|

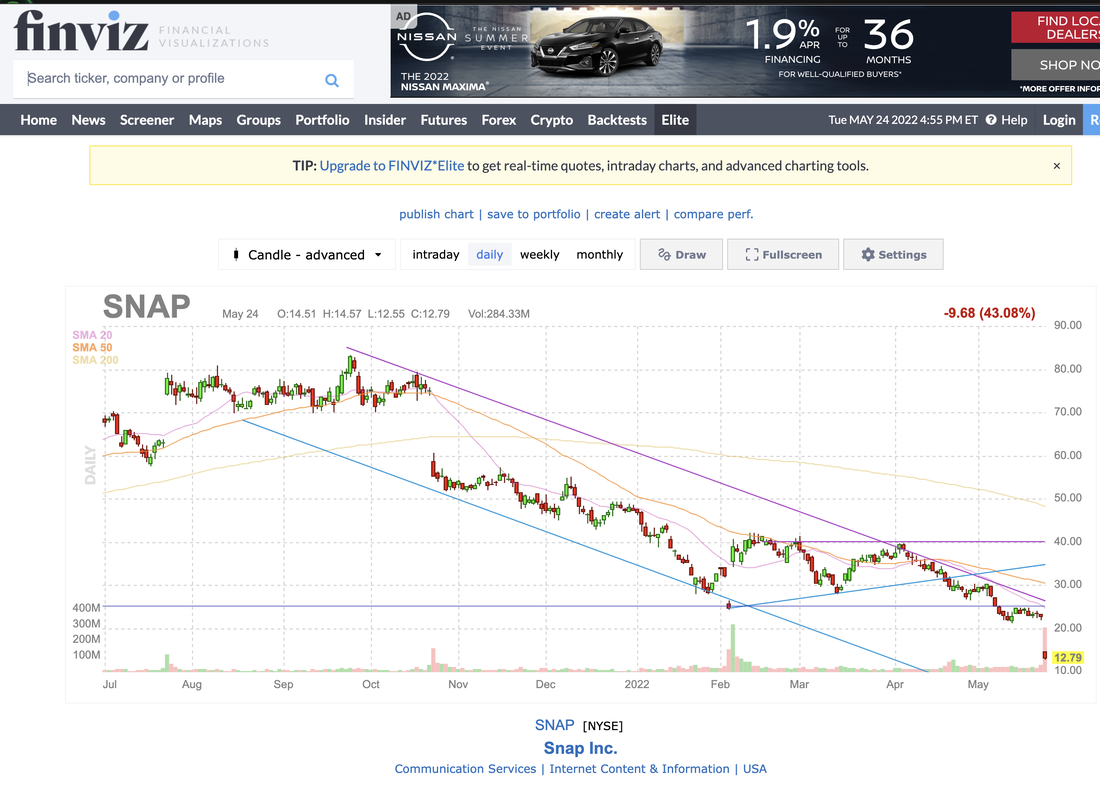

We have a saying here at Chicago Quantum. FOMO is a cost effective strategy. It means that stocks that have been falling will continue to fall during this market, at least for the next week or two. We do this because we are seeing extensions of trends of falling stocks. If you like a stock and the price has been falling, it is likely you will get to buy it still cheaper. We tested this hypothesis on $SNAP because we have never looked at this stock. Not our wheelhouse. When we look at this chart, the stock fell from $80 to $40, then paused, then fell to $30, and is now below $13.00 per share. The news from the CEO may have been a shock to the after hours market, but it is aligned with the overall direction of the stock over the past eight months. We stand by our strategy to hold onto your cash, and wait for a clear sign that the market has bottomed before investing downtrodden stocks. This does not mean you should not invest your cash in assets, but do so into index funds like the S&P 500, Nasdaq Composite or Russell 2000. Wait to pick individual stocks for now.

We continue to build our buy list for when the rain stops and Noah can step out of the arc. Today we further cleaned our model inputs. We removed stocks of companies that are not US companies. We find anecdotally that non-US company stocks are more volatile and possibly could lose significant amounts of value due to non-company specific factors. Better to remove them and have a more consistent risk profile. We also are refining our filters and due diligence approach for stocks. Most valuation metrics are trailing indicators, or feel like driving backwards while looking in the rear-view mirror up to 3-months ago. However, if we can get comfortable with a company's direction and future prospects, and their discipline in handling (protecting) cash and assets, then past performance gives us reason to research these stocks for the future. We can see industry sectors that tend to be valued with lower metrics and valuation ratios. These may be the industry sectors that make our buy list as the market bottoms. The key is to create due diligence processes that work well in each industry. We also found a few stocks that are susceptible to weakness in equity prices. They hold assets that will need to be marked to market, and impact their earnings and potentially, even if they are unrealized losses. Contact us for more information.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed