|

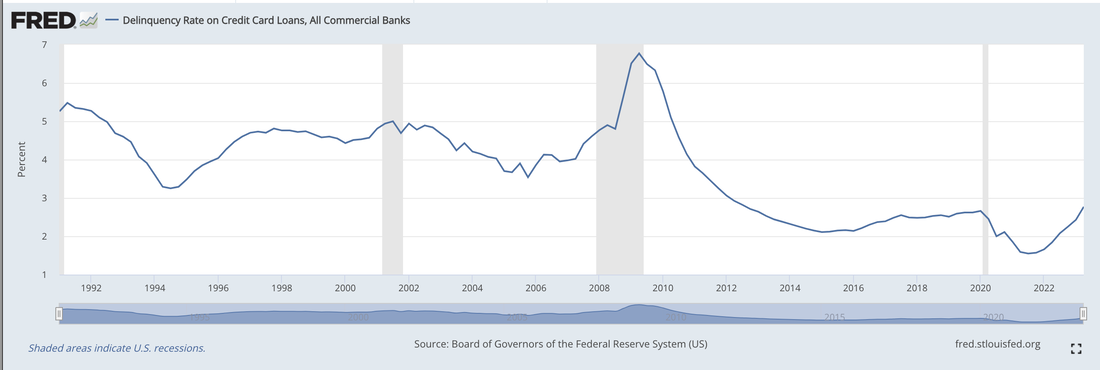

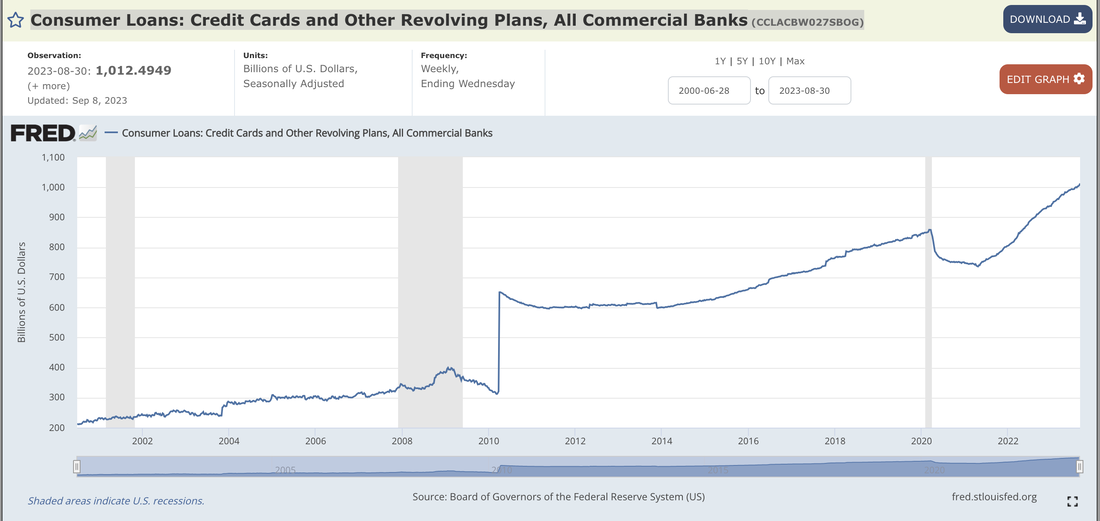

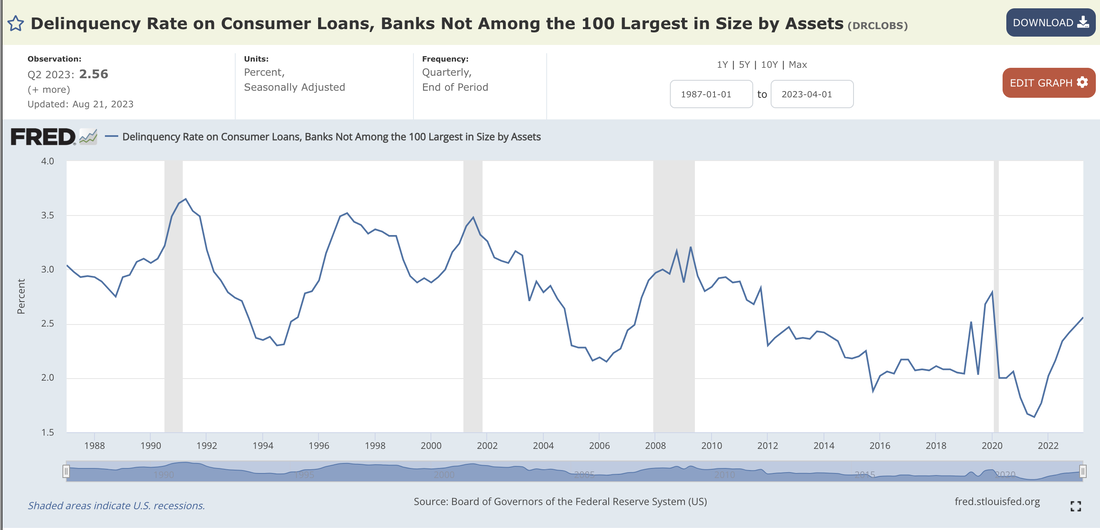

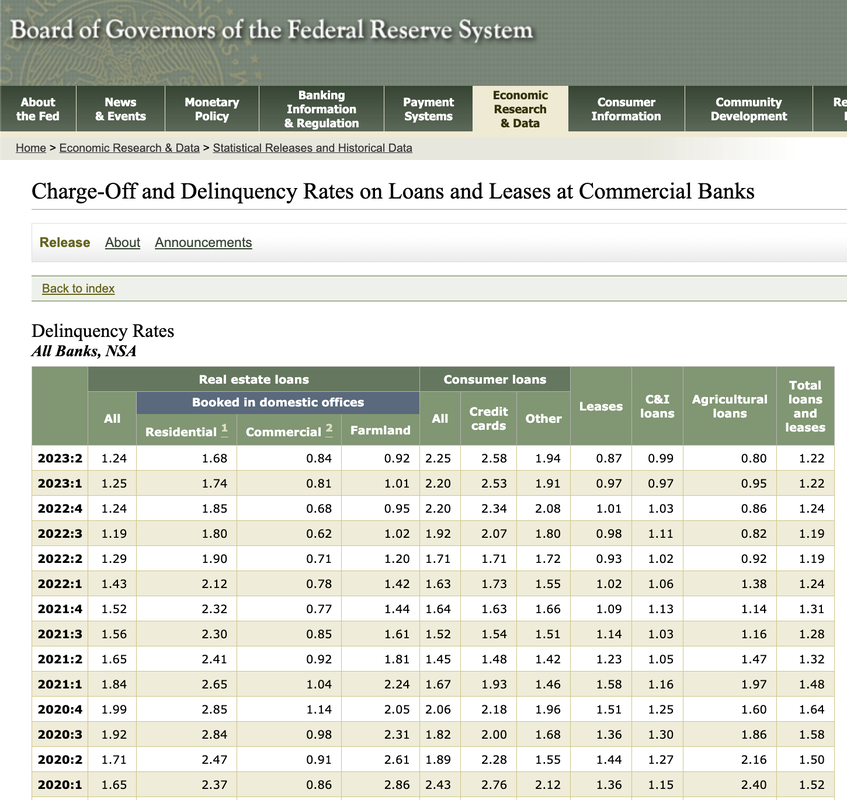

By Jeffrey Cohen We will walk through a few statistics on US consumer debt in this BLOG post. Delinquency Rate on Credit Card Loans, All Commercial Banks (DRCCLACBS) The Q2 2023 delinquency rate on credit card loans, all commercial banks (FRED (DRCCLACBS) dataset) is currently 2.77% last updated August 21, 2023. This rate used to fluctuate between 3.5% to 5% before the Great Financial Crisis, when it rose above 4% from the period of Q1 2007 to Q4 2010. It has remained below 3% for the past 11 years. To us, 2.77% is approaching the 'resistance level' of 3%, which indicates the US consumer credit distress. https://fred.stlouisfed.org/graph/?g=rRVR The interest rate on consumer credit cards has increased significantly. In May 2023, it reached 20.7% We take this to be either an average or a metric like a 'prime rate.' Source: FRED Commercial Bank Interest Rate on Credit Card Plans, All Accounts (TERMCBCCALLNS). In February 2022, the same rate was 14.6%. https://fred.stlouisfed.org/series/TERMCBCCALLNS The delinquency rate of credit card loans varies by the size of the bank issuing the card. For banks among the 100 largest in size of assets, the currently Q2 2023 delinquency rate is 2.63%. The delinquency rate for smaller banks is 7.51%. Here is the underlying data and notes: https://www.federalreserve.gov/releases/chargeoff/default.htm. The amount of credit extended to Consumers has also increased, reaching $1.01 Trillion US Dollars on August 30, 2023. This reading was updated on September 8, 2023. FRED Consumer Loans: Credit Cards and Other Revolving Plans, All Commercial Banks (CCLACBW027SBOG) and the link is https://fred.stlouisfed.org/series/CCLACBW027SBOG. Consumer debt was $859B just before the COVID pandemic, fell to $736B April 2021, and has risen by 36% in the past two and a half years. By way of comparison, Delinquency rates on all loans, banks not among the 100 largest by size, are still at historic lows of 0.95%. Delinquency rate on single-family residential mortgages, for all commercial banks, is a historic low 1.72%, a figure we have not seen since before the Great Financial Crisis in 2005. So, overall credit quality seems ok, especially when secured by business or real estate assets. Delinquency rate on consumer loans, made by banks not among the 100 largest in size by assets, have risen to 2.56%, which is up recently, but looks to be in the average range over the past 35 years. https://fred.stlouisfed.org/series/DRCLOBS. When compared to credit card loan delinquencies, this delinquency rate is significantly lower (2.6% vs. 7.5%) for the same sized banks. This either says that consumer loans are a better risk for smaller lenders, or that something is very broken with credit card debt issued by smaller banks. This same statistic for all commercial banks is 2.36%, which is up since 2021 and 2022, but low by historical standards. The spread between large and small banks is only 0.2%. If we look at delinquencies on all loans and leases, to consumers, on credit cards, the total is $23.8B, which is at the high end of the range of the data since 1992, but also seems pretty low overall. Asset Quality Measures, Delinquencies on All Loans and Leases, To Consumers, Credit Cards, All Commercial Banks (DALLCCACBEP). It is up 120% since Q2 2021. In short, the size of the credit delinquency problem has doubled since Q2 2021, and seems likely to continue to grow. This may be a 'tempest in a teacup' at current levels. However, if it continues to grow, it will soon become a black spot on the banking and consumer finance industry. One last look in this BLOG post is delinquency rates, for all banks, non-seasonably adjusted, since 2020. Here we see credit card debt, and other loan debt, for consumers. The credit card debt delinquency rate is growing, but has not quite reached the level in Q1 2020. The Other Consumer Loan level is in a similar situation, still below Q1 2020, but growing back to achieve that level. The other observation is that before the educational loan 'pause' in early 2022, these levels were the same. Recently, consumer loans have been a better risk, but we wonder if that spread will close again now that educational loans are incurring interest. We hope you enjoyed this blogpost and found it informative and helpful. We are doing this due diligence to better understand the underlying trends.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed