|

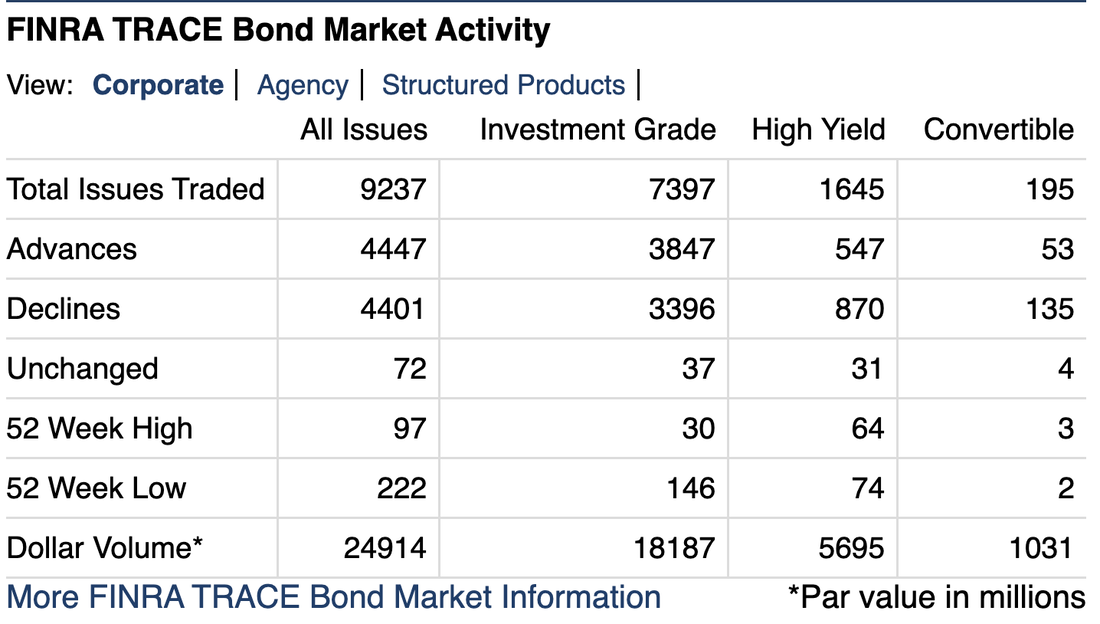

Good morning and happy President's Day in the USA. We notice that the number of advances and declines has been almost equal the last few times we looked at Corporate Bond price changes. Note in the chart below that for every 100 declines in bond prices (where yields rise), there were 101 advancers. It is hard to get more even than that. Into the details, you can see that high-yield bonds declined and convertible bonds declined, which reflects a weakening of expected returns to equity, and equity-like bond structures. We see that in our model run too. Investment grade bonds have outperformed, which reflects a 'flight to quality and low risk assets' that we have also seen in our model run. Why would bonds be flat? A few price patterns have stabilized in the short term when we have checked them (not all the time, ad-hoc review only): interest rates have stabilized, along with credit quality and the overall economy seems to be stabilizing. US Treasury Bonds are trading in a range too. Good luck in the markets. Jeffrey Cohen, President, US Advanced Computing Infrastructure, Inc. And now, check out our latest video where we explain how the market has turned RISK-OFF.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed