|

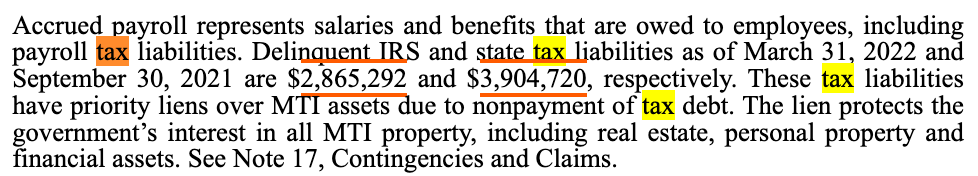

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Here is what we saw this morning: US Equity Futures were RED, indicating a lower open. SPY QQQ IWM. We checked and there was a big buy pre-market that took prices higher for just a minute or two, but they continued to fall. Many of our leading industry indicators were down pre-market as well. Semiconductors, Money Managers, Crypto and Mining, Retail (specialty). Trucking and Transport was mixed. Our 'DOWN' stocks and possible short squeeze 'runners' were generally lower, except for $SIGA and $MULN which were higher in pre-market. Our CQNS UP Run stocks were lower or unchanged in pre-market. This is a sign of institutional 'bets' being made as these stocks require deep analytics to find and put together into portfolios. These are your risk vs. return optimized portfolio bets (best and larger portfolios) $MULN is up pre-market. Mullen Automotive is in default on some loans, and has ~$3M in delinquent payroll taxes that puts most of their assets under an IRS/State tax lien, even before their senior secured debt. Source: 10-Q. The signs of lower liquidity are present in the market. We shared charts showing the main US equity indices are hitting higher highs and lower lows (as a multiple of SPY 1.25%, QQQ 1.50% and IWM 1.75%). This is one potential outcome, and not an absolute sign, of liquidity. Global markets were mixed. Mainland China and Japan were higher, while Hong Kong was lower. Europe was down slightly. Gasoline was up to $4.21, then $4.22 per gallon wholesale. This is very high, and causes us concern over specialty retail and retail in general. We spoke at length on this topic. Most commodities were about the same, but Lumber (random lengths, used for houses) has been falling sharply lately. Also, copper recovered from the 'stock market crash' a few weeks ago. This was surprising to us, as copper had climbed to $4.70 as a support level, then fall to 4.10, and was up above $4.50 this morning. This means that copper was set to resume its rise, and either reflect a stronger economy, or just cost the consumer more in all the electronics they purchase. Copper is a staple, or important input for an industrial economy. Watching the price rise 10% in a month is troubling for inflation watchers. US Treasury Bonds and Notes yields were up. The 30-year Bond trades at $137.97 (yield 3.08%) and the 10-year Note trades $118.50 (yield 2.91%). This matters because investors are losing money on their bond holdings (and mutual funds). This also will impact residential mortgages, which could easily see 6% (3% base + 0.5% default + 2.5% margin). This will hurt home improvement retail, remodeling, appliances, home building, lumber (already falling), banks and mortgage companies, and reduce construction labor demand. This also hurts those who hold the long bond in their investments. We suggested to keep track of the absolute price of the 30-year bond: $137.97 during future videos. Corporate Bonds: Sorry, cannot remember what we discussed here. Agency Debt / MBS: Issues were about 1:1 advancers to decliners, so pretty flat. However, we see 4.5 : 1 new lows to new highs in issues, so there must be pockets of weakness in the mortgage market. We looked at potential runners or short squeeze candidates. VIEW down MULN up on high volume *** BBAI down BSQR no volume SIGA up BBIG up a little BKKT down AVYA low volume US dollar was stronger, and this continues to weigh on US corporate profits for global firms. EuroDollar = 107.28 Yen/Dollar 130.292, or ~ 0.77 $RVP Retractable Technologies Inc. makes safety syringes and has government funding to expand domestic (US) capacity for manufacturing. That capacity is likely to sit idle now. However, we like this company. Not sure we like the stock at this price, but we like the company. We also like $CLF and $FLXS but again not sure on a stock price target. We like the companies. After the video was made, we listened to President Biden speak to the American people. He said something important about the economy. He said that we will run a smaller US Federal deficit in 2022 than 2021 by $1.7T. Most of the year is over, but if this continues next year, it is deflationary. Another sign of extra money with no place to invest it is the Overnight Reverse Repurchase market / window at the FED. Link: https://fred.stlouisfed.org/series/RRPONTSYD This shows that $1.99T is being parked overnight at the Fed. This is one reason why inflation is 'only' 8.3% and not higher. If this $2T had someplace to go (loan demand), that money would be chasing goods, services and assets along with the other ~$26T in M2 that already is. We also checked the COVID numbers through June 1, 2022 in the US. Cases are up and rising, but not nearly as high as in January 2022. Deaths also continue to rise, and surpassed 300 / 100k people in total. Daily cases are approaching what looks like 200k, and we worry this is bad for the 'Main Street' economy (along with gasoline prices). We checked with our friends at the Bureau of Labor Statistics, BLS.GOV, and inflation is still posted for April, which was 8.3% overall, and 30% for gasoline. The problem is that gasoline inflation has been 30% for 2+ years, which has a compounding effect (and why gas is $4.22 this morning, wholesale). Bitcoin / USD was lower today, down to $29,500. This brought down the bitcoin miners as well. We discussed the 1-year performance of the main US equity indices (excluding dividends ~ 1%). Actual SPY return = 0.61% Actual IWM return = -16.70% Actual QQQ return = -5.27% Very distracting but listening to President Biden's speech today. He said an important thing, that the US Federal Government is on track to pay down debt, this quarter, for the first time in recent history. This is inflationary, but probably not big numbers yet. (you give me bonds, I give you cash). He also said the US Federal Deficit is on track to shrink $1.7T this year (vs. last year). This is deflationary (brings down inflation), because you give me more money in taxes, and I give you less money in payments for good & services, or I make fewer payments). So, in the inflation-fighting scorecard, this is $1.7T to the good. We saw a little in the Treasury General Account (TGA) in an earlier video of about $12B, so we saw evidence of this. Video available here: https://www.whitehouse.gov/live/ Good luck in the markets today.

We worked hard today not to veer off course and stick to key economic and financial data. After typing this up, I realize that this is probably too much content for one video, but important to get the big picture. Hope you find it helpful. GLTA Jeffrey Cohen

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed