|

By Jeffrey Cohen, Investment Advisor Representative, April 25, 2022

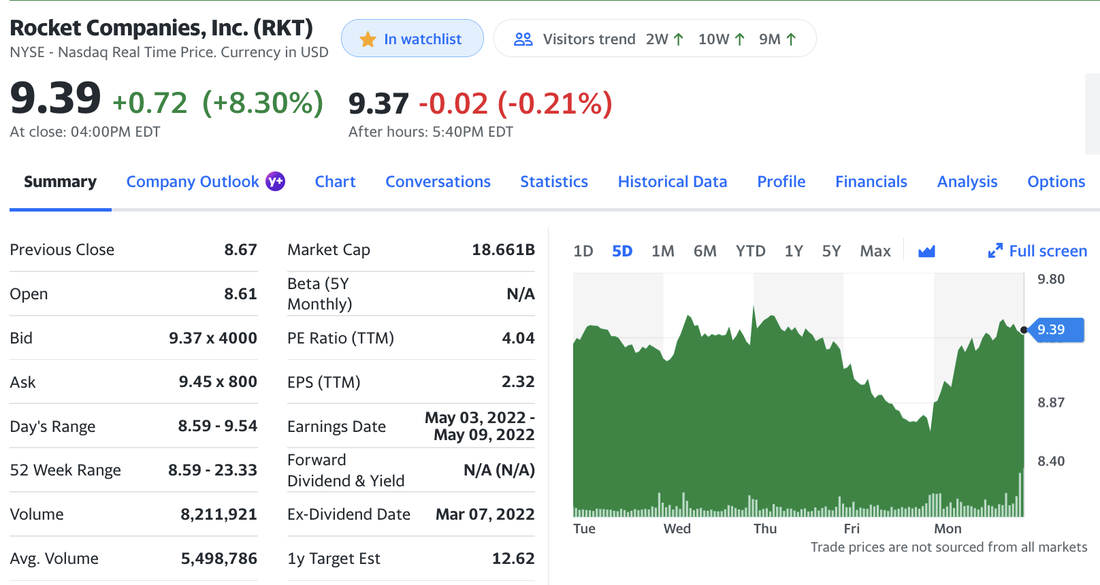

This morning the entire global financial market seemed to be flashing RED (meaning down). I tweeted this morning about a host of financial assets being down, including commodities, global equities and fixed income. The VIX, US Dollar and US Treasury yields were all up (bearish signs for equities). Almost every stock we track across sectors was lower this morning, including money managers, specialty retail, minerals and mining (including crypto), semiconductors, high-BETA and low variance stocks, the diversified indices, the stocks we think of as shitcos (high risk and speculative names), and others were all down, hard. Broad declines, and steep declines. The CQNS model forward looking returns hit the floor limit of 4%. This is because the S&P 500 Index ETF $SPY earned only 5% last year, while both the NASDAQ Composite $QQQ and Russell 2000 $IWM were down. Decided to work on our model today and take a long bike ride. First day exercising after COVID 19, and felt good to ride 12 miles, although it took ~90 minutes, and came back around 3:30pm ET to watch the close. To my surprise the markets were up, and key 'institutional investor' sectors were up strongly. Money Managers - up IT Services - up Shitcos - mixed Cannabis - mixed Minerals and Mining - down (but recovered ~ half) Crypto - up Personal Computers - mostly up Leptokurtic and low variance (down - people avoided these fairly riskless havens of income) Efficient portfolio (CQNS UP Run & individual efficient names) - UP strongly Chips and Semiconductors - UP significantly Specialty retail & high-end Furniture- up Discount retail - down Trucking - up This is a reversal of the recession fears of this morning. It happened at Noon ET today across the DOW, NASDAQ and S&P 500. Why the change? I think that the market had fallen enough to make the risk-reward trade-off attractive for institutional money. The high BETA stocks that will rise with the market (much faster and straighter), were bid up because at some point the S&P 500 will reverse. The specialty retailers pay healthy dividends and have strong earnings. Maybe next year will be down, but the return implied at current prices makes the trade more worthwhile. There also could have been short-covering and options bets being made as we have a full month until May expiration. As an example, I saw one of my personal holdings (a stock under $1.00), have 100,000 shares worth of calls purchased for $5,000, or $0.05/share, near market open. A nominal bet that could pay off well if this stock turns around. At the same time, the MEMErs called out to short this stock today, so we saw relentless pressure (at first with low volume), then a partial recovery at day's end. Even I thought of burning the shorts by buying their short shares this morning, but I already have enough exposure to this stock. I also thought of putting some money to work in those cheap, OTM options, since they were suddenly liquid. Institutional investors might have taken the other side of the short/RED stock sales this morning, which could explain the mid-day reversal. Our CQNS UP run stocks look to have returned about 5x the $SPY return today, so the 'smart money' in the market that wants exposure on the long / upside knew where to place their bets. This tells us that it was institutional investors or well informed accredited investors. Let's see what tomorrow brings. Thank you for reading our BLOG. For more information and to read our brochure* please visit our website at www.chicagoquantum.com. *(available at no charge and without logging in, from our homepage) PART 2 (UPDATED 17:44pm ET): Bitcoin (currently trading at 40,112 to 40,165) had a green day. This was another asset that was down sharply this morning and recovered. Speculative shape of the week. We see this, to varying degrees, across many speculative names at market close today. 5-day chart. $RKT is an example. Recession & rising interest rates destroy the fundamentals of their business (mortgage initiation). Friday and into Monday the story was pessimistic, including China's Beijing COVID 19 lockdown, but Monday afternoon this name fully recovered. It still makes us think about what macro force brought all these names back this afternoon (e.g., short-covering, long exposure into May).

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed