|

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure Inc. Good morning to my cherished friends, clients, followers, family, and friends. This morning the markets look weakly higher. There was some news this morning to share, and we see markets that opened slightly, and weakly higher but are now flat. 1. The Case-Shiller US National Home Price Index is moderating. Housing prices were rising quickly, and that curve is now flattening. We think it is because of increasing interest rates on conforming 30-year fixed rate mortgages. Fewer home purchases likely means less spending in the economy. This is likely not the case for rental properties (in our opinion) which we think are driven by different factors. Rents are likely to move higher due to previous buying up of smaller, rented homes by large investment trusts while prices were lower. 2. The news in ZeroHedge and CNN were, well, about general interest topics. Lots of domestic news about violence, politics, medicine and just regular stuff. Not much discussion of markets or the economy In our words, the fix is in and our attention is being diverted away from money and markets. It could be rational behavior by those operators who show what is in demand. When we enter a bear market (again), people lose interest in stocks and investing. 3. Market breadth was very, very negative and bearish in both US corporate fixed income (bonds) and equities (stocks). New lows were significantly larger than new highs, and decliners outnumbered advancers. This is another sign of a bear market (yesterday's results). 4. Energy prices are down in the US. Gasoline was trading close to $2.50 per gallon wholesale, and is now at $2.61/gallon. This is a significant decline from a few weeks ago, and will help give us a reduced inflation reading (CPI). Oil is also trading lower, down to $90.50. 5. Currencies (non-US) are trading lower (meaning less valuable when compared to the US Dollar). We spent time in our morning video discussing the Japanese Yen at 138.50. We read that the Chinese Remnbi is also around 7.0, which is also very weak. These two export-focused economies are keeping inflation out and driving their export markets by lowering domestic income from export-related businesses. It also increases the price (and lowers demand) for imported products. 6. Copper grade #1, in contracts of 25,000 pounds, is trading lower at around $3.50 / pound. This is a sign of weakness for economic inputs. We also saw silver and gold trading lower. This will hurt the price of $FCX, which is a large copper producer. 7. Bitcoin is trading around $20,000 again. Dogecoin is around $0.063 8. Interest rates for savers in accounts of $100 or more have reached 2.20%. This higher saving rate helps lower the expected return for risk-based assets for the retail investor class.

9. The Federal Reserve Bank is not really tightening the money in circulation. They are not really doing quantitative tightening (QT) like they said they would. Sure, the amount of assets the FRB has liquidated is positive since April 2022, but it is $114B. That is miniscule and most likely not significant. We also discussed how the FRB is lowering the prices for MBS just as they might have to sell some. This is a market subsidy to market makers paid for by the taxpayer (which is you and me). 10. The Consumer Price Index (CPI) reading by the Bureau of Labor Statistics (BLS) will likely read lower and slower growth during the next reading. The largest component of growth is energy prices, and those are falling (at least for gasoline and oil, but not for coal). This recent fall in energy will support a 'friendly' inflation reading. Well, that's all folks. The US equity markets are trading down today. We will be focusing on building out a CQNS UP run model portfolio today. Stay tuned for more updates!

0 Comments

By Jeffrey P. Cohen

Investment Advisor Representative US Advanced Computing Infrastructure Inc. Chicago Quantum

Update: 1430 ET today: The market fell hard today, and indiscriminately.

The market looked stronger this morning pre-market. However, it quickly headed lower. The market fell after Federal Reserve Board (FRB) Chairman Powell gave a fire and brimstone speech. We listened to it live and in replay mode, and were assured that the FRB would maintain its fight against inflation (bringing it back to 2%) with a tenacious and relentless focus, regardless of the cost to our society. This caused the financial markets to teeter on the brink. The US Dollar rose, interest rates (the long ones) rose, global stocks fell (except mainland China), and it looked like the bear market was in full bloom. High risk (high BETA) stocks fell dramatically. However, today, the picture looks different. It seems like things are settling down. We are worried about the size and amplitude (dramatic) financial markets movements based on a speech that was most likely a distraction meant to send the markets lower. It cost us a significant drawdown. We were uncomfortable for the weekend and Monday, but survived to trade another day. Now, Copper and other precious metals are back in their range. The US Dollar has moderated and interest rates seem to have calmed down (but they are still elevated). We made a video, and hope you like it. It is early pre-market, 0700 ET this morning. If you like the video, please hit the subscribe button and drop a comment. It helps us spread the word, since we are not paid to make the videos, nor do we advertise them. When you subscribe / comment, it tells YouTube that this is trusted and safe content that they can recommend to others.

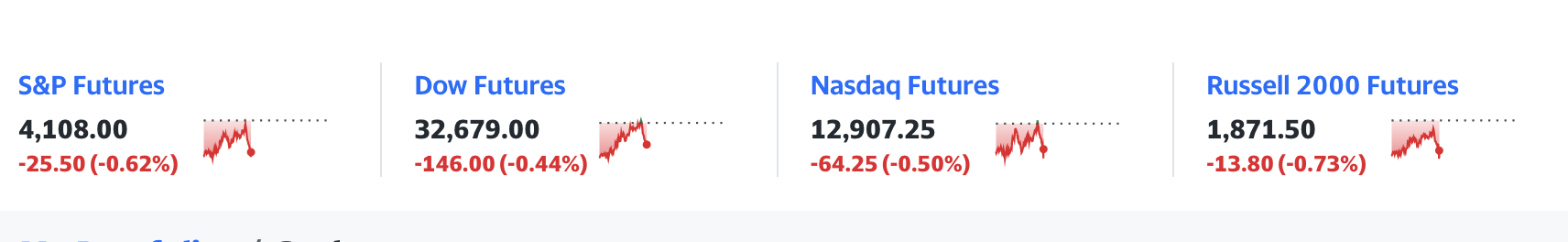

Good morning, what we see are stocks trying to rally with flat futures prices. However, we saw a strong US Dollar and rising interest rates (yields on US Treasuries). We see an elevated VIX which means the price of downward protection is elevated, up about 25% over the past week. Commodities are mixed, but the pressure from the US Dollar and interest rates will be bearish on US equities. GLTA Enjoy our video below. In it, we discuss Verizon Communications $VZ in great detail. We share what we saw when we decided to go long the calls on $VZ, and why the stock price dropped this week. By: Jeffrey P. Cohen, Investment Advisor Representative US Advanced Computing Infrastructure Inc. Chicago Quantum Yesterday was a tough day in the markets. We saw it trending significantly lower in pre-market, and by the time the markets opened at 0830 ET, the move was largely completed. Thank you Finviz.com for the visual below. It does not mean that the markets were silent during the day, as we saw our investments move significantly during the day, but the die was cast early. In full disclosure, we added a long and a short position on Friday, and sold our short position Monday afternoon for a 2% profit. It was good work. However, our long position lost more than the gain and we added to our long bet with 80% of the profits of the short trade. This is what most investors will do, add to their long bets and 'buy the dip.' We did, fingers crossed. No bling bling today until our ultimate trade settles (hopefully higher). The market flip-flopped this morning in the past hour. Interest rates moved negative. US equity futures moved negative. VIX: negative. Semiconductors and chips are more down than up this morning. The market moderated this morning, with 17 minutes left before market open. The trades that looked obvious last night are mixed this morning. We will be watching the screens today. The markets are interesting and show some conflicting data this morning.

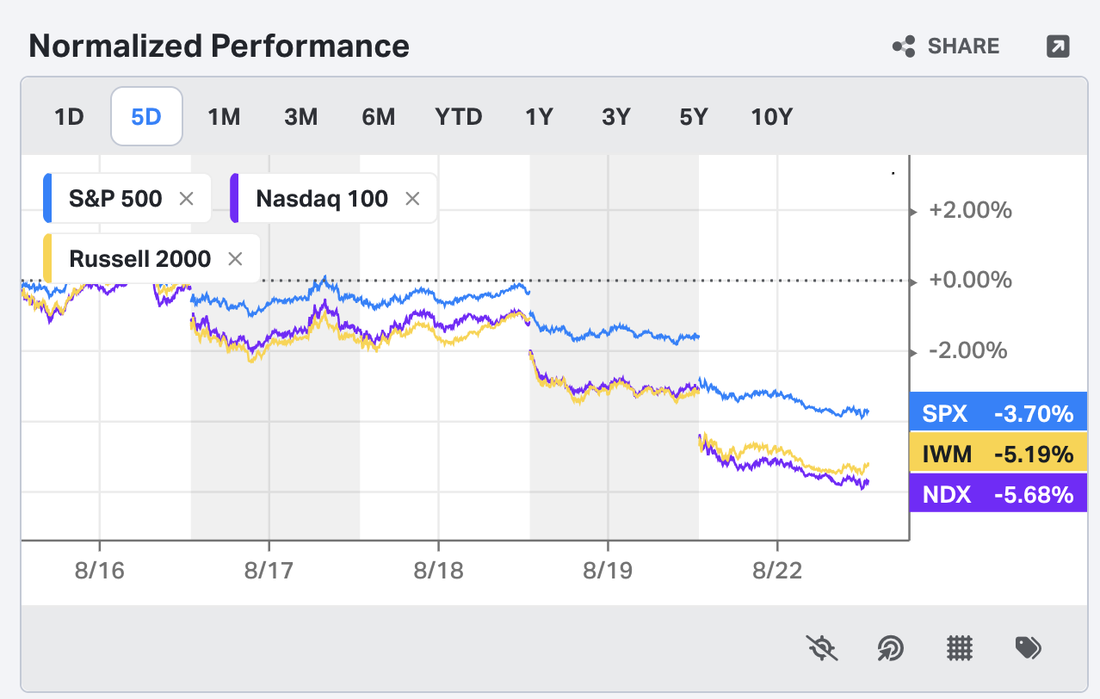

Interest rates rose this morning in the past few minutes (all pre-market), and they were down earlier. Most economically sensitive sectors are trading higher pre-market. The US Dollar is on fire, up against most currencies. However, the market is on a new downturn leg, down 5% over the past five days. Watch out, this could be the beginning of a new movement lower. I do like that the pre-market action is pointing higher, which could be just normal trading or a Bear Trap. By: Jeffrey P. Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Ok, we see weakness across the US and Global (non-US) stock markets. Even Jakarta and Malaysia were down yesterday. However, mainland (PRC) China stocks were up. Europe is down. The cost of insurance is up significantly, as measured by the VIX. We get the feeling that traders are betting against US Equities using the Nasdaq Composite 100, The S&P 500 Index and the Russell 2000 Index. They are simultaneously buying puts, which will profit as the market drops (so, they make money both ways, actually 3 ways). Profit on the shorts, the puts and the insurance, and if they bought the VIX, they make money on that too. Who is losing today? The individual retail investor who bought risky stocks. You know who else may be losing today? Bank depositors. The top 10 US banks are trading lower in pre-market. Not sure why, need to take a look. Good luck in the markets today. Be careful, we have not seen a down Monday like this in a while, and it could define the week. Other notes we took while recording our video: 1. Yield curve not really inverted anymore, the long bonds are dropping. 2. Corporate bonds, especially investment grade, are dropping (both yield, and risk) 3. Economic metals are down, slightly. 4. Energy is flat this morning. 5. Long UST Notes/bonds are flat. 6. Yahoo Finance VIX is up 18.25% this morning to 23.13. FinViz VIX was already at 24.50 last night. 7. Fallon: Fibonacci Retracement Support level markets were down 23.8%. Fibonacci circle is found in nature as being a very efficient shape. Snail is a fibonacci. If you like Gold, NEM Newmont Mining. If you like Copper, FCX Freeport McMoran BX Blackstone $103.30 The Carlysle Group CG: $33.56 Narrative: Economy is doing great. Lots of Jobs. Inflation still a concern: FRB: Continue QT and Interest Rate Hikes Stock Market: US Equities: Will start to fall again Bond Market (Corporate): Will also fall US Treasuries (short-end will see higher yields) and (long-end: market will decide). Short UST: unchanged 1-year UST are up to 3.3% Mortgages are up 30-year fixed conforming: to 5.6%, and MBS are down sharply. Quantitative Tightening Pattern (up and down) - rinse and repeat. Each time, it goes lower. Silver under $20.00 an ounce. Gold at $1,743 / oz Yen 137/Dollar Bitcoin $21,250 (Hit $20k before $30k) Walking Wounded and MEME stocks are down PM Top 5 US Banks are down, PM Money Managers: Down Retail is down PM FLEX: Flexsteel industries: up PM Party City hold PRTY Up Coal is up Bitcoin related stocks are lower: Physical mining - lower This is the morning that people turn bearish. VIX is up 4.55% this morning. (Finviz) Pre-market: RED RED RED Why are all of the top 10 US Regional Banks lower this morning? - Recession Fears? - Housing Fears? - Interest Rates / Interest Income? - New Law / Politics? - USD - Stretch Her name was Darya Dugan. Looks like a Red Sparrow, which would be a valid military target if true. The Ukrainians are fighting back. VIX Climbing is a signal for short-term pressure against US Equities. By Jeffrey P. Cohen, Investment Advisor Representative

US Advanced Computing Infrastructure, Inc. Chicago Quantum By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Big day today. Lots of movement if you know where to look (in pre-market). Generational wealth being created and lost in pre-market and expected throughout the day today.

In today's video we focus on options expiration and a few stocks that are really moving in pre-market. We don't see the kind of news in the mainstream social media, or news media (online) that gives us a reason to trade either up or down. The narrative feels managed and politely positive. That is ok with us, we like polite society...however, this is not how you manage money or your investments. Stocks are showing red pre-market. Down about one percent. We have not seen this in a while and it surprises us. The VIX is trading where it landed two days ago, up about 15% to 20% from the low of 20.00 it reached recently. There is not much fear in this market despite almost retracing half the losses of the recent bear market. The US Dollar is super strong. Interest rates are rising and falling multiple times in a week as the market tries to decide whether we are in a recovery, a recession, a tightening, a pivot, and whether inflation rising in China and Japan just means that this is a global contagion of 'free money' and we all have to work together (sink or swim) to recover global tight (and valuable) fiat currencies. We don't know whether firms are hiring, firing or just standing by. Production and orders are down, inventories are being used up...but not sure whether this is just a short-term malaise as the Summer wears on. Cannot tell long-term economic direction today. So, Good luck out there. There are individual risky (high BETA) stocks that are down 5% to 15% pre-market at the time we made our video and those options values are moving dramatically. Options premium is being burned and earned even before the market is open. We noticed so many stocks that are trading actively this morning. We discuss Corbus Pharmaceuticals stock trading action today. It was exciting over the past few days, and the large, million share bets sent the stock down from ~$0.30 to ~$0.215. Very risky moves, and looks like there was a big short again this morning of over 1 million shares. We also see significant pre-market movement in Verizon $VZ lower. Hallador Energy Corporation $HNRG is trading higher this morning, up to $7.00 per share. Corporate bonds were lower yesterday and Mortgage Backed Securities lower today. Likely in part due to slight weakening of risk-free US Treasuries, and the rest is market / firm risk. Markets looking flat today. Bond Yields not moving much. Recession fears seem to be abating. Most industry sectors are mixed this morning. There is not a firm commitment of direction either way today. Enjoy the video. Not investment advice. Good luck to all! GLTA! Jeff Disclosure: At the time of the video, we are long the common of $AMS and $CRBP and short the common of $HNRG. By: Jeffrey P. Cohen, Investment Advisor Representative & President US Advanced Computing Infrastructure, Inc. Chicago Quantum Good morning, it’s August 17. We wore a RED shirt today because we thought the market would drop today. We are not happy that it is falling, but we are in a bear market and this is a good reminder. Friday, Options expire on individual stocks that have them. VIX was up 17% last night. People were buying downside insurance on their portfolios. BBBY up pre-market. There is a market to make money in individual stocks that is independent of the direction of the overall market. It happens in the summer (things are slow), kids off school and college, low liquidity and few people around. Quiet times. We heard 2nd hand (hearsay) that the Federal Reserve / US Treasury bought its own 30 year bond issuance. Bought $38B of it this week. By doing that, they are keeping yields lower and raising the price of the bonds. US Treasury PUT or a floor under bond prices. Corporate Fixed Income was down. ROTATION ALERT Market Sector Rotation from Risky to Consumer based and lower-risk names. Risk off on UST 1 month yields down 1, 10 and 30 year UST yields up. 10-year yield is up significantly. DD: latest 10-year auction. Bond futures are down (hard to tell).1/4 to 1 down. The geo-political narrative has changed in the US mainstream media. Everything is bad economically, and there is no news internationally except that Europe will suffer from crushing economic hardship. Ukraine Russia news is hard to find. Taiwan China news is impossible to find. Inflation is not in the news either, must have been fixed by that new law. News is on the drought globally. Liz Cheney (love her dad, Dick Cheney) lost her congressional seat in Wyoming. She was not true to her party, and she paid the price for that disloyalty and lack of grace. EUROPE stocks down significantly. VIX moderated. Big bets were made in Asia last night, and again this morning after the market opened. Asian markets bought the puts against the SPY Asian markets up significantly last night, and spent some of their earnings to protect their US equity positions. Global players doing that too. Easier to trade Asian hours, probably. Equity Breadth still solid. 80% trading above 50 SMA 34% above 200 SMA, bear market rally 2.5:1 new highs to new lows Bitcoin dropping a little US equities dropping a little. We might add bitcoin to our runs to see the price relationship to US equities. US dollar is up Housing inventories up, new housing construction and permits are down. Buying are walking away from house contracts. Housing is bearish today. BBBY $28.35 seems very high for this stock today. Not sure what is happening. IMO: Chicago Quantum: We need to ‘end or win or negotiate a settlement’ to the Russia Ukraine crisis. Ukraine can target Russia's energy infrastructure without taking a single civilian life in the process. $FMNB made it to $15.00 per share. Congratulations. Now, the day is well underway and we are just passing Eastern Time Zone lunch hour. Stocks that are risky and high-BETA have dropped significantly today. This is not a good day for risk assets (after they have risen 100% or more since the June 16 low).

Our personal portfolio is down and the CQNS UP run picks are down as well. Good luck to all. By Jeffrey Cohen, Investment Advisor Representative & President US Advanced Computing Infrastructure Inc. The markets continue to rise, but this morning pre-market the day looked slightly weak for US Equities. We mention: $HNRG $AMS $CRBP $EJH, $VZ, $BANF, $FFIN, $WMT (of course, they reported earnings), a bunch of US banks, $KRE, crypto, cannabis, chips and semiconductors, computer makers (only a few left), money managers, and other proprietary indices we use to track key sectors. IMO: Markets expected to be slightly lower today. Slow, slightly down US equities day in a very broad-based rally. S&P 500 up to 4,294, VIX steady at 20.45, oil, gas and other commodities pretty flat.New highs to New Lows 3:1 (positive breadth). Energy down Industrials up Risk is up B2C struggling Lending is up Big Tech is up Asian markets down or flat. Except Jakarta, Indonesia and Malaysia, New Zealand, S. Korea which are up slightly. Europe is higher this morning between zero and one percent (markets were still open). USD stronger. The Eurodollar is approaching 1.00 (at 1.0127). And Japanese Yen at 134.42. Bitcoin at 24,050 (still between the 20k and 30k support level. A small downtick in an upward trend from 18k. UST Interest rates slightly higher (at all maturities). Still are as we write this. Market Breadth turning more positive: - Corporate Fixed Income (US) is up 2.3 : 1 (A:D), new lows 1.3 : 1 vs new highs. - US Equities: 3:1 New High : New Lows - 80% above the 50 SMA On the geo-political news front, we see a few interesting developments. Global instability is rising, and our latent neocon roots are tingling. China has again demonstrated its military power near Taiwan. Ukraine strikes back into Russia at their nuclear facility in Kursk, in a strategy we suggested a few months ago. Took three tries according to the Russians. Russian military bases erupting in flames based on 'accidents' and saboteurs. We hear no talk of recession, and see no writing of recession or economic malaise in the US mainstream media. Everything is awesome, the markets are rising, and midterm elections are right around the corner. The yield-curve inversion is fairly light, only indicating a lower long-term yield on risk-free money. No short term credit crunch, only FRB policy tightening. What does this mean for us in the markets? Stay tuned for more insights...

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Chicago Quantum (SM) We had a good time with this morning's video. We took some of our earnings from Friday and invested them in BLING BLING for our video. YouTube Livestream Video Link: Here BIG BEARISH BETS this morning US Equities selling pressure increasing into the open. Those bearish bets petered out by lunchtime. We are attempting to profit again this week and not sure our back or neck can take another 'investment' in bling, but we are willing to try. Big smile on this one...and we do share our trade. We bought Verizon $45 calls when the stock price dipped below $45, and we sold them when the price rose above $45 for a 3-day, 8% gain. We hope to rinse and repeat today. It didn't happen, Verizon moved with other consumer non-discretionary stocks higher, while energy and economically sensitive stocks (and high BETA stocks) fell. We noticed about 15 macro-economic pieces of news this morning. They show a mixed stock picture for today, Monday. After the market opened, and through the morning, the market has been up and down. The morning was a risk-off morning where riskless stocks rose, and high-BETA stocks fell. We are in wait and see mode.

Also, remember that Friday is options expiration for individual stocks (which we trade in). This means that stocks and options 'come together' at market close on Friday. Expect above-average volatility. Crude oil down almost 5%, or $4.48 to $87.61. This is a large drop, and is taking energy stocks down with it. It is either a sign of dramatic increases in supply (moar drilling), or diminished demand. Not future expectations of demand, but current demand. Global demand for energy is down. Either that or more people bought, rented or borrowed electric vehicles than ever before. We rode our bicycles yesterday and saved a little gas. Recession 1: Recovery 0 Economic Metals fell, but are still at elevated levels. - Copper down $0.11, still elevated. - Silver down $0.50, still elevated. Recession 2: Recovery 0 Short-term interest rates are higher, and long-term interest rates are lower. This will make longer-duration investments more affordable, but could reflect tightening of the money supply and more difficulty rolling over current debt and loans. Things could be getting tighter out there for companies that need to borrow money. Long-term, long-duration, Risk Free, UST Interest rates are lower on this Monday morning. Ultra short money at 2.2% (same as a bank account with $1 minimum balance). Bank accounts at 2.5% Recession 3: Recovery 0 5.33% 30-year fixed mortgage. 2% fees 2% points 2% margin for the banks (3.33%) for the money, plus costs. 10-year UST 2.8% plus 0.5% in loan origination costs. MBS looking strong. Gold under $1,800 Bitcoin still in the range at $24.200 VIX still in range at $21.00 VIX at 21.50, 21.55 STRONG US dollar. The US Federal Reserve Bank is tightening money supply, along with the US Federal Government's fiscal policies. This is good for other counties to sell goods to the US, and bad for the US corporations that sell abroad. - Eurodollar at 1.02 - CNY to USD: 6.77 on a rate cut in China. - Chinese currency is weakening, makes their exports cheaper to US buyers. Recession 4: Recovery 0 This is good news for US consumers. Gasoline down $0.12 per gallon wholesale Recession 4: Recovery 1 Verizon debt weakening, higher yields. $VZ stock has been down lately (almost 10%). We think it could recovery, but expect a bumpy ride. Verizon stock rose today with other consumer defensive stocks. Argentina raised its main rate of interest to 69.5% to combat inflation of 70%. Wow. China lowered its policy interest rate a bit to stimulate domestic economic demand. They don't have inflation because (in part) they did not utilize fiscal 'give-aways' to deal with COVID 19 slow-downs. I remember reading about small subsidies for food delivery, but that was all. This is not the case in NATO countries which resorted to fiscal stimulus. Recession 4: Recovery 2 Red day in the futures pre-market. QQQ -1/4, -4/10 SPY -1/2, -6/10 Russell -2/3, -3/4 $BBBY - STONK that is up 20% this morning. $WMT earnings (watch for the news on US and Global consumer behaviors). By: Jeffrey Cohen, Investment Advisor Representative & President Chicago Quantum (SM) US Advanced Computing Infrastructure, Inc. It's a 'so so' day in the markets pre-market. Not much action at all. Things trading in ranges, stocks up and down, commodities, interest rates and currencies all in range. Bitcoin up and down lately, but still in support ranges without much commitment in movements. Just a slow morning on a Summer Friday. A few things we saw: The stocks are mixed pre-market. Banks are trading higher today. The recession must be over. Retail stocks were up too, showing that people have more cash to spend. Gasoline was down ~$0.06 pre-market (wholesale, 42k gallons), and so trucking firms were up pre-market. However, cannabis is up this morning, likely on Michigan's revenue read-out. I read that alot of people bought alot of cannabis last month. Medical was ~$21M, and recreational about 9x that amount. People cannot afford to drive or eat, but they can get high. Makes sense...and likely contributing to the significantly lower productivity rates in our non-manufacturing economy. (manufacturing you have to be there, and likely drug tested especially if operating heavy machinery). Interest rates are up and down, but in the range. Lots of jerky movements, but not sure anyone is paying attention. We did see FRED Fed asset holdings INCREASE by $5B this past week. This is not quantitative tightening, this is quantitative easing at the margins. We were happy to see one month of inflation being under control, but it is definitely too early, in our opinion, for the FRB to start loosening the purse strings on monetary policy. Too early. Good breadth yesterday in US equities, with more new highs than new lows, but the opposite in US corporate fixed income. New lows continue to outpace new highs, but high yield was more up then down, and investment grade was more down than up. This shows an increase of risk on the balance sheets of US companies. We are still upset about the new corporate alternative minimum tax in the Inflation Reduction Act bill that passed the Senate on a party-line Democrat vote. It will hurt large corporations, and transform how companies report earnings. Gone are the earnings smoothing and earnings boosting accounting methods. Things will get a little gloomy on income statements over the next few years if the bill becomes law with this provision. Market action over this past week has been consistent. Rise in the morning, then fade lower all day. We see it in labor-only businesses like ATI Physical Therapy. $ATIP

Also true in the coal mines of Indiana: Hallador Energy Corporation. $HNRG Get used to it. Labor already costs more and produces less in the US. Will the trend continue? Data found here. By Jeffrey Cohen, Investment Advisor Representative & Management Consultant US Advanced Computing Infrastructure, Inc. So much to discuss this morning in US financial markets. Inflation news was very positive. Not only was consumer inflation down (CPI-U) but so was producer price inflation (PPI). This gives the government a little breathing room. We noticed quantitative tightening is having the first $100B in impacts, and the interest rate hikes are of course positive in helping fight inflation. On the other side, we see the dollar weakening, which helps raise inflation in USD. Finally, where is inflation in China and Japan? More like 2% to 3%, nothing like NATO is suffering. Markets are not up this year. Despite reports to the contrary, all three major US equity exchanges are lower this year, even accounting for dividends. We are merely rising within the fall. Our model picked two dividend stocks. These stocks scored better than the SPY (S&P 500 Index ETF), and paid higher dividends last year than the SPY. This is not usual, the model was bearish in the extreme until recently. The variance of the S&P 500 remains elevated while the variance of individual stocks seems to have peaked and is down slightly. This reinforces our notion or hypothesis that the S&P 500 is a point of leverage and manipulation of the market. Big bets are made in the SPY or ES_F, and these cascade through the market. The market for individual stocks is moving more slowly, and could be indicating an end to some of the destructive volatility we have seen. It is still very early, but call this an early warning. Volatility in the stocks of money making and money losing companies may have peaked this week. With a reduced and modest 8% expected return on stocks, our model is quite bullish. Eleven (11) stocks scored better than the SPY for risk-return trade-off. For the longest time (weeks) there were none. The CQNS UP run model likes stocks in the following sub-sectors (not the sub-sectors, but a few stocks in them): Semiconductors Money Managers Large-cap tech stocks Software & eCommerce Our CQNS Down Run sees many of the same faces, but also a few new names. Some of these are old MEME stocks. Some just act like it. High volatility and no sense of direction. I guess these are good to sell options on. All hat and no cowboy. All smoke and no fire. Big, dramatic moves that don't seem to go anywhere, or circle the drain of a price of zero. There are more stocks to invest in. I remember when we started running and publishing results in our model there were 3,100 stocks that passed data validation. That number is up around 20%, and that discounts foreign HQ/located companies that we pull out of our CQNS UP run. VIX is down, below 20 this morning in pre-market trading. This suggests downside insurance against stock price declines is less costly than before. Insurance against stock price declines in the US is cheaper than before. What's funny is that stock prices are higher...but insurance against falls is lower. You would think intuitively that it would go the other way. Try this one on for size. As the variance of SPY stock price moves increases (showing larger, more asymptotic moves), the VIX or price of insurance against those moves decreases. This is an anomalous relationship and could indicate poor prices before, or a disturbance in the force currently. Both stocks and bonds are up over the past few days, although corporate fixed income is lower for those companies that already have lower-price bonds. It looks like the market is punishing high-risk companies (companies at risk of repaying their debts). We would need more hard evidence, but we can see this anecdotally in FINRA-Morningstar data and in the WSJ Bond Benchmarks. According to the WSJ, corporate bonds in junk status (rated CCC) yields rose from 7% earlier this year to 13.1% currently. They were even higher, with an average of 15.2%. More to come on how to quantify this, but it looks like some corporate debt is firming, while others weaken. The US Dollar is down HARD since the news on consumer inflation, which likely reflects the lower expectation of future short-term or policy interest rate hikes. Energy prices are rising, and economic metals are up today (and over the past few days/weeks). This may suggest the recession is ending. We found some really bad news in the Inflation Reduction Act that the Senate passed on a 100% Democrat vote (51-50) with VP Kamala Harris casting the deciding vote. Read Section 10101. Corporate Alternative Minimum Tax and shoot me a note. I spoke about this in the video as I found the appropriate and relevant tax in the bill. Boom, this could knock a few percentage points off the S&P 500 if it passes in its current form. This is one reason to be bearish into the Fall. We did due diligence on Hallador Energy Corporation $HNRG. They have liquidity issues and recently raised money from company insiders (convertible unsecured debt paying 8%) where most of it was converted into equity almost immediately. That money, around $20M, is needed for capital projects for the rest of $2022. Good luck to this company. Their mines are showing safety violation allegations in their latest 10-Q filing with the SEC, and they recently had a mine fatality. His name was Brian Rodriguez and he was a US Marine who served two combat tours in Iraq. Let's hope they use the money to keep their mines safe and prevent future accidents. Document here. We notice that moves higher in this market are happening in the morning, and very quickly. If you blink, sometimes you can miss the move higher. Pre-market moves without follow-through during the day. Interesting, as we saw this in previous markets. By: Jeffrey Cohen, Investment Advisor Representative & President Chicago Quantum US Advanced Computing Infrastructure, Inc. Many tried to politicize the news and say it wasn't good, and maybe the market reflects that narrative. I say, if prices were flat, and I mean there is a zero in the column for July CPI-U index growth, then the US Federal Government (less spending), the US Federal Reserve Bank (QT and rates) along with the people of the United States (change behavior), did their job and brought prices back under control. Good job, round of drinks for everyone!

So, the market did not buy the same narrative. The stock market went up for the first two candle sticks, or about 40 minutes, then rode flat all day. Just say it again to let it sink in. After inflation rose 8.5% for the year (and it rose for 11 months), it stopped in its tracks in July and did not rise. The lead lining in the news is that while energy prices fell (gasoline wholesale back to $3.00 from $4.00 for example), the price of food that you buy in the grocery store and prepare at home rose very quickly. It rose over 1% in July. People, real people, are still suffering. Also, US non-farm labor productivity fell 4.6%. This reflects more hours worked and less product and service produced. Also, wages rose ~10% for the same period. So, we worked longer, made more money, but produced less. This is not very good news for the economy, and might be a result of over-hiring for some, and under-performing for others. As a funny example, I am on Twitter during the day because that is how we promote our points of view. We share our video link and make comments about stocks, bonds and markets. We do it as part of our work. However, there are many on Twitter during the work day that I think might have full time jobs, and are not paid to tweet personal views. Just saying...and the work at home model is great until you want to go for a bike ride (we did yesterday), or your wife 'wants to talk' (she did), or you have to go to the store and fix an electrical fixture someone broke last night (I do). Productivity is down (in part) because employers have less control over their workers' productive time that they are paying for. The other thing that I reflect on this morning is the whip-saw in interest rates. We were going along great, with mortgages and loan rates low and accommodative. We were building, fixing, buying and selling homes across the nation. Prices were rising, money was being made, but it only lasts while people can afford to invest, risk, buy, and pay on real estate. The rise in interest rates and prices have given people pause, and that is enough to slow things down. Let's see what today brings. I expect that the new corporate income taxes (15% on stated income), declining labor productivity, declining corporate fixed income (forgot to talk about that - bonds are falling while UST risk free bonds are rising, reflecting greater corporate risk), reduced consumer spending and enthusiasm, and the possibility of two global wars for the US might drive down corporate profits. That would be the end of this bear market rally, and bring back the bear. Only time will tell. Please be careful out there and always do your due diligence before investing. GLTA By Jeffrey Cohen, US Advanced Computing Infrastructure, Inc. Chicago Quantum President and Investment Advisor Representative We look at a few data points and overall, cannot say that the bear market rally is over. It could be, and it may end shortly, but not feeling it today.

Here is what we see: 1. New Quantum Computing firm hit the market. $QBTS 2. Stock market breadth (US Equities) is more positive and bullish than we have seen in a long time. 3:1 New Highs to New Lows. Also, more than 6,400 stocks are trading above their 50 day simple moving average (SMA) and only 2,400 are trading below. This has been significantly reversed for a long time. 3. Fixed income is still negative, more new lows than new highs. In fact, Fixed Income declined yesterday despite lower US Treasury long-term rates. This means the fixed income market sees more risk in corporate borrower ability to pay. 4. Semiconductors are 100% lower in early pre-market trading. I wonder if people are worried about an economic blockade of Taiwan by PRC's military? Could be, or this is just a bet against high BETA and economically sensitive stocks. The PRC military escalation against the US, and China letting their currency weaken further against the USD could be a sign of supply chain risk. 5. Yesterday's market action resembled a Lazy Boy TM Recliner. (Lazy Boy is a registered trademark). It pumped in pre-market, rose for 90 minutes, then fell for 135 minutes to the opening level, then was up and down for the rest of the day, closing at the opening price. 6. We also continued to tweak our Chicago Quantum Net Score (CQNS) model parameters to see how bullish or bearish the market could be. We took the expected return for new money, inclusive of dividends (1.39% paid on the S&P 500 last year), down to 8%. This implies a 6.61% capital gain on new money invested in either the QQQ, SPY or IWM. The analysis continues to be very bullish and risk on. Notes from our discussion: We adjusted the expected return of stocks by investors (new money) inclusive of dividends, down to 8% (from 10%). Dividends were 1.39% Stocks deliver a capital gain of 6.61%, not unreasonable. High BETA stocks chosen, and those large-caps that consolidated recently. Bitcoin finance Semiconductors E-Commerce Money Managers Software Big Tech If you like dividends, you want to hold the money managers. Finally, we took a look at indices, and the S&P 500 looks the weakest. The big red candle is about 100% overshadowed by the big green candle (Monthly chart) and so the question is whether the support level at 4,120 will hold. It may or may not, only time will tell. However, the NASDAQ Composite 100, or QQQ, looks stronger and better. Not sure this will drop given the trend. This week, and in fact the period starting June 16, has been an aggressive, RISK-ON time for stocks and bonds. Bond yields at the long end have fallen, which increases the prices of bonds. Stocks have risen ~15%, which is a large and aggressive rise and 'earned back' about half the loss in the first part of the bear rally. Commodities in economically sensitive areas are down, foreshadowing a recession. We even have a recession-calling 'yield curve inversion' that we can talk about. This is another foreshadowing of recession. What's funny is that stocks seem to have temporarily moved beyond that. We also have geo-political tensions, and those seem to be of minimal impact on market action. Finally, this is the Summer, and most 'big money' traders are desks are on holiday. That all changes in early September. Saddle up and let's ride. Good luck to all in the markets (and in life) today! By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Good morning.

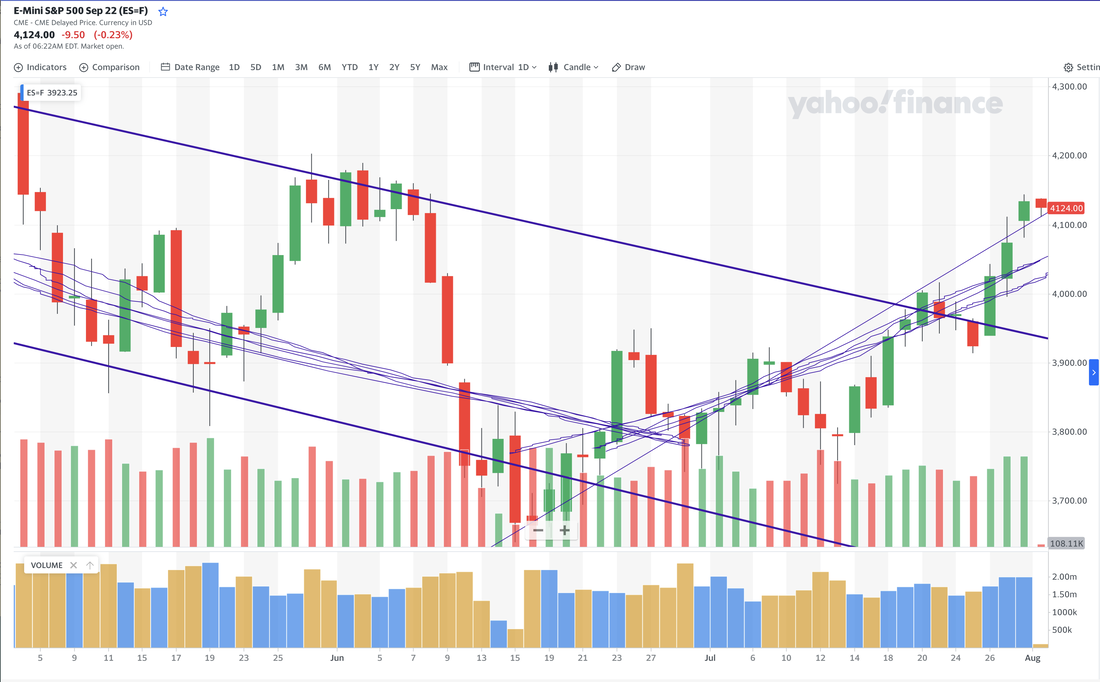

We noticed a few things today and last night while thinking about the markets. 1. Mornings on social media are mornings wasted. I just spent 30 minutes on financial twitter trying to get a handle on things...and now I cannot get the phrase 'vibe-recession' out of my head. 2. Inflation is now a global phenomenon. When did that happen? I thought inflation was based on currency growth (broadly speaking, including velocity of money) minus economic growth. Now, everyone has inflation, including Indonesia, Europe, Latin America. What makes sense is the US Dollar becoming the world's global currency, along with just a few others. When we interlink the Euro, Great British Pound, Chinese Renminbi (Yuan) and other dollar-tied currencies together, then the US Dollar impacts those countries. We have seen many countries deflate or weaken their currency so they can sell into the US less expensively, but that means their prices of globally priced goods rise (like oil, gold, and most likely foodstuffs). This does not apply to Japan, which has pursued an independent monetary and fiscal policy from the US. Japan has inflation, but it is 'high' at 2.5%. The Japanese Central Bank spent a significant amount of yen recently defending low Japanese Government bond yields, and Japan's inflation is high at 2.5%. Link here, thank you Trading Economics. 3. The market is trading in just a few, active stocks with volume. This may not 'really' be true but it sure seems like it. Most stocks we track are trading well below their normal volumes. However, a few stocks are 'hot' and seem to be getting most of the attention. Our model called them out, and we were too 'chicken shit' to put our capital into them on Tuesday morning when first called. Their options were expensive to us (4% per month ATM calls), and the spreads were high pre-market (up to 10% spread between bid and ask). However, during the day these stocks moved quickly and decisively. Interestingly enough, the moves in pre-market were most of the moves by market close. You had to be in pre-market, or in the first few minutes of trading, or you missed the rally. 4. Cannabis industry is in trouble. Declining prices for weed, along with reductions in discretionary spending (income and savings) means significant declines in business for major 'axe and shovels' providers like Hydrofarm $HYFM and GrowGeneration $GRWG. Their footprints have increased, but their sales decreased. A good provider of pricing information is the Cannabis Business Times, link here. 5. The S&P 500 and other stock market indices are recovering significant territory on low volume. The S&P 500 is trading at 4,151.94 as we write this. The market was 'over-priced' in our opinion at 4452, or 8% higher (300 points). The market corrected from ~4,600 to ~3,600, or 22% (1,000 points). I keep thinking 'when did this happen' but I realize it happened starting at the recent bottom at June 16, 2022. US Treasury long-term yields peaked on that day, along with the VIX, and most US equity indices hit a bottom. Remember that date, June 16, 2022. That was right around when we sold out of our bearish bet on regional banks. Thank goodness we eeked out a profit on that large-ish position. Since then, the regional banks have recovered nicely, and continue to move sideways / higher. The core, macro-economic and monetary news is worse now. Political tensions are rising between NATO, China and Russia, and the world is slipping into a global recession / depression with widespread inflationary pressures. Globally, we see short-term interest rates rising (if only to defend against the USD strengthening too much), and a world battle to end zero-interest rates. There is more to discuss, much more. We don't know what the markets will do today, Friday, but we plan to have an insightful and entertaining livestream this morning. Good luck out there. GLTA. Jeff By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. The highlights from yesterday was the reversal in US Treasury fixed income securities that are longer-duration. 10-year and 30-year notes/bonds were falling the day before, fell in the morning yesterday, then boom, recovered after lunch. This changes the dynamic because as bonds are worth more...this removes a big stressor in the markets. This morning we see futures flat on US equities, however our model, our CQNS UP run model, is still bullish and suggesting a few very risky sectors to invest in to beat the S&P 500. Bitcoin-related, semiconductors, software and eCommerce. Internet related growth stocks. The model was right yesterday, and today it picks similar stocks. The model suggests jumping into risky stocks if you believe the overall market is expected to rise 10% over the next year (inclusive of dividends). Remember though, this could be a bear market rally and be short lived while most of us are on vacation in August. There are fewer participants and liquidity is lower. This is the time when market players can make significant profits. It is like trading pre-market. The new high - new low indicator is still negative (more new lows than highs), but is moderating and close to 1:1. In the stocks we looked at today, the core economy of discretionary expenses is lower, and companies that benefit from when we have modest means (inflation, fewer jobs, stagflation), were higher. In mid-June, the US Equities and Fixed Income market changed. It started going up again. This has been a healthy rally, rising ~15% depending on the index. US Treasury interest rates have fallen in light of a diligent and hawkish Federal Reserve Bank. Volatility of most stocks has stabilized, albeit at a higher level than before. Volatility of the S&P 500 continues to rise. The VIX started to fall in Mid-June, and has not looked back. The cost of insuring against a market fall is lower, even though the market has gone higher. It is a matter of perception in the market...stocks are rising and risk is back on. In a recent video I had said "you can be right, or you can be wrong and rich in this market.' What I meant is that most people think the market should be falling further. They reflect on economic, political, fiscal and monetary conditions and say Rome is Burning. Sell stocks, go short, bet against the market. However, while this is happening the riskiest sections of the market have been rising, and stocks suggested by our model are already up 25% to 50% already since mid-June. Our model has done a 180 degree turn with the change of one key assumption. That model run was amazingly correct yesterday, and we made our optimistic video, and even wore a Chicago Bulls hoodie to support it (in pre-market before we saw the results). All we did was suggest that investors in the market expect to make money. They expect to make 10% over the next year, inclusive of dividends. That is all we need to push the market higher. 10% expected returns. By comparison, when we had 5% returns to risk assets (as the market was in free-fall), the model had us picking the more conservative sectors of the market, including consumer discretionary stocks, insurance companies, insurance brokers, B2B industrial firms and the like. In other words, low BETA and high profit companies that can weather the storm. We ran the model again last night with the 10% 'override' assumption on expected returns. The model again picked a risky basket of stocks to invest in. Good luck to all. Check out our video this morning. By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure Inc. Chicago Quantum (SM) August 1, 2022 06:22 ET Today, as of 11:30 ET, the us Stock Markets reversed course and moved higher. Not all sectors are up, but the overall indices are green. US Equity Futures falling faster pre-market. It is 09:06, and pre-market futures are down more. Whack-a-mole is a game where the user holds a large hammer (usually very light). There are nine squares or holes where a possible mole (furry little creature) pokes its head up. We presume the moles rise in a random, independent distribution. The goal of the game is to hit as many moles with the hammer as possible. The US equities market seems to us to be like this. A few weeks ago, before our July vacation, the model was picking the largest tech stocks. Now, those stocks have risen and are out of the top 50 stocks. The model has a rotation of consolidating stocks that are low risk, high return (all relative to the overall market), and stocks rise to the top in groups. Today's group now begins to reflect MLPs in the energy sector. These dividend payers are falling out of favor. Also, we see some utilities, hard-core industrial B2B companies, insurance and insurance brokerages, and consumer favorites like McDonalds and the beverage companies. The model likes these individual stocks best. It is likely that these stocks have either risen and fallen in roughly equal measures, and with less volatility than other sectors, or fallen and risen repeatedly in a wave-like pattern. The model likes them because you can buy a stock with lower variance (in the past year) but still get some return on your investment (including dividends). The #1 pick by the CQNS up run is Berkshire Hathaway Inc. B-class shares $BRK.B. Why is this not surprising to us given where we are? We also see higher BETAs in commodities that move with the stock market. Money is flowing into commodities like copper $CPER, oil $USO, and Silver $SIV. Makes sense if someone wants to invest in a 'Fed Pivot' or the end of the current recession. That could also explain the recent rise in the markets. People say the stock market predicts 'real life' 6-9 months ahead of time, and this would suggest that our economic troubles, both inflation and recession, will be behind us in January 2023. This does not seem to be an unreasonable belief, although it is not one that we hold ourselves. We are not ready to see beyond the current troubles, and think they may last for a year or more. Then again, our coffee cup appears to be half empty, not half full this morning. It is all about perspective. BTW, our offices are in Highland Park, Illinois (map below). The S&P 500 E-Mini Futures show a steep decline in May and early June, followed by a steady and aggressive recovery from Mid-June through July. US Equity Futures are down slightly this morning, along with the US Dollar. The US Dollar has declined significantly against the Euro and Japanese Yen. The VIX (or fear index) is up slightly. Energy prices are down, and while short-term bonds are stronger, US Treasury Bonds (30-years) are weaker. Good luck to all. Our Chicago Quantum Net Score UP run stocks are as follows today:

[deleted, hope you caught it this morning] This is an equally weighted portfolio that you would buy today, at the open. It is expected to outperform the S&P 500 for 20 trading days, especially if the market rises. Note the mix of companies, from sleepy telcos to old and new tech, MLPs, retailers, and a whole mix of industries. Pharma, consumer products, chips, software, fast food and software. Diversification is the key to an uncertain market with higher interest rates and negative historical returns in the past year. This is as of August 1, 2022. We will track the performance of this Chicago Quantum Net Score UP run through August and report on our results. This is the type of deliverable you gain when you buy an UP run, along with all the data you see in our Invest Information sub-tabs, and a spreadsheet of stocks with supporting information. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed