|

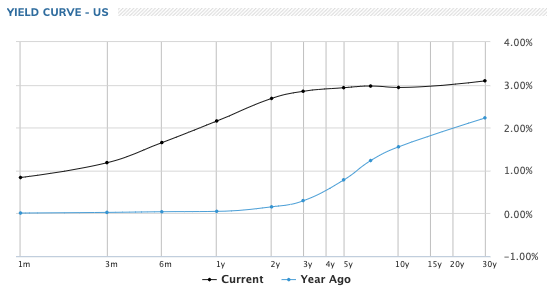

Today we see US Treasury Yields up across the board, and a flattening yield curve.

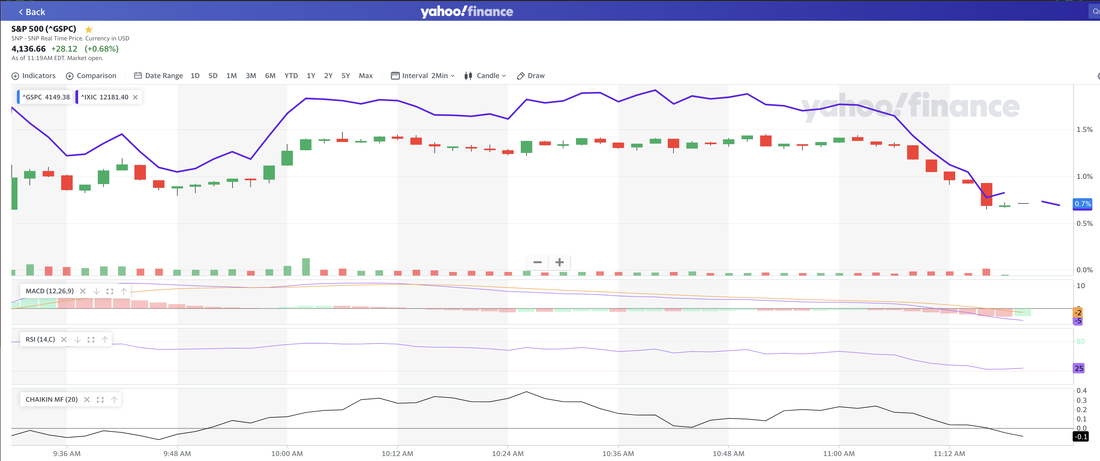

1 month bills, 10 year notes and 30 year bond yields are all up today. And yet, the US equity indices are also all up today. Since we starting writing this post the S&P 500 Index and NASDAQ Composite 100 both fell sharply over the past 5 - 10 minutes. I guess we are not the only ones watching... Normally, rising interest rates means equities fall. Unless, a second order effect is taking place where higher yields are expected to reduce inflation, which is good for stocks. This seems far-fetched to us and stretches reality. We think today is an anomaly and either US equity returns will fade into the close (meaning equities fall), or bond yields will fade into the close (and bonds prices will increase). We also see three stocks rising (against deteriorating fundamental valuations): $MULN Mullen Automotive $VIEW View Inc. $AVYA Avaya Holdings Corp. We are currently short Avaya, and plan to go short the other two in the near future. Another stock we have not researched is also up: $PEGY Pineapple Energy Inc. IMO: PEGY going to run. Somebody (or a group) traded 2.5M shares and did not move the stock price. My guess is this buy order was submitted before and the market maker took the stock price up to clear the trade. PEGY has a 5.6M share float (so this trade was 45% of the float). 7.44M shares outstanding, so this is 33.6% of the total outstanding shares. Unless we see an SEC filing for a take-over, I would guess this is a group purchase to run the stock. Good luck today. GLTA!

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed