|

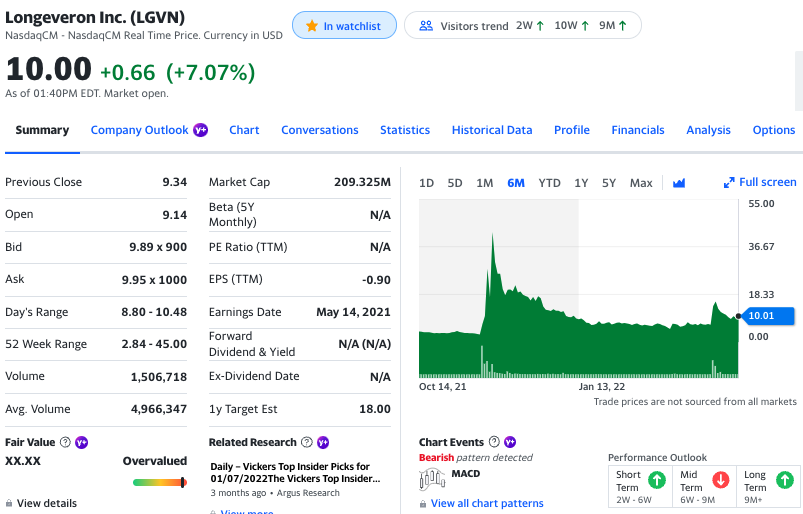

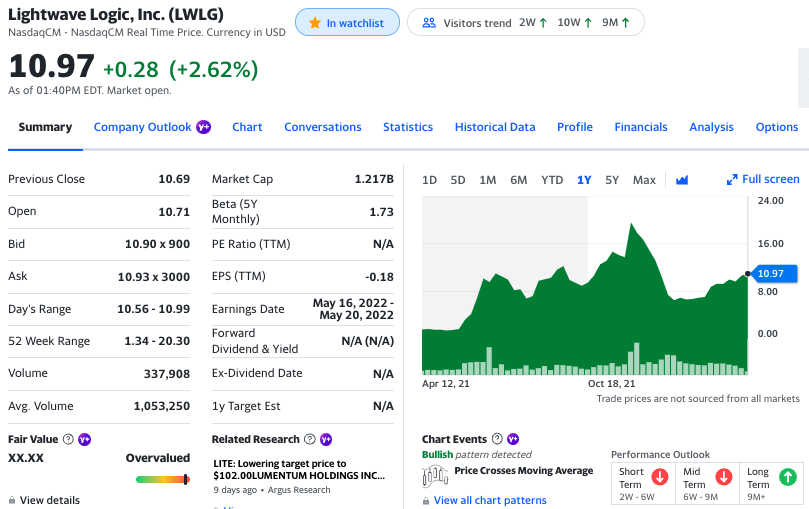

LVGN RGN LWLG BBIG GGE FATH SGLY DDL BBAI TEAM We evaluated buying puts today on one of these stocks, but find them to be less than responsive to short-term changes in the underlying security. Therefore, you are not getting better 'bang for your put option buck' when the stock price rises. LVGN has very interesting SEC Edgar filings that we are reading. However, this is a tightly controlled stock and so it might not be 'free' to trade to its valuation. 3/4 of the shares are held by 3 shareholders (Class B common stock). More research to do. Also, they announced a shelf offering of $50M, and the price/date they picked was the one day it spiked. It seems so much easier to buy stocks that will/may increase in price. It is much more tricky to profit from trading in a stock that goes up and down frequently and dramatically. For now, we will not initiative a long position on these stocks until we continue/complete our DD.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed