|

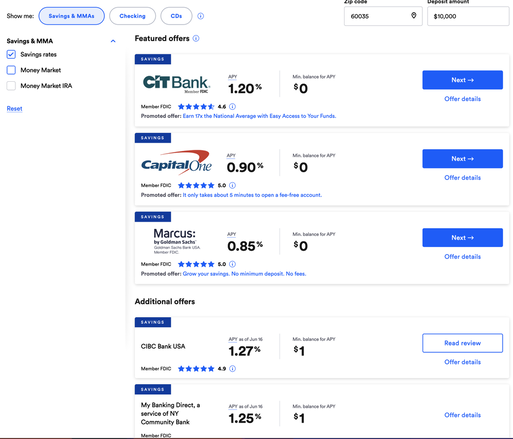

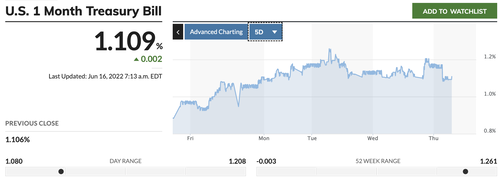

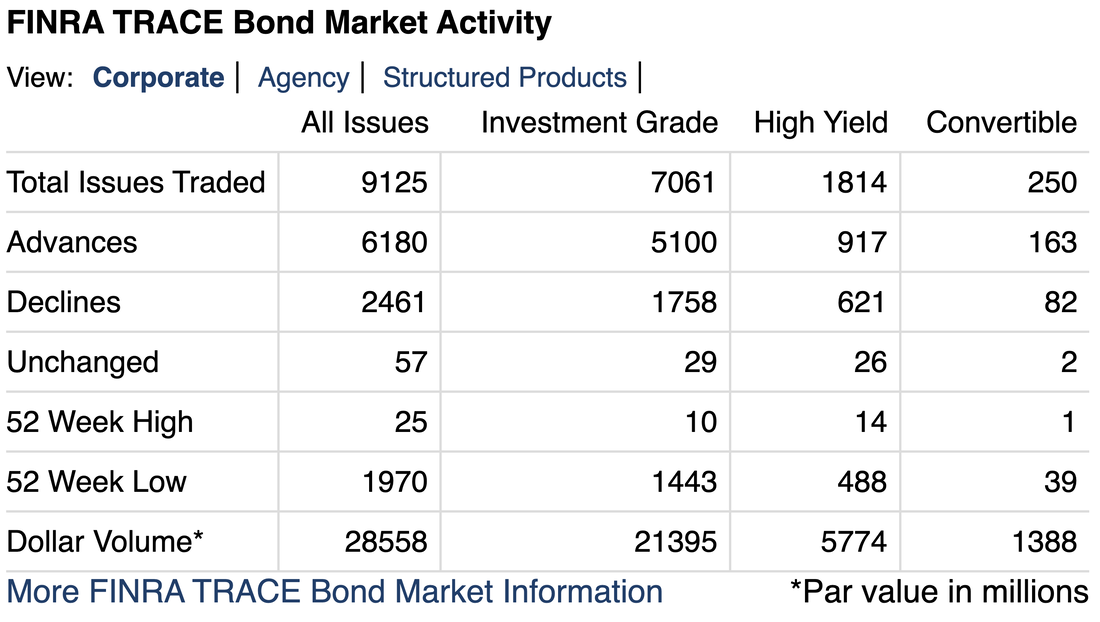

By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Updated intra-day 1421 ET We ran our models last night and made a few tweaks based on the Federal Reserve Bank raising interest rates. We thought it would not make a significant difference. We watched the futures last night and everything looked Green/UP. This morning, our analysis suggests something different and the US equity futures and UST bond and note futures are RED/down. What do we see? 1. We raised the 'risk-free' interest rate in our model last night to 1.5% from 1.0% and it made a big difference. You may remember in school when people said 'rising interest rates make people sell stocks and put their money in the bank.' We do. I also remember people saying that inflation is the enemy of stocks, and interest rates are bad for stocks, and there is competition. We see it today. 2. Many new lows were hit in US Corporate bonds (fixed income) and US equities even though the indices were up yesterday. This makes sense if you remember the adage "do not catch a falling knife" or "bottom pickers get stinky fingers" or "hey you, get out of the way." Stocks that have been weak in this market continue to weaken further. It isn't the hedgies or big money guys or 'The Man' betting against your favorite stock. These companies are worth less every day due to something that is likely very real. Retail sales were negative on a REAL basis in May, and were flat for the entire year (May 2021 - May 2022). 35% of stocks and 80% of bonds that declined (the quantity of declines) were new lows. 3. There are many analysts that speak about trading strategies and big events. There are two that I remember from reading last night (after market close). Friday is OPEX or options expiration where I believe ~$3T in options (at nominal values) expire. Also, supposedly there are investment funds that will be buying stocks at month-end. 4. Our model gave very different results today. Watch the video to see if we share more of this new, cutting edge insight (or if it just goes to clients who pay for our runs). GLTA. Enjoy the video. Intra-day update (1421 ET)

A few key industry sectors:

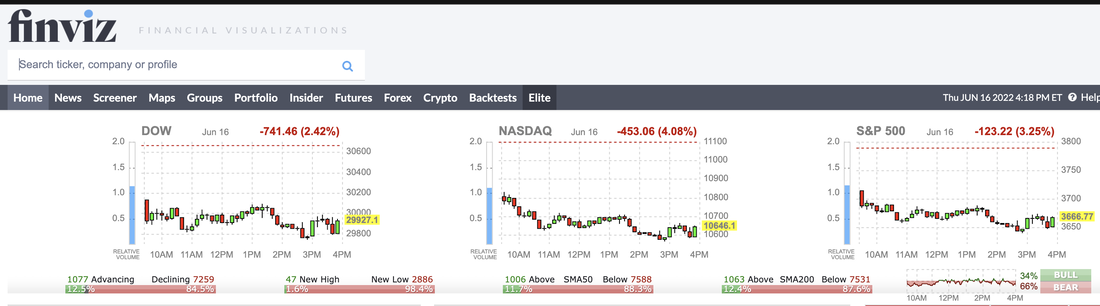

Update at market closeThe markets continued to fall throughout the afternoon. Notice the slight uptick, decline, and uptick into the close during the last hour of trading.

We will likely discuss how 2,886 stocks hit new lows out of the 7,259 that traded lower today, and how 66% of participants were bearish. The market opened lower, likely due to large bets already set in motion at the open. This was not retail driven and the day saw little strength. Tomorrow about $3T in nominal value options expire, then the cycle starts up again into July.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed