|

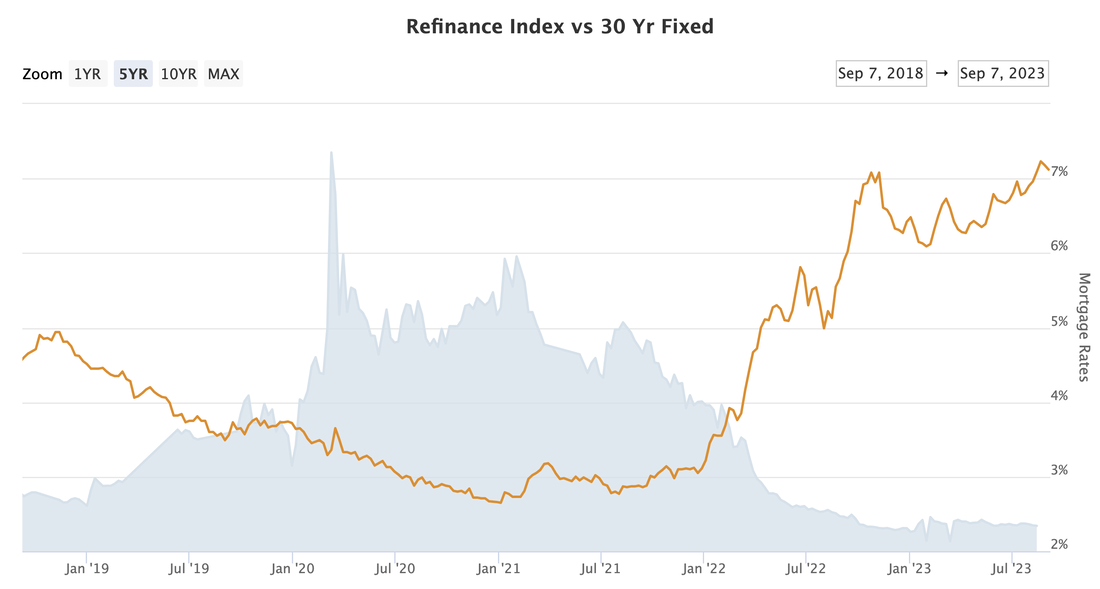

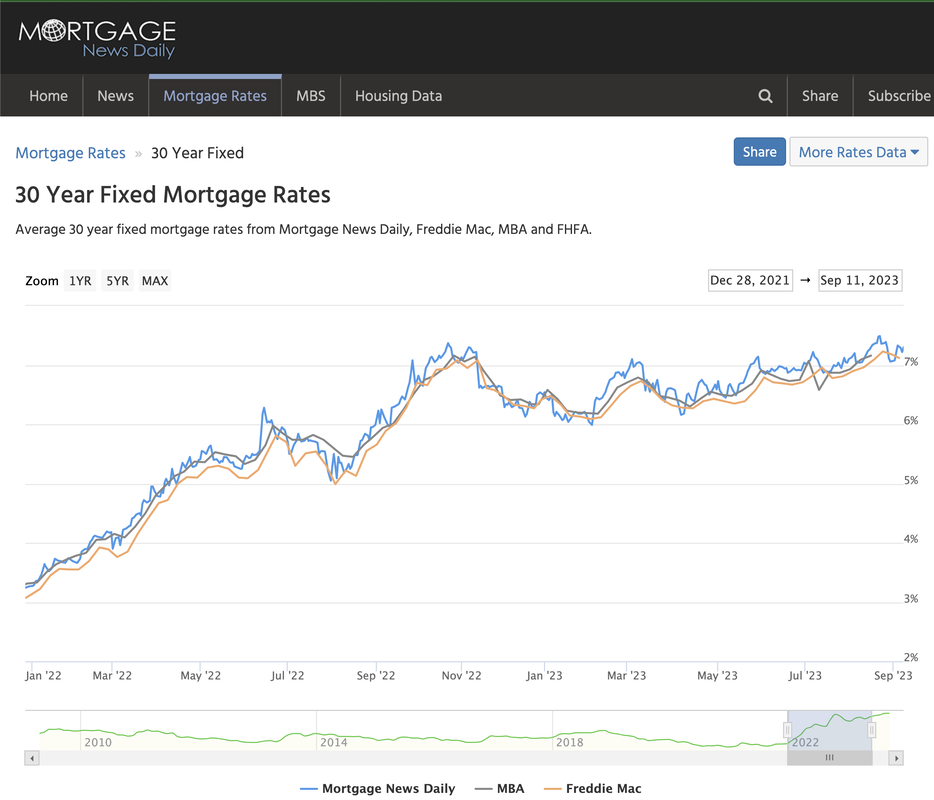

Thank you Mortgage News Daily for the chart. As seen below, over the past five years we are at peak mortgage rates over 7%, and we see refinance rates largely flat this year, but with volumes significantly lower from 2022. We see three concerns with this data from a macroeconomic perspective: 1. The companies that process mortgages are less busy, and mortgages become more stale (more years since credit underwriting). 2. US homeowners are not able to access the increased value of their homes without giving back some of those gains in higher future interest rates. 3. All homes become less affordable. If this translates into lower home sale levels, it impacts related economic sectors (e.g., real estate industry, mortgage, trust, legal, movers, home improvements and furniture). In July, single-family homes, townhomes, condominiums and coop apartments were down MoM and YoY, according to the National Association of Realtors (NAR). Mortgage News Daily data indicates that 30-year Fixed (conforming) mortgage rates today average 7.30%. This is up from ~3% in January 2022, a 4.3% increase that more than doubles the interest a home buyer would expect to pay over the life of their mortgage. In our analysis, this rate is based on the US Treasury 10-year and 7-year note yields, which are currently 4.3% and 4.4%. This implies a 3% credit spread, or markup, on home mortgages. In conclusion, interest rates and US residential mortgage rates are higher over the past 21 months, and this has reduced the volume of both home purchases and mortgage refinancing. The credit spread, or markup on conforming, 30-year fixed mortgages is 3% which reflects lender underwriting standards and overall industry competition.

If long-term interest rates continue to rise, and US consumer credit quality were to decline, we would expect a significant reduction in US housing activity. It is our opinion that the reduction in housing activity has not yet worked its way through US economic data as reported by the US Federal Government, and will have a negative effect on economic growth for the coming year.

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed