|

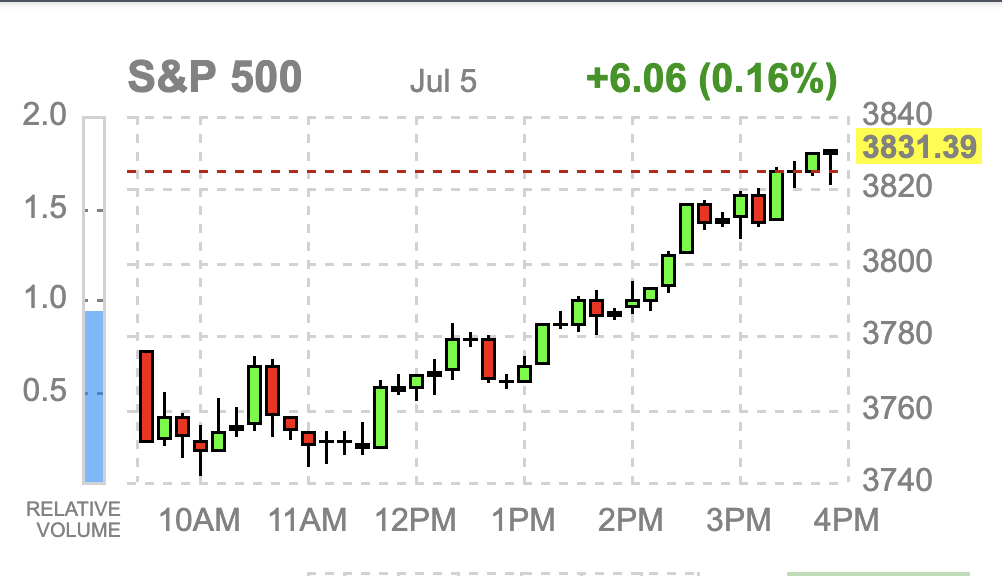

By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Here is what we see (updated): The US Dollar is more valuable than it was on Friday against commodities and other currencies. However, US Treasury Bonds are more valuable, and interest rate yields are lower. By 1110 ET: Dollar is stronger still. This is bad for US Equities. Eurodollar at 1.0243 GBP/USD: 119.09 USD/CAD: 1.3050 BTC/USD: $19,369 Also, we see Oil/WTI down sharply to $101.11 and even gold down to $1766.80. So, the US Dollar is more valuable for reasons other than yield. This appears to be a flight to safety. Original Post Below: News today: US dollar hits a high today, climbing steadily. WHEN THE US DOLLAR RISES, THE US EQUITY MARKET TENDS TO FALL Indian Rupee hits a record low today EuroDollar hits 1.0299 in pre-market 071445ET USD / CAD 1.2940 USD/JPY 136.08 US Equity Futures are down, but they were up last night. Commodities. Copper down Silver and Gold up slightly Oil, heating oil, Natural Gas, Gasoline all down slightly this morning (0% to 1%) US Treasury Bonds and Notes are down slightly, rates are up slightly. Inversion play. VIX up slightly, but still below 30 at 28.10 BTC Bitcoin down this morning below support level of $20k Recession fears in the news. MARKET BREADTH STILL NEGATIVE, INDICES DOWN. Low conviction day in the markets this morning, but the trend is definitely bearish. S&P 500 Has a cup and handle pattern that is bearish. At the end of the day, the S&P 500 was up slightly. We were right to have low conviction on the decline today. We felt the decline in long-term interest rates was too bullish for stocks to let them fall too much. However, breadth was very bad, with new lows greatly outnumbering new highs (1,040 : 31).

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed