|

By: Jeffrey Cohen, Investment Advisor Representative

US Advanced Computing Infrastructure, Inc. Updated to add commentary on US Treasury Bonds.

Sitting here on a Saturday morning trying to make sense of the S&P 500 Index performance from a technical analysis perspective. I have my Harry Potter wand nearby (from last year's Halloween Trick - or - Treating in Highland Park). We need to go back to that house. It was hosted by what looked like a real witch and a huge wicker display of mystical things. Very friendly too. She shared a wand with me although that was not something I was supposed to ask for.

So, what do I see when I look at ^GSPC (the index), $SPY (the ETF) and $TNA (the 3x long ETF derivative). The TNA has been higher, and is now lower. It is below its moving averages (20, 50, 200) using closing prices, exponential smoothing.If you look at the MACD lines below, it has been in distribution mode since about August 20 when the purple line crossed under the yellow line (momentum indicator turned negative). I call this the "riding the bicycle down the hill" pattern. It slows down and speeds up, but it keeps going as long as momentum is on it's side, which it is. Notice the purple line separating from the yellow line this week. More negative momentum. That is likely due to the FED FRB raising interest rates and giving a 'I am a flaming, angry, fighting Jackson Hole' speech with Q&A that reinforced the message that interest rates are going up to 5% if necessary. Some realized that could break some things (us too, we have shorts on one of those things), so the market turned lower. The TNA has three days in a row of selling with higher volume. True movement of 'stock' inventory out of investor's hands and into other investor's hands. Makes you wonder who is buying? The chart below shows ~ 6 months, and concentrated bouts of increasing selling last up to 5 days, then the market exhausts. Sometimes the selling only takes 2 or 3 days. This week, we had 4 days of increasingly heavy selling. Four days of downward pressure. If we sell into next week, it means we have tapped into a new source of pessimism, a new data point, a new paradigm. The TNA has an RSI (or relative strength indicator) of 29. This is a good way to look at longer-term momentum over the past 14 periods. We see that indicator is approaching its lowest point in 6 months, and in previous periods led a modest, intra-bear market rally. It is hard for markets to sustain either buying or selling for too long before they have to pause. We are reaching the commonly accepted limit of 20 (or 80) which probably correlates to standard deviations. Not sure.This indicator shows price movement and momentum. One last thing on the TNA. Notice the Volume Rate of Change indicator (Vol ROC (14)) over the past 14 days that shows the relative volume. This indicator shows volume trends. The last big spike in volume was in early September and showed the sell-off 'blew out' and exhausted itself. Previously in early May, we see buying volume pick up after ~2 weeks of selling, and that persisted for three days, with another spile later in early May which happened just before the May/June bear market rally. In summary, the TNA is going up and down, and the momentum indicators show (in hindsight) the changes. As we look at current indicators, two of the three point to continued declines (volume neutral, accumulation / distribution is negative, and RSI is approaching a reversal signal). The length of time of the decline, like RSI, is approaching a reversal limit.

Let's look at the next chart which is the exchange traded fund (ETF) that tracks the S&P 500 Index. This trades like a stock, and although not a perfect correlation does not require the ability to trade futures to invest with. This chart goes back ~10 months and shows 5 separate declines. Those are marked by up/down lines. The horizontal line at ~430 is a general support/resistance line.

The first thing I notice is that the slope of the lines is increasing during this bear market. Makes me think traders and markets are growing impatient, or their bearish bets are growing bolder relative to liquidity, and this moves things along faster. The RSI (or price momentum) is reaching the limit / reversal level of 20. The volume in mid-September spiked at the end of the 'false flag' pattern of 4-days of rising, and began this recent bout of selling (volume spike before 9 days of selling). Accumulation / distribution indicator is showing continued and increasing distribution in this market. This cross-over occurred in mid-August and we have seen a month of downward movement. The question for us remains whether the market wants to continue the downward movement. There is no reason for the market to change direction. No change in fundamentals. Nothing political that we can see. Just a weekend for traders, investors, corporations, pension funds, and money managers to look at these same charts and ask themselves a question: " Do we aim for 350, or an S&P 500 level of 3500?" Are we sufficiently positioned for bearish movements, or did we blow out our shorts and puts? The rising volume on Friday (we can dig deeper into the Friday chart) could indicate traders bought back their positions on Friday.

The next chart is the 5-minute chart for the $SPY ETF. The indicators are all showing performance relative to 5-minute periods.

We can see that 'all' the price movement of the day happened in the first 10 minutes of trading. The rest of the days was calm, and the last hour was very bullish. The market bought back their short positions at an even higher volume than they sold them at the beginning of the day. This is a familiar pattern for us in other market sell-offs years ago, and worth a quick mention.

Anecdote time. We are building our managed account / hedged fund to offer to investors. We are paper-trading it now, but very realistically, entering trades with a brokerage and tracking things to the penny the way we would do it if live. We are a front-loaded fund that trades at the open based on pre-market values. We noticed that the market was down considerably in pre-market. The bets were in, the stocks had fallen, and we ended up dollar cost averaging (DCA) up more than a few positions and adding a few new longs from our model. When we calculated our NAV / cash balances at the end of the day, little had changed. Less than any day this week. That is when we noticed that the huge decline all happened in the first 10 minutes of the day. We noticed that $CS, or Credit Suisse First Boston was down significantly today. What if this was a 'big hairy risk bet' by a trading house (not $CS) that has to make up for a poor Q3? There are few days left, and liquidity is awfully tight. News is bearish, interest rates have been hiked, and financial twitter #Fintwit is filled with market mavens or fake gurus, #FURUs, willing to repeat and retweet a story. So, they spend the premium to buy up puts, they short mostly liquid stocks, likely make some bets in the futures, and see if their pessimism can be amplified throughout the day. They buy back during the last hour, and count up the profits. If they sell first and buy back first, they do the best by capturing the change during the day. For other 'fast followers' that copy the trade, their shorts after 09:45 and their covers after 15:15 did not do as well, and the later the bets were made the worse they did. This tells me that Friday may have been an isolated event by a few big desks to force a sell-off on a Friday. It didn't work, and now Monday comes and more traders lost money and likely hope in their magical, Harry Potter gambling powers, which would limit liquidity further into Monday. In closing, markets go up and down. Watch for big desks making big bets as you will see them in pre-market. A pre-market or market open sell-off is not always bearish, especially if there is no fundamental catalyst for the trade. Look for the cover by the end of the day (last hour?) and maybe beat them to the punch by a few minutes. Good luck to all. If you want to buy a run (a market analysis) so you can emulate our managed accounts / hedged fund, you can go to our Quant Analysis tab and purchase there. We run the models, write reports, provide data, and we think this would make you a smarter trader / investor for the next 20 trading days after accessing the data. Visit https://www.chicagoquantum.com for our brochure.

UPDATE: One last thought about an hour later...

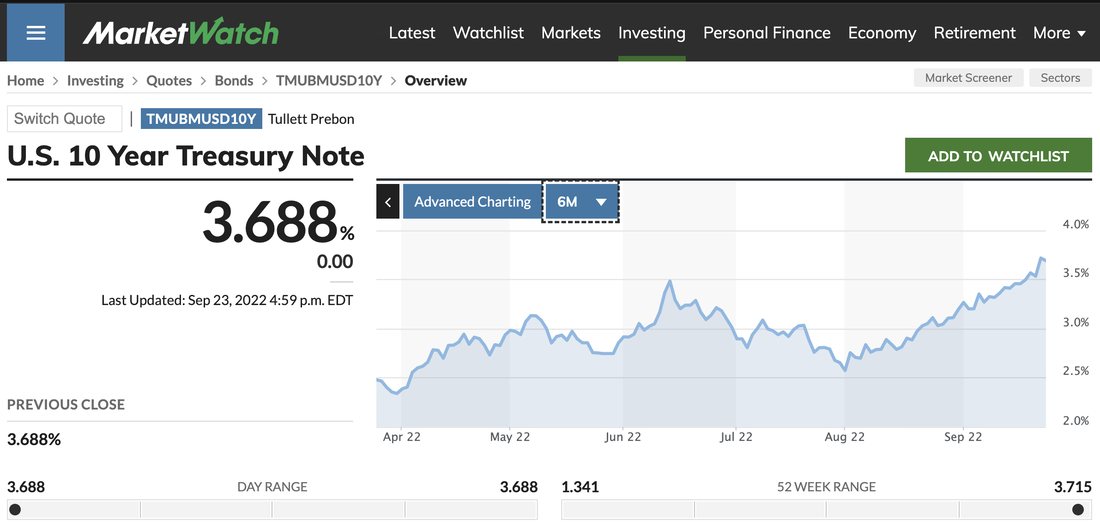

What happened in the 'real economy' to support this recent decline in stock prices? Interest rates rose for long-duration debt (think 10-year and 30-year US Treasuries). Those are not caused by the Federal Reserve. Prices for long bonds are driven by the market. They bring together a few ideas to set a price. 1. Supply and demand of bonds liquidity: There are plenty of bonds to go around and fewer people want to buy them (at least since August 2022). In a situation of high inflation and positive expected future economic growth, this money will be needed (our SWAG). 2. Inflation really is here to stay. 3. The economy isn't that bad. 4. The Federal Reserve Bank NY Branch and FOMC refuse to begin quantitative tightening with anything like urgency. Last I looked, on ~8.9T of debt, we removed ~0.15T from the FRB balance sheet. 5. US is raising short-term and policy interest rates. This tightens capital for stock speculation. 6. The US Dollar continues to strengthen, and the world's economy keeps going (at the expense of standards of living outside the US). This hurts US corporate earnings (as they are earned overseas and repatriated / revalued into US Dollars). I would watch the long bonds for a clue on future stock prices. The higher long bond rates go, the lower stock prices tend to go (all things being equal, and not an R = 100%). I follow many stocks, and two of them are worth mentioning. 1. Big company with lots of debt. Buying back debt at a 20%+ discount. People bidding down the stock price just in case they stop generating cash, stop earning healthy revenues, stop making a profit, and that debt load crushes them. 2. Small company with lots of debt. Sold off two parts of their business to pay down revolver (low interest rate, but most senior and restrictive debt). Being crushed under senior unsecured debt yields, as interest expense now exceeds earnings. Their debt yields 15%, which will likely be the cost of new debt if they need it (which they likely will). Crushed under existing debt costs and unable to borrow new capital at less than PE or Pawn Shop rates. Stock just crashed. We are optimistic on the first stock as we feel / believe the economy will keep them afloat and ahead of their heavy ($150B) debt load. They can always raise a few prices, cut a few costs, and maybe advertise a little less. They have market power. We are less optimistic on the second stock. We are not sure they will make it through the next debt cycle in 2026 without massive dilution, being acquired, or a little Harry Potter magic.

Had a thought and chased it down. There was a morning bet against the US Treasury 10-year bond. It is not an out of the ordinary bet, and the same bet did NOT happen in the 10-year UST. It just pushed yields up to almost 3.75%, or about 2.5 basis points (bps). It took 5 minutes, and in the next five minutes the bet was reacted to, and rates were pushed down almost 3 bps. The move of 5.5bps is very large, especially in 10 minutes on a Friday when there is less market liquidity, and nervousness about.

By mid-day, the yield on the 10-year was up the 2.5bps and more, for an intra-day move of about 6bps. What's more, the yield on the 30-year US Treasury bond also rose into mid-day, although it did not meaningfully participate in the morning market open action. So, one possible thread on Friday's action: - Morning game of racquetball or breakfast at that fancy hotel in Midtown Manhattan to discuss how trading profits are down. Bonus checks will be flat. We could even get, gasp, fired. What to do? Let's bet other people's money and have a really, really big day today. Let's make it all back in one screaming jubilee today. - One partner, Luke (or was it Obi Wan), says that we should bet the markets will go up, and tell all our friends and clients to buy some stocks and bonds. This way, everyone in America gets richer, and flowers bloom. - One partner, Darth (or was it Senator Palpatine) says that stocks take the stairs up and the elevator down. No time for stairs, let's do a Die Hard and force a big escalator move lower. You know, Black Monday only took one day! So, it was decided that the equity desk would sell everything it could get its hands on pre-market (never mind the larger spreads) and put in place the pre-market down equity bets. Once that was done, it started at the open by selling everything it could that was not nailed down. It was a storm of fury for 10 minutes. By then, the ammunition was spent, there was nothing else to sell, and the markets did not actually fall further. I even read a 'well placed' tweet by a #fintwit account that maybe the selling was due to an investment banking failure, and $CS stock was down hard. It didn't work. The next partner entered the fray 15 minutes into the market (5 minutes after the first partner was done), and they used a laser beam and toasted the 10-year US Treasury Bond. They sold it hard, for 5 minutes. They probably borrowed a bunch of bonds, sold their own inventory, and maybe even did something with futures or options (but we don't know that). They drove up yields by 2.5bps. This is a big market, and after 5 minutes they were done firing their cannons. However, the rest of the market woke up and bet against the crazy bond desk, probably thinking it was a fat-fingers mistake and easy money. The yields on 10-year US Treasuries actually fell by more than it went up (not just unwinding the 2.5bps, but taking yields down another 3bps). So, that didn't work. Actually, later on in the day the yields on 10-year and 30-year US Treasuries did rise, then fall. It seems maybe that trading desk shook things up just enough, but by the end of the day the action was flat. Ok, the bets were made and nothing worked. Stocks and Bonds did not follow. Nothing happened! Now, it is approaching market close. It is an hour before the close, and the markets have had a meh day, with ups and downs, but no trajectory. The equity desk starts closing out and covering its negative equity bets. Since they knew it was their bets that drove the market down, they wanted to cover first after eliminating any doubt that their 'trick' would not work. They waited until 1500 ET and started to buy back negative bets. It was done by market close. On fixed income, my guess is that they closed out their negative bets for a loss either before lunch, or by around 1400 ET. It is too hard and too embarrassing to lose that much money on US Treasuries. Also, that could actually cause the head of the desk to get fired. They likely missed the tiny recovery into market close (which likely was tiny because they already covered). If you like this scenario, you are likely to see it more and more between now and next Friday, Sept 30, 2022 when Q3 closes. If the market stays in a bear market pattern, you may also see this in Q4.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed