|

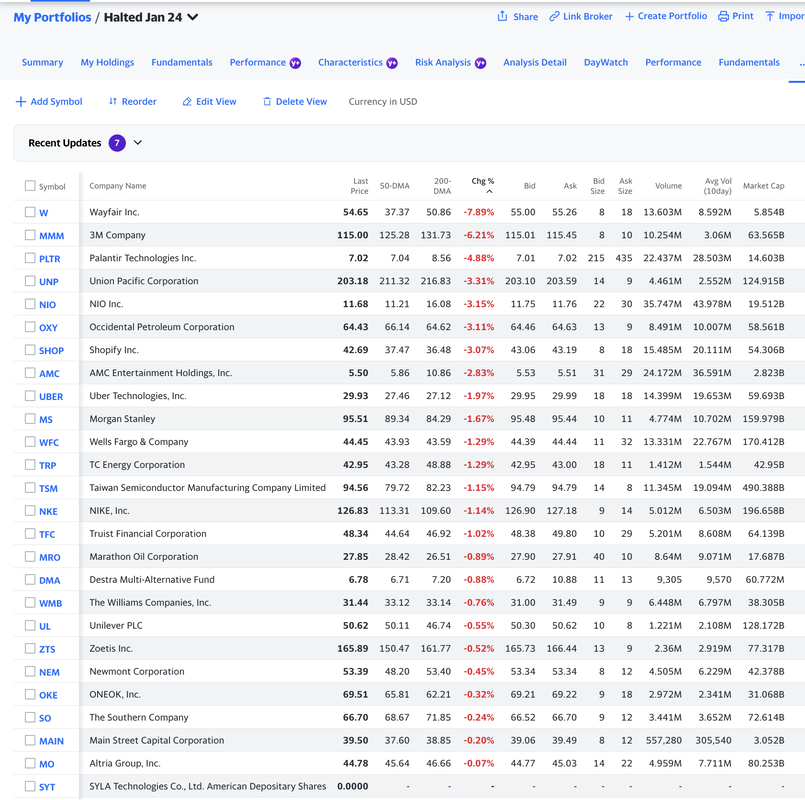

We were getting ready to make a video and do whatever it is we do at market open when BOOM all of a sudden the market falls dramatically. Twitter lights up. Stocks in the S&P 500 are halting. These are not small capitalization, MEME stocks, but big stocks worth billions or hundreds of billions of dollars in equity market capitalization. Stocks like $MCD, $VZ and $MMM. Some had earnings today.

We thought that this was terrible. It was a sign of market instability. Flash crashes are not helpful, and if they last for more than a few minutes they could trigger significant market instability through margin selling and forced unwinding of positions due to Value At Risk and Compliance issues. We tweeted something positive and life affirming, think it was the Kool Aid character and a statement that we were bullish, because we did not want to contribute to a possible crash. Not our style at all.

By the end of the day the market recovered. Not just that, but the stocks that sold off the hardest also recovered. In fact, they hardly moved at all and were flat on the day, along with the $ES_F which was down only -0.07%.

Here was a tweet of an analysis we did after the market closed:

In the end, this was a non-event.

In my opinion, based on my active imagination and some anonymous twitter vibes, I think what happened is that some options activity which required hedging by selling the underlying S&P 500 stocks happened. It happened in error, and there was the equivalent of a fat finger mistake (or just adding a few zeros to the position sizes). In other words, some trading desk made a mistake and sold liquid, highly capitalized stocks to hedge an options or derivative bet. The NYSE and NASDAQ exchanges figured it out quickly, halted trading, and the janitorial crew came in and put Humpty Dumpty back together again. There was "nothing to see here" by the end of the day and the halted stocks (the few that we read about on Twitter) were equally up and down and the median move was ~ equal to the overall change in the index. Nothing to see here, but wow will I be careful about putting in out of the money buy orders unless I really want those shares. Good luck tomorrow. Jeff

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed