|

By: Jeffrey P. Cohen, Investment Advisor Representative US Advanced Computing Infrastructure Inc. Chicago Quantum Yesterday was a tough day in the markets. We saw it trending significantly lower in pre-market, and by the time the markets opened at 0830 ET, the move was largely completed. Thank you Finviz.com for the visual below. It does not mean that the markets were silent during the day, as we saw our investments move significantly during the day, but the die was cast early. In full disclosure, we added a long and a short position on Friday, and sold our short position Monday afternoon for a 2% profit. It was good work. However, our long position lost more than the gain and we added to our long bet with 80% of the profits of the short trade. This is what most investors will do, add to their long bets and 'buy the dip.' We did, fingers crossed. No bling bling today until our ultimate trade settles (hopefully higher). The market flip-flopped this morning in the past hour. Interest rates moved negative. US equity futures moved negative. VIX: negative. Semiconductors and chips are more down than up this morning. The market moderated this morning, with 17 minutes left before market open. The trades that looked obvious last night are mixed this morning. We will be watching the screens today. The markets are interesting and show some conflicting data this morning.

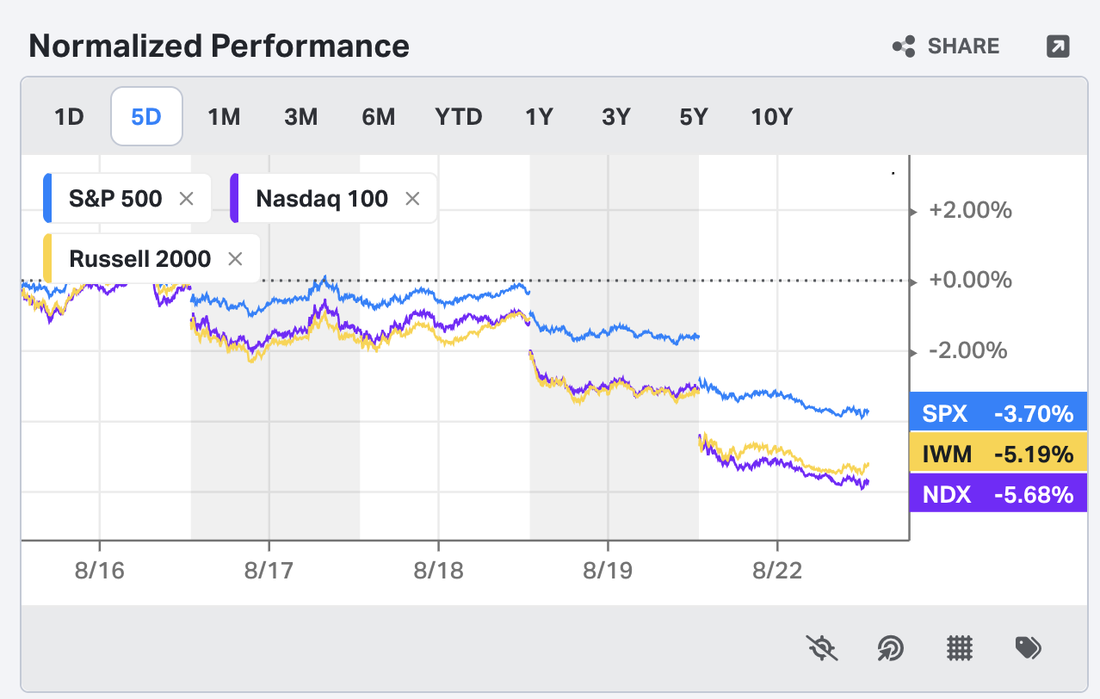

Interest rates rose this morning in the past few minutes (all pre-market), and they were down earlier. Most economically sensitive sectors are trading higher pre-market. The US Dollar is on fire, up against most currencies. However, the market is on a new downturn leg, down 5% over the past five days. Watch out, this could be the beginning of a new movement lower. I do like that the pre-market action is pointing higher, which could be just normal trading or a Bear Trap.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed