|

By Jeffrey Cohen, Investment Advisor Representative

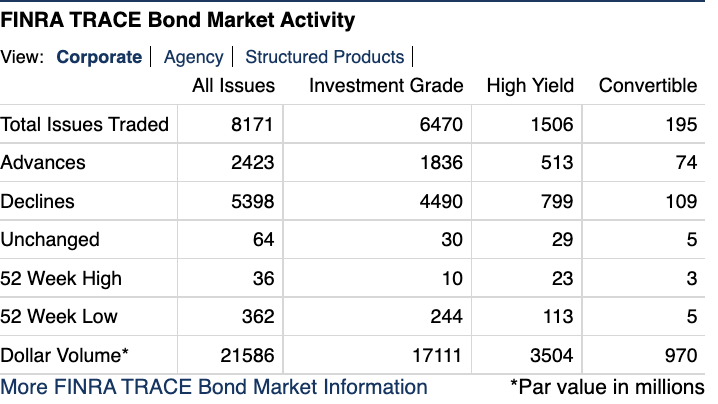

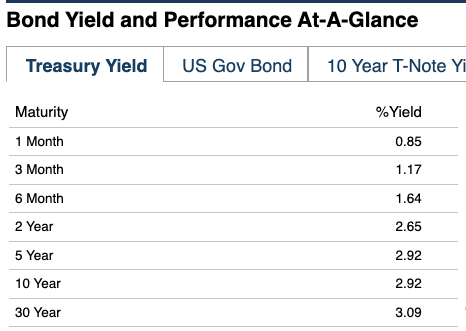

This morning the US equity markets are set to open higher by 1% or more, but are weakening as we write this BLOG. Silver (+2%), oil (now flat) and gasoline (down 1%), natural gas (+5%) and copper (-1%) are sending us a mixed message. VIX at 25.40 means the market is starting to settle down. Not sure if this is Summer Doldrums, an increase in liquidity and confidence, or something larger. Food commodities are up today, with Wheat up 3.5%. USD slightly weaker. Euro/Dollar at 1.0730 and 100 JPY / Dollar = 0.7655 show slight strengthening against the USD, but not by much, and these are weak levels. The S&P 500 e-mini June 2022 futures have been trading higher all morning. We are thinking these are the best way to hedge our CQNS UP portfolio, as long as the contract sizes are not too large. One contract trades for about $207,600k, and provides 50x the S&P 500 index movement. There is a micro e-mini future which trades similarly, and trades for ~$20,000 per contract. Not sure if it has the same liquidity, but this allows for hedging of much smaller portfolios. Crypto is much higher today. Bitcoin / USD = $31375. Last night it was at $31,111. This will support crypto stocks like $MARA $RIOT $SI $BTBT $HUT $CLSK $CAN $SLNH and likely the trading applications like $COIN and $HOOD. This is support for a risk asset that is not equities. Fixed Income Fixed Income: Long Bond at 138.19, 10 year at 118.56 are about the same as Friday. This is confirmed by looking at yields. 30-year UST Bonds yielding 3.09%, 10-year & 5-year UST Notes yielding 2.92%. The 1-month bill is yielding 0.85%, which is up and starts to push savings account and money market interest rates higher. Savers will start to see more attractive yields, which could pull money from equities more quickly (not just a risk-off move, but also an income generator). This is not great for banks, who may still be borrowing short and lending long. That yield is evaporating, especially when the risk-free rate for financial institutions is 0.08% at the FRB Reverse Repo window. Banks are taking advantage of this 'window' for more of their excess deposits and reserves, up to $2.03T on June 3rd. The good news is that quantitative tightening has the money parked overnight, and so the first ~$1T of liquidity pulled from the market can, in theory, come from excess reserves. This will take some finesse from the FRB. To me, it means we have the possibility of a pain-free tightening at least for the first $1 Trillion. We shared a Goldman Sachs note on Friday or Saturday that indicated high yield corporate debt has a great last week. Many issues were priced and demand was strong. They indicated this week would be weaker, with only one issue to be priced. We saw strengthening in the downtrodden stocks we follow, which is confirmation to this point. Corporate bonds were down on Friday. The New Low : New High ratio hit 10:1, which shows weaker issues were pushed further lower. The Decline : Advance ratio was 5.4 / 2.4 or 2.25. Investment grade issues suffered the worst, with a 24:1 new low to high ratio. Watch out for falling knives in this market. Final point: the pre-market movement of four industries / proprietary indices we follow are all up significantly. This points to early morning money moving into momentum-based sectors. This supports the indices to open higher. Now, we don't always listen 100% to pre-market moves, as they are typically on lower volume and cost significantly more to trade (spreads can be 10x to 100x larger), but on large, consistent moves we do take notice. Money wants to be in-place before the market opens. These 4 industries are all up broadly and significantly in pre-market. Money Managers Specialty Retail & Furniture Chips and Semiconductors Crypto and Physical Miners Trucking & Transportation is also up (about half the issues unchanged, and half up) Final point. We read anecdotally that new car retail sales were down in May. We want to follow up on that information for tomorrow's video. Do we have any stocks (potential runners) we follow to discuss? $MULN (The only significant and violent pre-market action is here) $VIEW $AUTO $VRM $COIN $KOS $GBR $MTMT and many more... Good luck in the markets today. Jeff

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed