|

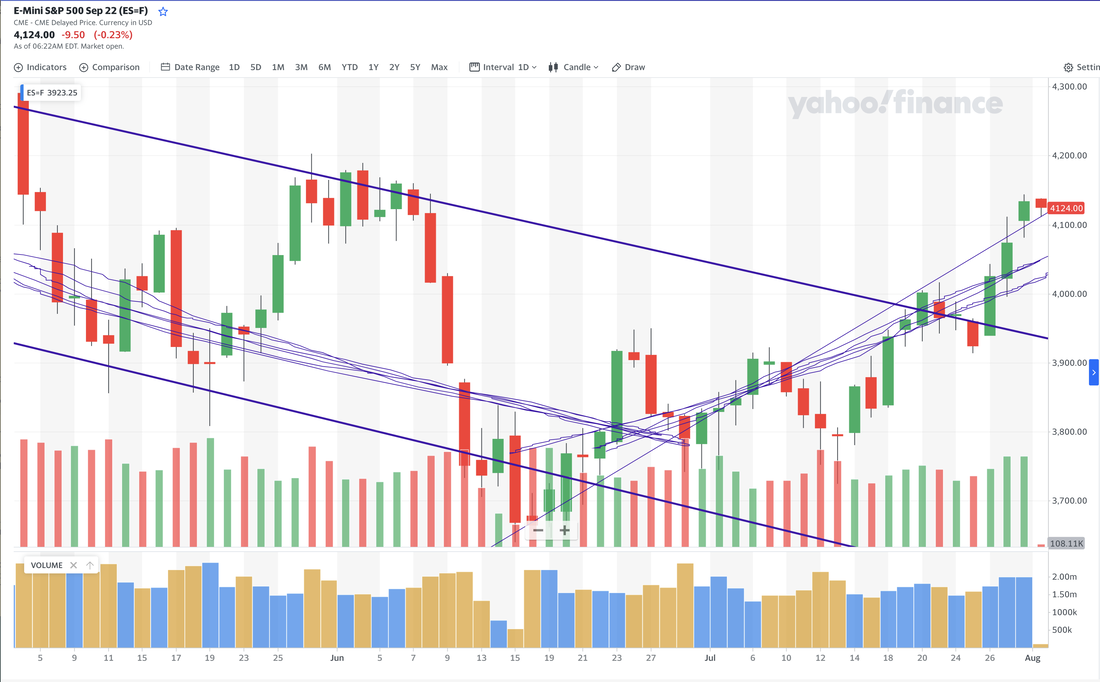

By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure Inc. Chicago Quantum (SM) August 1, 2022 06:22 ET Today, as of 11:30 ET, the us Stock Markets reversed course and moved higher. Not all sectors are up, but the overall indices are green. US Equity Futures falling faster pre-market. It is 09:06, and pre-market futures are down more. Whack-a-mole is a game where the user holds a large hammer (usually very light). There are nine squares or holes where a possible mole (furry little creature) pokes its head up. We presume the moles rise in a random, independent distribution. The goal of the game is to hit as many moles with the hammer as possible. The US equities market seems to us to be like this. A few weeks ago, before our July vacation, the model was picking the largest tech stocks. Now, those stocks have risen and are out of the top 50 stocks. The model has a rotation of consolidating stocks that are low risk, high return (all relative to the overall market), and stocks rise to the top in groups. Today's group now begins to reflect MLPs in the energy sector. These dividend payers are falling out of favor. Also, we see some utilities, hard-core industrial B2B companies, insurance and insurance brokerages, and consumer favorites like McDonalds and the beverage companies. The model likes these individual stocks best. It is likely that these stocks have either risen and fallen in roughly equal measures, and with less volatility than other sectors, or fallen and risen repeatedly in a wave-like pattern. The model likes them because you can buy a stock with lower variance (in the past year) but still get some return on your investment (including dividends). The #1 pick by the CQNS up run is Berkshire Hathaway Inc. B-class shares $BRK.B. Why is this not surprising to us given where we are? We also see higher BETAs in commodities that move with the stock market. Money is flowing into commodities like copper $CPER, oil $USO, and Silver $SIV. Makes sense if someone wants to invest in a 'Fed Pivot' or the end of the current recession. That could also explain the recent rise in the markets. People say the stock market predicts 'real life' 6-9 months ahead of time, and this would suggest that our economic troubles, both inflation and recession, will be behind us in January 2023. This does not seem to be an unreasonable belief, although it is not one that we hold ourselves. We are not ready to see beyond the current troubles, and think they may last for a year or more. Then again, our coffee cup appears to be half empty, not half full this morning. It is all about perspective. BTW, our offices are in Highland Park, Illinois (map below). The S&P 500 E-Mini Futures show a steep decline in May and early June, followed by a steady and aggressive recovery from Mid-June through July. US Equity Futures are down slightly this morning, along with the US Dollar. The US Dollar has declined significantly against the Euro and Japanese Yen. The VIX (or fear index) is up slightly. Energy prices are down, and while short-term bonds are stronger, US Treasury Bonds (30-years) are weaker. Good luck to all. Our Chicago Quantum Net Score UP run stocks are as follows today:

[deleted, hope you caught it this morning] This is an equally weighted portfolio that you would buy today, at the open. It is expected to outperform the S&P 500 for 20 trading days, especially if the market rises. Note the mix of companies, from sleepy telcos to old and new tech, MLPs, retailers, and a whole mix of industries. Pharma, consumer products, chips, software, fast food and software. Diversification is the key to an uncertain market with higher interest rates and negative historical returns in the past year. This is as of August 1, 2022. We will track the performance of this Chicago Quantum Net Score UP run through August and report on our results. This is the type of deliverable you gain when you buy an UP run, along with all the data you see in our Invest Information sub-tabs, and a spreadsheet of stocks with supporting information.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed