|

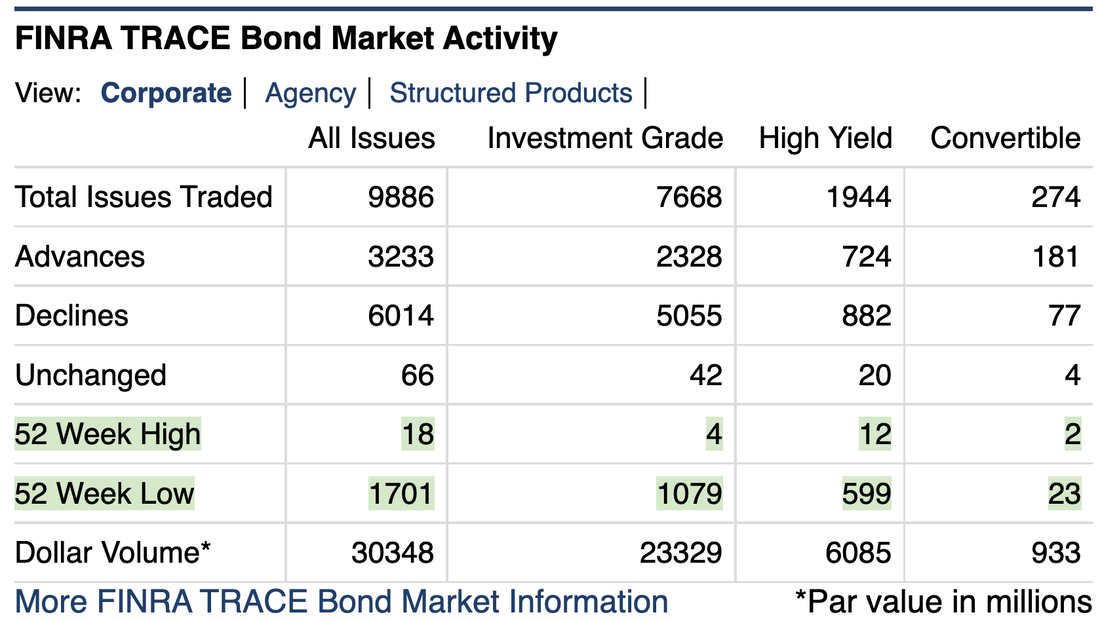

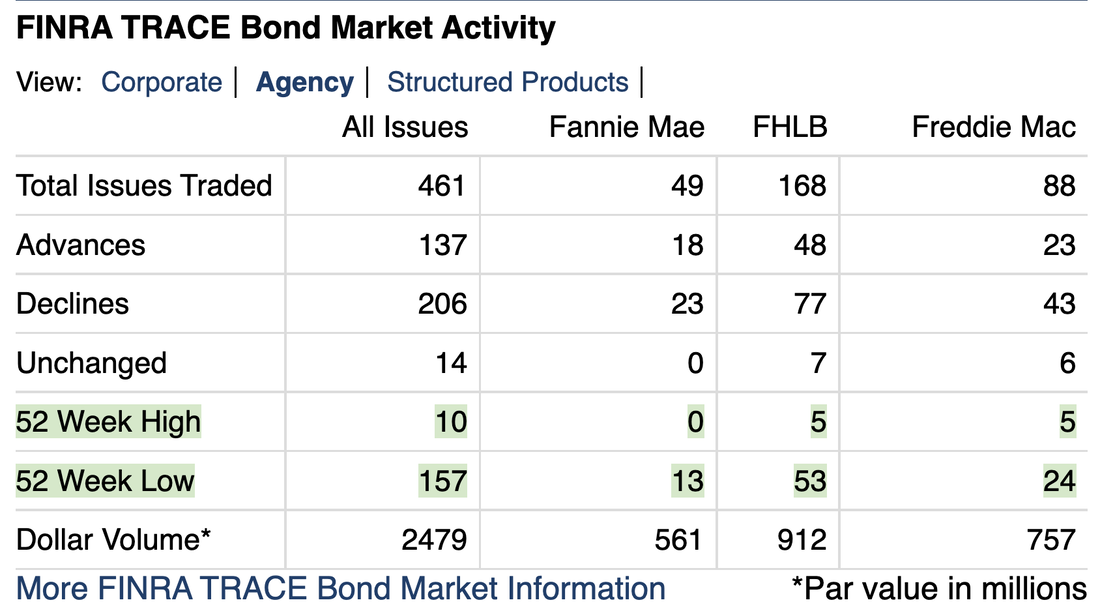

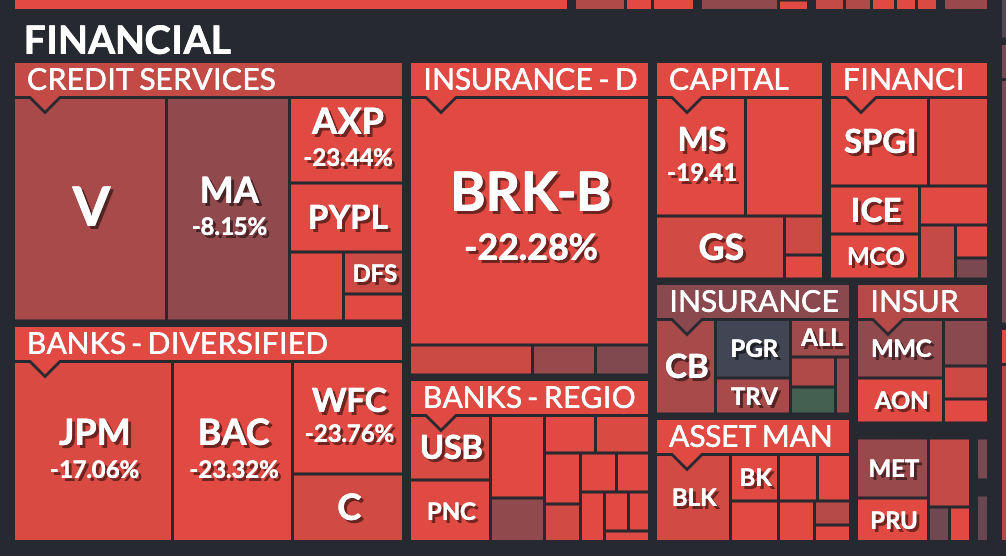

By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. We noticed a few important things yesterday. 1. The market move happened before the market opened. The market opened gap up. Retail investors could not participate. Once the market opened, the moves up and down were slight ripples. This means, to be precise, that stocks you might want to buy were already up in pre-market so you would be buying them at the open, or in the first hour, at their already 'runner' prices. We see this today with the lower open expected. Pre-market stocks like $COIN Coinbase are already down more than 8% pre-market. If you wanted to ride Coinbase lower, you already missed that move. It is the same across our 'indicator' or 'canary in a coalmine' industry sectors. They have already moved in pre-market. 2. We also see a significant number of new lows in yesterday's 'UP' market. This is very surprising to us. We also see the average stock is lower than it was over the past 2.5 months, and over the past 10 months. There is still a weakness in individual stocks and bonds. Corporate bonds (91:1) new lows to new highs (not a typo, ninety-one to one) Agency bonds (16:1) new lows to new highs (largely residential mortgage holdings) US Equities (10:1) new lows to new highs. What this says to us is that the market is not 'throwing good money after bad' and is leaving many companies behind. This does present a buying opportunity in certain companies with strong valuations that are down-trodden. However, those stocks likely will be less expensive in a week or two. Probably better to wait. 3. We see commodities like Copper showing weakness, approaching $3.90 from ~$4.50 when we first starting tracking it. However, big picture, copper has traded for a long time around $2.00, and rose (similar chart as the Russell 2000) from the Covid-19 pandemic lows to more than double. This is a return to a normal, historical level of pricing. We would also expect copper miners like Freeport McMoran $FCX) to fall with it. 4. We see weakness in the mortgage backed securities MBS market, both in Freddie Mac, Fannie Mae, Ginnie Mae and FHLB. This is likely due to the rise in long term interest rates. Yes, short-term and long-term interest rates are rising. This makes everything in our economy more expensive. Companies that borrow short and lend long, or that take in deposits and make investments in long-term fixed income, will not have a good Q2/2022 according to the data we are tracking. When we looked, the banks have dropped from 20% to 30% over the past quarter with the adjustment in market rates. Good luck in the markets today. It looks like a RED or down open for US equities, and the move is already well underway in pre-market. I hope that if you have a trading idea, it is still there when the markets are open and not 'already played.' Thank you to the websites we are using for our data and analysis.

https://finra-markets.morningstar.com https://app.koyfin.com https://finviz.com https://www.marketwatch.com https://www.mortgagenewsdaily.com https://finance.yahoo.com https://www.chicagoquantum.com https://www.cmegroup.com

0 Comments

Leave a Reply. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed