|

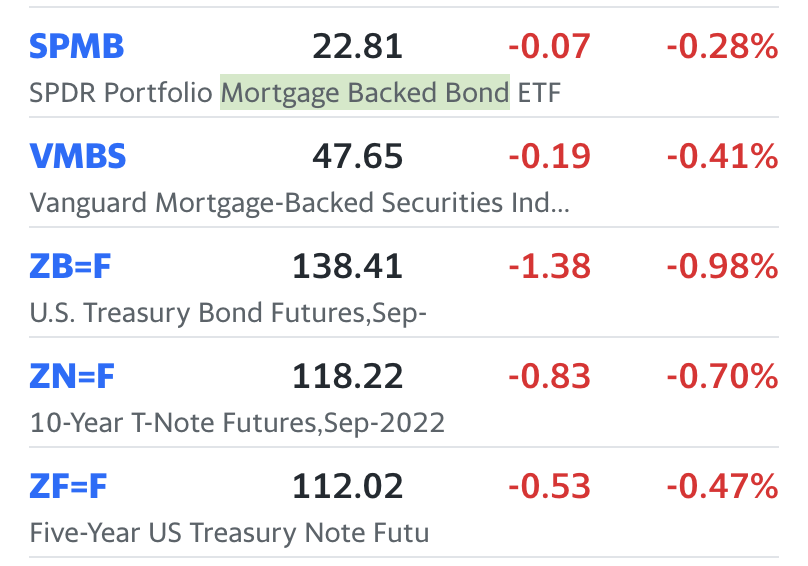

Be wary of banks that are holding long bonds and mortgage backed securities as investments. These are declining and may cause accumulated other comprehensive income (AOCI) to be strongly negative. AOCI is not reported in net income, or accounted for in EPS, so it seems invisible. However, it is a mark - to - market mechanism that impacts a company's equity (or book value). In the case of banks, this reduces their common or shareholder equity, which is their cushion against further losses. We watch this carefully, and saw it fall dramatically about a month+ ago, then recover just as dramatically 2 weeks ago (climaxing at quarter-end on June 30), and now is starting to fall again. If this continues, it will reduce the shareholder equity (or book value) of banks we follow that have large investments in these securities. We just read two 'lightly documented' articles that discuss how auto loan delinquencies and home rent delinquencies are both rising. Auto loans a little, and rent must more. It was estimated that 15% of all renters are delinquent on their rent and face possible eviction.

Check these out. Still early days, but if these loans are securitized, or the rents are part of large REITS, we could see some systematic issues, and potentially demand destruction. https://www.zerohedge.com/markets/prepare-tidal-wave-evictions https://www.zerohedge.com/markets/prepare-auto-loan-crisis-delinquencies-begin-rise

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed