|

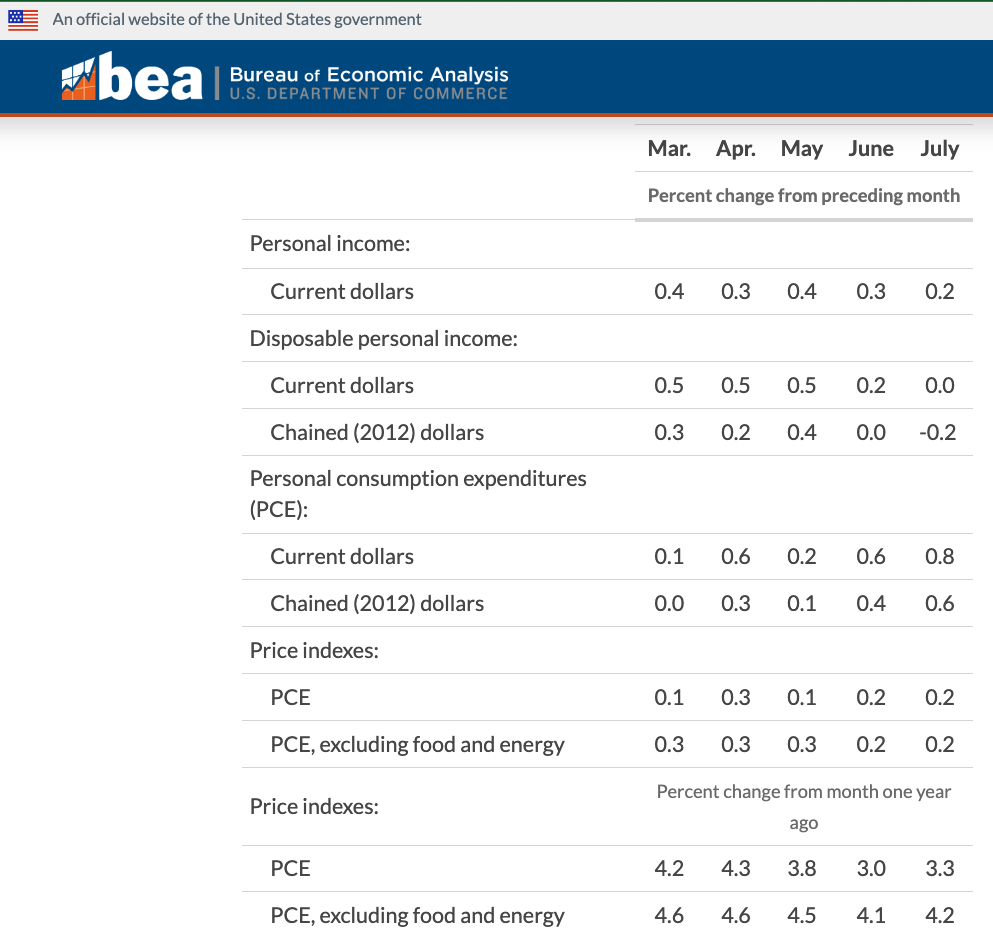

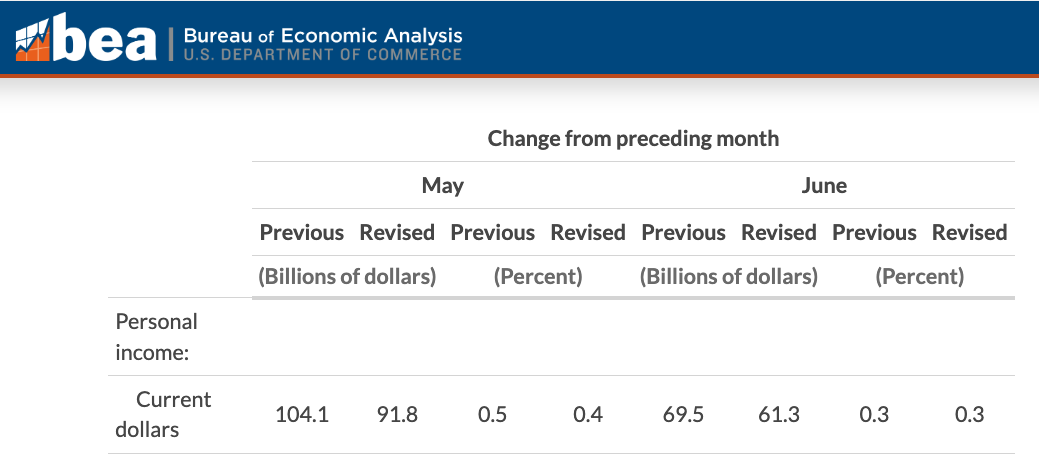

By Jeffrey Cohen US Advanced Computing Infrastructure, Inc. Chicago Quantum SM Consumer spending grew significantly faster than disposable personal income in July. According to the US Commerce Department (here) personal income increased $45B (0.2%) while consumer spending increased $145B (0.8%), and personal savings was 3.5% of disposable personal income. In short, the consumer fell $100B behind in July. Put another way, when accounting for inflation personal income was flat (0.0%) in July, but personal consumption expenditures rose 0.6%. Consumers were not just keeping up with inflation, as they grew spending 3x to 4x faster than prices rose. In short, they spent more, and they grew spending more than they grew their income. We also saw downward revisions to consumer's growth in personal income for both May and June of 2023, by a combined $20.5B. US consumer income growth was slightly weaker than we thought. In the totality of the data, we see that the US economy continues to grow based on increases in personal consumption for every month in 2023. Our question is regarding where the money is coming from to pay for those purchases, and whether the consumer is taking on unhealthy levels of credit. Only time will tell.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed