|

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. So Jeffrey, I hear, what is the bottom line in the markets today? Bottom line is the stock market and overall financial markets are moving a little more than normal. That movement can accentuate trends. Highs go higher. Lows go lower. Things move more quickly and more deeply than before. Also, prices trending towards weakness, with lower stock prices, lower bond prices, and even lower housing prices. We see commodities weaker (except for oil, which is staying strong in the $80s). So, what should we do? We are debating that same question, and today, Monday, requires some deep analysis. When financial assets fall, expected returns rise, especially for companies that make an economic profit. An economic profit is when a company earns enough money to supply sufficient capital to grow, and to pay dividends (or pay down debt, or buy back shares). As those stock prices and bond prices fall, the expected return of those financial assets rise. The question is whether expected returns are rising as asset prices fall, right now, today, and for the next 253 trading days (1 year). Our models assume an 8.5% return on new money in risk assets (including dividends). It also assumes a 3.5% return to risk-free assets (e.g., 3-month US Treasuries, short-term CDs, Money Markets, US Savings Bonds, etc. Should we go up to 10% expected returns as the market falls further? When do we make that shift? When do most people become optimistic? Is it when stocks are falling the fastest, when stocks bottom, or when they begin a recovery? Do you buy the recovery or buy on the way down? When does the mindset change for the market in regards to expected returns? What our new Chicago Quantum Net Score / Smart Volatility fund is doing is to keep a relatively small number of stocks (currently ~12 longs) and three shorts. The model sees opportunity in risk today, and is RISK ON. If we increase our expected returns then the model will pick fewer longs, and will choose different stocks to hedge with. BTW, we are paper trading our model while we work through the investment processes, outsource our custodial services to Charles Schwab, and look at different hedging strategies. We will be our own first customer once the processes are complete and plan to open the fund to investors. What we notice in the markets is a falling knife.

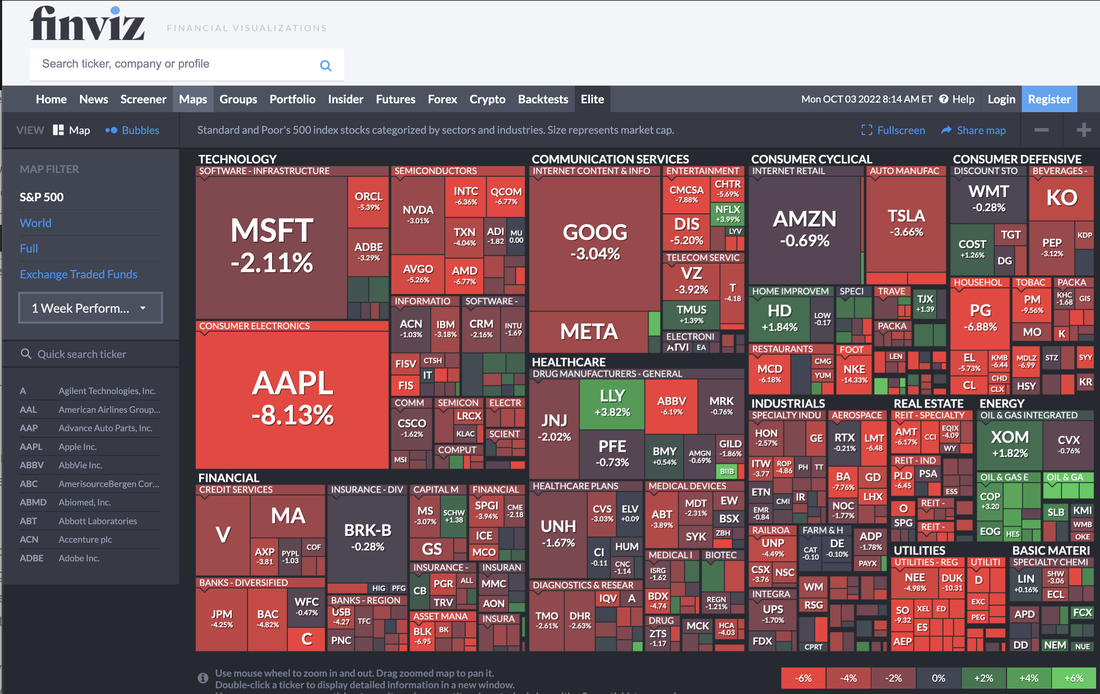

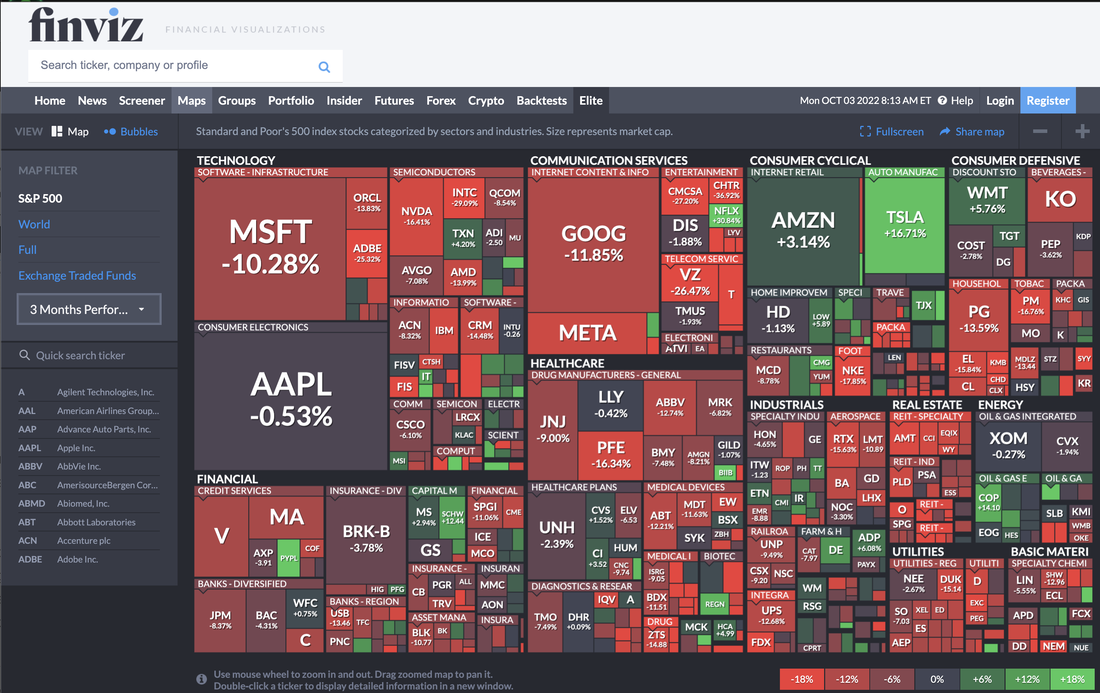

US Equities are down and trending lower. We are in a bear market. (TY Finviz) 32 new highs vs. 1,282 new lows (40:1) US Corporate Fixed Income is down too. We are in a bear market for bonds. (TY Finra Morningstar) 22 new highs vs. 1,633 new lows (74:1) Strategy #1: Do not catch a falling knife. Fear of missing out is a cost effective strategy. Wait for your favorite stocks that is reaching new lows to bottom before buying. Do not buy just because a stock is falling. Strategy #2: Fundamental valuations are more important than ever. As companies face higher interest expenses, and more difficulty in raising money (tougher terms & conditions), companies that are generating cash flow and paying down debt at a discount are building wealth. Look at stocks that are down that are worth more than their stock price and hold those dearly. As an example, we hold two stocks that we value more highly than their stock price, and will keep adding to those positions over time. We may be early, and we may be wrong, but we will feel ok holding those stocks for a long time while the market valuation catches up to fundamental valuation. Strategy #3: Stay hedged. Have a mix of investments that move up and down. We made the mistake in January 2022 of only holding bullish bets and it cost us dearly. Now, we are about 65% bullish, 35% bearish, and we are thankful for the gains of our hedges. We can always sell off our profitable hedges and replace them with new hedges at lower prices. See evidence below of the performance of the S&P 500 (TY Finviz) over 1 week, 1 quarter and 1 year.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed