|

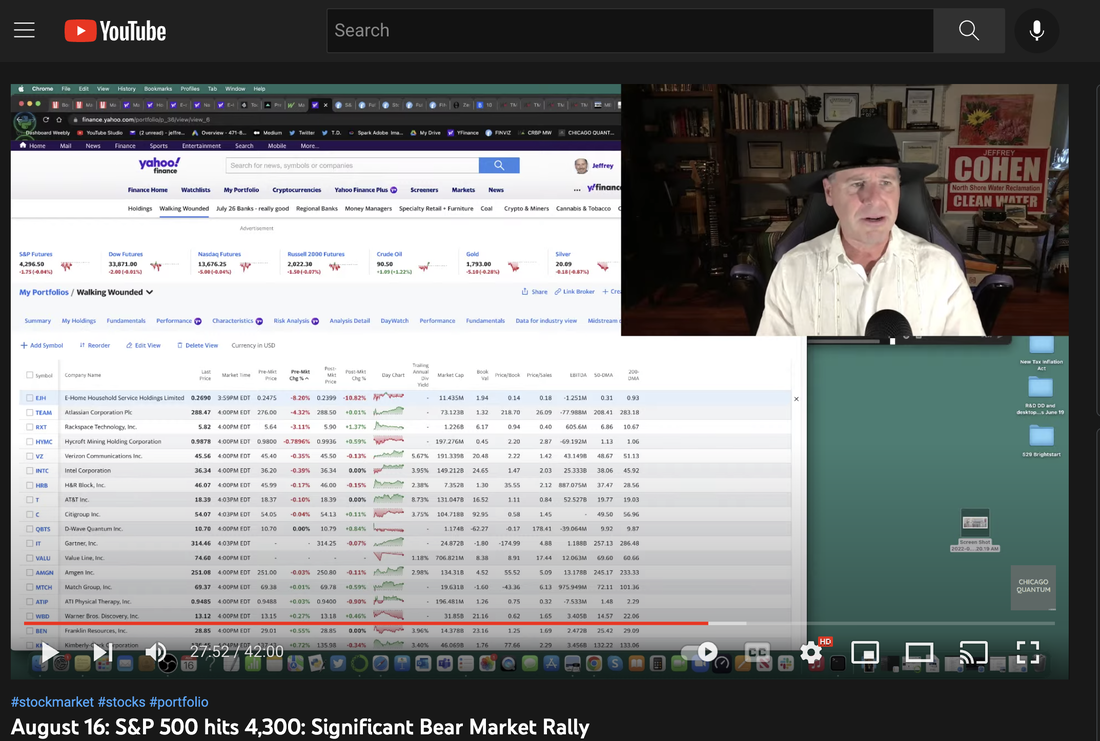

By Jeffrey Cohen, Investment Advisor Representative & President US Advanced Computing Infrastructure Inc. The markets continue to rise, but this morning pre-market the day looked slightly weak for US Equities. We mention: $HNRG $AMS $CRBP $EJH, $VZ, $BANF, $FFIN, $WMT (of course, they reported earnings), a bunch of US banks, $KRE, crypto, cannabis, chips and semiconductors, computer makers (only a few left), money managers, and other proprietary indices we use to track key sectors. IMO: Markets expected to be slightly lower today. Slow, slightly down US equities day in a very broad-based rally. S&P 500 up to 4,294, VIX steady at 20.45, oil, gas and other commodities pretty flat.New highs to New Lows 3:1 (positive breadth). Energy down Industrials up Risk is up B2C struggling Lending is up Big Tech is up Asian markets down or flat. Except Jakarta, Indonesia and Malaysia, New Zealand, S. Korea which are up slightly. Europe is higher this morning between zero and one percent (markets were still open). USD stronger. The Eurodollar is approaching 1.00 (at 1.0127). And Japanese Yen at 134.42. Bitcoin at 24,050 (still between the 20k and 30k support level. A small downtick in an upward trend from 18k. UST Interest rates slightly higher (at all maturities). Still are as we write this. Market Breadth turning more positive: - Corporate Fixed Income (US) is up 2.3 : 1 (A:D), new lows 1.3 : 1 vs new highs. - US Equities: 3:1 New High : New Lows - 80% above the 50 SMA On the geo-political news front, we see a few interesting developments. Global instability is rising, and our latent neocon roots are tingling. China has again demonstrated its military power near Taiwan. Ukraine strikes back into Russia at their nuclear facility in Kursk, in a strategy we suggested a few months ago. Took three tries according to the Russians. Russian military bases erupting in flames based on 'accidents' and saboteurs. We hear no talk of recession, and see no writing of recession or economic malaise in the US mainstream media. Everything is awesome, the markets are rising, and midterm elections are right around the corner. The yield-curve inversion is fairly light, only indicating a lower long-term yield on risk-free money. No short term credit crunch, only FRB policy tightening. What does this mean for us in the markets? Stay tuned for more insights...

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed