|

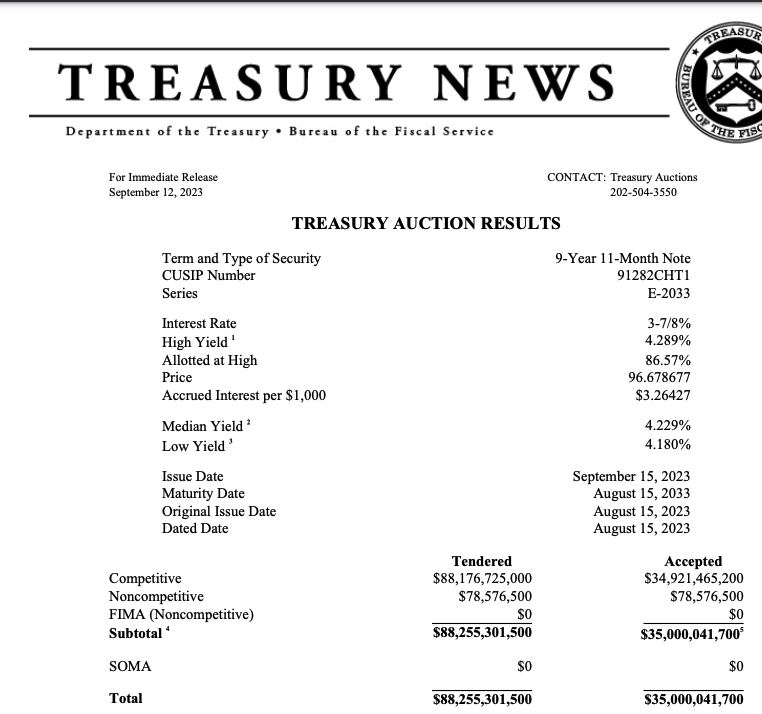

4.289% yield on today's $88B US Treasury 10-year auction. None purchased by the NY Fed (SOMA). That is a high rate of interest the US Government will have to pay.

4.289% yield Free of state income taxes. The way to read this is that all bids at or under 4.289% yield were accepted. It is an auction, so if you bid a lower yield or interest rate, you earn less. So, it is a good indication that some market participants were willing to accept as low as 4.180%. That isn't that low either, only 11 basis points (or 0.11%) less than the high bid. We smell blood in the water. We expect higher yields on long-duration US Treasury bonds and notes. Inflation is just too high to expect these yields to drop within the next 12 to 18 months.

1 Comment

|

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed