|

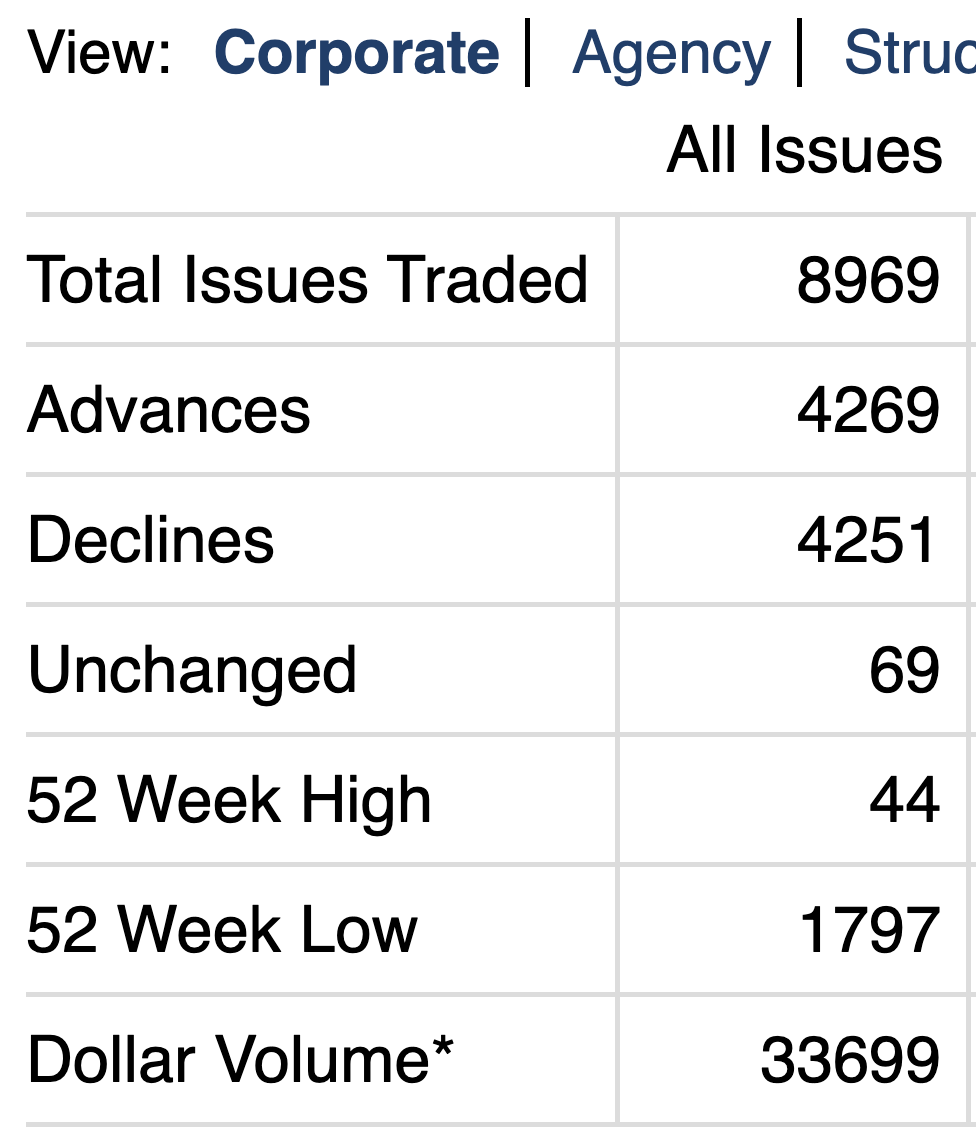

There are many more new lows than new highs across corporate fixed income and US equities.

This means that if a stock is down, it is likely to keep falling lower. Few stocks are reaching new highs. So, FOMO is a cost effective strategy still applies. If you like a down-trodden stock and feel you have to have it. Write it down, do some more due diligence, then wait 1-2 weeks. It will likely be cheaper then. If not, there will be many other cheap stocks to choose from. GLTA

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed