|

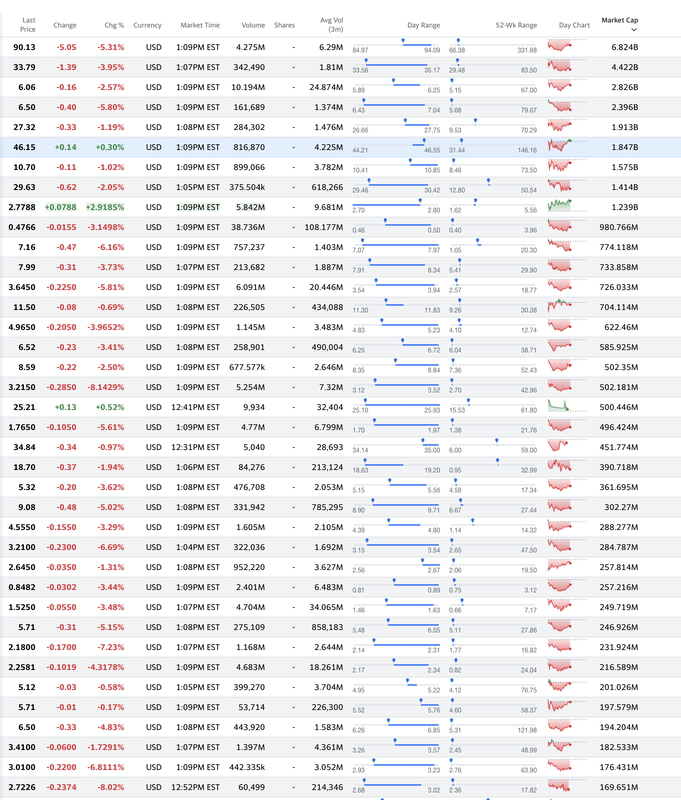

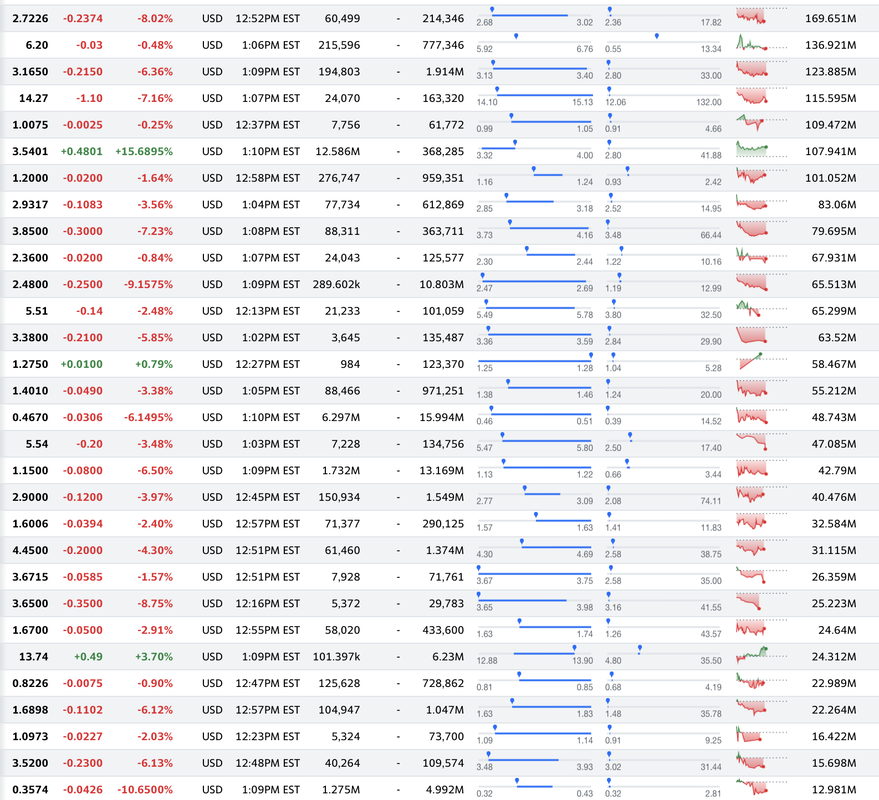

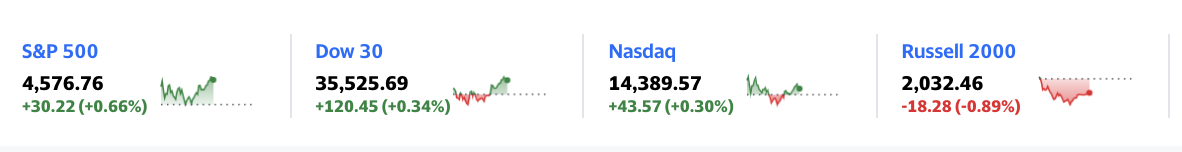

We have been running our CQNS Down run more often starting on January 5, 2022. Markets were trending lower, the FOMC announced tightening, and it became our belief that shorting "DOWN" stocks would be better than being long "UP" stocks during this market transition period. In addition, we have been studying the impact of changes in liquidity on the markets. We hypothesize that current conditions limit market participant liquidity (across participant types). Today, the market was very bearish on high volatility, low expected return stocks. Here is a pair of Yahoo Finance pictures of all the stocks we track as DOWN stocks since Jan 5, 2022, sorted by Market Capitalization (largest on top). The results as of Feb 2, 2021 at 1:09:30 pm ET: Today we see 6 stocks up and around 61 down. By the end of the day (02/02/2022), there were 8 stocks up, and 59 down. This is a very RED market and our CQNS Down picks would profit the short seller greatly. This is on a day when the indices are generally up. (time: 1:15pm ET) If you would like your own set of CQNS "DOWN" stocks before market open, please purchase the service via the button below.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed