|

By: Jeffrey P. Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. We notice a few things today:

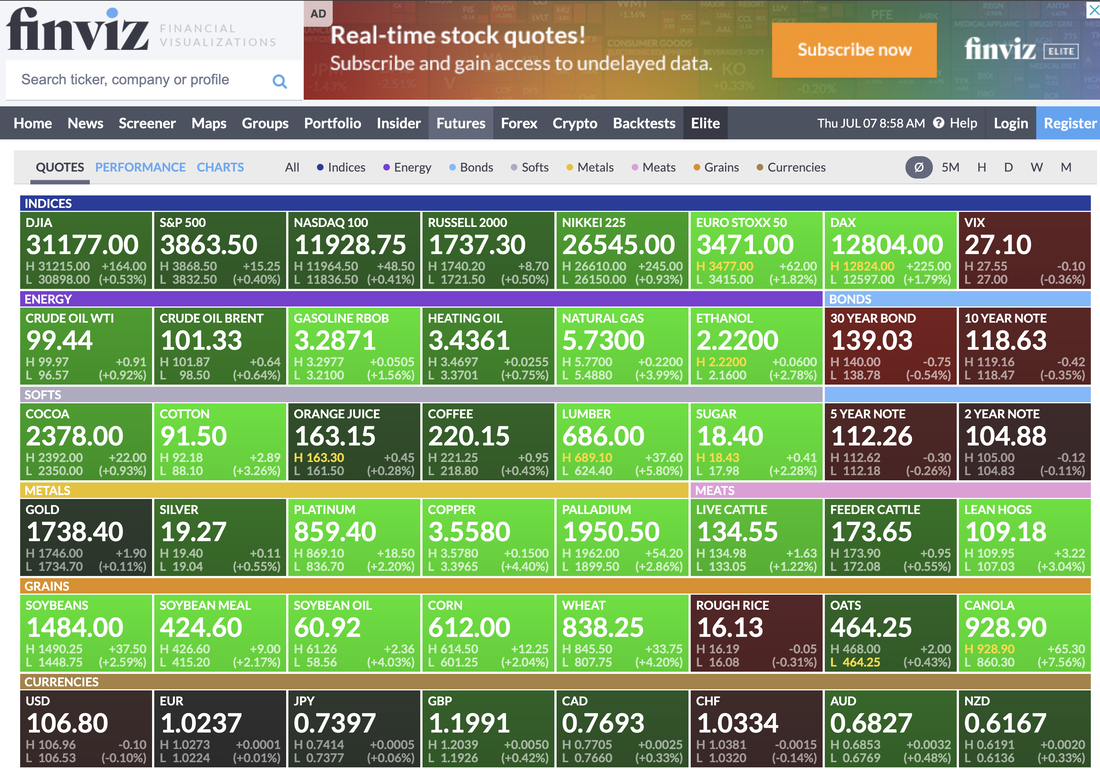

1. During a tough economic cycle, Europe and S. Korean steel companies can lower their prices and flood your market. In Turkey in 2019 and 2020, they lowered the price of steel to $473/ton of flat rolled steel. "The new levies follow an investigation into trade between October 2019 and September 2020, when flat steel imports totaled $2.05 billion, according to the Trade Ministry. Average import prices fell to $473 a ton in that period, from $624 per ton in 2018." No matter how efficient our USA manufacturers can get, the imports can lower their prices even further. Our government has some protections in place (tariffs) to protect our large manufacturers, and we hope our Administration keeps those protections in place where appropriate. 2. Bond Yields are rising. Looks like Europe sold bonds overnight (actually early this morning USA time). Bond prices rose into the open, and are falling again as we write this. 30-year at 3.16%. 3. Market Breadth still very negative. Many more new lows than highs. The US equity indices fell, rose, then fell again to close near where they opened. There are movements across equities, but they are intra-day and not very large. Looks like in a period of lower liquidity, there is also lower volatility. Interesting. We notice that 1.6 x 10-4 is the variance of both the 2000+ profitable and cash flow positive stocks we analyze in our CQNS up Run, and for the SPY S&P 500 Equity Index ETF. The variance of the market has plateaued at this level for the past few weeks. 4. Talks of a large China stimulus and lowering of interest rates. China needs the growth more than anyone with hundreds of millions of its citizens still living below the poverty level. 5. ORA or Ormat Technologies is in play. Yesterday they traded 7M shares, which is alot for them (up 500% over last year's average). They borrowed money to pay back old debt, and buy back stock. 6. 30-year Fixed Rate Mortgages (conforming) are up to 5.65% today. We cannot see how housing prices continue to rise when it costs more to buy, operate, insure and pay property taxes on new homes. They will go up with inflation over a long enough time horizon, but are most people earning more this year? Only time will tell, and MBS prices are the canary in the coalmine. 6. The futures are a field of green this morning, except for bond yields which are higher. We don't buy the messaging that everything is ok. The market is trying harder today.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed