|

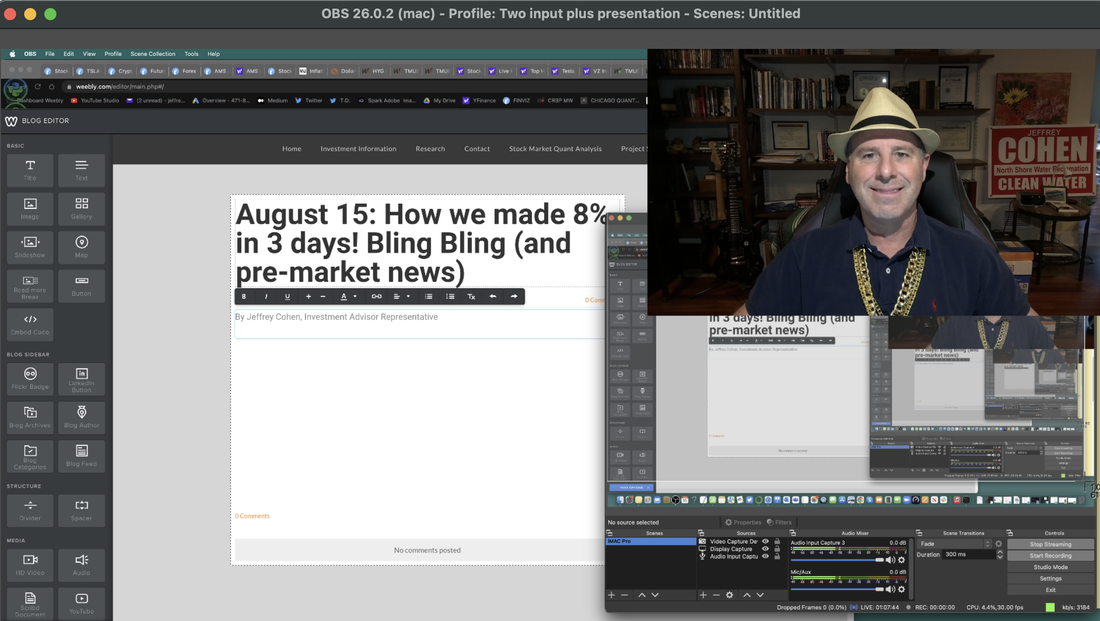

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Chicago Quantum (SM) We had a good time with this morning's video. We took some of our earnings from Friday and invested them in BLING BLING for our video. YouTube Livestream Video Link: Here BIG BEARISH BETS this morning US Equities selling pressure increasing into the open. Those bearish bets petered out by lunchtime. We are attempting to profit again this week and not sure our back or neck can take another 'investment' in bling, but we are willing to try. Big smile on this one...and we do share our trade. We bought Verizon $45 calls when the stock price dipped below $45, and we sold them when the price rose above $45 for a 3-day, 8% gain. We hope to rinse and repeat today. It didn't happen, Verizon moved with other consumer non-discretionary stocks higher, while energy and economically sensitive stocks (and high BETA stocks) fell. We noticed about 15 macro-economic pieces of news this morning. They show a mixed stock picture for today, Monday. After the market opened, and through the morning, the market has been up and down. The morning was a risk-off morning where riskless stocks rose, and high-BETA stocks fell. We are in wait and see mode.

Also, remember that Friday is options expiration for individual stocks (which we trade in). This means that stocks and options 'come together' at market close on Friday. Expect above-average volatility. Crude oil down almost 5%, or $4.48 to $87.61. This is a large drop, and is taking energy stocks down with it. It is either a sign of dramatic increases in supply (moar drilling), or diminished demand. Not future expectations of demand, but current demand. Global demand for energy is down. Either that or more people bought, rented or borrowed electric vehicles than ever before. We rode our bicycles yesterday and saved a little gas. Recession 1: Recovery 0 Economic Metals fell, but are still at elevated levels. - Copper down $0.11, still elevated. - Silver down $0.50, still elevated. Recession 2: Recovery 0 Short-term interest rates are higher, and long-term interest rates are lower. This will make longer-duration investments more affordable, but could reflect tightening of the money supply and more difficulty rolling over current debt and loans. Things could be getting tighter out there for companies that need to borrow money. Long-term, long-duration, Risk Free, UST Interest rates are lower on this Monday morning. Ultra short money at 2.2% (same as a bank account with $1 minimum balance). Bank accounts at 2.5% Recession 3: Recovery 0 5.33% 30-year fixed mortgage. 2% fees 2% points 2% margin for the banks (3.33%) for the money, plus costs. 10-year UST 2.8% plus 0.5% in loan origination costs. MBS looking strong. Gold under $1,800 Bitcoin still in the range at $24.200 VIX still in range at $21.00 VIX at 21.50, 21.55 STRONG US dollar. The US Federal Reserve Bank is tightening money supply, along with the US Federal Government's fiscal policies. This is good for other counties to sell goods to the US, and bad for the US corporations that sell abroad. - Eurodollar at 1.02 - CNY to USD: 6.77 on a rate cut in China. - Chinese currency is weakening, makes their exports cheaper to US buyers. Recession 4: Recovery 0 This is good news for US consumers. Gasoline down $0.12 per gallon wholesale Recession 4: Recovery 1 Verizon debt weakening, higher yields. $VZ stock has been down lately (almost 10%). We think it could recovery, but expect a bumpy ride. Verizon stock rose today with other consumer defensive stocks. Argentina raised its main rate of interest to 69.5% to combat inflation of 70%. Wow. China lowered its policy interest rate a bit to stimulate domestic economic demand. They don't have inflation because (in part) they did not utilize fiscal 'give-aways' to deal with COVID 19 slow-downs. I remember reading about small subsidies for food delivery, but that was all. This is not the case in NATO countries which resorted to fiscal stimulus. Recession 4: Recovery 2 Red day in the futures pre-market. QQQ -1/4, -4/10 SPY -1/2, -6/10 Russell -2/3, -3/4 $BBBY - STONK that is up 20% this morning. $WMT earnings (watch for the news on US and Global consumer behaviors).

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed