belief #2: Buy profitable companies that do one thing well when secular trends go against them and drive down their share prices (relatively speaking of course). Summary: It is time to make your stock buy wishlist. Valuations are improving. Negative secular trends + improving individual stock valuations + reduced price volatility + increased expected returns (BETA) = increased probability of investing success We are intrigued by our dividend stock picks...never built a dividend income stream before. LVGN RGN LWLG BBIG GGE FATH SGLY DDL BBAI TEAM We evaluated buying puts today on one of these stocks, but find them to be less than responsive to short-term changes in the underlying security. Therefore, you are not getting better 'bang for your put option buck' when the stock price rises. LVGN has very interesting SEC Edgar filings that we are reading. However, this is a tightly controlled stock and so it might not be 'free' to trade to its valuation. 3/4 of the shares are held by 3 shareholders (Class B common stock). More research to do. Also, they announced a shelf offering of $50M, and the price/date they picked was the one day it spiked. It seems so much easier to buy stocks that will/may increase in price. It is much more tricky to profit from trading in a stock that goes up and down frequently and dramatically. For now, we will not initiative a long position on these stocks until we continue/complete our DD.

There are 10 good dividend stocks to buy (we are waiting until the market drops further, but these are solid stocks today).

Four of them are highly efficient stocks (BX CG APAM QCOM) Six are down ~40% last year while still paying out dividends > $SPY. (FL RCII AEO FLXS GPS QRTEA) Those dividend stocks became quite popular yesterday, and rose dramatically while the $SPY rose. However, just following the simple criteria does not work (price drop and paid a high dividend). Some of those may be 'going out of business' stories as opposed to value stock buys. It requires due diligence into each stock you may buy or sell. All of these stocks have an Achilles heel and a story. Most will suffer in a market decline, a recession, and a continuation of 5.4% per month inflation in energy, warehousing and transportation services. We see a very low expected market return (under 6%), which means that reducing volatility and price variance is key to surviving and thriving in this market. Of course, this is much harder to do computationally, so we are tuning our models and running them deeper. The best portfolio to buy today...is equally a 4, 5, 6, 7, 8, 9 and 10 stock portfolio. It depends on whether you like a larger or smaller set of holdings. The CQNS scores are all the same (within our rounding error range). -0.0012 ['AOSL', 'SI', 'SITM', 'TTD'] 4 -0.0012 ['AOSL', 'SI', 'SITM', 'SQ', 'TTD'] 5 -0.0012 ['AOSL', 'SI', 'SITM', 'SQ', 'TTD', 'UPST'] 6 -0.0012 ['AOSL', 'DDS', 'SI', 'SITM', 'SQ', 'TTD', 'UPST'] 7 -0.0012 ['AOSL', 'CLFD', 'DDS', 'SI', 'SITM', 'SQ', 'TTD', 'UPST'] 8 -0.0012 ['AOSL', 'DDS', 'LSPD', 'SI', 'SITM', 'SQ', 'TTD', 'UPST'] 8 -0.0012 ['AOSL', 'CLFD', 'DDS', 'LSPD', 'SI', 'SITM', 'SQ', 'TTD', 'UPST'] 9 -0.0012 ['AOSL', 'CLFD', 'DDS', 'LSCC', 'LSPD', 'SI', 'SITM', 'SQ', 'TTD', 'UPST'] 10 Finally, as the market expected return falls, the advantage that individual stocks have over the $SPY or $QQQ or $IWM falls. For most investors that do not follow the markets and want a safe and low risk way forward, just buy the indices. Our models are for those who want to work through the risk and return math and find those alpha / edges in the market. In conclusion, why trade with us? Why trade with us? We do the homework. We run the models. We analyze the markets to help you make better trading decisions. We find the insights, and we do deep proprietary due diligence on companies before you invest. Jeffrey Cohen Investment Advisor Representative +1.312.515.7333 (cell) We have a highly liquid tech stock showing up with an adjusted close price of 'blank' or 'null' and that just isn't right. Sure, the markets have been RED, and $QQQ is down, but no price at all at market close is ridiculous.

We are working with our code to allow for this exception to flow through our model (and print an exception report), while our market data services provider works with their data suppliers to put things right. In the meantime, may we suggest some calming music or some herbal tea while everyone else makes money in the stock market? Found 6 stocks that are down this year, pay dividends, and pass initial valuation due diligence4/12/2022 By Jeffrey Cohen, April 12, 2022, President and Investment Advisor Representative Today we did a special analysis. Find all dividend paying stocks that paid more than the $SPY (1.32%) last year. Then, look at those stocks that declined significantly in share price over that same timeframe. These dividend paying stocks are down 35% to 65%. Then, we do initial stock valuation due diligence by reading the 10-K for each firm. Out of 12 stocks we like 6, and are putting them on a dividend purchase watch list. (see image below) The work isn't done yet. We need to set a buy price for each of these while monitoring the macro-economic factors that are impacting these stocks. Retailers: Most are retailers and they are impacted by recession fears. CPI should help them if they can pass along price increases, or find and sell lighter and more local merchandise. Optimizing shipping is important. Labor costs and supply are another driver of performance (product does not often sell itself). Supply chain costs hurt them too. Furniture: Two are in the furniture trade. These are impacted by supply chain and materials costs. Of course, economic activity and moves help them, and with increases in mortgage interest rates or fears of recession (and fewer moves), activity could slow. In one case, an acquisition was made that increased debt, and that debt is variable. Variable debt In most of these cases, the companies are financing their acquisitions or growth by borrowing money that has a variable interest rate (e.g., LIBOR + 3%). In this situation, as the US Federal Reserve raises interest rates, it will increase their interest costs. Firms that can pay down debt will do so, while others will see their Net Incomes, and ability to pay dividends, decline. At the end of the day, we are building a set of efficient dividend paying stocks (mostly in the money management business) with one technology growth stock, and now we see 'downtrodden' retailers and furniture companies.

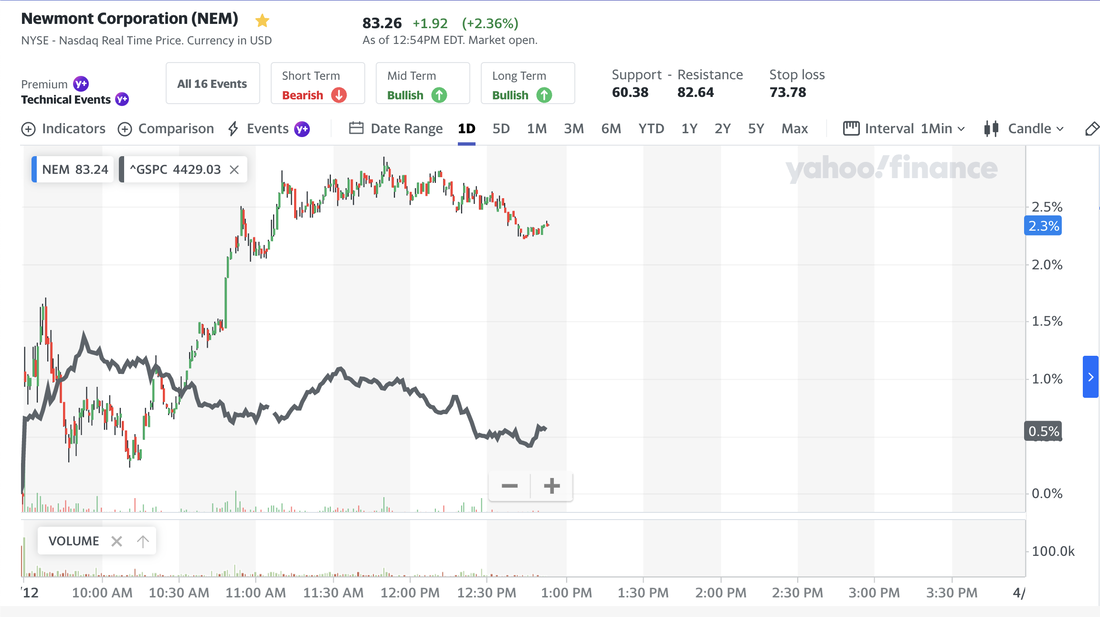

Once we see some 'blood in the streets' we will start to buy dividend names and build an income stream. Both for ourselves and with our clients. Newmont Mining $NEM is acting the part as a hedge against the S&P 500 Index ETF, up to a point. Check out the chart. Since 11am ET, this starting tracking the rise in the S&P 500. Cool criss-cross pattern. $SGLY up 17%

$OP up 16% $IMPP up 14% $FATH up 11% $LGVN up 7% $LWLG up 6% as of 12:57pm ET on April 12. One up day in the market and the dogs start to howl. We don't like these dogstar stocks. Our model ran all night (about 8 hours) but did not find a very deep mathematical answer. Flat markets (4.87% ER) => harder to pick stocks. Best portfolio is 5 stocks, evenly held. More negative BETA stocks Gold & USD hedges: $NEM $AAAU $GOLD $UUP - US Equity futures slightly green

- Forward-looking CQNS model annual expected return: 4.87% - Crypto staged a healthy evening recovery - UST yields & ^VIX unchanged Our quant model worked overtime, found a shallow mathematical equilibrium (need QC again). Actually, we really do need to 'dust off' our quantum computing model, our particle swarm optimization model, our simulated bifurcator, and even our greedy solver (steepest gradient descent) since we did not need them to find very deep mathematical equilibrium. When the market has shallow expected returns, the model has to find the best variance-reducing solutions. That takes 'real' computational and solving horsepower. That takes quantum computing from D-Wave Systems. The S&P 500 will stop falling after it starts falling, but it has not started falling yet. It's flat since 08/16/2021. Over the past year (all ex. div): $IWM -10.1% $QQQ +4.2% $SPY +9.8% We seek top dividend & high BETA stocks to buy at the bottom. $MARA put options already pricing in the March 31, 2022 termination of their Hardin, MT data center contract in favor of 'clean energy alternatives.' ATM puts, one month, cost > 10% Tech Blue-Light Specials $NVDA, $AMD, $MSFT, $TSLA, $COP, $XOM, $OXY all on sale today. In fact, this morning every large cap stock in the S&P 500 was down. Even BRK.B. @chicago_quantum Companies with negative net income have a greater risk / reward payoff than companies with positive net income (at least over the past 252 trading days) The top dividend stocks we called for today, and the CQNS UP stock picks we called for today, are almost all down. Many of our CQNS DOWN stocks we picked are down too. Most stocks are down today, along with most US equity indices. I find this very distracting. However, I think I found a few MEME stocks with anomalous behavior that could pop either up or down. Been in SEC EDGAR Search all day looking up filings on stocks. $FATH: DD underway. This is a SPAC. Listened to the earnings call and read the 10-K. Looked at the options prices (PUTs much more expensive than calls). Looks like Q4 Net Income is positive due to reduced earn-out (seems strange, right)? Majority ownership and voting rights are held by one entity, so it does not matter what shareholders think while this persists. And more...

I cannot yet tell whether this is another $ATIP. It might be. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed