Someone or a group are trading ToughBuilt Industries stock $TBLT like it is their personal ATM2/29/2024 Good evening, it is Jeffrey Cohen, President of US Advanced Computing Infrastructure, Inc., an Illinois registered investment advisory firm.

UPDATE: In the last 7.5 minutes of trading, about 7,000 shares were purchased for around $3.90 per share, +/- $0.05. It started at 15:52:30, and it took the price up ~ $0.08. We we see few trades on the smaller exchanges, most/ all of these we see are on the NASDAQ exchange. We do not see the off exchange, black markets or dark pools, where more could have been traded. The last trade was a 100 share round lot sale, that took the price down by $0.05, so we never saw the run-up into the close unless we really looked closely. So, this isn't a 'short squeeze' player, it is someone ready to ride the stock higher in the morning, then dump hard. If you buy for a quick profit, take your profits fast. If you are looking to buy, maybe wait for the 7,000 share dump, then take advantage of that moment to acquire and ride it higher. With a $4.00 stock, it doesn't take a millionaire to move this stock, just about $40,000 and guts. ORIGINAL ARTICLE: We noticed today that in the morning, the stock was run up in pre-market, then in the morning session. It was taken from 3.70ish on Wednesday, to open at $3.89, then traded to $4.25. It was exciting to watch, especially because we own shares. At around $4.20, we started thinking "this isn't too bad, maybe we should buy a few shares" but we knew the drill before it started. While we were finishing our second cup of coffee at Starbucks, the stock started to fall. It fell to $3.60, or down $0.65 from the peak of the morning. The stops were hit, and selling continued. The margin calls and fear kicked in. The stock was in a rout. Then, a little daylight appeared and the stock recovered to $3.85, with a $0.15 spread, so it was tough to trade on low, late morning and afternoon volume. So, it closed right around $3.85, and we are ready for Friday. But, what did we see? Why write the blog post? 1. Social media on the stock turned decidedly positive. We saw calls for $5, $10 and even $20 on the normal chat boards. This is a stock that has been left for dead for weeks, and suddenly, the pumpers were pumping. I should probably write those account names down. They were right on target, right on queue, pumping the stock over $4.00 and watching it fall to $3.60. 2. This is an illiquid stock. We know this, and recently posted it to the Yahoo Finance chat board. Someone, or a few traders, were trading in large blocks today. 5,000 shares and 10,000 shares were bought or sold, then slowly the reverse action takes place to refill the position. The issue is that once the selling kicks in, there really isn't anybody excited about the stock (not that we see), so once they sell to fill the buy orders, the thing just free-falls. Then, a few sell orders are put in at the lower price, and the buy orders get lower, and the fall continues. Note to self, when we see market open accumulation, we can expect those shares to be dumped in one order, or in a few seconds, to tank the stock, then accumulation continues at the lower price. Part of our strategy on this stock is to buy and hold. However, our other strategy (which we are not pursuing) would be to watch the action, and trade against it. If somebody sells 10,000 shares and the price drops, buy 10,000 shares at the lower price, and sell them back to them. This would only work if they went short the shares, which they do not seem to be doing. In this case, they would have bought 10k shares, sold 10k shares, then we buy the 10k shares, then they wait. Maybe they accumulate, or maybe they do short 10k shares, putting our new position deep into the red. This is a hair-raising stock to watch on a minute-by-minute basis, because it is so illiquid. 3. The volume shifts on this stock are massive. We accumulated this stock when each day maybe 3,000 or 5,000 shares traded, and we bought half those shares ourselves. We also saw 'big days' with 15,000 shares traded, or even, gasp, 40,000 shares in volume. Today, over 500,000 shares traded in the morning. This is a stock with only 700,000 shares outstanding, and Jeffrey Eaton owns 70k of them. So, what will Friday bring for ToughBuilt Industries Common Stock $TBLT? We don't know, but we expect the same volatility, the same rise and fall as today. We will be watching, but not likely to trade it. Good luck. This is not investment advice...just someone watching from the sidelines. We are amazingly bullish on this stock and company in the medium to long-term. We are long the common.

0 Comments

By: Jeffrey Cohen, US Advanced Computing Infrastructure, Inc. www.chicagoquantum.com February 27, 2024 We read the Lowe's earnings documents and listened to the Lowe's earnings call live this morning. Here are our top takeaways:

They are focused on: WINNING SPRING Comparable same sales weakness accelerated from November through January: -4.8% Nov, 2023 -6.6%. Dec 2023 -7.4% Jan, 2024 For 2023, tools had comps above product average, but not in Q4 2023. The larger the ticket (100, 100-500, 500+) the worst the comp. -4.5% <$100 -7.2% [100,500] -8.8% > $500 1. Sales are down almost $4B, but ~$2.5B came from the Canadian divestiture, and one less selling week vs. 2023 2. Comps down 6.2% based on 6.1% fewer transactions and 0.1% smaller transaction size. 3. Customer satisfaction scores up 200 basis points (2%) and in some cases 25% 4. Perpetual Productivity Improvement PPI looks to repeat the $400M in savings next wear. They are focused on improving sales productivity in the store, not in building new stores. 5. Lowe's stated that January weakness was weather related, and demand related, but mostly weather related. 6. The larger the transaction, the worse the comps. DIY is focusing on smaller, non-discretionary projects (think repairs). They are preferring to spend on services and experiences. 7. Housing sales are down massively, and likely to continue until mortgage rates decline again. Until then, may not see as many large DIY and PRO projects. Disposable income, housing sales, housing price appreciation, and the age of housing drives DIY and PRO housing improvement project spend. 8. No idea when home improvement spend will increase, we are not yet at a bottom and we are not calling a recovery, a trough, or anything. Maybe H1 2024 is the trough, and H2 2024 is the recovery? Lowe's is positioned to thrive under any demand scenario. We think, maybe H2 2024 will see a turn-around, but we are not betting on it. 9. Their rural product lineup into clothes, pets and automotive is doing great, and as they learn more they may roll it out into some non-rural locations. 10. The investments in omni-channel, with better delivery options, and text-based customer service, and appliance full-service, and logistics, supply chain and fulfillment innovation, and inventory stocking, will see them continue to gain share and grow profitability. At the end of the day, Lowe's returned more cash to shareholders through dividends and share buy-backs than they generated. They have a 2.3x debt to EBITDA ratio, and likely grew their debt leverage to return all that cash. Interesting choice...they are not seeing nor planning for a recession by not building a cash hoard (IMO, implication we take away). They celebrated the return of Klein tools into their stores for electricians. Did well in hand tools and stackable tool storage. Record sales. What does this mean for ToughBuilt Industries $TBLT?

- Tools & Accessories is a good area, with above average YoY comparables. However, this sector is waiting for either a PRO recovery (not yet, Lowe's PRO surveys suggest stability), or it is looking for an increase in larger DIY project spend, especially in discretionary projects. Until the secular housing market recovery, this is a fight for tools share (in a declining market) based on innovation, value, consumer choice, product quality (and safety) and aggressive, global product distribution. - We are interested to see how Lowe's restocks their tools and accessories for Spring, starting in March 2024. We would like to see if they grow their display for Stack Tech TM mobile storage solutions including the new product SKUs introduced in Q4 and Q1 2024. We will be looking for restocks on saw horses, modular work tables, mitre saw tables, levels, knives, tape measures, screw drivers, hammers, hand saws, wrenches, pliers, clamps, belts, tool pouches, knee pads, rolling tool bags, tool bags, tool totes, other soft goods and electrical products. - If we see a large influx of ToughBuilt products for the Spring and Summer selling season, it will support management's narrative of a positive CFFO in Q3 2024. Fingers crossed for a strong ToughBuilt 2024. On February 19, 2024, the US and Philippines performed joint air patrols in the West Philippine Sea, according to the Chinese Communist Party and state-run media outlets. The US brought out its Stratofortress B-52H and the Philippines brought out their FA-50 fighters (three in total). Source 1 Source 2 In another interesting update, the Philippines will possibly grant access to military facilities in the Batanes Province, which is the northern tip of the Philippines. According to Wikipedia, the Province of Batanes is in the northernmost province in the Philippines, and is about 101 miles North of the Luzon mainland. This is a mountainous and hilly set of islands, but the main island of Batan is more level.

Source: Asia Times Basing would be under the Enhanced Defense Cooperation Agreement (EDCA) and a similar agree with Japan. The military base is close to Taiwan, just across the Bashi Channel. Location: 20°35′N 121°54′E. No satellite imagery captured at this time. Wikipedia article Good morning, been catching up on the overall home improvement market that is relevant for consumer spending around the home.

What we heard today:

On the other hand, medium and long-term factors are positive.

Some unique points:

Walmart saw strong growth in the value-conscious consumer in Q4, 2023. What does this mean for ToughBuilt Industries $TBLT in our opinion? Overall: the industry recovery is still ahead of us, so ToughBuilt needs to play offence and defence.

Disclosure: we are long ToughBuilt Industries Common Shares. Updated Feb 27, 2024:

I was shopping today for tools and accessories, and I noticed that Walmart still is not stocking ToughBuilt in the stores, but carries many SKUs online. The Mutual Ace Hardware near me is only stocking the utility knife/scraper in-store, but the rural Ace Hardware in Zion, Illinois, near the Wisconsin border, has a significant soft goods selection (~40 product SKUs). I was surprised to see two sellers on eBay with many listings of ToughBuilt products, and each one has dozens to hundreds of units for sale from ToughBuilt. They are all in new condition. They sell for reasonable market prices. It made me wonder where they get their merchandise from. Are they a reseller community that is being stocked with merchandise? Are they grey market or black market? Do they take an order and buy from somewhere else and hope for a reseller markup? Today, I asked them. Did a 'contact seller' message. One seller responded the next day and told us their products came from the manufacturer, they have inventory in stock, and that manufacturer warranties would be honored. This is interesting because it means ToughBuilt is lining up resellers for their products in the eCommerce space outside normal channels. This should grow revenues and distribution, helping them achieve scale (albeit at small scale). It is interesting how challenging it can be for an innovative, hard and soft goods designer and manufacturer to grow their distribution channel, and how no stone can remain unturned to reach potential customers. Of course, the largest channels, like Lowe's and Amazon, will require the most care but it will take global distribution, both in-store and on-line, to achieve the kind of revenue required to achieve minimum profitable scale. We went for a quick shopping trip to Lowe's in Lincolnwood, Chicago to visit the tools area.

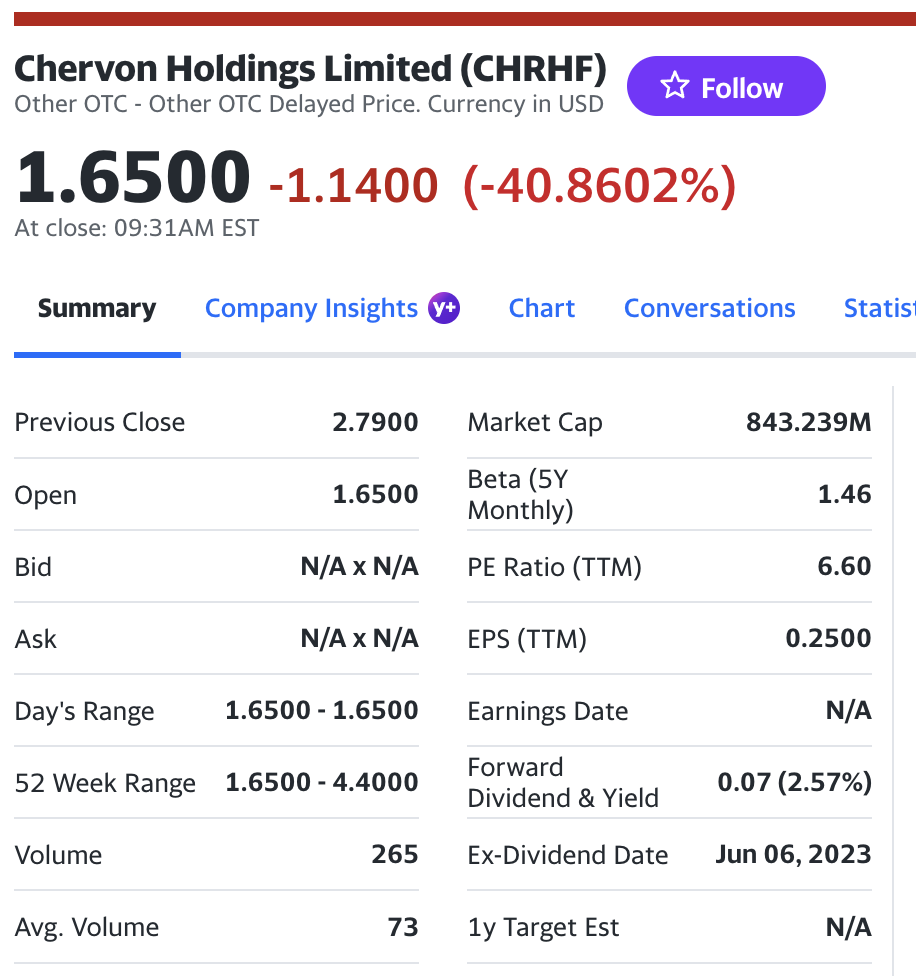

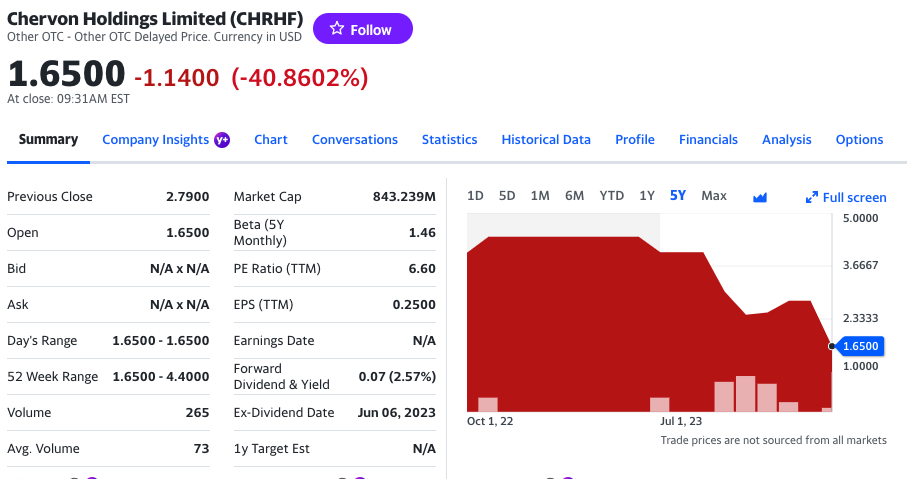

This is the store with the cardboard display of ToughBuilt hammers on sale, and a full stock of tools and accessories from ToughBuilt. This trip the tools section was underwhelming. There were fewer ToughBuilt items on the shelf, as many had been cleared out on clearance, and others were sitting, waiting to be sold at an already lower price. The knee pad display of four SKUs was a little under-stocked, and had a glove in the box atop knee pads. The screwdrivers and knives took up a good amount of display area, but had many yellow 'clearance' stickers. I do not recall seeing any ToughBuilt levels, tape measures, or larger items like saw horses, tables or mitre saw tables. There was (the same) one whole room 360 degree level at the same marked down price of $399 from $499. There were a few things that were full price and stocked: Phase 1 of StackTeck mobile storage. It was a full display, at full price, but we didn't see many of the phase 2 items. Saws Hammers ClipTech fasteners and pouches Massive Mouth tool totes and rolling tool bags (with a new DeWalt competitive bag priced $20 higher) Competitive Notes: 1. DeWalt bags to match up with ToughBuilt were new in this store. They were nearby the ToughBuilt display. 2. Flex was moved away from StackTech, and Craftsman red boxes were closer. Those are significantly cheaper (say 50%) and so that is the consumer choice. Flex is moved aside, but was still full price. 3. Nobody had really added stock to their displays. The place looked a little under-stocked. 4. Saw horses are still an issue, and we saw maybe 4 BORA competitive metal saw horses, as well as a bunch of cheaper plastic ones. This was not a very reassuring trip. We hope that we will see a new set of ToughBuilt products soon. Jeffrey Cohen President, US Advanced Computing Infrastructure, Inc. We are long the common stock. The Tools & Accessories sector is showing real weakness. One of the stocks we follow, Chervon Holdings Limited (out of China, listed on OTC in the US) was down 41% today. We looked and could have bought a few shares today, it was a bona-fide bid ask spread of only about 10 cents. This firm is a substantial, but smaller market cap competitor to ToughBuilt. It is worth looking into for due diligence, and it reflects on the weakness across the tools sector. $CHRHF is the ticker, listed on Other OTC. It looks like it went public on October 1, 2022 for $4.00 per share, and has barely traded until later in 2023. We will do a little more homework on this stock.

It is still too big for ToughBuilt to consider acquiring, but it would give them a strong manufacturing base in Asia. $TBLT S-1A - Amended S1 filed: New price is $6.44 and the number of shares is 776,398 and an equal number of Series F Common Warrants (each for 1 share).

That $4.2M will be enough to fund 6-months of capital needs. Let's see if we can capture the essence of it:

How we met: We took a long position in another stock, were introduced to Shrimpey, and he asked me today about this stock and why I think the business could turn around. My Key Take-Away (KTA): Focused business improvements on both the cost and revenue side put ToughBuilt on the path to near-term positive cash flow and longer-term profitability. However, there is no guarantee of success and there is significant risk on that path. Positive cash flows and positive EBIT will boost their equity valuations. We await Q4 earnings for increased visibility. Jeff: We are long $TBLT common stock Shrimpey: How do you possibly see a turnaround there? Jeff: In super broad strokes, the whole tools sector is soft. $SWK $TTNDY $SNA $CHRHF etc. They are cutting SG&A and COGS, I see evidence from 2023. Brand new Q4/Q1 new products are amazing. I see growing global distribution. A steep climb to profitability. Jeff (2): I equated it to buying oil E&P firms with good acreage when the price of oil was down. I am betting on a secular (housing and construction) recovery AND this company does better. Shrimpey: Okay, but what is going to stop that insane cash burn? Jeff: They are improving their cash cycle & inventory turns. They had a negative four million dollar cash flow from operations (9 months through Sept 30 2023). In theory, increased revenue in Q4 and Q1 could cover that. They only have ~$1M in debt. New revenue comes from new products and increased global distribution. Shrimpey: That's good, but only temporary. Shrimpey: Okay, but what is going to stop that insane cash burn? Jeff: I also model out what a break-even EBIT looks like for Q4. Shrimpey: Seems like alot to make up for, with -$9m in EBITDA and only $5m in gross profit. That is alot to catch up to. When do you think that they will break even? Jeff: I don't know. I am waiting for Q4 results as there are too many moving parts right now. Shrimpey (2): I saw you noted something about a restructuring, but are there any real numbers around that? Jeff: There are real estate savings, 20 job cuts & a shift from China to Vietnam and India for a portion of imports. We follow a set of tool makers and these stocks have not been doing well during this earnings season. The whole industry is showing weakness, a secular decline driven by housing and commercial construction weakness.

Snap-On had a really bad week, as this stock recently was trading close to $300 (as in this week). We saw Techtronic Industries lower for days at a stretch, and it may not be because of the publicity issue. Stanley Black & Decker had a rally, but it pulled back. Chervon...same story. So, where are we? We are optimistic that patience will pay off in this sector and we are long. We might not see real secular improvement until the construction and residential markets pick up. By Jeffrey Cohen

President, US Advanced Computing Infrastructure, Inc. Q: What do you need to see to cut rates? A: More good data. We are confident that inflation is coming down. More good data. Q: Nick Timeros, WSJ, what does 6 weeks or 3 months buy you? Why wait? A: Growth strong. And labor market strong. Really confident that inflation is at or below 2%. Median participant wrote down 3 rate cuts this year. We need some confirmation, sustainably to 2%. Gaining confidence. Sliding employment would also allow for cuts in interest rates. Cutting sooner if there was weakness in labor market conditions. Q: What about if we see stronger economic growth? A: Solid economic growth is welcome, desired, and as long as this is here, we don’t need to cut. Nobody (the voting members of the FOMC) wanted to cut rates. They were not considering a rate cut. Q: Are you looking at economic data like OpenTable reservations or indicators of activity? Which ones? A: It’s not the pandemic. People are working and are earning wages, so we can look at traditional data. We don’t need ‘innovative’ data. Q: Are interest rates restricting the economy? A: Supply side is growing quickly. More activity is driven by labor market healing and supply chain healing. When this peters out, you will see more restriction. In other words, we are not seeing interest rates being very restrictive. Overall, we are in a good position. The economy is doing ok. March is not the base case for cuts. My Thoughts at that time: Equity market is down at 3pm ET, maybe not such a good meeting. Q: What about balance sheet run-off? Changes to the balance sheet of the Fed? A: March meeting, that's the balance sheet meeting. They will look at that independent tool of runoff. Should they? It could happen that rates decline, but runoff stays or vice versa. Q: If not in March, when would we know? How many months? A: We have growing confidence on inflation. It is a very important decision to start cutting rates, it is consequential, and they want to get the job done right. Q: Change gears. Your name comes up, and what about a third term as Fed Chair? A: I am focused on doing my job, and this year is a very consequential year. Buckled down to do our jobs. ToughBuilt Industries Inc. $TBLT Company Analysis

We will be updating this webpage frequently with new information. If you have feedback, please let us know here in the comment section below. Jeffrey Cohen, US Advanced Computing Infrastructure, Inc.

We see interest rates rising in an aggressive and significant matter. We follow the US Treasury 10-year note, which is up to just under 4.16%, and the 30-year is over 4.33%. Interest rates rising has a few direct impacts (e.g., more expensive loans on consumer and business credit, secured loans, asset based lending), so business will slow. Mortgage rates will likely rise 100% with the 10-year UST Notes. The indirect impact is that the US Treasury will pay more to roll over its trillions of dollars in debt. However, on the flip side they will pay less if they want to buy back debt in open market transactions, and then the loss moves to banks, pension plans, and longer-term investors. What we see is home improvement, materials, and tools & accessories stocks are down. Check out $XLB. Momentum stocks are down sharply, these are your best 'sharpe ratio' stocks, which are falling with the overall US equity market. For an example, look at $TSLA. This is an equity decline and we are watching it happen. It is difficult to watch. Our recommendation is to look at longer-term debt (as a buyer) as we could see 5% yields on the US 10-year. That is an absolute buy point for us, unless things change. Boston Consulting Group BCG article that discusses our work. It’s Time for Financial Institutions to Place Their Quantum Bets OCTOBER 16, 2020 By Jean-François Bobier, Jean-Michel Binefa, Matt Langione, and Amit Kumar https://www.bcg.com/publications/2020/how-financial-institutions-can-utilize-quantum-computing Here is the link again, in a button format.

|

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed