|

By Jeffrey Cohen, Investment Advisor Representative

US Advanced Computing Infrastructure Inc.

We did our cursory look at the financial markets on Sunday night. We do the typical 'blah blah' look at global markets and figure that Monday is a mystery. The vision is not clear, and usually never is.

Today, it looks very clear. The markets are set for a dramatic fall on Monday, if things stay the way they are. We condensed it down to a tweet just now. Here are the pictures we saw that give us the most pause.

Bitcoin has fallen through its $30k support level. The US Dollar is starting to approach support levels for the EuroDollar. Stronger dollar and weaker bitcoin starts to impact global citizens. It makes people feel less safe, less 'on top of their game' and less sure of their 'new world' narrative.

If bitcoin continues to fall, and the dollar continues to strengthen, this takes us back towards the old world order where the US and capitalism are the safe place, the place to invest, thrive and survive turbulent times.

The Eurodollar is approaching support levels (around 103.5) and the Japanese Yen continues to weaken against the US Dollar. It will soon take 135 Yen to buy one dollar. Why any US company would work hard to generate profits in Japan and repatriate their earnings into US Dollars is beyond me. Japan is self-isolating and will survive due to exporting their way out of economic trouble.

This is also a return to traditional ways of being.

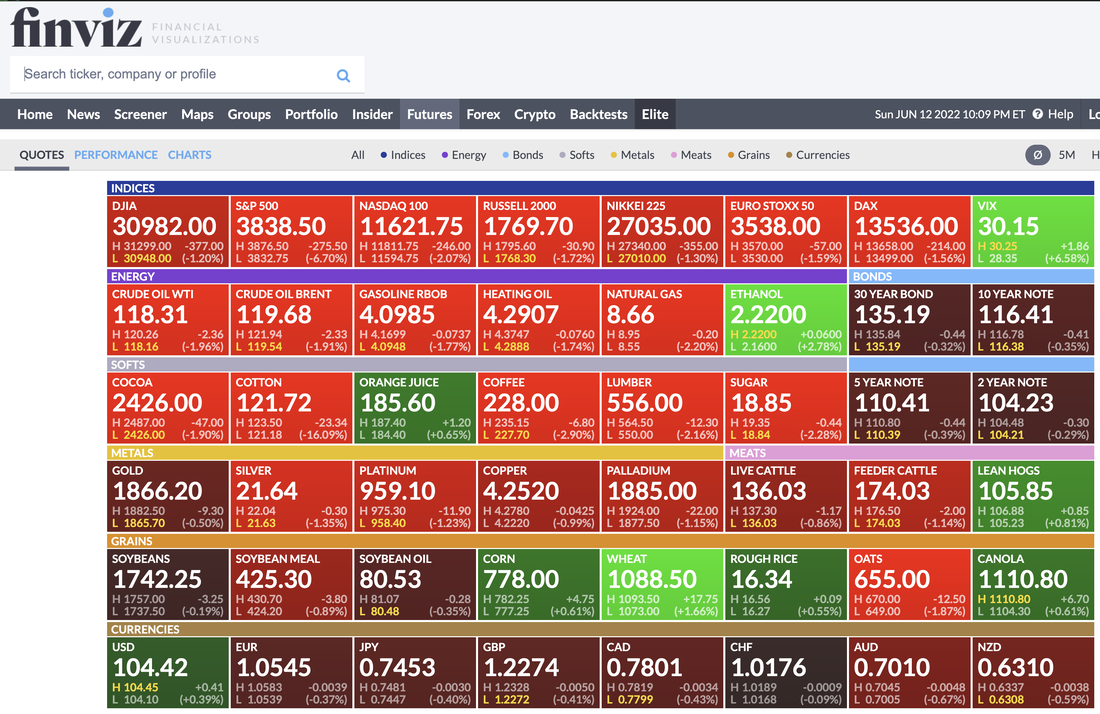

Thank you Finviz (found at finviz.com) for this excellent visualization. You can see the VIX has now broken above 30. This reflects the same analysis we did this weekend and found that volatility (actual, historical) volatility is higher today than it was yesterday, or last week, or largely for the past year. I would expect that if the US Equity markets continue to 'rock the boat' like they have been, VIX will continue to rise. In this case, it is only math and not emotion.

Gasoline fell to below $4.10. This is good but not enough. UST 30 year bonds are approaching key support levels of 135.0. Other UST notes are also lower. This indicates higher market-set long-term bond yields. This turns into less business and real estate demand and activity. This is a 'wet blanket' on the real economy. I don't know if I believe the S&P 500 hitting 3838.50 on Monday, but that is where it is trading right now (or at least about 20 minutes ago when we took the picture). That is a 6.7% decline, and something like a 4 standard deviation move in one day. Seeing markets like this makes me glad I am taking the next four mornings off from trading and taking my daughter to her Summer camp. It is a day-camp, far away, and I will drive her back/forth each day. I may have my trading account open...and may make a few trades, but I will not be in front of my office screens until the earliest 2pm ET. Good luck to everyone. I will sleep with a heavy heart for all of those fully or heavily invested in the US equities or US fixed income markets. I pray for your net worth, your sanity, your courage and your ability to recover from shocks like a 6.7% decline in the S&P 500 on a Sunday. GLTA Jeff

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed