|

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Today will be quick: 1. Expected returns in stocks and bonds are going up due to the fundamental weakness in the economy, fear of a recession (and the game theory answer which is to sell first), and increasing risk-free rates of interest. When expected returns go up (or need to), then prices fall. 2. Currency markets are boiling. US Dollar is strengthening (but not against the Canadian Dollar today, which is already down), and this will hurt the US Economy at the expense of our major trading partners. They are all (except for Europe) weakening their currency which lowers inflation in the US, and makes us prefer imports to our own domestically manufactured goods and services. 3. Long term interest rates are up (even over the 5-days) and mortgage backed securities are down (also over the past 5-days) of the bear market rally. They fell, which fed the rally, and now they rise, which will starve the rally of fuel. We shared our investments. CRBP and AMS are long term holdings where we are under-water. We are long, diamond hands, and could either gain a big pay-day or lose it all. BOH and LKFN are short or long-put positions where we are out of the money and betting on a decline based on their losses on investments. These show up as AOCI, which is reflected in their weakening balance sheets, but not in their net income. Larger depositors may flee these banks, while the FDIC bails out (and back stops) smaller retail depositors. These banks are trading at high multiples of common equity, which continues to fall with rising rates. This is a very bad situation for their stock prices. Good luck out there. If you like the video on youtube, please hit the subscribe button and leave a comment. It helps us spread the word without advertising. Also, we are not paid to write these blogs or make our videos. Update: Bank of Hawaii is a Hawaii-based bank holding company. Lakeland Financial Corp is an Indiana-based bank holding company. Since banks lend primarily on housing (both residential and commercial), let's see what the Federal Housing Finance Agency has to say on this topic (here): Hawaii housing prices are up 4.3% this quarter, 22.75% this year, and 59.15% over the past 5 years. Indiana housing prices are up 3.52% this past quarter, 15.65% this year, and 60.98% over the past 5 years. Mortgage rates also vary by state. According to Consumer Finance .gov (here), a well qualified buyer (800-820 credit score) buying a $500k house and putting 20% down for a fixed 30-year conventional loan has access to a spread of rates.

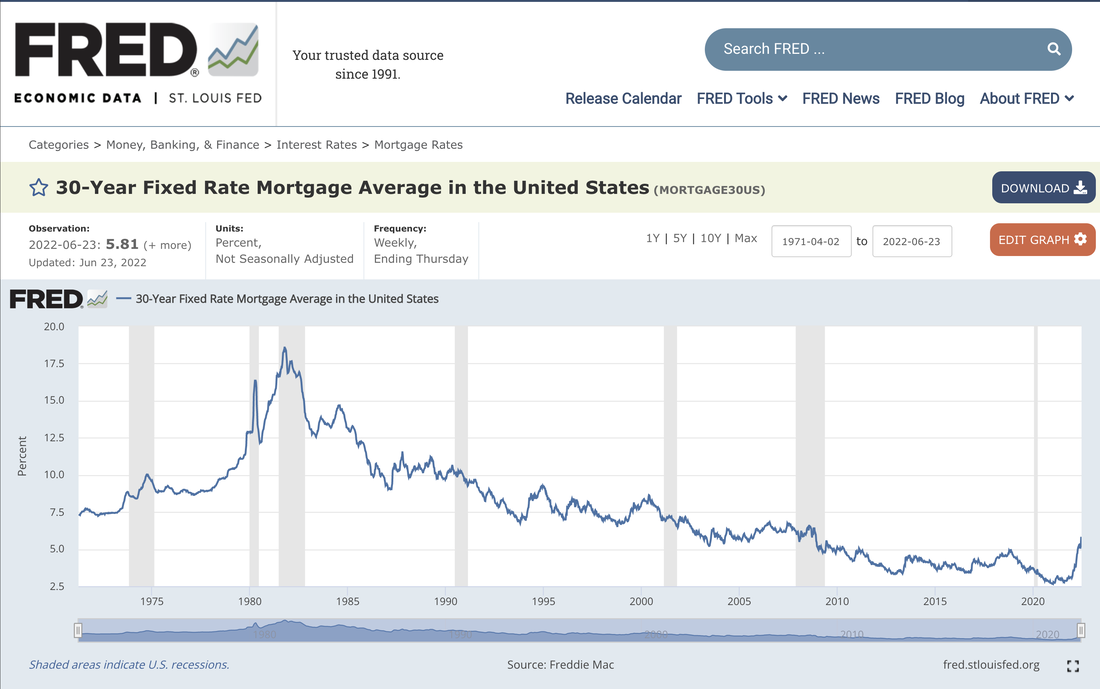

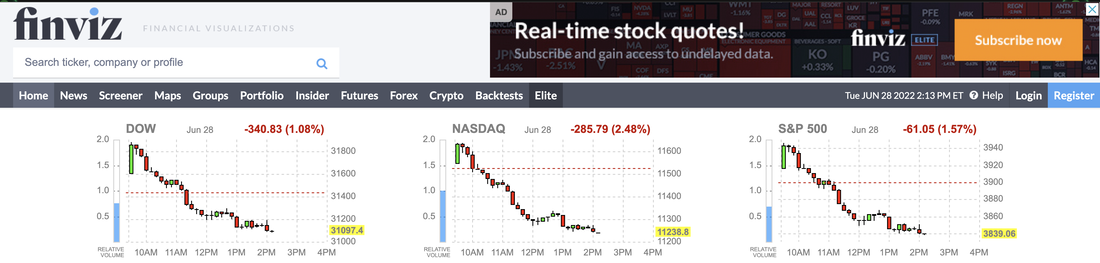

Lake City Bank offers mortgages on their website. 30-year fixed rate, with zero points, has an APR of 6.105%. We went deeper and entered information for Fishers Indiana, $500k house, $400k mortgage, without impounds or escrows. 30-year Fixed Rate: 6.033%, with no points. Excellent Credit History required for this rate. In Aiea, Hawaii (96701, 96740), there is only one mortgage available and it is from LoanDepot, with an APR of 5.22%, 1.946 points, and fees of $7,219 and the loan is only a 15 year fixed loan. BankRate does not have any lenders giving quotes on 'the big island' at 96740. Bank of Hawaii offers a 5.305% APR with 2 points, 20% down payment for a 30-year fixed loan. Maximum loan amount is $970,800 and these are not fixed rates, just a calculator used today (here). To drill down deeper, you have to create an account with SimpliFi, and that seems intrusive to us. A $400k house would then have a payment (before taxes and insurance) of $2,406/month, unless the borrower chose to pay $8,000 in up-front points and then the monthly payment would be $2,224, or $182/month cheaper, with a 44 month break-even point on the points, excluding interest you forego, which would likely take it out to 45 - 48 months. It seems that Bank of Hawaii charges more for mortgages Lake City Bank. The question is whether people buying a home can still afford the $2,400 mortgage payment, property tax of ~ $1,000 to $2,000, property insurance and the cost of operating the home. Conservatively, this makes the home cost ~$5,000 / month. If not, we will see homes declining in price, or people losing their homes in a recession. Again, we are betting against the prices of $BOH and $LKFN as we think a recession is possible, and we estimate both banks will have negative (net income - AOCI), which will reduce their shareholder equity and make their stock market valuation more 'rich' all things being equal. Everyone knows this who watches social media, but just in case, mortgage rates are above 5% for the first time since February 2011, or 11 years ago. At some point, this will slow down house purchases for 2nd and 3rd time home buyers. If the 10-year and 30-year US Treasury rates continue to rise as the FRB raises interest rates, then mortgage rates will continue to rise too. Look at the performance in the 1970 - 1983. Mortgage rates are historically sticky. Update Two: The market did rise initially (first 15 minutes) then fell and flatlined after lunch. Even if they go up into the close, it is just more volatility that isn't helpful to stock market investing. Look at NASDAQ 100 down 2.48% on an initially up day. This is a very large swing from a historical perspective.

Thank you Finviz for the visualizations.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed