|

No, AMC Entertainment is not worth $13.06 per share. We would pay about $2/share.

Here are the reasons why, and a video where we discuss it openly and frankly. AMC: 516,820,595 shares outstanding Their fundamental movie business loses money at Q1 volumes.

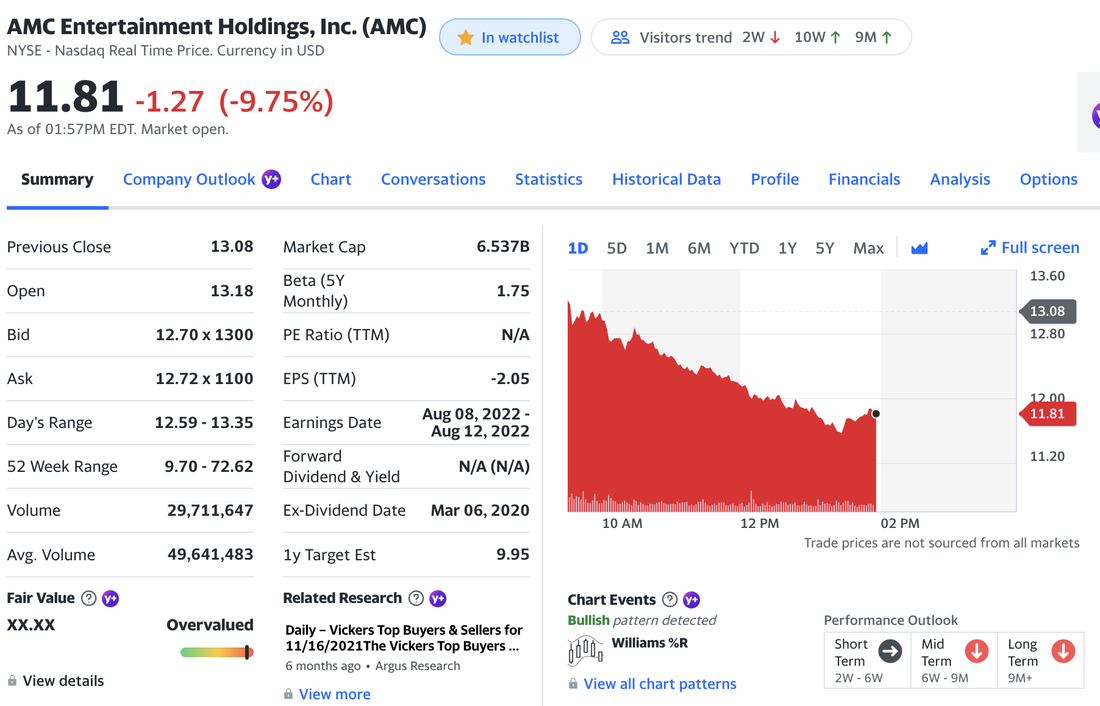

I have a Gold and Silver mine to sell you… AMC purchased 23.4M shares of HYMC and warrants (one of each). A week before the purchase the shares were worth about $0.30, or ~70% less expensive (not including the warrant which is now trading at $0.25). This is a terrible purchase. Hycroft runs an open pit gold and silver mine in Nevada that loses money. They have a shareholder’s equity deficit of either $2.2B (total) or $4.7B (tangible assets only). They have some timing issues with their 2023 liabilities as well. They spent $300M in CFFO in Q1 2022, and about the same amount in Q1 2021. Their operations bleed cash. We know that as labor costs increase, the losses will be higher unless they can raise movie ticket prices. There is an awfully large amount of debt, around $5.6 Billion Dollars. Maturities are owed in 2022, and start up significantly in 2023, 2024 and 2025. They issued some new 2029 debt (7.5% interest) to pay back earlier maturing debt. 7.5% cash interest = $70M / year in interest expense. This is only ~20% of their debt. Some of their debt costs much more in interest, and some a little less. They have $1.2B in liquidity, but their operations burn $300M / quarter. Simplistically this gives them 4 quarters before they need to borrow more money, or sell more stock. Their business is seasonal, so this isn't quite right, but it is close enough. Maybe they have 6 quarters because Summer is a good time for movies. In summary: Negative net worth Negative earnings and cash flow. Large-scale debt they cannot afford to pay back Necessary to dilute the equity further to cover losses and maturing debt. Investments in an open pit silver and gold mine that loses money (in Nevada). This company is significantly over-priced at $13.00. If it were our money, we would pay $2.00 for the stock. We would continue to streamline operations, increase viewership, and focus on reducing the $5.6B in debt. UPDATE: The next day AMC Entertainment is trading at $11.81 when we checked at ~2pm ET. We are not surprised. Only another $9.81 more to fall to hit our price target of $2.00.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed