|

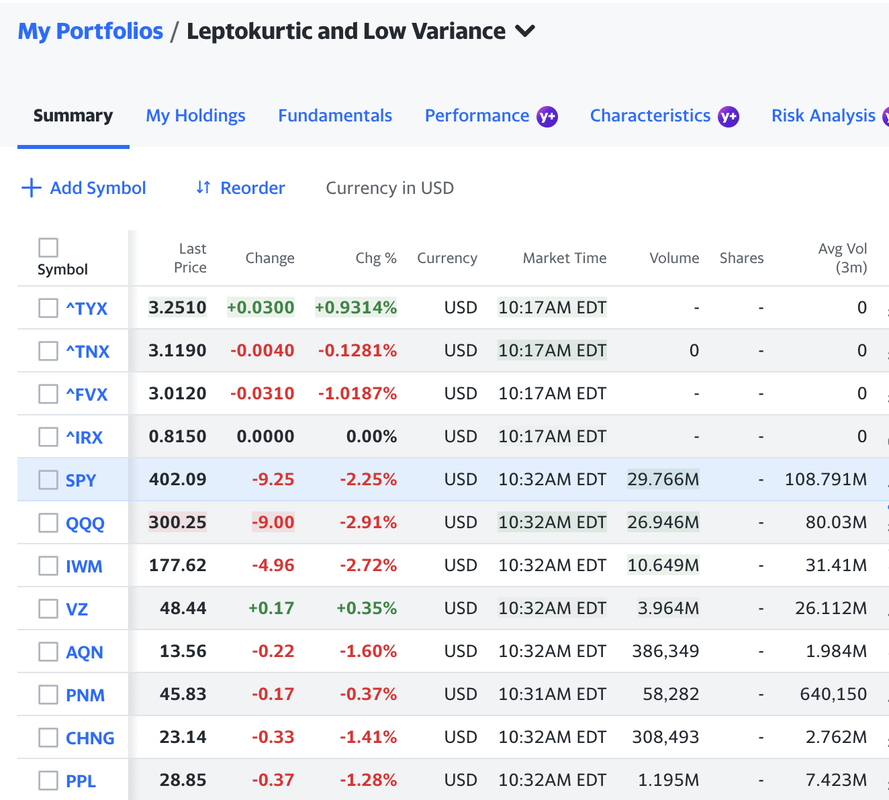

By Jeffrey Cohen, President and Investment Advisor Representative, US Advanced Computing Infrastructure Inc. Update: Markets have been open one hour. All US equity indices are down significantly. Our leptokurtic and low variance stocks are a safe haven, down less as a group than the $SPY (see image below). Our efficient stock portfolio (UP RUN) is down significantly, both the small portfolio of 8 stocks and the larger one at 25 stocks. Median daily return after 66 minutes is -6.14% for the larger portfolio, and -6.69% for the smaller portfolio. While we typed this BLOG post, the markets fell further. Our Proprietary Industry Indices that are down this morning:

Trucking is mixed. We are updating our trucking index to add freight railroads. If you compare Friday's close to the average of the adjusted closing prices for the past year: $SPY -0.55% $IWM -17.35% $QQQ -6.27% Our model's expected return for all stocks for next year: 4.00%. $SPY Closing price variance: 1.137 x 10-4 CQNS Down Run Analysis: 668 Stocks net income < 0, $500M market cap, positive BETA, & passed data validation. Expected return: 6.33% for all 668 stocks. Price variance 3.553 x 10-4 If you want BETA, $TNA gives efficient BETA exposure. Most efficient money losing co. stocks: $SQ $MRVL $TU $COHR $CDAY Least efficient money losing co. stocks: $LWLG $ZY $DCPH $BBIO $VTNR Best combination of shorts (when trading up): $LWLG $ZY Only 2 Negative BETA stocks of money losing companies: $FATH $SES. Very few money losing stocks paid dividends over 5% $ECVT $GOGL $ORC $IVR $NS $SWI $SFL $SBRA $INSW $PBA $BRSP $GEL $TU $PPL $FTAI High dividends paid (possibly one time) and currently earning negative income. Money losing stocks that have fallen in price (bottom fishing candidates down 71.5% or more vs. last year's average close): $ZY $FUBU $TRHC $BBIO $CVNA $SKLZ $PTON $NVTA $BAND $DOMA $GENI $NEO $FTCH $RDFN $TSP. Money losing stocks that have risen in price (up MOMO with velocity): $SRRA $BORR $LNTH $NEX $CRK $AR $KOS $OXY $TH $NEXT $EQT $VTNR $GLNG $APTS $TWI $VAL $SLCA $PTEN Our model & DD picked some of these last year. Lots in Oil, Gas & Midstream. A REIT too. Low volume names (negative net income): $CUEN $ENTX $YVR $PYR $SSKN $BBAI $GSAT $SAVA $SDC $INNV $WBX $MVST $MVIS $SWBI $CLOV $GEL $EVGO $WISH Volume down at least 63% vs. last year's average volume. High volume names (negative net income) - in play? $RADI $AVLR $GH $TCX $BILL $PACK $BHC $W $DASH $CVNA $LYFT $RDFN $SAIL $ZG $TXG $CORZ $WMB $PMVP Volume of 383% of last year's average volume, or more (up to 884%). All > $500M equity market cap. CQNS UP Run Analysis

1,966 stocks have market capitalization of $500M and above, positive net income, and passed our data validation. They have an expected return of 4.94% (~1.2 BETA x $SPY over 253 trading days), and have an equally weighted closing stock price variance of 1.379 x 10-4. Most efficient individual stocks: $LSCC $NVDA $MXL $APH $CG $TRMB $MSFT $GOOG $AMP $AAPL $ANSS $GOOGL $BLK $SNPS $KEYS $CPRT $TROW $AVGO $BX. Least efficient individual stocks: $CPK $QIPT $HUT $TROO $NEGG $ERO $ARQQ $FRGE $LGMK $MTMT $UONE $BTU $EQOS $GGE $CAR $GRAB $UONEK $CHGG $GLS $FFIE Stocks that have declined the most from last year's average price: $$FSRD $CZOO $ARVL $PEGY $LTRY $STNE $MTMT $FFIE $LSPD $SHOP $LGMKk $PAGS. These stocks have fallen at least 65.8%. Stocks that have advanced the most: $FRGE $AMR $CEIX $PBF $HPK $ARCH $UAN $SD $ARLP $LXU $CVI $GTE $VET $DVN $CVE $NRP $MRO $VLO $RES. Many of these are in energy (Oil, Gas, & Coal). These advanced at least 63% over last year. Our heuristic solvers found the most efficient portfolio and reach equilibrium on it. It is 8 stocks for a 4.5 x 10-4 edge today at market open. These are consistent names and should rise quickly if the $SPY advances. There are ~25 portfolios with the same edge (within 1 x 10-4 rounding), and the largest has 25 stocks, held equally in a portfolio. This is the best way to diversify your portfolio to maintain BETA exposure, but reduce price variance. We found individual stocks with Negative BETA in our run: $BTOG $IHS $K $NEM. We also found ETFs that deliver negative BETA: $AAAU (physical gold) $SQQQ (short QQQ fund) $UUP (US Dollar fund) $UVXY $VIXY (VIX short-term EFT) Profitable stocks that delivered the highest dividends last year (at least 5%): SHEN Shenandoah Telecommunications Co. 1.69 ZIM Zim Integrated Shipping Services Ltd 1.49 PEGY Pineapple Energy Inc 1.27 RMR RMR Group Inc (The) 1.27 AFG American Financial Group Inc 1.24 VMW Vmware Inc. 1.22 SBLK Star Bulk Carriers Corp 1.20 LPG Dorian LPG Ltd 1.16 IEP Icahn Enterprises L P 1.16 QRTEA Qurate Retail Inc 1.15 USAC USA Compression Partners LP 1.14 FSP Franklin Street Properties Corp. 1.13 CVI CVR Energy Inc 1.13 DHIL Diamond Hill Investment Group Inc. 1.13 KNOP KNOT Offshore Partners LP 1.13 DMLP Dorchester Minerals LP 1.13 KEN Kenon Holdings Ltd 1.13 ARR ARMOUR Residential REIT Inc 1.13 GLP Global Partners LP 1.13 FLNG Flex Lng Ltd 1.12 UAN CVR Partners LP 1.12 MPLX MPLX LP 1.12 MTMT Mega Matrix Corp 1.12 ICL ICL Group Ltd 1.12 TWO Two Harbors Investment Corp 1.12 RC Ready Capital Corp 1.12 CEQP Crestwood Equity Partners LP 1.12 KRP Kimbell Royalty Partners LP 1.11 NLY Annaly Capital Management Inc 1.11 DKL Delek Logistics Partners LP 1.11 MMP Magellan Midstream Partners L.P. 1.11 CAPL CrossAmerica Partners LP 1.11 PCH PotlatchDeltic Corp 1.11 SUN Sunoco LP 1.11 RTL Necessity Retail REIT Inc (The) 1.11 EFC Ellington Financial Inc 1.11 AB AllianceBernstein Holding Lp 1.11 GNL Global Net Lease Inc 1.10 ARI Apollo Commercial Real Estate Finance Inc 1.10 ORI Old Republic International Corp. 1.10 AGNC AGNC Investment Corp 1.10 AMSF Amerisafe Inc 1.10 CIM Chimera Investment Corp 1.10 SHLX Shell Midstream Partners L.P. 1.10 IFS Intercorp Financial Services Inc 1.10 DX Dynex Capital Inc. 1.09 CFFN Capitol Federal Financial 1.09 ARLP Alliance Resource Partners LP 1.09 KNTK Kinetik Holdings Inc 1.09 NRZ New Residential Investment Corp 1.09 AM Antero Midstream Corp 1.09 RILY B. Riley Financial Inc 1.09 PBFX Pbf Logistics Lp 1.09 BRMK Broadmark Realty Capital Inc 1.09 OHI Omega Healthcare Investors Inc. 1.09 CADE Cadence Bank 1.09 SPH Suburban Propane Partners LP 1.09 ALX Alexander`s Inc. 1.09 ET Energy Transfer LP 1.09 RTLR Rattler Midstream Lp 1.09 GBL Gamco Investors Inc 1.09 EGLE Eagle Bulk Shipping Inc 1.09 SOLN Southern Company 1.08 APAM Artisan Partners Asset Management Inc 1.08 LUMN Lumen Technologies Inc 1.08 VGR Vector Group Ltd 1.08 EPD Enterprise Products Partners L P 1.08 CODI Compass Diversified Holdings 1.08 HESM Hess Midstream LP 1.08 SLG SL Green Realty Corp. 1.08 RFP Resolute Forest Products Inc 1.08 HEP Holly Energy Partners L.P. 1.08 PAA Plains All American Pipeline LP 1.08 MO Altria Group Inc. 1.08 DCUE Dominion Energy Inc 1.07 NYCB New York Community Bancorp Inc. 1.07 T AT&T Inc. 1.07 WLKP Westlake Chemical Partners LP 1.07 GHLD Guild Holdings Co 1.07 WY Weyerhaeuser Co. 1.07 RRR Red Rock Resorts Inc 1.07 CNA CNA Financial Corp. 1.07 ENB Enbridge Inc 1.07 LADR Ladder Capital Corp 1.07 RKT Rocket Companies Inc 1.07 DDS Dillard`s Inc. 1.07 AROC Archrock Inc 1.07 ACRE Ares Commercial Real Estate Corp 1.07 ETRN Equitrans Midstream Corporation 1.07 GOOD Gladstone Commercial Corp 1.07 WES Western Midstream Partners LP 1.07 CMRE Costamare Inc 1.07 BSM Black Stone Minerals L.P. 1.07 LTC LTC Properties Inc. 1.07 MNRL Brigham Minerals Inc 1.07 OMF OneMain Holdings Inc 1.07 BGS B&G Foods Inc 1.07 PZN Pzena Investment Management Inc 1.07 GLPI Gaming and Leisure Properties Inc 1.06 OKE Oneok Inc. 1.06 KMI Kinder Morgan Inc 1.06 BWMX Betterware de Mexico S.A.B. de C.V. 1.06 UWMC UWM Holdings Corporation 1.06 VNOM Viper Energy Partners LP 1.06 ETD Ethan Allen Interiors Inc. 1.06 BLX Banco Latinoamericano De Comercio Exterior SA 1.06 NHI National Health Investors Inc. 1.06 CTRA Coterra Energy Inc 1.06 SIRE Sisecam Resources LP 1.06 MFC Manulife Financial Corp. 1.06 TFSL TFS Financial Corporation 1.06 NRP Natural Resource Partners LP 1.06 NWBI Northwest Bancshares Inc 1.06 OLP One Liberty Properties Inc. 1.06 UVV Universal Corp. 1.06 WMB Williams Cos Inc 1.06 STLA Stellantis N.V 1.06 BCE BCE Inc 1.06 EOG EOG Resources Inc. 1.06 ENLC Enlink Midstream LLC 1.06 BNS Bank Of Nova Scotia 1.06 SCCO Southern Copper Corporation 1.06 TRP TC ENERGY CORP. 1.06 LAZ Lazard Ltd. 1.06 WPC W. P. Carey Inc 1.06 GNK Genco Shipping & Trading Limited 1.06 PXD Pioneer Natural Resources Co. 1.05 SRC Spirit Realty Capital Inc 1.05 DCP DCP Midstream LP 1.05 GTY Getty Realty Corp. 1.05 MC Moelis & Co 1.05 IRM Iron Mountain Inc. 1.05 GMRE Global Medical REIT Inc 1.05 CQP Cheniere Energy Partners LP 1.05 SCU Sculptor Capital Management Inc 1.05 PAX Patria Investments Ltd 1.05 XOM Exxon Mobil Corp. 1.05 CM Canadian Imperial Bank Of Commerce 1.05 CNQ Canadian Natural Resources Ltd. 1.05 VINP Vinci Partners Investments Ltd 1.05 SWM Schweitzer-Mauduit International Inc. 1.05 EPR EPR Properties 1.05 PCGU PG&E Corp. 1.05 OAS Oasis Petroleum Inc. 1.05 CWH Camping World Holdings Inc 1.05 PM Philip Morris International Inc 1.05 KRO Kronos Worldwide Inc. 1.05 FIBK First Interstate BancSystem Inc. 1.05 IBM International Business Machines Corp. 1.05 DEA Easterly Government Properties Inc 1.05 SU Suncor Energy Inc. 1.05 FRG Franchise Group Inc 1.05 VLO Valero Energy Corp. 1.05 FE Firstenergy Corp. 1.05 UBA Urstadt Biddle Properties Inc. 1.05 AY Atlantica Sustainable Infrastructure Plc 1.05 NTB Bank of N T Butterfield & Son Ltd. 1.05 UNIT Uniti Group Inc 1.05 Good luck to all in the markets today.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed