|

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. We discussed a few companies. All have the same attributes in common. 1. Weak fundamental valuations - even down to potential bankruptcy risk. These companies lose money, dilute their equity, borrow more, and generally have weak economics. 2. They had strong volume today. Heavily traded, although a few had high volume that way typical of the stock, others were well over average trading volume. 3. Most were up significantly in price, but 1 or 2 were down significantly. To make money in the market of thinly traded stocks people have to load first before they go up, else they don't profit. Some of these stocks could be in the loading stage. 4. SEC EDGAR SEARCH is your friend with these stocks. We read the 10-Q of every one of these stocks, or we read the SEC filing that had their current earnings report and relevant news. Some of them were quite exciting reads. All are important to review before you would buy, or sell these stocks. So important to know what you are buying or selling. 5. A few of these stocks had few or no shares available to borrow to be shorted. This means that for those stocks, there was no way to bet against them by selling shares that you didn't own. A few more stocks had no options to trade. This means that you could not bet against the stock through short sales or options. In the very short term, this means that the only way to go is up for these stocks, even though short term could be just an hour or two. This scarcity of stocks to sell could be because people in the know bought many of the available shares, or the float, and the rest is tied up and unable to be sold easily. Could be tied up in M&A or SPAC conditions, or family trusts or large shareholders with tax implications. 6. Going concern risk raised in their latest filing. We looked and a few of these stocks had issued "Going Concern" risks. This means that they were unable to determine how they could continue operations for the next 12 months without raising significant fresh, new funding, and they were unable to determine how they would raise that money. OK so what were the stocks found? Stock ticker, company name, and closing price May 31, 2022): VIEW View Inc. $1.27 (this one jumped 34% to $1.70 in early After Hours) MULN Mullen Automotive $1.40 INDO Indonesia Energy Corp. Ltd.$16.73 BKSY BlackSky Technology Inc. $3.27 AMC AMC Entertainment Inc. $14.34 SIGA SIGA Technologies, Inc. $10.94 BBIG Vinco Ventures, Inc. $2.30 VRM Vroom, Inc. $1.43 SAVA Cassava Sciences, Inc. $30.60 BRDS: Bird Global Inc. $0.7573 Stocks we did not cover, but that could make this list: BBAI Big Bear AI $5.33 MKD Molecular Data Inc. ADR $0.8635 This is not investment advice. Do you own due diligence before investing. We are not trading on these names, and do not have a position in any of them as we write this. Good luck out there. These are exceptionally risky stocks. Buyer beware.

0 Comments

By Jeffrey Cohen, Investment Advisor Representative

US Advanced Computing Infrastructure Inc. May 30, 2022

Weekend Point: $SPY moved to a slightly positive return for the year, excluding dividends.

With US markets closed, there was market movement driven outside the US. These were bets against the US Dollar, against US Treasury securities, and the US Equity Futures were trading in a tight range.

This morning in pre-market.

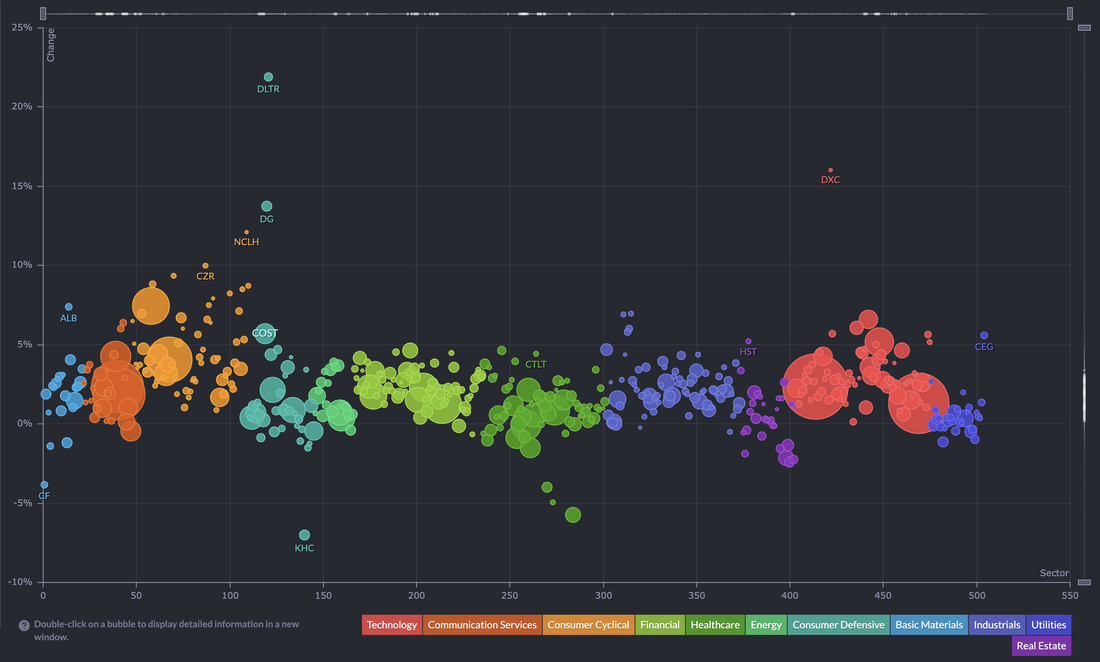

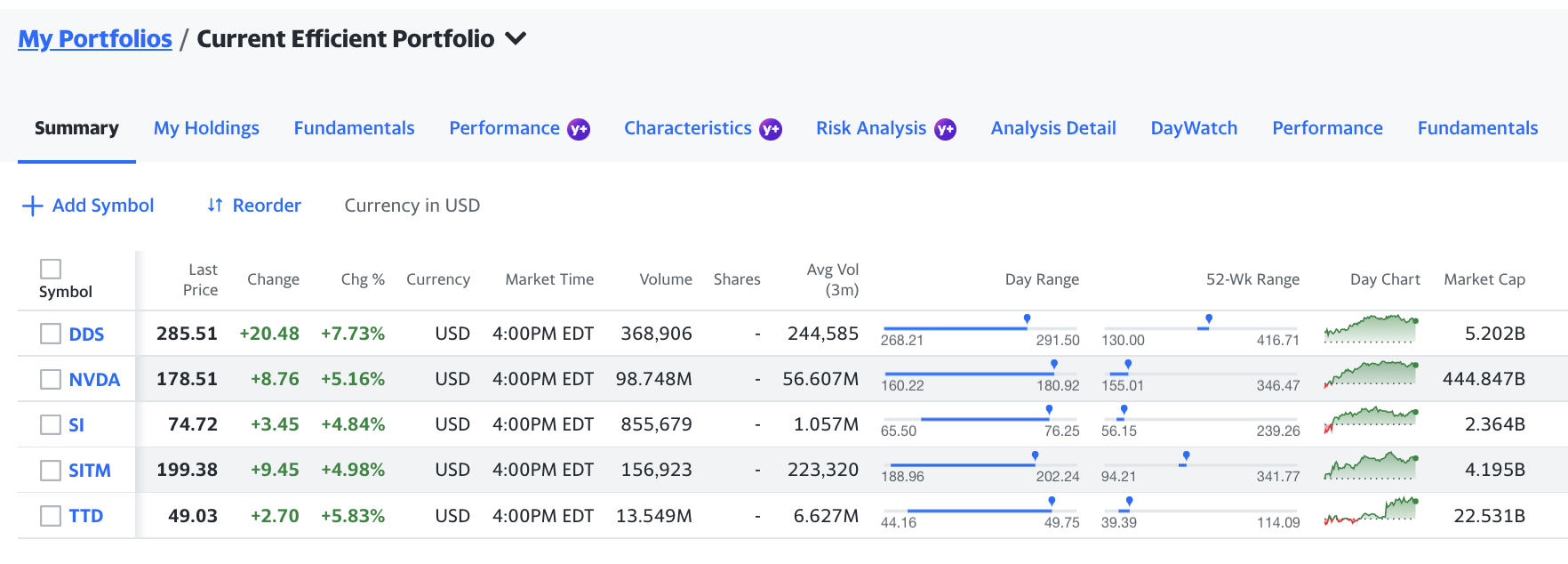

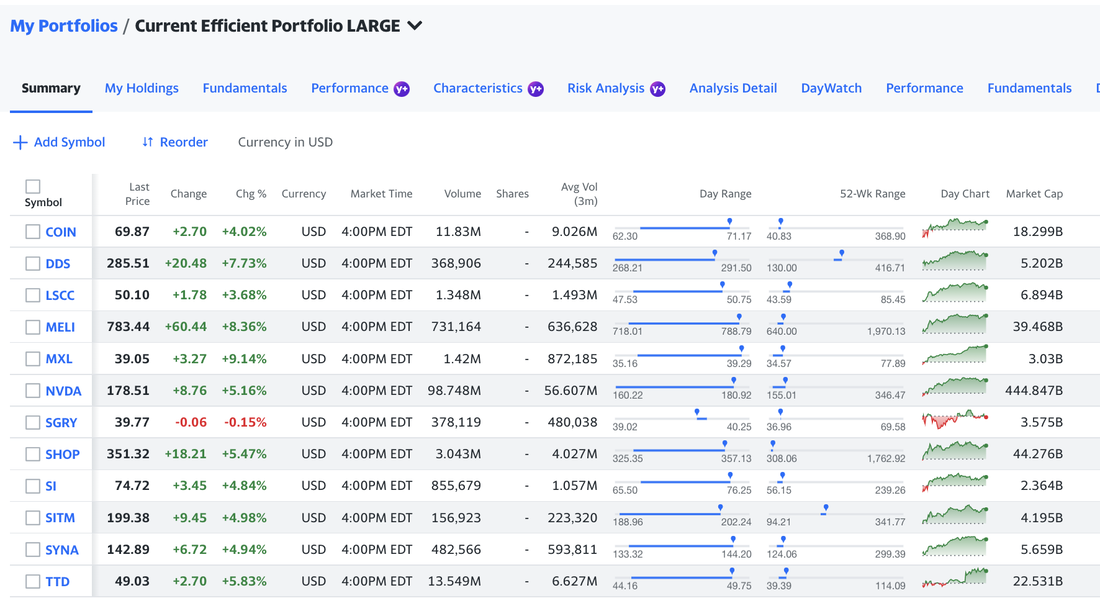

The sense I had in this market today was that it was different. We saw AMC very active in pre-market, almost like a whole day of trading was going on pre market, starting at 4am ET. Bitcoin was down 1.5%, and not really moving this morning. US Gasoline RBOB, or 42,000 gallons of feedstock available for delivery (wholesale price before additives, transportation, taxes and retail margin) is above $4 at $4.0156. This is high, and could lead to $6 gasoline in Chicago. US WTI oil was up 3.5%, or +$4.04. to 117.21. It strengthened today to $117.21. In Finviz, we saw a positive development for stocks and trading. The number of new highs is rising, and the number of new lows is falling. Pre-market it showed 153 New Highs, and 27 New Lows. While the market is open, this has moderated to 172 New Highs and 55 New Lows. This a positive indicator on breadth of the market. We did have significant news this morning. European (EuroZone) inflation approached levels in the US. Eurozone inflation hit a record 8.1% in May driven by energy and food prices. Previous record was set in March and April 2022 at 7.4%. This means inflation is rising in both Europe and the US at consistent rates. Inflation in the eurozone is now at its highest level since recordkeeping for the euro began in 1997. We saw mixed messages in the market industry sectors we follow pre market. Money managers were mostly lower Specialty retail was down Current efficient portfolios were up Crypto related stocks are up, especially $COIN and $MARA. We found four stocks ‘in play’ or highly active in pre market US stock market hours. SIGA SIGA Technologies Inc. was down significantly AMC AMC Entertainment Holdings Inc. This stock was very, very active in pre-market with large price swings and significant volume. During the day, it has traded 73 million shares already. This swung about 10% pre-market, then came back down, and is now up $0.51 or about 3.5% on the day. The current position shields the volatility and activity of this stock during the day. We really have to dig deeper into AMC. This stock has a very low intrinsic value and still has BK risk. However, good movies this summer and investor attention is rising this stock. $COIN or Coinbase Global, Inc. was up pre-market. It had fallen back, and is rising again today. It is up 7.5% today to $81. $MARA was up premarket and has fluctuated during today’s trading. It is up 3% today on average volume. Premarket speciality retailers targeted for clothing and young adults was down today. AEO, ANF, GPS are all down. Other retailers also down, included PRTY BGFV and CONN. We noticed that 30-year US Treasury Bond prices are down to 138.91 pre-market. This is a significant decline, but not even close to support levels around 134. There is more room for long bond yields to rise in the coming days. During the day the price rose to 139.19 during the trading day. 10-year US Treasury Bills are in the range at 119.38. This are declining price levels, but not yet approaching support levels. The EuroDollar Euro/Dollar rate is at 1.0731 during the trading day. It was at 106.90 this morning, so the dollar fell slightly today. 100 JPY/USD is 0.7779, up slightly from 0.7777 this morning pre-market. n terms of global markets, we saw the Europe was uniformly weaker (or down) this morning before US Markets opened. Asian markets excluding China mainland & Hong Kong were lower last night, while China was higher. The VIX was 27.75 this morning pre-market. This is an elevated level, and was up slightly in pre-market. However, this is overall lower from the worst of the readings recently when it was over 30. We see the 30 level as important, at least psychologically. We see a few stocks highly active and engaged while the market is open. BKKT Bakkt Holdings Inc. is up 16% today. This is a $2 to $3 stock that has made a move higher today on moderate volume. GME GameStop Corp. did not trade much pre market. While the market is open it is down $10.00 per share or 7.3%. This is a surprising move given the inactivity pre-market.

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure Inc. May 27, 2022 1024 ET Both US equities and US Corporate fixed income performed well yesterday. Our Chicago Quantum Net Score UP (or long) picks also did well. Today's video is a deep dive walk-through of last night's Chicago Quantum Net Score run and deliverables received by a client. Hope you enjoy it. Please ask questions and make comments. GLTA Initial thoughts after a few days is to compare equity capitalization to common equity. Should be around 1.0. We can look at things like AOCI, Dividends, Investments, their ability to generate NI and CFFO, and the quality of their loan portfolio.

Each day we get a little smarter on this industry sub-segment. Stay tuned.

These are the FOMC minutes published on May 26, 2022 for the meeting on May 4. They can be found here.

These are worth a read if you want to see the big picture.

The FOMC in May missed this development and only referred to some earnings reports being negative. I think this will hit the news and financial information by Q2 earnings reporting in July and August 2022.

That is...if the weakness in earnings continues. It is possible that companies sell more products and services, serve more digital customers, and keep things rolling in the USA. A look at today's stock markets makes me think the 'gravy train' has pulled into the station.

May 26: Strong day yesterday for fixed income and stocks, today looking up in pre-market trading5/26/2022 By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. May 26, 2022 0926 ET Markets look healthy, green and up in pre-market trading. Discount retail looking strong, especially $DLTR Dollar Tree. Fixed Income Corporate was up across the board yesterday. Fewer new lows, and more new highs. Stocks were up yesterday globally (overnight and this morning), and the US equity market looked strong and up yesterday as well. US Treasury yields were down yesterday. This is the opposite of the recent FOMC rate hikes and quantitative tightening we were told to expect. The market says no, long rates are coming down both for sovereign debt and corporates too. Not much news today, except Broadcom is spending $61B to buy VMWare, and Nvidia had a somewhat poor quarterly report. Their sales and gross margins were up, but operating expenses rose faster and they hurt their quarterly earnings. The press release did not say why, so we need to read the 10-Q. We did fundamental analysis 'on the fly' for $CONN or Conns furniture stores. Here is the quick bull and bear case we developed. It came up because we are providing significant amounts of fundamental data with our results now to clients. One should not trade blindly on data, but to understand the bull and bear case of every stock they hold, or consider to buy or sell. Fundamental valuation Bull and Bear case CONNS: Bull case: stock is down, cash and NI generation is strong. If they keep it up, they can pay down the debt…equity value will rise. Return cash to shareholders, and they manage a hefty 1.5B revolver Bear case: Heading into a recession Housing sales (new homes) down 3% Inflation is up, especially transportation and energy. Furniture is heavy, a lot of trucks. Inflation zaps their earnings Recession reduces sales $500M of debt becomes a noose around their neck BK Spent $55.4M buying back shares (now down 40%) We also looked at dividend stocks. Here are some strong dividend stocks. We say strong because they pass two requirements. They are towards the top of our risk-reward curve for individual stocks (but not as good as $SPY), and they paid dividends higher than the $SPY did last year. Here is that list of stocks. Most are in financial services and are exposed to market risk. Buyer beware, of course. Future dividends are not assured. CG AMP BLK TROW BX AVGO PNM PAYX RJF MMC ADI MCD ATLO TXN QCOM ADP Oh, before we forget. The vix fell to 28.31 this morning. Risk is slightly lower today of large market swings. Also Oil is up to $112 / barrel and gasoline was doen 10 cents to $3.73 per gallon. GLTA! Good morning. We are doing due diligence on some companies we have heard of. These are the downtrodden stocks we often speak of.

I am reflecting on a few stocks that I did homework on. They fall into two patterns: 1. Companies reacted to the supply shocks and expected future price increases by increasing inventories. They 'had to' increase operating expenses through wages, cost of energy, product costs, etc., and in come cases threw in some discretionary expenses as well. Regardless, they have levered up their current assets and current liabilities by 'investing' in inventory. This was a seemingly prudent move as COVID 19 subsided, the masks came off, and we were 'full steam ahead' in our economy. However, now those companies have suffered weakness in sales and consumer demand. Their sales are not consuming the inventory, and now somebody has to pay for those inventories, and increased operating expenses. It looks like it will not be the consumer. So, they borrow more money, issue preferred stock, and the lucky ones can issue more common shares to pay for the losses. However, once the common stock is down (say 80% or 90%) the dilution feels punitive. Once bonds are trading in the 70s, this means yields are in the 20s, and new debt is priced extremely expensively. The only thing to do is to cut expenses dramatically, or look for strategic options. This market feels full of companies looking at downsizing, strategic options, or BK. With each earnings release, expect more of these to go public so long as inflation and energy prices remain elevated. 2. Companies continued to operate as normal. Good, solid performance year on year. Long-term contracts supplemented by spot sales. B2B and B2C can fall into this pattern. Solid business plans with little to change or improve. Steady Eddies. Some R&D, maybe a few new products. Selective hiring but nothing crazy. Most office workers work 'from home' and things remain status quo. The inflationary cycle hits them. Costs increase, as they must. Labor costs rise, the occasional rent or capital expense increase, and of course raw materials cost more. Maybe costs only rise 6% vs. 8.3% for CPI and management seems satisfied that it is tightening its controls. Now another factor hits them. Capital costs more. Debt for high yield companies keeps hitting new lows, which means yields rise. We track some debt yielding from 20% to 30%. Equity costs more too. Investors expect lower returns (Our model suggests 4.5% to 6%) so investors pay less for new shares, and require more of a share of the equity for every dollar invested. Where does a company turn to when it needs a hand up? There are a few sources of funding (outside the pawn shops and payday loan businesses). Firms can turn to private equity, venture capital, specialized lenders / turnaround shops, and banks. Regular banks that hold trillions of US retail deposits. They may charge higher interest rates, but hopefully it will be lower than our default credit card rates of 29.999%. This hurts in another way too. We notice that firms that were healthy took on additional debt. That debt in many cases is variable rate, which usually means some index plus a mark-up, plus a percentage of unused borrowing capacity. As interest rates increase, their cost of debt rises immediately, from quarter to quarter. One company we looked at has no economic profit and interest costs of $200M/year. As rates rise, and their interest hits, say $300M, they likely will need to borrow to pay higher rates, or dig a deeper financial hole. Finally, the impact of inflation and fears of recession play out in their consumer's minds and spending habits. Maybe spending only falls 5% or 10%, but that, with increased costs, means that profits evaporate and now the company has to cut further or dip into those expensive capital and debt markets. Now, we turn to the consumer. The consumer is hit by layoffs from companies feeling the squeeze of inflation, and they have to pay more for items they absolutely need to live, such as food and energy. This is how economic downturns happen, and why inflation is so dangerous. What does this mean in the stock market for investors? It means that you should not buy shares of stock in companies that are sliding towards bankruptcy. That is a slippery slope that only gets harder to leave over time. Good luck in the markets. Sorry for the gloom and doom. It comes with the territory of being a financial advisor and researching companies. GLTA! By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. May 25 0930 ET The market is set to open lower today. We cover a somewhat random walk through the markets this morning and look for insight, indicators, anomalies, and clues on how the market will do today. If we were a day trader, we would be doing just this homework. However, we would probably be doing it at 0500 to 0700 ET instead of 0845 ET. VIX is interesting. It is trading above 30 this morning (up from 29.x). This is converted to daily price moves that 'break even' the cost of the insurance in our video. The way to think about it is you take the VIX number, say 30, then divide it by 19.1 (assumes continuous trading), and that is the percentage change for the S&P 500 within 2 standard deviations (68% of the days). Put another way, if you buy the VIX at 30, you are betting that the market will stay within a 1.57% daily change in price 68% of the days for which you bought that insurance. Earlier this year, the VIX was much lower, and that change was ~ 0.6% for a daily change, mostly because in a steadily rising market you pay less for downside insurance protection. Next thing we noticed is that our fundamental screener (which only gives you stocks to research - not a sure thing), is yielding stocks with total capitalization (debt + equity) that is not that much more than either Cash Flow From Operations (CFFO), or Net Income (NI), or both of them. This yields stocks to look into, to see if their future earnings will be just as good as their historic earnings. One such stock $FNF or Fidelity National Financial, which trades at multiples of 4 and 7, and paid a 3.52% dividend, looks like one to dig into. Hopefully rising oil and gas prices and a potential recession won't stop their cash generation. Let's learn more and find out. We covered oil and gas this morning. Prices are not just rising, but have been higher for a while. We discuss how short-term fluctuations in the price of crude oil are buffered by the refining industry, finished product storage, and hedging activities. We then discuss how when these prices are higher for 3 months or so, like now, those buffers get worked through and now prices will likely remain higher, and be buffered in. For examples, E&P may hedge their production at recent prices to ensure they make a profit. However, when oil is $110/barrel, hedging at that price may be cost prohibitive and so they sell at the spot market, which is $110/barrel. If costs of hedging fall, because traders get used to $110/barrel, then that price will be locked in for months up to a year. For gasoline, cheap crude works through the refineries, and into finished gasoline storage. Once the inputs cost $110/barrel, then the new product, which may take 3 months to be sold, is more expensive. Together, these effects will work to keep the price of gasoline higher for consumers. On the consumer side, if gasoline stays at $5/gallon retail, eventually economic activity will slow down. This will cost other retailers business, both from less driving and transportation, and in substitution of goods, services and meals at restaurants for the money poured into gas tanks. For most people, money supply is not elastic, but is fixed on a monthly basis. For example, we spent $48 to fill our tiny Toyota Corolla gas tank yesterday. At some point, it just won't be worth the drive...and we will stay home. Imagine if we still had the Chevy Trailblazer XT! As you can see, the price of oil and gasoline has been higher since the beginning of March. Those higher prices will start to change consumer habits as they 'sink in' and become permanent changes to expectations. We will say, "remember when gas was only $3/gallon?" like it was years ago.

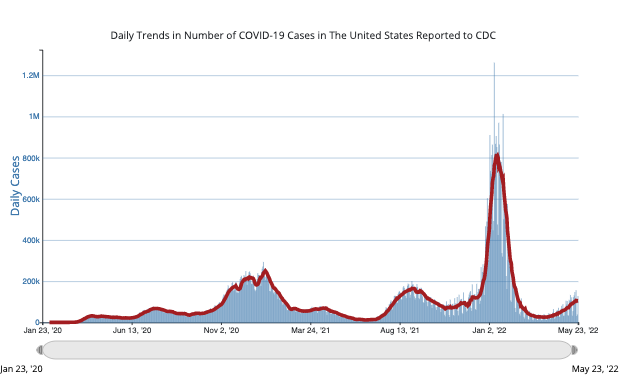

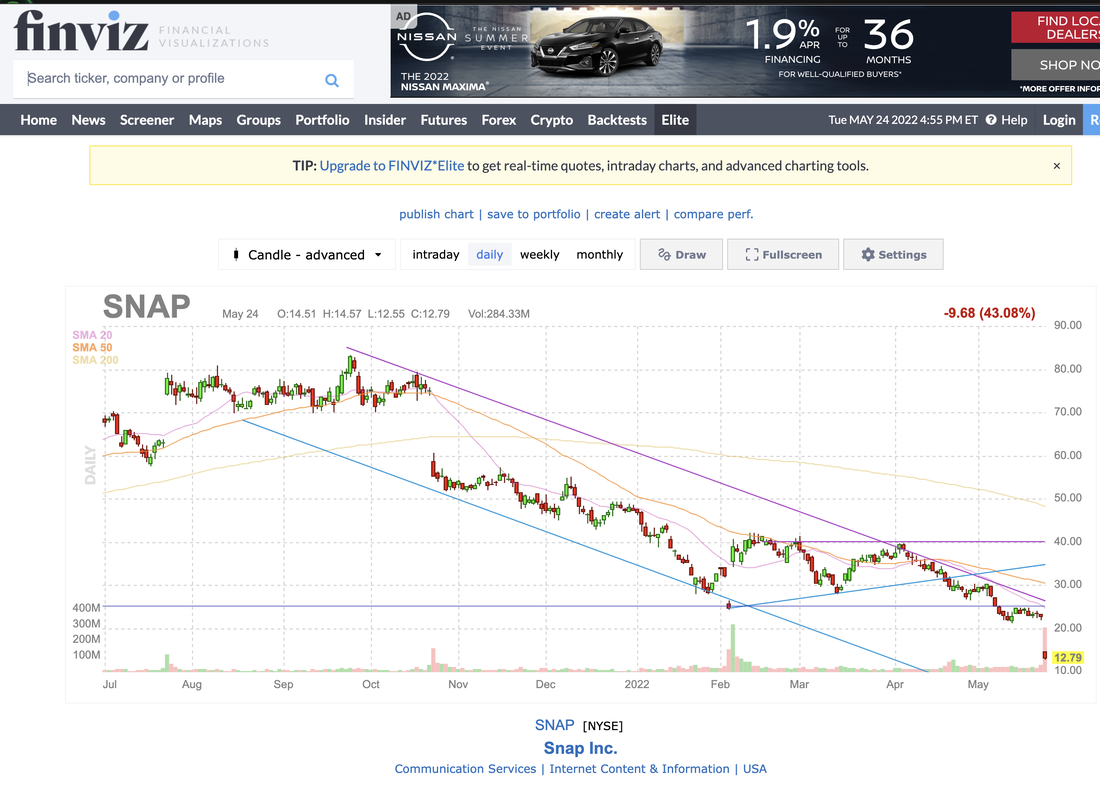

We also did some homework on our "stocks to buy" and "stocks to sell" lists. We confirmed bankruptcy risk on $RGS Regis, $AUTO Autoweb, $ATIP ATI Physical Therapy, and will be checking out $PRTY Party City next. If these companies recover, these stocks are a screaming buy. If not, they will not likely hit these high prices again. We still like $CLF Cleveland Cliffs $NVDA NVIDIA Corporation, and recently discovered $INTC Intel Corporation, but are still waiting for lower stock prices as the market crash / correction continues. We continue to watch $BA Boeing, $AVYA Avaya, and in the medical research field we like $RWLK Rewalk, but in all cases are sitting on cash to let the market find its new equilibrium. We expect to see markets calm down, for daily swings to get smaller (not larger), for liquidity levels to rebuild before we re-invest in the market. We may miss the bottom, but that is ok. We did not discuss this in the video, but we see US Covid cases rising again. This is bearish for Main Street, retail and service industry stocks. Our mantra still stands: FOMO is a cost effective strategy today. Downtrodden stocks will likely be lower in the next week or two, so it pays to wait a bit before investing fresh capital. GLTA! We have a saying here at Chicago Quantum. FOMO is a cost effective strategy. It means that stocks that have been falling will continue to fall during this market, at least for the next week or two. We do this because we are seeing extensions of trends of falling stocks. If you like a stock and the price has been falling, it is likely you will get to buy it still cheaper. We tested this hypothesis on $SNAP because we have never looked at this stock. Not our wheelhouse. When we look at this chart, the stock fell from $80 to $40, then paused, then fell to $30, and is now below $13.00 per share. The news from the CEO may have been a shock to the after hours market, but it is aligned with the overall direction of the stock over the past eight months. We stand by our strategy to hold onto your cash, and wait for a clear sign that the market has bottomed before investing downtrodden stocks. This does not mean you should not invest your cash in assets, but do so into index funds like the S&P 500, Nasdaq Composite or Russell 2000. Wait to pick individual stocks for now.

We continue to build our buy list for when the rain stops and Noah can step out of the arc. Today we further cleaned our model inputs. We removed stocks of companies that are not US companies. We find anecdotally that non-US company stocks are more volatile and possibly could lose significant amounts of value due to non-company specific factors. Better to remove them and have a more consistent risk profile. We also are refining our filters and due diligence approach for stocks. Most valuation metrics are trailing indicators, or feel like driving backwards while looking in the rear-view mirror up to 3-months ago. However, if we can get comfortable with a company's direction and future prospects, and their discipline in handling (protecting) cash and assets, then past performance gives us reason to research these stocks for the future. We can see industry sectors that tend to be valued with lower metrics and valuation ratios. These may be the industry sectors that make our buy list as the market bottoms. The key is to create due diligence processes that work well in each industry. We also found a few stocks that are susceptible to weakness in equity prices. They hold assets that will need to be marked to market, and impact their earnings and potentially, even if they are unrealized losses. Contact us for more information. Here is what we saw:

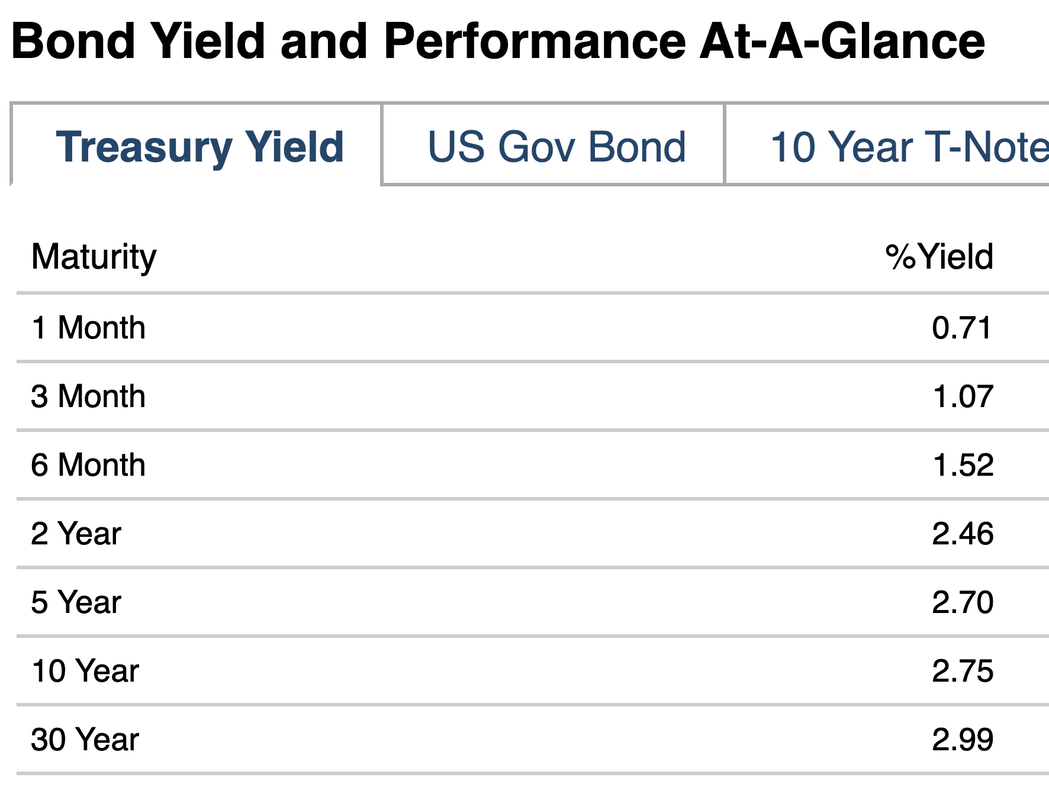

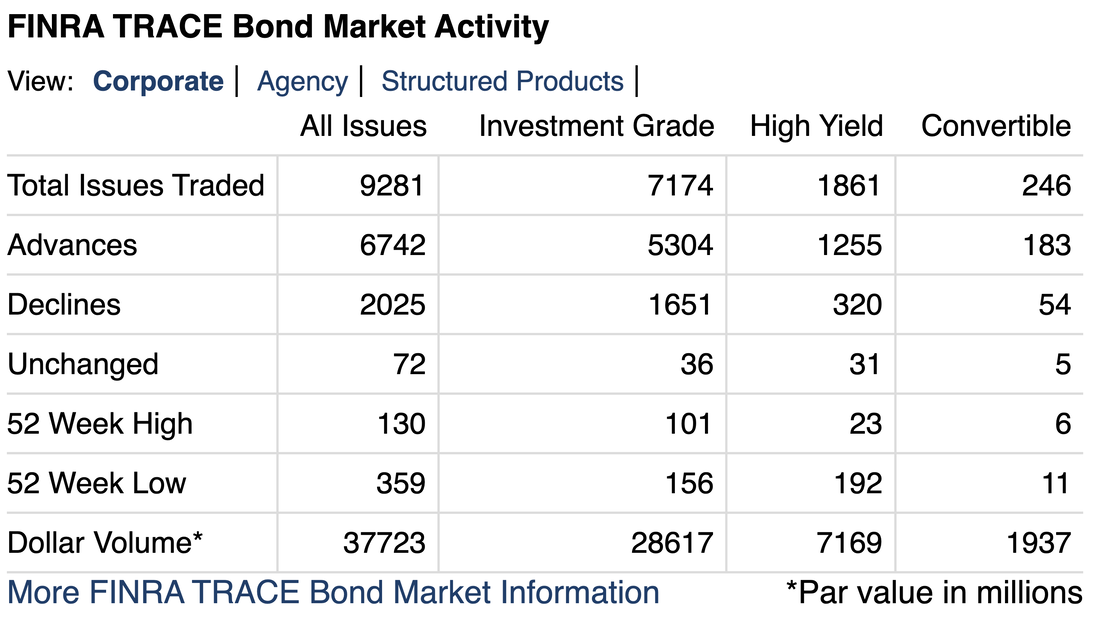

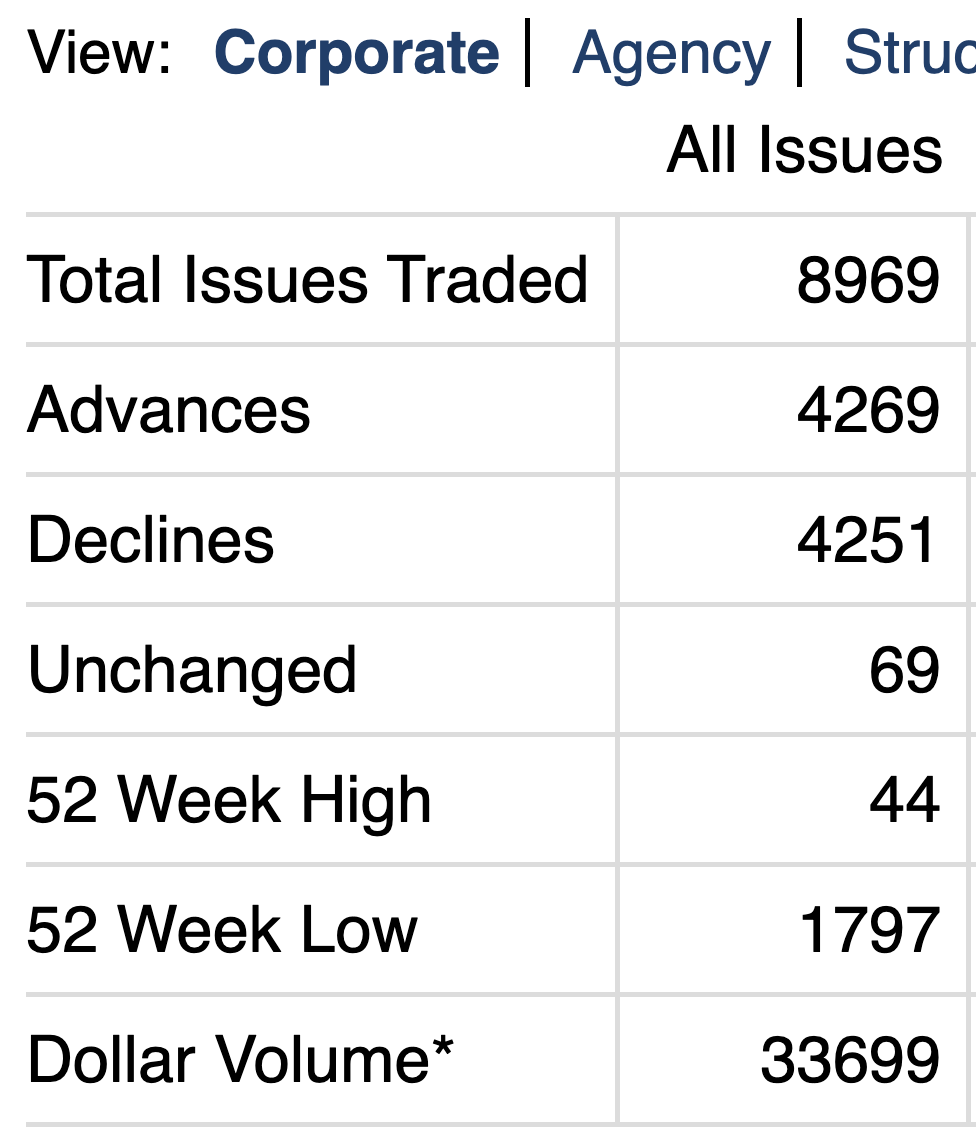

Interest rates looked ok, the US Treasury yield curve is upwardly sloping and rates were coming down. Long Bonds yielding 3.08%. 10-year yields dropped further today during the trading day, now down to below 2.75%. Fixed income: Corporate bonds fell, with more declines than advances. About 25:1 new lows to new highs, so the down issues kept falling lower. Investment grade bonds were the worst performing. Crypto (specifically Bitcoin) was down this morning, and the EUR/USD hit a high we had not seen in a while, up to 1.075 (or thereabouts). The US Dollar is breaking down this week. Pre-market equity movers (all lower that we saw) pointed to a decline in economic activity, including digital advertising. $SNAP Snapchat, indicated that April 2022 saw a significant decline in economic activity which impacted their revenues, and profits. That CEO letter of warning cost this stock 41.41% of its value, and the stock is trading at $13.20 as we write this. I wonder if the CEO saw that coming, or consulted with shareholders before making this disclosure in such an abrupt way. We saw $ANF Abercrombie & Fitch fall in pre market as well. $BBAI Big Bear AI fell, but that is a MEME stock so this could be an unrelated 'trading' situation. Retail, including specialty retail, was almost universally down in pre-market and in early trading. Some of the retail names that have liquidity and solvency risk are significantly lower, potentially due to the recession risk. We think that shuttered stores and massive retail layoffs will just add to the recessionary dialog if this continues. In retail, companies that are a credit risk are a self-fulfilling prophesy. This is because stores need credit to stock inventory for holidays (think Thanksgiving and Christmas). Otherwise they have to pay for all merchandise in advance, which limits how full their stores will be. An empty store is an unprofitable store in most cases. Companies that rely on digital advertising are also down today. $AUTO Autoweb is an example of what happens to companies that seize the initiative, work to grow their business in a new area, but ultimately are chocked when capital becomes more expensive (as it did in 2021). Don't be surprised, high-yield debt became much more expensive in the 2nd half of 2021, and we are seeing the effects in 2022, almost a year later. Autoweb does not have the capital resources to maintain a used car business that bought (wait for it) either 100 or 1,000 cars in April. There are many other capital constrained businesses that in hindsight squandered the money they earned or raised over the last 2 years of economic recovery. Companies like $TUP Tupperware, $FL Footlocker, $VRM Vroom and many more spent their cash, and now are facing creditworthiness risk. There are many more like this...we also see ~1,000 new lows in the corporate bond market. Debt is becoming much more expensive for companies without a liquidity cushion. This can quickly turn into massive high yield default and liquidation / BK. $AVYA Avaya Holdings Corp. had a tough quarter in their core business and has fallen significantly to $3.4250. This is an enterprise IT firm that sells innovative voice technology B2B. Back in the day this equipment and software was indispensable. That said, we advise our clients to wait before buying stocks in companies where the stocks have already fallen significantly. We call them 'the downtrodden' and our tagline is FOMO is a cost effective strategy in this market. Stocks that are lower now will likely be lower in a week or two. We have been saying this for 8 weeks, and it is still true. Global equity markets were lower overnight and into this morning. The VIX was up, but not significantly. It is elevated, but not at 'panic' levels above 30. Other stocks we discussed were $URBN, $AVYA, $COIN, $RWLK $CLF (now at $22.05), and $FLXS (now at $17.69). In all cases, we are looking for price targets to make a purchase. Retail sales data came in from Census.gov (an advance reading for April 2022), found here. It showed rising prices, and actually house sales falling back to historically normal levels for April of 600k units. For us, the news is that prices have increased. "Sales Price The median sales price of new houses sold in April 2022 was $450,600. The average sales price was $570,300." Hope you found this BLOG post enjoyable. If you like it, and the video, please click the YouTube subscribe button and also sign up for our mailing list. Thank you for reading. Chicago Quantum presents The Bottom Line. Stock market news during a stock market crash. We look at the pre market stock market signs of a stock market crash. We continue to have one of the worst months in recent history. What you should do? Pre market stock market news and analysis. May 23 2022: Pre-market analysis of financial conditions By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. The US Equities markets are set to open Green, or up this morning. What do we see? We normally work in the top-line market. The headlines. Macro-economics, money flows, fixed income, US equities, and look at the major indices (S&P 500, NASDAQ Composite and Russell 2000). Today, we are going to look at the bottom line market. Some stocks that are at extreme levels of fundamental valuation. The edge where people can make or lose a fortune with stocks that seem values at a level 'too good to be true.' We are no longer looking at MEME stocks or fast runners this morning, we are looking at The Bottom Line, extreme valuations. Of course, we will also review the news, market futures, industry sectors, fixed income, commodities and all that jazz. Probably check out a few US Government websites for data. Look at pre market movers. Check out global markets overnight and earlier this morning. This time, we dig into some ultra-low valuation stocks. Stocks that trade at very attractive multiples to profit or net income, and others that trade a low multiples of cash flow. But, look out for debt levels. This is the difference between a valuation trap and a valuation opportunity in many cases. The bottom line market. May 23, 2022 Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. We are looking for potential runners today based on extremely good valuations. Top-line: Yield curve normal, but short money is yielding higher, and long bonds under 3%. Corporate fixed income: Was strong on friday in investment grade, balanced in high yield (1:1 ratio) and slightly lower in convertibles due to the equity exposure. New lows continue to dominate new highs, around 25:1. If you can afford to wait, let's falling stocks and bonds fall further. US Dollar looks significantly weaker. EUR/Dollar up to 1.0656. We saw this recently as low as 1.039. This is bullish for US equities. Material news None found. Futures for US Equities Green across the board. Up ~1% pre-market. Currently Efficient Portfolio: Was flat, 1:1 advance to decline in pre market trading. This is not bullish. Europe and Asian markets, Global equities: Asia was down, Europe is up. Nikkei (Japan) was up. VIX fear gauge: Lower this morning, but still elevated. Gasoline, Oil and Natural Gas: Gasoline at $3.82 is still very high for the US consumer. Oil is up at almost $111 / barrel West Texas Intermediate, and Brent is almost $114 / barrel. We think big money is behind the moves in the indices on this Monday morning. Commodity futures up across the board. Gold, silver, platinum all up Bond futures Looked lower, so rates are set to rise today. Overall: Equity Factors Industry view (canary in a coalmine industries): NA Money Manager News: NA Crypto-currencies, such as bitcoin: Up 1%, not much movement, but positive. The Bottom Line: There are three stocks with high volume and high volatility that lost money. Check them out in the video, they are set to move today. We found a bunch of stocks that pass a pretty aggressive faluation filter. Also check them out in the video. Closing things out. What we saw: Green futures. Some stocks are trading at valuation discounts, but these are in industries that will suffer the most in a recession. What you can do today: Avoid investing in stocks and bonds that are at new lows. Unless, of course, you are investing in them falling further. Some of the stocks we looked at have a chance to run (either up or down). Not investment advice, you get investment advice when you become a paying client. I wish you good luck in the markets. Enjoy the video. GLTA! For those that made it this far, thank you for reading our BLOG posts.

Here are the three stocks that were very active on Friday, have high historical volatility, and lost money. Three stocks that move fast, and had high volume on Friday GENI - down ZYME Zymeworks - down, but loaded recently. LWLG - Lightwave Logic - moves every day…trader’s paradise. Here are the multiple stocks that had a strong fundamental valuation based on last year's performance, and are significantly down in price. These are your falling knives with good metrics. Up Stocks: $100M equity market cap or above. Traded every day for a year Positive BETA Positive net income Positive CFFO Stock prices that pass validation. Down in price, but good earnings, better than 10:1 ratio on total capitalization / CFFO, and total capitalization / NI (both conditions are met): COIN Coinbase Global TUP Tupperware Brands RVP Retractable Technologies CONN Conns Furniture store BGFV Big 5 Sporting Goods PLCE The Children’s Place BIG Big Lots LEU Centrus Energy Corp RKT The Rocket Companies URBN Urban Outfitters PVH PVH Corp WGO Winnebago Industries GPRO Go Pro BBY Best Buy NATR Nature’s summer harvest CASH GHLD FL - Foot Locker SIG Signet Jewelers LTD (foreign) AAN Aarons DKS Dicks Sporting Goods JHG - Janus Henderson (money manager UK) Sporting goods and sporting apparel is down. UA is down massively last week. 9 Up pre-market, 4 down 8 Up vs. 5 down Even in a down market, cash flow from operations and net income matter. They are valued by investors. In a recession, however, earnings and cash flow evaporate and you end up holding stocks with worse valuations. And these final two stocks are just a little different. Worth looking at: CLF Cleveland-Cliffs Inc (down 5%) AUTO Autoweb (down much more than 5% - going concern risk) Good luck in the markets today. GLTA! By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure Inc. May 20, 2022 It occurs to me that I will go to extraordinary lengths to avoid finishing a white paper, calling or writing potential clients, or 'gasp' programming our model. I will perform fundamental analysis on stocks. I look for signs that 'this time is different' when I know it is the same. That the laws of finance and economics are as constant and true as the laws of physics and behavioral science.

Yesterday I researched a MEME stock named Big Bear AI. This is a government contractor to the DoD and other agencies that require secure decision support services and software. This is like our business, except they have ongoing projects and we are entering the field. This company has a cost and revenue model that yields no economic profit. This was true before they went public, and is now slightly worse off due to the costs of being a public company. BTW, great mission and we support them 100%, but we cannot justify their current stock price at $10. Yesterday we also researched Vroom, a used car dealer and eCommerce platform that is moving into used car financing (as a keeper of the paper on their books). The due diligence was not positive for us, and we said so on Twitter. I heard from an analyst that I was likely wrong and they shared a more optimistic point of view. I responded with the bare bones of our analysis. This unfortunately is not a buy for us at the current price of $1.50. Today, we looked at how their bonds were trading. They were clever and issued 0.75% bonds. This morning they yield 29.47%. This company spent $417M of their cash last quarter on acquisitions, losing money in operations and the like. Imagine if they would have bought back their debt which last traded at $33.80. What a great way to increase shareholder equity! Well, they didn't do that...the $417M is gone...and now they need to find room on their balance sheet to hold consumer used car loans, as a borrowing cost of 29.47%. Today we looked at Party City Holdco. We like this business. They sell party supplies, costumes, and in a word, fun. They do about 1/4 wholesale and 3/4 retail in large US stores. My daughter worked there after school one year. Cool place. The stock is down to $1.18 today and we cannot justify the purchase based on current performance. They owe too much money $1.346.7B in long-term obligations along with other debt. The interest payments will be unbearable, especially as their core business operations are now unprofitable due to inflation. Adios Mios, and their debt trades at $74 for every $100 of debt yielding 18.732%. They redid their financing so they only owe ~$23M in 2023 which they can likely pay off, then have a breathing spell until 2025. That is not what we are worried about. Assuming they can pay their debt, tighten their operations, make their interest payments, and carry on, how likely is it that trade partners will finance new inventory? Once their trading partners stop extending seasonal credit, then they have to make use of their $135M in available borrowing capacity (SEC FILING HERE) which won't last long. We hope they make it, but cannot invest our money in their stock. We are still hopeless romantics with money invested in a biotechnology dream of the company that cures cancer, solves obesity, and helps those with chronic skin rashes due to inflammation. Everyone has to have at least one dream, and ours is here in Corbus Pharmaceuticals. I think this stock is equally likely to be $1.00 as it is to be delisted by 12/31/2022. It trades at $0.33 as we write this. Now, what we realize is that there are stocks of companies that make a profit which we should be analyzing. They may not have a huge Twitter following and we may not get MEMEs or .GIFs posted with apes or Leonardo DiCaprio. This is disappointing to us, we like seeing those. To be continued while we analyze one more 'troubled' company. So far, so good actually.

In today's premarket video, we discuss $BBAI in detail, and we review the market. The open for US Equities looks strong based on global markets advancing and the futures.

We discuss the strength in fixed income, although the same pattern in stocks where lows go lower. So, continue to watch 'falling knives' but don't try to catch them yet. FOMO is a cost effective strategy, as your downtrodden stocks are more likely to be cheaper in a week or two.

We end our video sharing the three 'best' portfolios to own based on our model run last night. These would be purchased and held equally (say $100 apiece). These will do well today if the market stays green and rises on this options expiration day.

We also look at the variance of the market price action. $SPY which is the S&P 500 Equity Index has rising variance. It is 1.25 x 10-4. The overall set of 2000+ stocks with positive fundamentals has a price variance of 1.37 x 10-4. The stocks with weaker fundamentals have a variance of 4.2 x 10-4. This is quick, anecdotal evidence in the data that says to buy and hold stocks in companies that are profitable and perform well. You can still make profit by investing in turn-around stories but it is easier, calmer, and more of a hands-off strategy to invest in strong, sound, profitable companies which generate strong cash flows from operations. It is funny that we feel so 'stodgy' or 'old' when we say this publicly. However, it is true. You sleep better at night when your money is invested in companies that make a profit, generate cash from their operations, and pass all the other data validation steps we have in place to help ensure investor protections and liquidity. Good luck to everyone in the market today. Jeff

Remember, if you watch to the end you will see our three portfolios that were picked by our CQNS model to go up today if the market stays green. They should outperform the $SPY over time even if the markets continue to stay choppy (lower risk and higher expected return).

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure Inc. May 20, 2022 It feels like we are on the eve of a special day today. It is Friday, options on individual stocks expire, and we are finishing off a difficult week in the markets. There is little news of significance other than inflation rages on, and our US Federal Government is taking a very cautious approach to making changes.

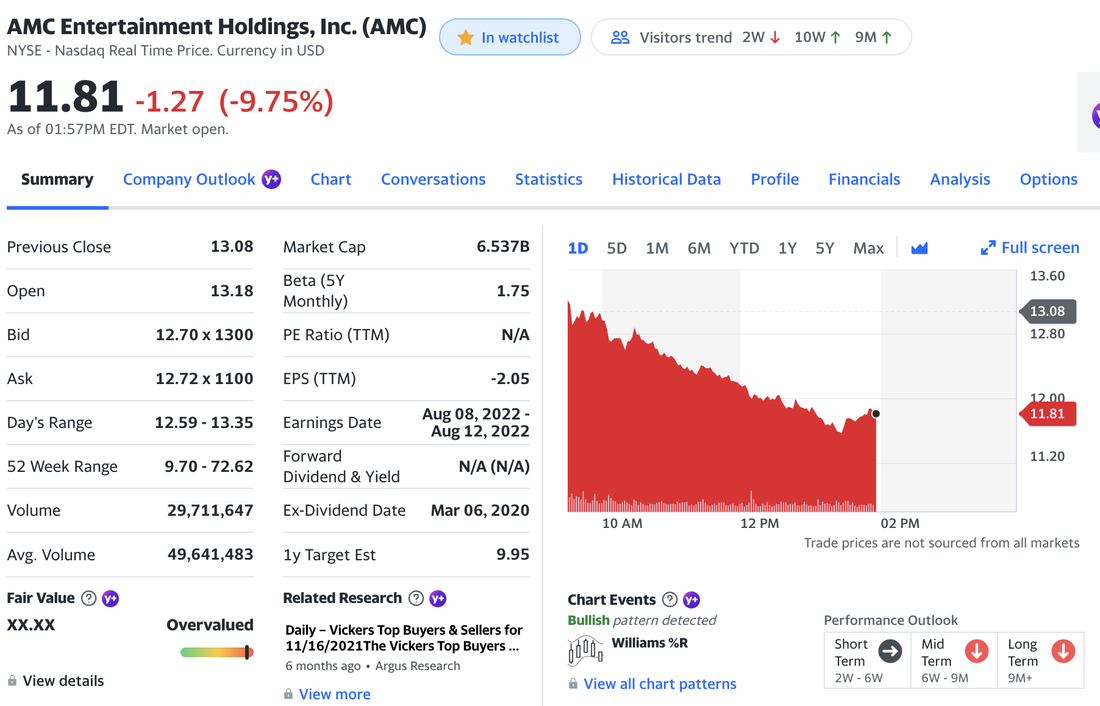

Yesterday, we stepped into the world of MEME stocks and the lure of easy money. After spending a day doing research we realize that the stocks being pumped do not have fundamental values to support increased prices. They are being promoted on the belief of a brighter future, or the lure of class struggle, or truly meaningless tweets with funny pictures. Today is a new day. We tightened the filters on our analysis to incorporate even stronger fundamental stocks. No, AMC Entertainment is not worth $13.06 per share. We would pay about $2/share.

Here are the reasons why, and a video where we discuss it openly and frankly. AMC: 516,820,595 shares outstanding Their fundamental movie business loses money at Q1 volumes.

I have a Gold and Silver mine to sell you… AMC purchased 23.4M shares of HYMC and warrants (one of each). A week before the purchase the shares were worth about $0.30, or ~70% less expensive (not including the warrant which is now trading at $0.25). This is a terrible purchase. Hycroft runs an open pit gold and silver mine in Nevada that loses money. They have a shareholder’s equity deficit of either $2.2B (total) or $4.7B (tangible assets only). They have some timing issues with their 2023 liabilities as well. They spent $300M in CFFO in Q1 2022, and about the same amount in Q1 2021. Their operations bleed cash. We know that as labor costs increase, the losses will be higher unless they can raise movie ticket prices. There is an awfully large amount of debt, around $5.6 Billion Dollars. Maturities are owed in 2022, and start up significantly in 2023, 2024 and 2025. They issued some new 2029 debt (7.5% interest) to pay back earlier maturing debt. 7.5% cash interest = $70M / year in interest expense. This is only ~20% of their debt. Some of their debt costs much more in interest, and some a little less. They have $1.2B in liquidity, but their operations burn $300M / quarter. Simplistically this gives them 4 quarters before they need to borrow more money, or sell more stock. Their business is seasonal, so this isn't quite right, but it is close enough. Maybe they have 6 quarters because Summer is a good time for movies. In summary: Negative net worth Negative earnings and cash flow. Large-scale debt they cannot afford to pay back Necessary to dilute the equity further to cover losses and maturing debt. Investments in an open pit silver and gold mine that loses money (in Nevada). This company is significantly over-priced at $13.00. If it were our money, we would pay $2.00 for the stock. We would continue to streamline operations, increase viewership, and focus on reducing the $5.6B in debt. UPDATE: The next day AMC Entertainment is trading at $11.81 when we checked at ~2pm ET. We are not surprised. Only another $9.81 more to fall to hit our price target of $2.00. There are many more new lows than new highs across corporate fixed income and US equities.

This means that if a stock is down, it is likely to keep falling lower. Few stocks are reaching new highs. So, FOMO is a cost effective strategy still applies. If you like a down-trodden stock and feel you have to have it. Write it down, do some more due diligence, then wait 1-2 weeks. It will likely be cheaper then. If not, there will be many other cheap stocks to choose from. GLTA

$CSCO down 13.4% and $HPE down 6% in sympathy. Cisco Systems saw flat revenue, 7% GAAP earnings growth, and tight execution. Weaker forward guidance (rev down 1 to 5.5% in Q4). sec.gov/Archives/edgar… No news from HP Enterprise.

May 19, 2022 Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc.

We are looking for potential runners today (the bottom line) as well as doing a top-line market scan. Top-line: Yield curve still positively sloped, but yields are down. Short UST bills yield less, lowers bank account interest. 30 year UST bonds had a pretty big drop, almost 10 basis points or 0.1% Corporate fixed income: Strong day yesterday for investment grade. More new lows than new highs, dramatically more. US Dollar has stabilized with the Euro. Euro/Dollar has been flat lately at 105.36 No material news. New jobless claims up slightly to 218k. We expect this number to spike if recessionary fears come to reality. As companies have lower profitability, they will layoff employees. Futures for US Equities more RED than when we started the video, over 1% down for the three main indices, SPY, IWM and QQQ. High VIX at 32.30, and it is up pre market. Fear gauge is high. Gasoline came way down. $3.57, or down $0.43 in the past few days. This is good for US consumers, for Main Street, but not sure how this happens. Europe and Asian markets were down pre market. Lots of markets down 2%. China mainland was up 0.3%. Jakarta, Indonesia has been strong the past few days in a relatively tight range. Worth a look. We think big money is putting the puts back on after having taken them off earlier this week. Commodity futures are down in energy and cotton. Good news for the regular investor. Gold, silver, platinum are up. Bond futures up (yields down) Overall: Equity Factors, growth was down more than value yesterday. Less to fall, less belief in stock prices for value than growth. Tech, consumer discretionary, and consumer staples are all down 5% to 10% yesterday. Growth is down. Melvin Capital shut down voluntarily, they were running MEME stocks. We expect other money managers will have to drop out as well, as equities and fixed income drop. This type of volatility is not good for money managers who are caught on the back foot. Crypto looked ok, up 1%. Wale Tokens are down 50% since we started following them. You can buy 20 billion wale tokens for less than $4,000. The Bottom Line: High Volume, Low Price: Search for money losers on volume up (4x average volume) and price down more than 66.66% vs. the 253 day simple moving average. Down and active. No academic justification for this filter. We found five to look at. $EMBK $CMRX $ENDP $BRDS $OTMO $BBAI Big Bear AI BBAI no shares to borrow Up on heavy naked short volume Last 2 days Volume up yesterday, up 10x On the Bottom Line BBIG Vinco Ventures Longs loaded up heavily yesterday. Zero shares to borrow On the Bottom Line AMC AMC Entertainment Holdings Definitely an imbalance of shorts to longs. AMC GO APES! 13 short days 2 even 3 out of 5 accumulation days Moderated yesterday. Volume is up a little Very few shares to short On the Bottom Line? $LWLG Lightwave Logic, Inc. Being accumulated. Worst stock in the model, too volatile without anything behind it. Very little volume. Sleepy. Accumulation phase for this stock. 300k shares available to borrow. In accumulation phase, 300k shares available to borrow Not a lot of volume. No conviction. Price is towards the bottom. On the Bottom Line? $BRDS Bird Global, Inc. It’s a SPAC that started at $10. Big shorts 2 days ago. Heavy short on very light volume. $BRDS Only 55k shares available to borrow to short. This stock has seen tremendous selling pressures. BRDS SPAC from $10 to .78 This stock has significant short pressure for the past two weeks and the stock is down 92.2% from the IPO price. On accumulation volume, short short short 55k shares available to short 280,949,068 shares fully diluted. 270M basic shares. They earned 4 cents and grew their business. Borrowing money and used up cash. They are cash flow negative. Bird is a micro-mobility company engaged in delivering electric transportation solutions for short distances. The Company partners with cities to bring lightweight, electric vehicles to residents and visitors in an effort to replace car trips by providing an alternative sustainable transportation option. Bird’s offerings include its core vehicle-sharing business and operations (“Sharing”), and sales of Bird-designed vehicles for personal use (“Product Sales”). They have 240M shares of class A (1 vote) and 34.5M shares of Class X (20 votes per share). Since our first shared ride in 2017, we have facilitated over 140 million trips on Bird vehicles through our vehicle -sharing business. Today, Bird offers riders an on-demand, affordable, and cleaner alternative for their short-range mobility needs in over 400 cities worldwide. We believe that Bird is uniquely positioned to capture share in this market due to (i) our founder-led, visionary management team, (ii) our advanced technology and data platform, (iii) aligned incentives in the mutually beneficial operating model in which we utilize third-party logistics providers (“Fleet Managers”) to store, charge, maintain, and repair our vehicles, and (iv) our strong year-round unit economics. On the Bottom Line VRM Vroom Inc. is up 4% on average volume. Short volume has been mixed, long, then short, then long, then short then long. No commitment. Big volume days were flat, then short yesterday on typical volume. Positive gathering yesterday, accumulation. Almost no shorts left. Up 2.5% Close to a bottom. Almost nothing available to short. Probably going to run. 45k shares to borrow short now. VRM (to $3) from $1.36 Short volume dropped at this level. Looks like minimal volume to acquire it. Big load on May 10, smaller loads May 13 - 16. On the Bottom Line $MKD Molecular Data Inc., just announced another 100M shares in ADR for a maximum offering price of $0.05 per share. This is dilution. Could be to enable trading and liquidity in the stock. MKD just had 4 distribution days where shorts were 55% up to 60% short volume. Very high volume on 5/17. I wonder if someone knew the 100M ADRs were coming, as 37M shares traded in the FINRA dark pool. Probably yes, they shorted forward. 350k shares now available to short, down from 2M in the past 30 minutes. This must have been shorted to the moon on the news of the dilution. Not on the Bottom Line due to dilution. Raw analysis: No Bottom Line assessment: $BKKT Bakkt Holdings, Inc. is in accumulation phase on lower volume. 6 days, and the last day was the weakest. 200k shares available to borrow. Stock is up 1% on low volume. $CRBP Corbus Pharmaceuticals is not at risk of a short squeeze. CRBP shares available to short rose from 900k to 1.3M. $RIBT Yesterday's thoughts. Looks poised for liftoff. Low of $0.30, then $0.40, now $0.72 on significant volume. Looks like the shorts piled in last week on volume, and yesterday was the first day of even trade. 800k shares available to short into AH. 30.58M market cap, 50.25M public float. Loses money. $INDO Indonesia Energy Corporation Limited Yesterday's thoughts. Big dark pool volume lately, and shorts > 50% the past 2 days on high volume. Low volume today $UPST Upstart UPST is down 6.5% on average volume. Closing things out. We are still red in all US equities. Run away…VIX is up, dollar down, gold and silver up. Some of the stocks we looked at have a chance to run (either up or down). By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Today’s pre market action in US Equities

There are two stories to tell. Two markets. We normally work in the top-line market. The headlines. Macro-economics, money flows, fixed income, US equities, and look at the major indices (S&P 500, NASDAQ Composite and Russell 2000). Today, we also looked at the bottom end of the market. The stocks that are down, and trading higher and lower seemingly on emotion or inside baseball. There is more to that story as you will find out. Retail stocks are falling in pre market. Our CQNS UP model picked fewer stocks and we see a smaller edge. Our model ran very deep, reached equilibrium, and picked 7-10 stocks. Weakness in the markets. SPY at 404.60, and IWM at 181. WMT at 129.26. Twitter was negative this morning. Gasoline is down $0.06 to $0.08 since yesterday. Markets are flat to down globally. US dollar is ok, but USD/EUR is 105.3 and was as low as 103.9 recently. US dollar is strong. Fixed Income (corporate) had a very bad day today. We found news. Retail sales update by the US Census:

Bureau of Labor Statistics publishes the Consumer Price Index. Energy is up 30%, and food is 9.4%, with overall inflation (all items) at 8.3%. Walmart $WMT Stock Price analysis Originally during this market correction, the discount retailers went up significantly. This seemed a safe place in the market. Walmart had flat number of transactions, with average ticket up 3%. However, earnings fell 23%, and Walmart lost $3.8B in cash flow from operations. Why, the cost of gasoline to transport goods is up, the price of goods themselves are up, and the cost of labor went up. Walmart lost ground vs. inflation, which means customers either substituted cheaper goods, or they bought fewer items. They cut back. Was Walmart a good buy this morning? Our answer: Is Walmart a good buy at $129.50? It might be, but the odds are that the price will drop further in the next 1-2 weeks. FOMO is a cost effective strategy in this market. It doesn’t hurt to wait before you buy a downtrodden stock. US dollar is up slightly, and the VIX is under 30. We expect a small move. God help us if we get a big move (when VIX is low). Crypto is down pre market, which means crypto-related stocks will be down too. Fixed Income Fixed Income is an important part of everyone’s portfolio and investment plan. Everyone over 18 years of age should hold some fixed income. The US Treasury yield curve looks healthy and upward sloping. Short-term money has lower rates, but longer-term debt (bonds) are getting cheaper, with higher yields. Corporate Issues Traded: 3:1 declines to advances 5:1 declines to advances IG High Yield and Convertibles were around 1:1. The highs to lows are still dramatically skewed to new lows. Corporate IG bonds 1:100 new high/low ratio. This is extreme. Fear of missing out (FOMO) is a cost effective strategy for down-trodden fixed income issues too. New lows beget new lows. It pays to wait for the stock and bond market crash to play out. Fixed income, corporate, investment grade was the worst performing grade yesterday. News of the day: First item of substance is negative. US Housing starts and permits plunge, down ~3% (0.2% in April, and -3.0% in March) This does not bode well for construction labor, lumber, and home improvement stores. This is partially due to inflation, partially due to mortgage prices, and partially due to Main Street weakness. COVID 19 is up in the US, but not dramatically. Trending higher. Global Markets: Asia was down, mostly. Europe is down. Turkish stock market is a model for equities in a country with high interest rates. Major US equity indices are up, generally, on lower volume these past few days. When markets rise on lower volume, it is a lack of conviction. Also, all three US indices (the ETFs) are down for the year (excluding dividends). Did you know $KKR has negative cash flow from operations. That’s super interesting. Same with $ARES Ares Management Corporation. Discount retailers: Target down 25% Dollar Tree down 6% Dollar General Costco Walmart All down pre-market. This is a Main Street bloodbath. QED Other pre-market industries: Trucking RED Semiconductors and Chips RED Money Managers RED Crypto and Mining RED The US indices are down pre-market (futures are down). We also checked out our ‘shitcos’ or stocks that have fallen significantly in this market. $AUTO Autoweb, we like the business. Going bankrupt or MEME: Good list today for shorting? BBAI BigBear.ai Holdings, Inc Low Volume, 100 shares available to short. Been unshortable for the past few days. Low volume today BBIG Vinco Ventures, Inc. High Volume: No shares available to short, solid volume, especially in FINRA dark pool. Today, it is running up 12%, and no ability to short it down. High volume today. INDO Indonesia Energy Corporation Limited Big dark pool volume lately, and shorts > 50% the past 2 days on high volume. Low volume today EAR RGC IMPP LWLG Lightwave Logic, Inc. Reasonable volume. Short available to borrow down to 200k from one million yesterday. Low volume today Overall strategy: Be careful in stocks today. Be careful. Don’t get drawn in by a stock that is down in price. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

||||||

RSS Feed

RSS Feed