|

By Jeffrey Cohen US Advanced Computing Infrastructure, Inc. The consumer price index data came in this morning. It was lower by a tick, nothing more. All of a sudden, bond yields are crashing (10-year UST yield down 21.3bps). Stock index futures are up ~2%. There is a lesson to be learned here, but we are not sure what it is.

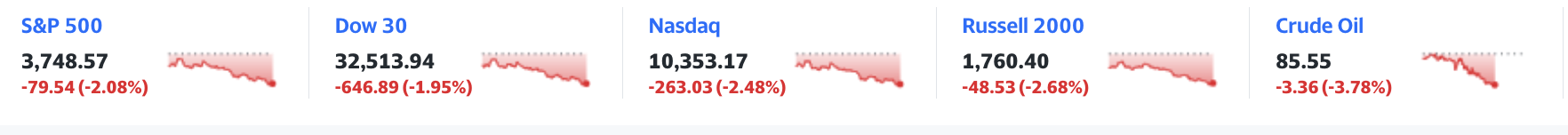

Here are some thoughts: 1. Don't trade in a market like this, where liquidity is down and moves are aggressive. You will lose your 'alpha' or edge in transaction costs. The pre-market spread for two stocks we own is 7% and 30%. There are significant bets being made (likely by multiple trading desks and portfolio managers) in the same direction. Huge bets in pre-market on UST-10 year (long) and US equity indices (long). As a retail investor, you will likely pay more in transaction fees, and the moves are so great you may lose more than your money...but also your nerve. This is like riding a tsunami on a surfboard. 2.We are 'stuck' with our stock portfolio as-is, until markets settle down. We have 19 longs, 3 shorts, and have a short SPY position. One long and two hedges (to track performance). Our CQNS Long portfolio wanted us to go 'Risk On' this morning, but we are too late due to the pre-market moves already made. There are significant sells of low-beta stocks and significant buys of high-beta stocks. The ideal portfolio for the SPY-based run is 11 stocks, and the QQQ-based run is 14 stocks as compared to our current 19-stock portfolio. We will ride out the storm until liquidity returns. 3. We will try to make a few position changes this morning to take advantage of the rising stock prices. However, if we only sell and don't buy, we will be in a > 1.0 hedged position. We will report back our progress. Ok, markets open 90 minutes. We sold > 50% of our CQNS long positions, the ones that were not in our CQNS Long portfolios as they read today. Those tended to be some of the in/out tech stocks, and the main street low BETA stocks. Those are now liquidated. We also reduced our hedges by around 20%. This means we are over-hedged for a few days while we wait for a chance to buy into our new longs (maybe Monday). This is a risk, but seemed a shame to miss a chance to sell into strength. The markets are acting strange today. US Treasury bonds yields are down 20 to 33 basis points, depending on the duration. Stocks are up 3% to 6% depending on the index. Crypto has made a recovery today Copper is up significantly, and carrying forward a recovery rally (up to $3.77/oz). Silver is up to almost $22, and even crude oil now is green. The US Dollar is weaker. It was like everyone saw a ghost. Everyone turning bullish, globally. Belief in a FED FOMC pivot. Crazy, actually...and we don't buy into the narrative. So, our CQNS Smart Volatility model portfolio is under-invested this morning after taking gains, and over-hedged by stonks and the SPY.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed