|

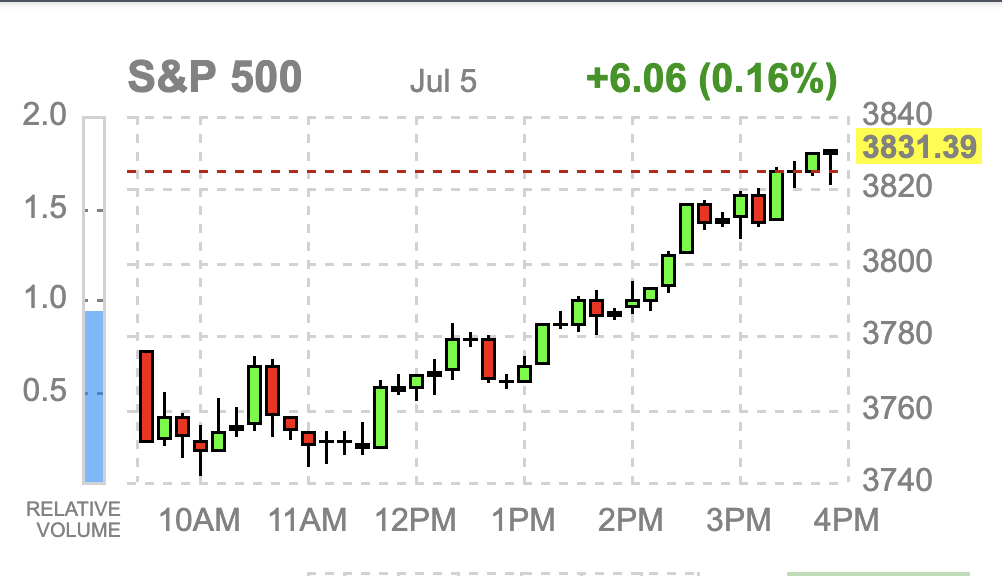

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Chicago Quantum July 29, 2022 Our first video is about the GDP advanced read by the Bureau of Economic Statistics. It confirms that the US economy looks pretty good, but is shrinking on a real basis (accounting for inflation). Things are moving, like that jogger on a treadmill at the health club in winter, but not fast enough to go anywhere. This is why we feel busy, and jobs look good, but we are not creating any lasting growth. I worry about this all the time, as the wealth of the country's poorest is going to pay for fuel, heat, rent and food. Earnings are up a little, but savings are up 3x more than income growth. People are nervous and saving their money. Rainy day funds...for those who can afford it. In our video we outline the story. We also explored the action of the stock market. Net-Net this is not a market acting like we are in a recession, nor is it acting like a period of rising interest rates. This is an enthusiastic market in an upswing, with strengthening market breadth. We are as surprised as anyone to see this. We discuss the details in our video. Point after point show the market rising in the face of bad news. Amazon has a bad quarter, and the stock is up double digits after hours and pre-market. US Federal Government passes a law to help semiconductor companies, and the established player stocks all drop. OK, that is normal...our government is picking winners and losers with our tax dollars and it upsets the natural order of things. Pre-market moves across economically sensitive industries is pretty mixed. Finally, our model shows price volatility to be flattening out this week. It is elevated, significantly, but the growth has stopped for now. The stocks picked by our CQNS UP run are consumer discretionary, food and beverage, and insurance brokers. The B2B industrial stocks and of course, Berkshire Hathaway B-class shares. A few weeks ago they were picking the NASDAQ large cap darlings like Apple, Microsoft, Google, and others. Those have now run up very quickly, blown out their volatility bubbles, and are back down on the list again. The model is now saying that consumer staples are the group that is consolidating and could either stay flat, or recover. GLTA!

0 Comments

By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure Inc. An Illinois Investment Advisor July 28 pre-market analysis

Equities

VIX

Global equities up too. US Fixed Income

Commodities

US Dollar

Europe

Money Managers

Market Breadth

Physical Miners

Crypto

US Banks

COVID

By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure Inc. Today we covered a great many topics while we wait for the FOMC release at 2pm ET. One important topic was to repeat an answer to a question posed by a potential retail investor client. Myron is his name, and he asked: "Can I get some good tips for free? What should a little guy like me invest in?" By way of background, Myron was on a job interview and had some investments he made this year in stocks. He did not remember all the tickers, did not know what the companies did, and did double his money on one trade, but not sure about the others. He bought them on a whim. For a retail investor with limited capital, what I suggest is to take money that you can afford to put to work for five years. Money you won't need for five years for living expenses. In Myron's case, that was $25,000. For the first $10,000 (he is a US citizen), I suggest going to Treasury.gov, or Treasury Direct, and buying I-Series US Savings Bonds directly from the US Treasury. You can lock in a 9.62% interest rate for the first six months. They promise to pay a little 'real' interest after making up for inflation. This is awesome for investors, and there are even some potential tax benefits. We recommend the first $10,000 go into I-Series US Savings Bonds. The next $15,000 goes into a low cost, passive, index equity mutual fund. We like the ones that track the S&P 500 Index although it is 100% ok if you want to put some into a passive index equity mutual fund that mirrors the Nasdaq Composite 100 (although there is significant overlap), and some into the Russell 2000 (small caps). The S&P 500 is our favorite, and provides the best risk-return tradeoff for a retail investor that cannot do the due diligence or run the quantitative models required to find an edge. The fund manager we use personally is Vanguard and have invested in their S&P 500 Admiral Class index fund since the 1990s. Fidelity also has a low-cost fund that should be fine. Also, we are setting up a relationship with The Charles Schwab to be our custodian for client funds. It is likely they have a comparable product as well. The key is to find a very low cost mutual fund (maybe pay 6 or 9 basis points per year in expenses) and to reinvest dividends. In year two, rinse and repeat. Put another $10k into US Savings Bonds and another $15k into US equities and watch your money grow. As your retirement nest-egg grows, and your income grows, there are other types of investments to consider. Hope that helps. This is Jeffrey Cohen. Please click on our youtube video and hear the discussion for yourself. Also, if you like the video, please subscribe to our YouTube channel. It helps spread the word! Oh, and watch out for today's FOMC announcement. We are very surprised that the stock market was set to rise early this morning (hours before market open), bonds were up, the US Dollar was down, and it was a 'risk-on' day. Watch out for Whiplash at 2pm ET today when the same trading organizations consider whether to reverse their bets. By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Today is a typical Summer day in the markets. Low conviction to most moves, and a few 'big plays' to keep people interested while most of (us) are vacationing. Interest rates are inverting. The long duration US Treasury securities are up, having recovered fully from their June falls. Short-term interest rates continue to rise, with bank deposit rates over 2%, FDIC insured, with $1 or $100 minimum deposit. Retail showing more strain. Walmart $WMT is down almost 10% pre-market as they warn that their $60B in inventory will require a sale to clear, and that consumer demand is down due to fuel and food costs. We are not sure there isn't some 'labor market' stress in there as well reducing sales in the stores. We personally saw retail suffering due to labor shortages with reduced hours of operation, messy stores, and longer lines in all retail we visited on our vacation. Other 'safe' dividend stocks have been much weaker than normal. AT&T $T and Verizon $VZ are both down significantly based on concerns that consumers will give up their expensive plans for phone and internet. Another worry is they keep their plans, but they do not pay their bills (or pay them later). We also see weakness in old tech and old financial services ($IBM $INTC) and ($AMP). We do see strength in regional banking, with bank stocks rising on stronger earnings and higher interest rates (short rates) which will allow them to make more profitable loans (in theory). Also, the decline in longer interest rates allows them to lower the price of their mortgages while still maintaining their profit margins. Banks like an inverted yield curve, but not a recession. This could be a short-term bounce higher. We track $KRE as an ETF that tracks US regional banks. We see fixed income getting stronger on lower long-term interest rates, while the Federal Reserve Board FOMC is likely to continue raising short-term interest rates. This could break the system and cause an inverted yield curve, but the market seems to be saying 'What, me worry?' US Covid numbers are up to 120k new cases per day and about 6k new hospital admissions per day. Even our President has Covid. Finally, we comment on President Biden's industrial policy of hope and prayer. This is not encouraging. We suggested the President create a 10-point action plan to recover our US economy, assign 100 Federal Employees to implement each step of the plan, and to track and report on progress to the American people monthly and quarterly. He should also present the plan and open up his Twitter lines to comment and feedback. Did he miss anything? Anything to remove? Will it work? Fine tune in the churn of the market and public opinion. This will help us all work together to recover our economic growth. It is our opinion that a politician should not change the definition of 'Recession' just because we might be in one. That is changing the goal posts in the middle of a Chicago Bears football game, or lowering the basketball hoops in the middle of a Chicago Bulls game. Maybe making the goal larger during a Chicago Blackhawks game. Sure, we would love it to see our teams win for a few moments, but then everyone else gets the same treatment, and all we did was make the games easier...and that is not the point. We will run our model tonight to look at market volatility and update our website with new data.

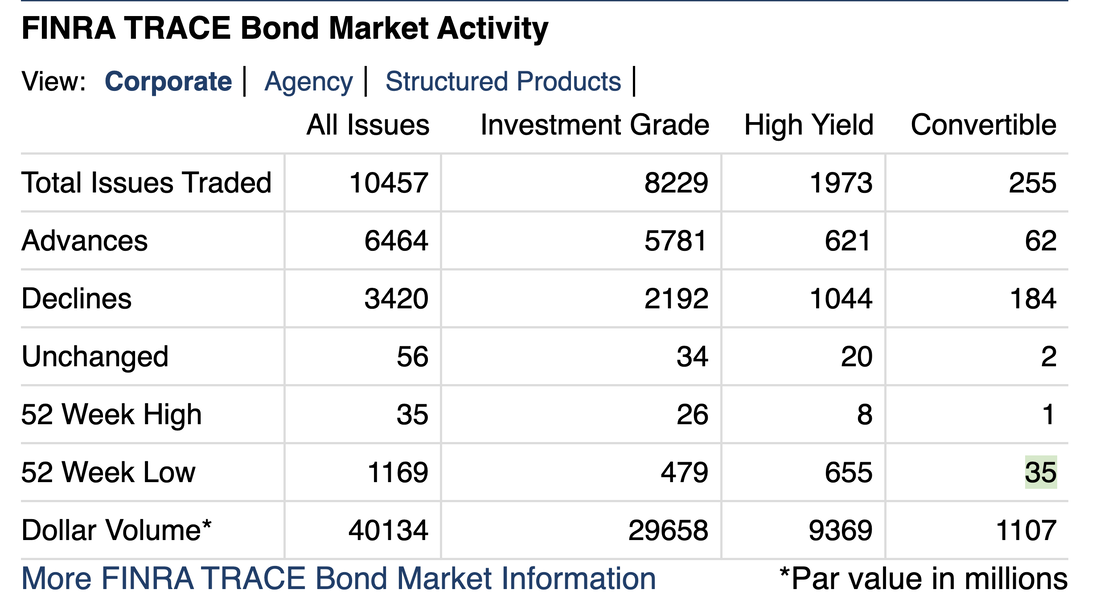

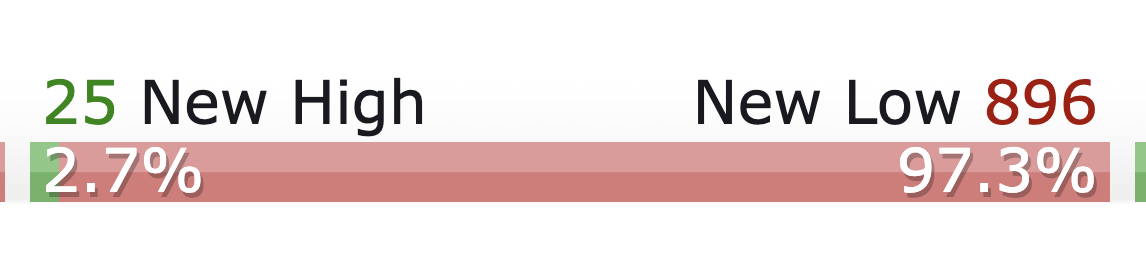

Good luck in the markets and watch out for the slow days of Summer. By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Market is set to rise today. Happened on large index futures bets 30 minutes before opening. US Dollar is weaker today, and this helps commodity prices (priced globally in dollars) to rise. Just a remember...the market may be going up this morning, but the longer-term trend is bearish and market breadth was significantly negative yesterday. Fixed Income: ~20:1 new lows to new highs US Equities: ~40:1 new lows to new highs. Variance is flattening but at a significantly higher level. It did not rise yesterday (lol) because the market fell then rose to close with a very small gain or loss. Intra-day moves were significant, ~2% yesterday, but the close paints the tape. US Treasuries are stronger at the longer end (10-year and 30-year). Solid gains in long bonds. However, the short bonds are down, and short-term yields are up. 1-year US Treasury Yields were ~ 3.15%, which is higher than 10-year UST Yields of < 3%. This is a significant inversion of the yield curve and a 'harbinger of bad things to come.' Harbinger...or sooth-sayer or oracle of doom *(recession, correction, decline). Our black swan event on the horizon is war with Russia and NATO. We realize that sanctions against Russia are going to cause poverty and economic pain across Europe due to the cut-off in energy supplies (if it persists). Zero Hedge article naming Deutsche Bank article made me sad this morning. It shows Germans chopping wood, or burning books and furniture, to stay warm. That is poverty in action, and unrealistic. It just means cold, sickness and death across Europe. Let's hope the worlds reaches a peaceful settlement to the crisis in Ukraine, or a decisive and swift victory. By Jeffrey Cohen, Your Investment Advisor Representative US Advanced Computing Infrastructure, Inc. A non-discretionary investment advisor in Illinois. We are very bearish on today's US Equities markets in this video. However, it is all 2nd order effects and macro-economic factors at this point. Lots of indirect causes and malaise. We think the market has only one way to go in the short-term, and that is down to continue the bear market decline.

We discussed multiple issues.

There is probably more that we discussed, such as our discussion with our daughter explaining how the government broke the US dollar and inflation is really high. It is bad for a 12-year old and her 19-year old sister. It is bad for everyone. We worry that the US Federal Reserve and the US Federal Government won't do what it takes to correct inflation, and we worry that they will do what it takes to correct inflation. Unfortunately, by waiting too long and letting the market forces do the heavy lifting, they only have lose-lose options. Those options will cause widespread global poverty. It isn't a good choice. We also worry that Russia will declare war on NATO. This is our black swan event concern and it will change things for the remainder of my lifetime, and likely most of yours. Good luck in the markets today. Jeffrey Cohen By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. We were up early today looking at the markets. Found a few key points to share.

Russia called a special session, EMERGENCY Session of their DUMA. Black Swan Event would be a War declaration against NATO. Bear Market Thesis: Market Breadth is negative 19:1 fixed income Equities 18.5:1 New Lows to New Highs. NASDAQ COMPOSITE 100 in a bear flag, testing the lower end. Overall CPI ‘shit the bed’ with evidence of inflation acceleration in June 2022. Shelter is up, along with food, energy, cars and most everything else. Don’t catch a falling knife today FOMO is a cost effective strategy today. If the stock is cheap today, likely to be cheaper tomorrow or next week. 19:1 New Low - New High Ratio (both corporate fixed income and US listed equities) COVID hospitalizations are up to almost 6k per day even though new cases are flat around 106k per day. By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. We saw 10 things in the market today.

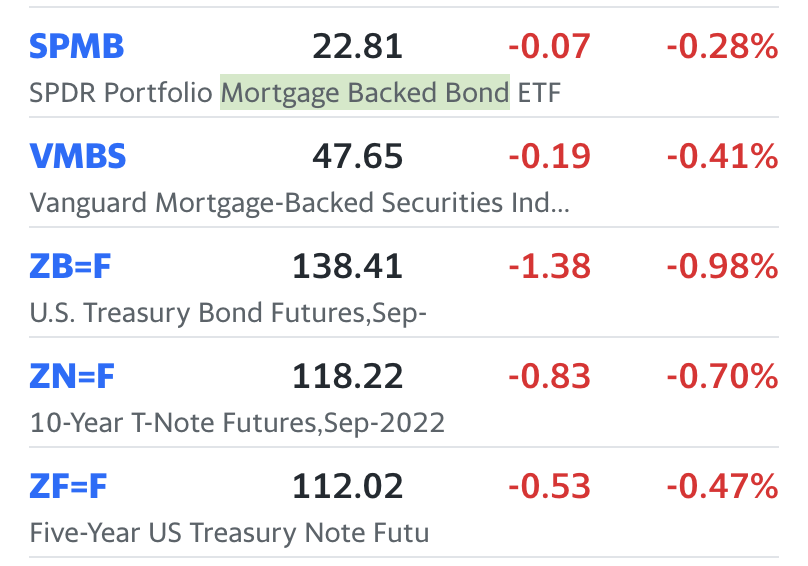

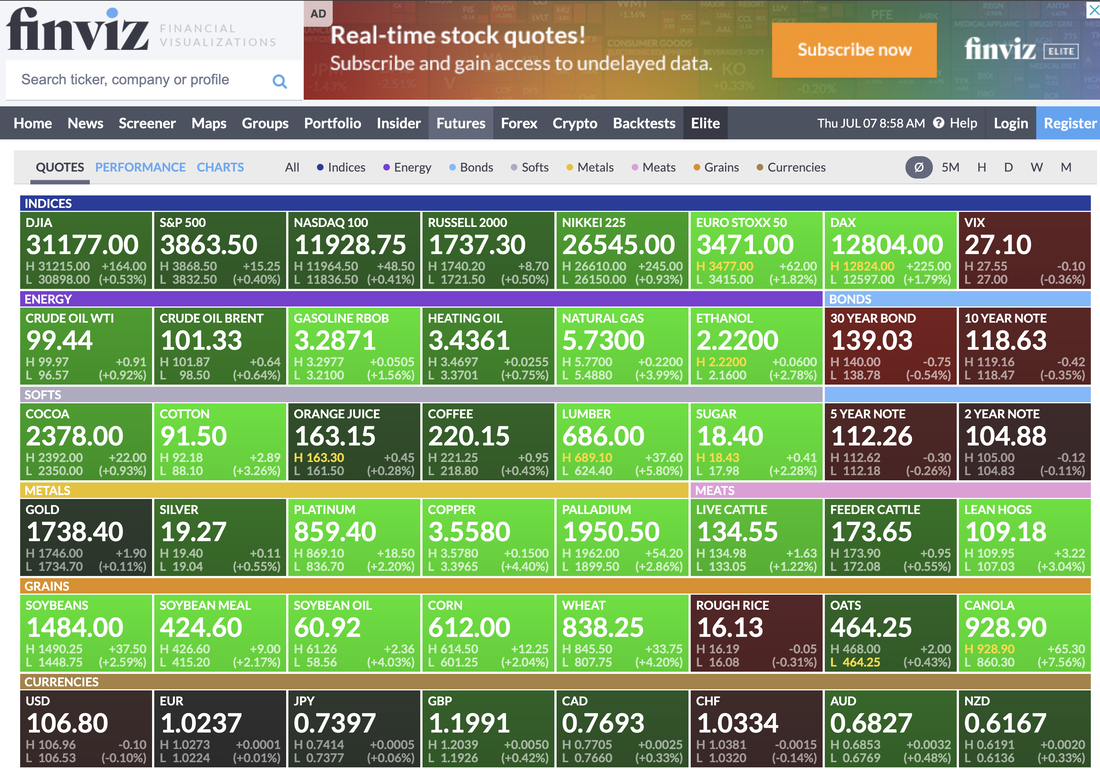

Pre-market movers tended to be small, except $GOEV is up this morning 74%, and $TWTR is flat. Most of our 'hot' industry sectors are pretty flat today. $MULN is active this morning too. Riskiness of individual stocks has climbed again. Individual stocks have blown out their correlations, and risk (or closing price variance) is up ~20% just recently on both profitable company, and unprofitable company stocks. Those variances are significantly higher than the $SPY now. Also, the risk free return continues to rise, and so expected returns on stock market investments are down. Our conclusion from this is that stock prices must fall, all things being equal, to incent investors to re-join the market and invest fresh money. Our CQNS UP model picked new stocks. 11 to 17 stocks to get a 6 tick advantage over the $SPY in risk-return. These are large tech, money managers, chips, and a few very low risk stocks to even things out for the portfolio. This is a different answer than before, and worth looking at. This is where the model wants you to go...stocks that have already fallen ~50% and have started to stabilize. It does not mean they cannot fall further, but these stocks are starting to reach the 'zero slope' point in their stock movements. Our CQNS Down model is still picking similar stocks, and these are either zero profit companies, biotech, or in-play declining stocks like $CVNA Carvana. US Treasury bonds are up, back to prior support levels. This is because long rates are falling, and likely due to recession fears. In a recession, or in times of turmoil, people would rather hide their money in no-risk US Government bonds than put them into productive investments like building a factory. We also think the EuroDollar fall to parity is due to European big money coming to hide out in US Treasuries. Japanese Yen is also falling, with the US Dollar buying over 137 Yen. We think this is because Japan (Japan Central Bank) is weakening the currency to protect low interest rates and support manufacturing and the domestic economy. Mortgage backed securities are up slightly this morning, and mortgage rates are down slightly. Last night we did some homework and we think housing is showing weakness. This would result in some problems paying on recent mortgages as housing prices have been elevated. Nobody wants to carry a home mortgage that is under-water. Also, it is hard to refinance a home when the value falls. We still have poor market breadth. New Lows greatly outweigh (more than 10:1) in both US fixed income corporate bonds and US equities. Do not catch a falling knife. Those are continuing to fall, and fall farther into new low territory. Bitcoin is back to $20,000, or it's new support level. Commodities that are economically sensitive are down hard, either 3% or 4% down this morning, including copper, crude oil WTI and silver. Pre-market movers $GOEV $MULN $RGC. GLTA We noticed 10 things this morning before the market opened. Some are bullish and some bearish for US equities today.

1. The US Dollar is very strong. The Eurodollar down to almost $1.00. Other currencies as well like the Japanese Yen. One US Dollar buys 137.39 Yen as we write this (higher than we have seen in a long time). 2. Long-term US Treasury interest rate yields are down significantly, while short-term US Treasury interest rate yields are up significantly. This is moving us towards an inversion of the yield curve. This is good for those who hold investments in long-duration bonds. 3. Mortgage Backed Securities (MBS) were lower pre-market, but then they turned higher. MBS are up today. In fact, after lunch-time NYC time, they are up across the board (UMBS, GNMA both, at 4.5% and 5.0%). Mortgage rates are down 7 basis points to 5.77% for a 30-year fixed rate, fully amortizing, and conforming mortgage. 4. Commodities that are sensitive to economic activity (like Copper) are down today. However, they are not down very much, and are up in historical terms. 5. Most economically sensitive stocks were lower in pre-market, including all of the money managers, chipmakers, trucking and transportation, and crypto and physical miners that we track. The pre-market sell-off seemed very widespread and affected economically sensitive stocks. We also notice the VIX is up slightly, although it is up by historical measures as well. This suggests the market is starting to price in the volatility we have been seeing in stocks (rising in the past month +). 6. Many large cap European banks were lower. China videos showing a run on the banks are running wild on Twitter. Looks like the Chinese banking system is in trouble, and I wonder whether European banks have exposure to that crisis. 7. The NASDAQ Composite 100 index is trading in a consolidation pattern. It is in a down-trend and trading in a rectangular box as the price bounces up and down since June 16 with little direction. Which way will it break out? The trend lines point to further losses. 8. The stocks we call 'the Walking Wounded' were almost all down this morning. They are still down as we begin the afternoon trading day. This reminds us that Fear of Missing Out (FOMO) is a cost effective strategy in a down market. The stock you want to buy will likely be cheaper in a week or two. 9. The edge in our Chicago Quantum Net Score model is smaller again. Much smaller edge than buy and holding the SPY. The reason is two-fold. Stocks that kept the edge (those that move up and down aggressively) seem to have been blown out by recent liquidity bursts. The stocks that are atop our list are now consolidating stocks, or low risk stocks. My net-net is that the QQQ looks like a good bet because large stocks in that index are flat-lining (or matching rises to falls) after significant drops this year. 9.a. We spent significant time this weekend tuning and improving our genetic algorithm, monte carlo (not much help there), simulated bifurcator (did ok, not great), simulated annealer (poor) and particle swarm optimization (did ok). There is so little edge that our optimization models are struggling to find better answers. It could be that the edge just does not exist, regardless of how hard and long we search. 9.b. The risk free rate of return has a 'bump' in it for retail investors. The first $10,000 you invest each year in US Savings Bonds can be invested in i-Bonds that pay 9.62% guaranteed for the first 6-months of your investment. We are going to buy some. This is a great rate, and pulls money out of the stock market from retail investors (or at least it should). We recommend this investment for retail investors with up to $10,000 to invest for a period of 5 years. In that case, you do not lose interest on your investment. Here is the link to Treasurydirect.gov. 10. Corbus Pharmaceuticals Holdings, Inc. $CRBP is showing great market strength. It is up again in pre-market and during the trading session. It is still very low by historical standards, but it is up recently to $0.3241. We are very bullish on Corbus Pharmaceuticals. Be wary of banks that are holding long bonds and mortgage backed securities as investments. These are declining and may cause accumulated other comprehensive income (AOCI) to be strongly negative. AOCI is not reported in net income, or accounted for in EPS, so it seems invisible. However, it is a mark - to - market mechanism that impacts a company's equity (or book value). In the case of banks, this reduces their common or shareholder equity, which is their cushion against further losses. We watch this carefully, and saw it fall dramatically about a month+ ago, then recover just as dramatically 2 weeks ago (climaxing at quarter-end on June 30), and now is starting to fall again. If this continues, it will reduce the shareholder equity (or book value) of banks we follow that have large investments in these securities. We just read two 'lightly documented' articles that discuss how auto loan delinquencies and home rent delinquencies are both rising. Auto loans a little, and rent must more. It was estimated that 15% of all renters are delinquent on their rent and face possible eviction.

Check these out. Still early days, but if these loans are securitized, or the rents are part of large REITS, we could see some systematic issues, and potentially demand destruction. https://www.zerohedge.com/markets/prepare-tidal-wave-evictions https://www.zerohedge.com/markets/prepare-auto-loan-crisis-delinquencies-begin-rise By: Jeffrey P. Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. We notice a few things today:

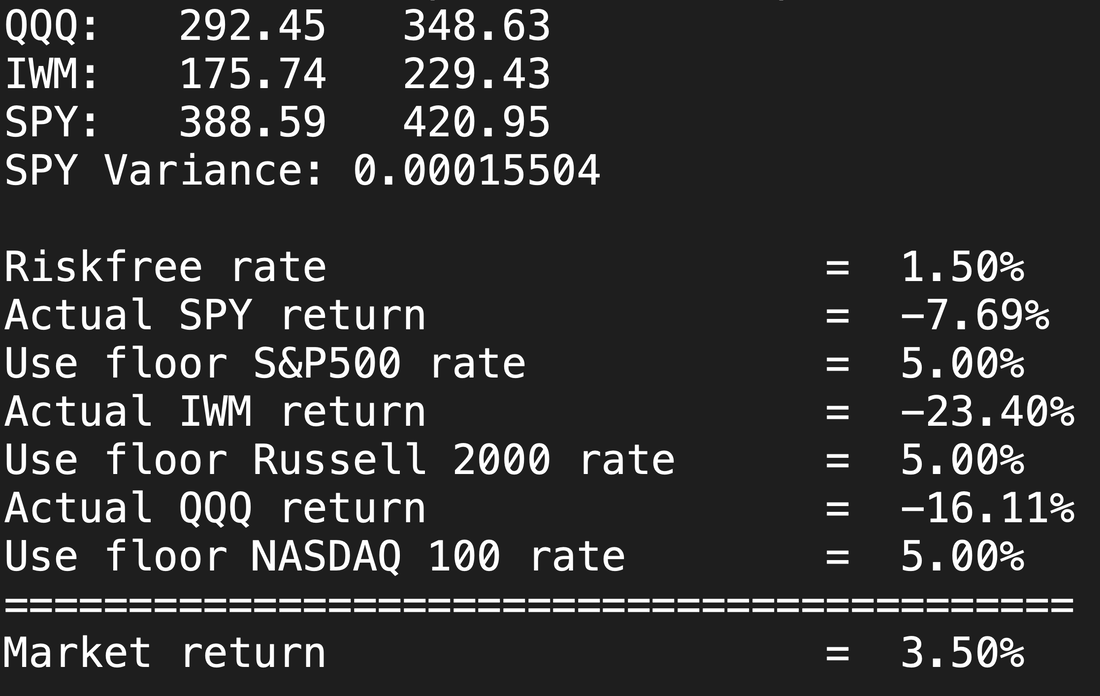

1. During a tough economic cycle, Europe and S. Korean steel companies can lower their prices and flood your market. In Turkey in 2019 and 2020, they lowered the price of steel to $473/ton of flat rolled steel. "The new levies follow an investigation into trade between October 2019 and September 2020, when flat steel imports totaled $2.05 billion, according to the Trade Ministry. Average import prices fell to $473 a ton in that period, from $624 per ton in 2018." No matter how efficient our USA manufacturers can get, the imports can lower their prices even further. Our government has some protections in place (tariffs) to protect our large manufacturers, and we hope our Administration keeps those protections in place where appropriate. 2. Bond Yields are rising. Looks like Europe sold bonds overnight (actually early this morning USA time). Bond prices rose into the open, and are falling again as we write this. 30-year at 3.16%. 3. Market Breadth still very negative. Many more new lows than highs. The US equity indices fell, rose, then fell again to close near where they opened. There are movements across equities, but they are intra-day and not very large. Looks like in a period of lower liquidity, there is also lower volatility. Interesting. We notice that 1.6 x 10-4 is the variance of both the 2000+ profitable and cash flow positive stocks we analyze in our CQNS up Run, and for the SPY S&P 500 Equity Index ETF. The variance of the market has plateaued at this level for the past few weeks. 4. Talks of a large China stimulus and lowering of interest rates. China needs the growth more than anyone with hundreds of millions of its citizens still living below the poverty level. 5. ORA or Ormat Technologies is in play. Yesterday they traded 7M shares, which is alot for them (up 500% over last year's average). They borrowed money to pay back old debt, and buy back stock. 6. 30-year Fixed Rate Mortgages (conforming) are up to 5.65% today. We cannot see how housing prices continue to rise when it costs more to buy, operate, insure and pay property taxes on new homes. They will go up with inflation over a long enough time horizon, but are most people earning more this year? Only time will tell, and MBS prices are the canary in the coalmine. 6. The futures are a field of green this morning, except for bond yields which are higher. We don't buy the messaging that everything is ok. The market is trying harder today. By Jeffrey P. Cohen Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Here is our running commentary from this morning: Noncommittal on the direction of the market today. Weak signals pre-market. Heard on the street: Housing getting weaker (at least in San Diego) USD Stronger Today Eurodollar below $1.02, at $1.0176 USD / CAD $1.3042 Mexican Peso heading to 21/USD Gold at $1,763 Bitcoin at $20,000 Oil (West Texas Intermediate): $100.35 Interest rates are going lower. Asian markets down (last night) European markets up (this morning) Silver at $19.21 (kinda low) Copper at $3.42 (middle of the road) People are buying fixed income (but not the ones at new lows…middle of the road and investment grade debt). Bitcoin: another bankruptcy in the eco-system Voyager Digital (lenders): $775M in loans are in default (2 lenders), 100,000 creditors. $700M is in a Singaporean 3 Arrows hedge fund. Interest rates (long-maturity) at 10 years + are down. Down 0.11% FRED/FED Down 0.70% according to Mortgage Data Daily, down to 5.5% Market Direction, Market Breadth: 1040 New Lows 31 New Highs (stocks) 33:1 Fixed Income (corporate): 736 New Lows 48 New Highs 15:1 Mixed global markets: Asia down, but now Europe is up. Bitcoin at support level of $20k Housing prices strongly higher: up 20% YoY May (CoreLogic Home Price Index (HPI TM) MRVL scored better than all other money losing stocks, and it scored better than all money losing stocks. Marvell Technology Inc. Expected Return of 8.66% over the next year. ETFs that model likes, in order: TNA QQQ SPY IWM SPY Variance: 0.00015716 Money making company stock variance: All Stock Variance = 0.0001614 Expected return: Expected Return = 4.76% Riskfree rate = 1.50% Actual SPY return = -10.39% Use floor S&P500 rate = 5.00% Actual IWM return = -24.51% Use floor Russell 2000 rate = 5.00% Actual QQQ return = -18.77% Use floor NASDAQ 100 rate = 5.00% =========================================== Market return = 3.50% Edge in our up-run is 0.000125 16 stocks to get there, evenly held.. Up to 22 stocks (roughly the same edge) Up to 25 stocks for a similar edge (More return, less risk) CLF is in the pick now. The model is preferring the down-trodden stocks. CQNS Down Run: Avoid the usual suspects. Down Run Variance: All Stock Variance = -0.0004786 Expected Return = 6.10% If you invest in money-losing companies, then on average you hold 3x more risk, and you expect returns to climb from 4.8% to 6.1%. Not as many stocks are trading pre-market. The ones that are trading are not moving as much *(smaller moves) 1 FTDR Frontdoor Inc. 1985.7% 2 CDK CDK Global Inc 1309.3% 3 SWM Schweitzer-Mauduit International Inc. 624.0% 4 PRPH ProPhase Labs Inc 480.8% 5 CTO CTO Realty Growth Inc 468.3% 6 CHEF Chefs` Warehouse Inc 447.4% 7 USAK USA Truck Inc. 425.6% 8 KRO Kronos Worldwide Inc. 422.7% 9 REX REX American Resources Corp 407.6% 10 EVI EVI Industries Inc 406.6% 11 IMXI International Money Express Inc. 390.2% 12 AMRK A-Mark Precious Metals Inc 385.9% 13 KNTK Kinetik Holdings Inc 340.1% 14 ACI Albertsons Companies Inc 320.9% 15 ACNB ACNB Corp. 316.3% 16 ORA Ormat Technologies Inc 310.1% 17 TUP Tupperware Brands Corporation 308.9% 18 EPAC Enerpac Tool Group Corp. 300.7% 19 ENTG Entegris Inc 300.4% The FOMC minutes are a non-issue. Same thing Chairman Powell said in Mid-June. No new news.

I do notice US Treasury yields are rising, with 30-year bonds at 3.13% and 10-year notes at 2.92%. By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Here is what we see (updated): The US Dollar is more valuable than it was on Friday against commodities and other currencies. However, US Treasury Bonds are more valuable, and interest rate yields are lower. By 1110 ET: Dollar is stronger still. This is bad for US Equities. Eurodollar at 1.0243 GBP/USD: 119.09 USD/CAD: 1.3050 BTC/USD: $19,369 Also, we see Oil/WTI down sharply to $101.11 and even gold down to $1766.80. So, the US Dollar is more valuable for reasons other than yield. This appears to be a flight to safety. Original Post Below: News today: US dollar hits a high today, climbing steadily. WHEN THE US DOLLAR RISES, THE US EQUITY MARKET TENDS TO FALL Indian Rupee hits a record low today EuroDollar hits 1.0299 in pre-market 071445ET USD / CAD 1.2940 USD/JPY 136.08 US Equity Futures are down, but they were up last night. Commodities. Copper down Silver and Gold up slightly Oil, heating oil, Natural Gas, Gasoline all down slightly this morning (0% to 1%) US Treasury Bonds and Notes are down slightly, rates are up slightly. Inversion play. VIX up slightly, but still below 30 at 28.10 BTC Bitcoin down this morning below support level of $20k Recession fears in the news. MARKET BREADTH STILL NEGATIVE, INDICES DOWN. Low conviction day in the markets this morning, but the trend is definitely bearish. S&P 500 Has a cup and handle pattern that is bearish. At the end of the day, the S&P 500 was up slightly. We were right to have low conviction on the decline today. We felt the decline in long-term interest rates was too bullish for stocks to let them fall too much. However, breadth was very bad, with new lows greatly outnumbering new highs (1,040 : 31).

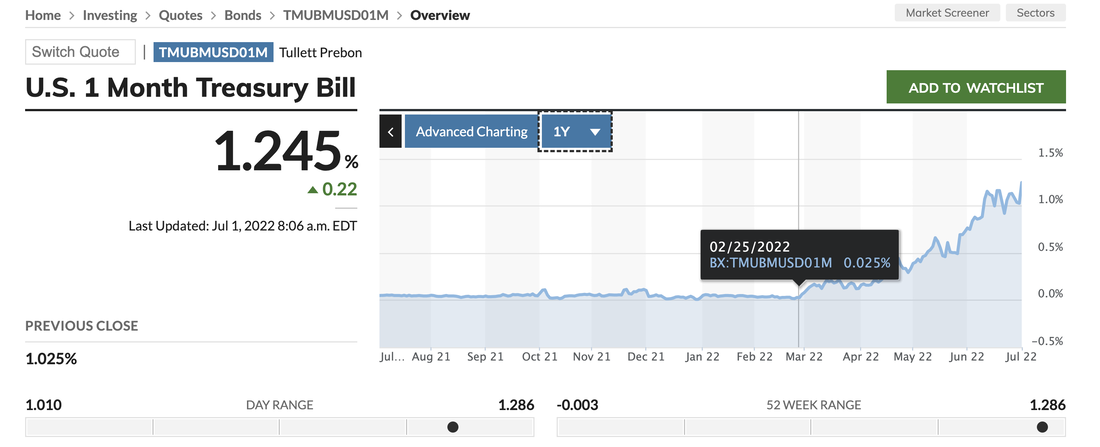

Good morning. Money now is worth more than money later. What do we mean? The interest you can get from the US Treasury on 3-month T-Bills is 1.27%, but you get less than 3% if you lend the US Treasury money for 10 years. The 3-month yields are skyrocketing this morning. Cash is King today. The other thing we noticed was New Highs and New Lows are out of balance again. Fixed Income / Corporate 1:35 New Highs to New Lows US Equities: 1:36 New Highs to New Lows We also noticed the VIX is trading to suggest a 1 standard deviation move in the S&P 500 of 1.51%. That seems about the range we are getting used to. Bonds are rising quickly to their last support level, which could make this a resistance level, or something like that. What we really mean is that US Treasury Bonds and Notes are going up in price, pretty quickly, from where they were mid-June. This surprising, and suggests either recessionary fears in the market or the Federal Reserve Bank and regular banks doing some serious buying at month-end. This could be the 'rebalancing' that everyone was talking about. It happened quickly and powerfully in fixed income at the end of June. We will watch for that next quarter as well. Copper is falling, along with Silver and Gold. Copper hit $3.57 while we were watching, and we reflect that copper can easily trade in a $2.00 range when the economy is weak / recessionary. As a result, a major copper miner $FCX or Freeport McMoran is down fast and hard. It has more to fall if copper keeps falling. This is like the steel industry right now, those stocks are crashing too. The final thing we noticed is the strong US Dollar vs. the Euro. The EuroDollar is trading 1.0418. Whatever is happening in the US with rates and quantitative tightening is outpacing, even if slightly, what they are prepared to do in Europe to control inflation. Good luck in the markets today. Jeff BTW, in the video we share some 'inside baseball' in our model. For example, here is our pick for the day, CQNS UP Run, best risk-return portfolio. ['AMD', 'BX', 'COIN', 'DDS', 'EBIX', 'MELI', 'MXL', 'NVDA', 'SGRY', 'SI', 'SITM', 'TTD'] Chart of market returns (ex. dividends) over the past year for 3 major US Equity Indices. Our model return to risk assets (fully diversified) is 3.5% over the next year, including dividends. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed