|

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. May 25 0930 ET The market is set to open lower today. We cover a somewhat random walk through the markets this morning and look for insight, indicators, anomalies, and clues on how the market will do today. If we were a day trader, we would be doing just this homework. However, we would probably be doing it at 0500 to 0700 ET instead of 0845 ET. VIX is interesting. It is trading above 30 this morning (up from 29.x). This is converted to daily price moves that 'break even' the cost of the insurance in our video. The way to think about it is you take the VIX number, say 30, then divide it by 19.1 (assumes continuous trading), and that is the percentage change for the S&P 500 within 2 standard deviations (68% of the days). Put another way, if you buy the VIX at 30, you are betting that the market will stay within a 1.57% daily change in price 68% of the days for which you bought that insurance. Earlier this year, the VIX was much lower, and that change was ~ 0.6% for a daily change, mostly because in a steadily rising market you pay less for downside insurance protection. Next thing we noticed is that our fundamental screener (which only gives you stocks to research - not a sure thing), is yielding stocks with total capitalization (debt + equity) that is not that much more than either Cash Flow From Operations (CFFO), or Net Income (NI), or both of them. This yields stocks to look into, to see if their future earnings will be just as good as their historic earnings. One such stock $FNF or Fidelity National Financial, which trades at multiples of 4 and 7, and paid a 3.52% dividend, looks like one to dig into. Hopefully rising oil and gas prices and a potential recession won't stop their cash generation. Let's learn more and find out. We covered oil and gas this morning. Prices are not just rising, but have been higher for a while. We discuss how short-term fluctuations in the price of crude oil are buffered by the refining industry, finished product storage, and hedging activities. We then discuss how when these prices are higher for 3 months or so, like now, those buffers get worked through and now prices will likely remain higher, and be buffered in. For examples, E&P may hedge their production at recent prices to ensure they make a profit. However, when oil is $110/barrel, hedging at that price may be cost prohibitive and so they sell at the spot market, which is $110/barrel. If costs of hedging fall, because traders get used to $110/barrel, then that price will be locked in for months up to a year. For gasoline, cheap crude works through the refineries, and into finished gasoline storage. Once the inputs cost $110/barrel, then the new product, which may take 3 months to be sold, is more expensive. Together, these effects will work to keep the price of gasoline higher for consumers. On the consumer side, if gasoline stays at $5/gallon retail, eventually economic activity will slow down. This will cost other retailers business, both from less driving and transportation, and in substitution of goods, services and meals at restaurants for the money poured into gas tanks. For most people, money supply is not elastic, but is fixed on a monthly basis. For example, we spent $48 to fill our tiny Toyota Corolla gas tank yesterday. At some point, it just won't be worth the drive...and we will stay home. Imagine if we still had the Chevy Trailblazer XT! As you can see, the price of oil and gasoline has been higher since the beginning of March. Those higher prices will start to change consumer habits as they 'sink in' and become permanent changes to expectations. We will say, "remember when gas was only $3/gallon?" like it was years ago.

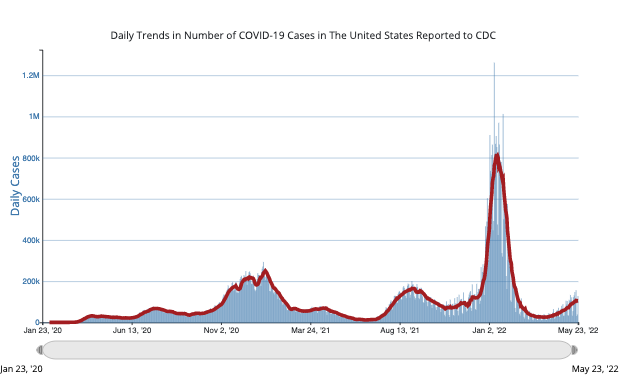

We also did some homework on our "stocks to buy" and "stocks to sell" lists. We confirmed bankruptcy risk on $RGS Regis, $AUTO Autoweb, $ATIP ATI Physical Therapy, and will be checking out $PRTY Party City next. If these companies recover, these stocks are a screaming buy. If not, they will not likely hit these high prices again. We still like $CLF Cleveland Cliffs $NVDA NVIDIA Corporation, and recently discovered $INTC Intel Corporation, but are still waiting for lower stock prices as the market crash / correction continues. We continue to watch $BA Boeing, $AVYA Avaya, and in the medical research field we like $RWLK Rewalk, but in all cases are sitting on cash to let the market find its new equilibrium. We expect to see markets calm down, for daily swings to get smaller (not larger), for liquidity levels to rebuild before we re-invest in the market. We may miss the bottom, but that is ok. We did not discuss this in the video, but we see US Covid cases rising again. This is bearish for Main Street, retail and service industry stocks. Our mantra still stands: FOMO is a cost effective strategy today. Downtrodden stocks will likely be lower in the next week or two, so it pays to wait a bit before investing fresh capital. GLTA!

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed