|

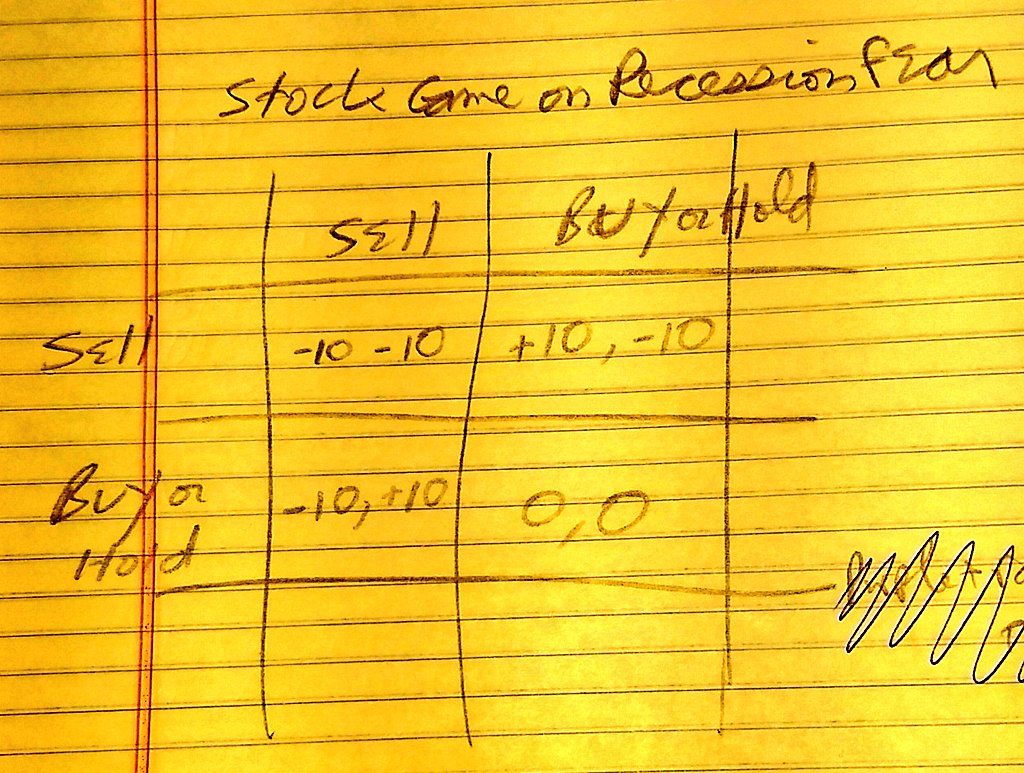

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. #recession #stocks #market #analysis #news #stockmarket #portfolio #stockstobuy #stockstosell #contagion We discussed four points today in great detail. 1. Most stocks we follow are trading near their 52 week lows. Many new lows were hit, both in US equities and fixed income. This 'contagion' is also hitting in US Agency debt, which is largely invested in mortgagers. 2. The major indices are in a down trend. They are following very clear and straight trendlines. The way up was marked by a similar straight line, but the candles were smaller. The way down is equally straight, but the candles are larger (more movement on the way down each day). Please be careful out there, the market is in a decline pattern. 3. There are signs of bets being made based on recession fears. Commodities are down. Long-term interest rates are falling (from last week's highs). Stocks in companies that make things (e.g., FCX, CLF, MT) are down. 4. We shared our game theory model. Hope you enjoy the video. By Jeffrey Cohen, Investment Advisor Representative So, where does that leave us in pre-market today? The US equity futures are up this morning. Bets were made while we were sleeping and before the market is open. Makes it hard to invest in this market because the 'action' is all decided by others before the market opened. Not investment advice. Hope you enjoy this morning's video. We enjoyed making it. We reflect on recessionary fear bets, the overall market direction, and our take on what is happening out there. Net-Net: almost all the 'bell-weather' stock industries we track are trading near 52-week lows. We are taken by surprise by this, and think most investors are unaware of this fact too.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed