|

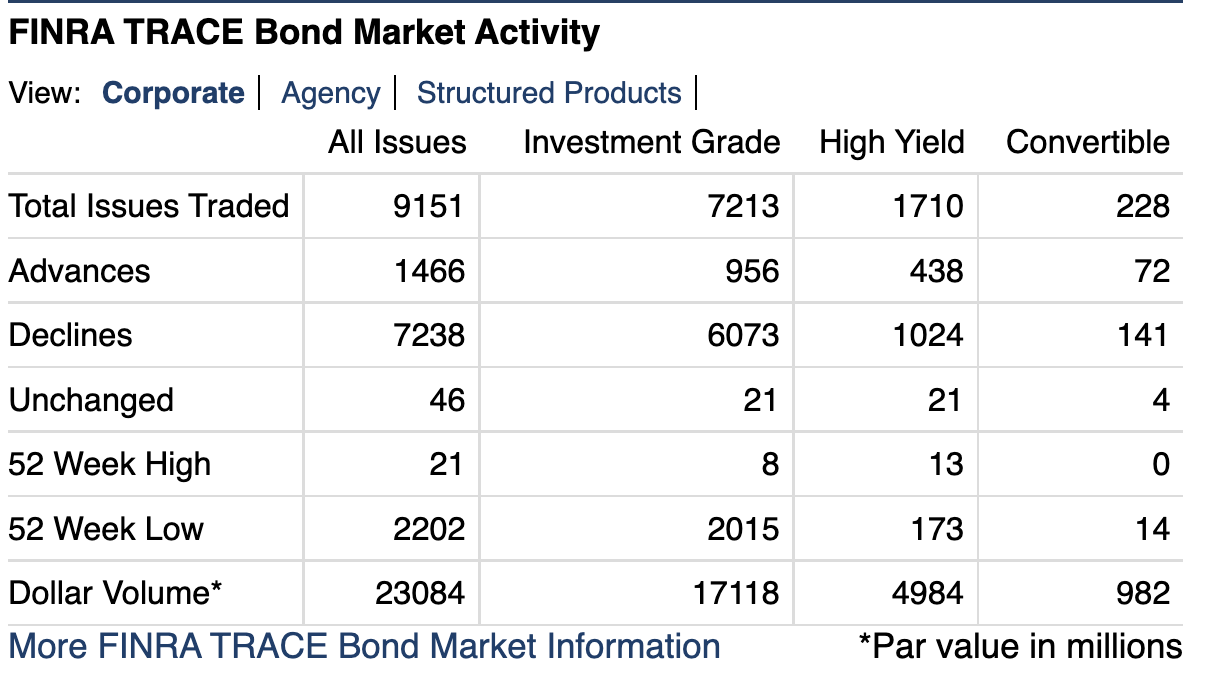

Well, the US equity markets are up slightly and stronger today. This is welcome news for us personally, as our personal holdings are down > 50%. The supporting financial assets are as follows:

Some of these movements could be due to the global energy shock as the world realizes that clean energy may not be plentiful enough, and that Coal, Oil and Sweat may be required for the foreseeable future. Sacrifices in demand must be made if we are to live with less energy, or we need innovation to leverage higher energy alternatives (like nuclear fusion, fission, and space-based. In fact, I am getting up now and turning off our AC (true). We are reflecting today on the sector rotation underway in the US equities market for the past year. Energy stocks have risen while consumer / communication stocks have fallen. It may be time for that rotation to reverse itself. Take a look at relative performance at Finviz here. Our model suggested a move into more commonly held stocks, and more of them. It takes 25 stocks, evenly held, and hedged against the SPY, to create an edge (or alpha) that can be captured regardless of market movements higher or lower. This is because variances are up, risk-free rates of return are up, and market expectations of new risk capital returns are lower. In terms of sectors, retail looks strong. Coal is weak. Retail Banks are doing ok (mixed but higher), and the rest of the industry sectors are mixed. Not to say 50%/50% up and down, but almost every sector is mixed.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed