|

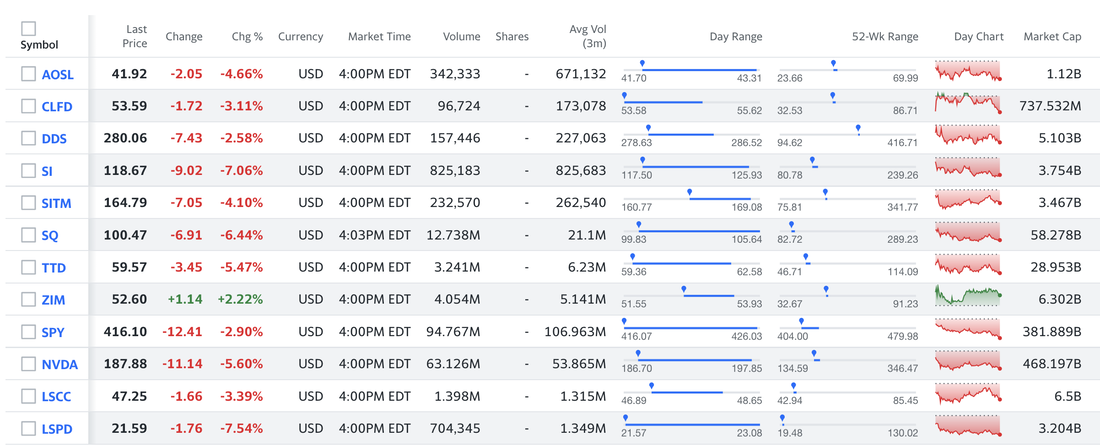

by Jeffrey Cohen, Investment Advisor Representative Ran our CQNS UP and DOWN runs KTA: Down run similar with a few new names. MEME stocks (high volatility) are out there. We see the same stocks maintaining their higher volatility status, with a few new names appearing. Swing trader's paradise for daily trading, with common or calls/puts. More diversification needed for long portfolios, and add QQQ names. More large technology companies making the list (showing tops or consolidation which reduces volatility). UP run maxed on the same 8-stock portfolio. It also found larger portfolios (3 to 42 stocks equally held). These portfolios have 6x the benefit of a fully diversified portfolio ($SPY, $QQQ or $IWM) in terms of risk-return. We ran the model for 8 hours and 15 minutes last night, and the results are clear ... find more stocks to smooth out daily price volatility. There are only 2 stocks that are individually better than the diversified market (this used to be ~25 when returns were higher). Indices score very well for long portfolios, unless you want to build your own 8 stock, or (3,42) stock portfolio. For those sizes, what we mean is that the model found 3, 4, 8, 8, 9, 10, 11, 12.....all the way to 42 stocks with roughly the same CQNS score). That score was 6x better than a fully diversified portfolio. ########### Yesterday was a crazy day in the markets. We had a reversal at about noon ET and markets turned higher. What that meant for Chicago Quantum readers and clients is that if you would have bought our 8-stock portfolio (or the larger 10-stock model) in the morning as the market fell, you would have done exceptionally well if you sold it at day's end. Return, less trading costs, would have been 6x higher than the SPY. This is the logic of the model, when the stock market goes up, these do even better. However, they do fall when the market falls. We have not looked at futures this morning. Good luck out there. The end of the day. US Equity markets were down with a small late-morning head-fake to make us think it was a repeat of Monday, but it never happened.

Our CQNS UP Run stocks were down (all but one) on low to moderate volume. We will run the model very deeply again tonight (we tuned the solvers again). We do not have any liquid investable capital today, so we cannot test these stocks. However, we keep watching the markets. They work when the markets go up. In defense of the picks, almost every sector we follow (with a buy list), was down today. Leptokurtic and low variance Current Efficient Portfolio (this one below) Chips and Semiconductors Specialty Retail & Furniture (Flexsteel was up, and we like that stock alot) Money Managers Trucking Crypto & Metals / Mining Cannabis We also have a long list of stonks (we call them shitcos - sorry), that are weak but potentially fast flyers when they turn around. in general, most stocks today were down. Our own personal portfolio is down 16% since we started looking at it again (about a month ago). It is down 3.45% today. This is not personally satisfying...but at least these stocks are a better value than they were a month ago.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed